Vendor financing, a strategic financial arrangement between buyers and suppliers, has gained prominence as a catalyst for business growth and sustainability. In this article, we delve into 17 significant reasons why businesses opt for vendor financing solutions. From bolstering working capital and mitigating financial risks to enhancing operational efficiency and fostering strategic partnerships, vendor financing offers a plethora of advantages for organizations across various industries.

Furthermore, it provides flexibility in cash flow management, facilitates access to essential goods and services, and supports innovation and expansion initiatives. By understanding the multifaceted benefits of vendor financing, businesses can make informed decisions to capitalize on this versatile financial tool and drive their success in an ever-evolving marketplace.

Join us as we explore the diverse motivations behind the adoption of vendor financing strategies by businesses worldwide.

What is Vendor Financing?

Vendor financing, also known as supplier financing or trade credit, is a financing arrangement in which a vendor or supplier provides credit to a buyer to facilitate the purchase of goods or services. In other words, the vendor extends credit terms to the buyer, allowing them to defer payment for the purchased goods or services over a specified period of time.

This type of financing can benefit both parties involved. For the buyer, vendor financing provides flexibility in managing cash flow by allowing them to acquire necessary goods or services without an immediate outlay of funds. Instead, they can pay for the purchase at a later date, typically after receiving or using the goods or services to generate revenue.

For the vendor or supplier, offering financing can be a competitive advantage that helps attract customers and increase sales. It also helps build stronger relationships with buyers and encourages repeat business.

Vendor financing terms can vary depending on the agreement between the buyer and the vendor. It may include details such as the duration of the credit period, any applicable interest rates or fees, and repayment terms. Overall, vendor financing can be a valuable tool for businesses to manage cash flow and facilitate transactions.

Also Read: What Is a Vendor?

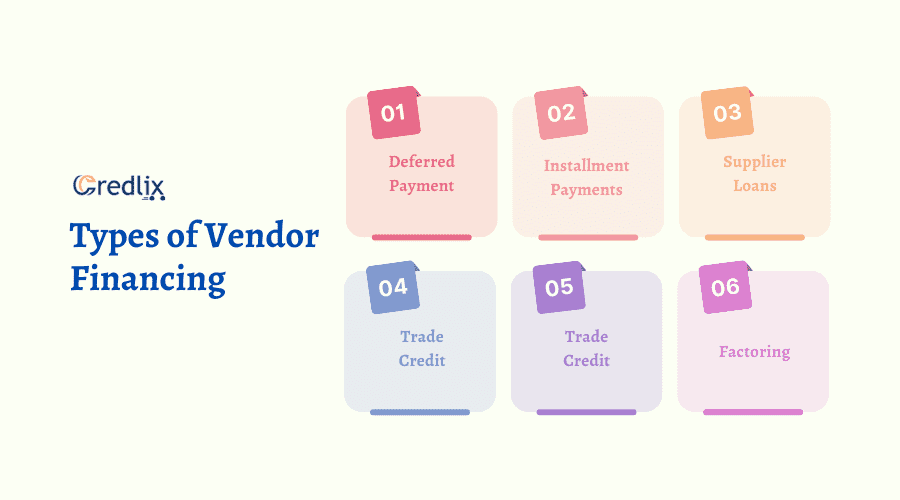

Types of Vendor Financing

Vendor financing, also known as supplier financing or trade credit, comes in various forms tailored to meet the needs of both buyers and suppliers. Some common types of vendor financing include:

Deferred Payment: In this type of financing, the vendor allows the buyer to defer payment for a certain period after receiving the goods or services. This gives the buyer time to generate revenue from the purchased items before making the payment.

Installment Payments: Under this arrangement, the buyer pays for the goods or services in regular installments over a specified period, rather than making a lump-sum payment upfront. This helps ease the financial burden on the buyer while still allowing the vendor to receive payments over time.

Supplier Loans: Some vendors may offer loans or lines of credit to buyers to finance their purchases. This can take the form of short-term loans or revolving lines of credit, providing the buyer with flexibility in managing their cash flow.

Trade Credit: Trade credit involves the extension of credit terms by the vendor to the buyer, allowing the buyer to make purchases on credit and settle the payment at a later date. This arrangement is commonly used in business-to-business transactions and helps foster ongoing relationships between buyers and suppliers.

Lease Financing: In lease financing, the vendor leases equipment or machinery to the buyer for a fixed period, with the option to purchase the assets at the end of the lease term. This allows the buyer to use the equipment without making a large upfront investment and may include maintenance and support services provided by the vendor.

Factoring: Vendor factoring involves the sale of accounts receivable to a third-party financing company (factor) at a discount. The factor advances a portion of the invoice amount to the vendor upfront, allowing them to access immediate cash flow while transferring the credit risk to the factor.

These are just a few examples of the types of vendor financing available. The specific terms and conditions of each financing arrangement may vary depending on the agreement between the buyer and the vendor.

Also Read: How to Use Vendor Financing to Buy a Business?

Reasons for Entering into Vendor Financing Agreements

Here are 17 major reasons for entering into vendor financing agreements:

Preservation of Cash Flow

By spreading payments over time, buyers can preserve their cash flow for other business needs such as operational expenses, marketing, or expansion. For example, a small retail business may use vendor financing to stock up on inventory during slow seasons without depleting its cash reserves.

Access to Goods or Services

Vendor financing enables buyers to acquire goods or services they need immediately without requiring upfront payment. This can be particularly advantageous for businesses with limited liquidity. For instance, a construction company might use vendor financing to purchase heavy machinery needed for a new project.

Risk Management

Vendor financing helps mitigate risks associated with non-performance or non-payment. Buyers can delay payment until they have received and potentially sold the goods, reducing the risk of financial loss. Similarly, vendors can ensure steady revenue streams and minimize the risk of bad debt. An example could be a technology company offering financing to customers purchasing expensive software licenses, ensuring payment upon successful implementation.

Enhanced Negotiating Power

Buyers may negotiate better terms or pricing by agreeing to vendor financing arrangements. Vendors may offer discounts or extended payment terms to secure a sale. For instance, a manufacturer might offer a discount on bulk purchases to a retailer willing to commit to a vendor financing agreement.

Relationship Building

Vendor financing fosters stronger relationships between buyers and vendors. By offering financing options, vendors demonstrate their commitment to supporting their customers’ success and building long-term partnerships. For example, a supplier of industrial equipment might offer financing to help a client expand its operations, leading to a mutually beneficial relationship over time.

Support for Growth Initiatives

Vendor financing facilitates business growth by enabling buyers to invest in expansion opportunities. For example, a startup may use vendor financing to acquire necessary equipment or inventory to scale its operations without requiring significant upfront capital.

Competitive Advantage

Offering vendor financing can differentiate vendors in competitive markets. Buyers may be more inclined to choose vendors that offer financing options over those that do not, especially if it helps them manage cash flow or access essential resources. An example could be a furniture manufacturer offering financing to retail partners, attracting more buyers, and increasing market share.

Customized Financing Solutions

Vendor financing can be tailored to meet the specific needs of buyers and vendors. This flexibility allows parties to structure financing arrangements that align with their cash flow, risk tolerance, and strategic objectives. For instance, a vendor might offer variable interest rates or flexible repayment terms based on the buyer’s financial situation.

Tax Benefits

Depending on the jurisdiction and terms of the financing agreement, there may be tax advantages associated with vendor financing. For example, buyers may be able to deduct interest expenses or benefit from other tax incentives, reducing their overall tax liability.

Expansion of Market Reach

Vendor financing can help vendors reach new markets or customer segments that might otherwise be inaccessible due to financial constraints. By offering financing options, vendors can attract buyers who may not have sufficient capital to make purchases outright.

Stabilization of Revenue Streams

Vendor financing can provide vendors with a steady stream of revenue, especially in industries where sales are cyclical or seasonal. By extending credit to buyers, vendors can maintain consistent sales volumes throughout the year.

Lower Financing Costs

Vendor financing may offer lower interest rates or financing costs compared to other forms of financing, such as bank loans or lines of credit. Buyers can take advantage of these lower costs to finance their purchases more affordably.

Streamlined Procurement Process

Vendor financing can simplify the procurement process for buyers by consolidating purchasing and financing activities. This streamlining can save time and resources for both buyers and vendors.

Opportunity for Upselling or Cross-Selling

Vendor financing presents an opportunity for vendors to upsell or cross-sell additional products or services to buyers. For example, a vendor offering financing for software purchases may also promote training services or maintenance contracts to enhance the buyer’s overall experience.

Brand Loyalty

Offering vendor financing can help build brand loyalty among buyers. Customers may be more inclined to return to vendors who have provided financing options in the past, leading to repeat business and long-term loyalty.

Risk Diversification

Vendor financing allows vendors to diversify their risk by extending credit to a broader customer base. This diversification can help mitigate the impact of defaults or non-payments from individual buyers.

Compliance with Market Standards

In some industries or markets, offering vendor financing may be standard practice. Vendors may choose to provide financing options to remain competitive and align with industry norms and customer expectations.

Final Note

Vendor financing emerges as a versatile tool for businesses seeking to navigate the complexities of cash flow management, risk mitigation, and market expansion. With 17 major reasons elucidated, it becomes evident that vendor financing transcends mere financial transactions, fostering strategic alliances, driving growth, and bolstering resilience. By harnessing the diverse benefits of vendor financing, businesses can unlock new opportunities, enhance competitiveness, and cultivate enduring relationships with suppliers and customers alike. As the business landscape continues to evolve, understanding and leveraging the power of vendor financing will remain integral to sustaining success and driving innovation in an ever-changing marketplace.

Also Read: Financing Receivables and Using Vendor Financing to Improve Your Business Cash Flow