[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12466″ img_size=”full” css=”.vc_custom_1711605478991{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Choosing the right supply chain finance partner is a critical decision for businesses looking to optimize cash flow, reduce financial risk, and enhance operational efficiency. With numerous factors to consider, navigating the selection process can be daunting.

This comprehensive guide presents 21 steps to help your company effectively evaluate and choose the best supply chain finance partner. From defining objectives to conducting due diligence, each step is designed to provide actionable insights and guidance for selecting a partner that aligns with your company’s goals and requirements.

By following these steps, you can confidently navigate the decision-making process and establish a successful partnership that drives tangible benefits for your business and its supply chain ecosystem.

What is Supply Chain Finance?

Supply chain finance (SCF), also known as supplier finance or reverse factoring, is a financial solution that enables businesses to optimize their working capital and improve cash flow by optimizing the timing of payments between buyers and suppliers within the supply chain.

In a typical supply chain finance arrangement, a financial institution (such as a bank or a third-party finance provider) facilitates early payment to suppliers on behalf of the buyer, usually at a discounted rate. This allows suppliers to receive payment sooner than their agreed-upon payment terms with the buyer, thereby improving their liquidity and reducing their working capital needs. In return, the buyer extends its payment terms with the financial institution, providing it with additional time to settle the payment at a later date.

Key features of supply chain finance include:

Early Payment Options: Suppliers have the option to receive early payment for their invoices, typically at a discounted rate, providing them with immediate liquidity.

Extended Payment Terms: Buyers can extend their payment terms with the financial institution, allowing them to preserve cash flow and optimize working capital.

Collaborative Financing: Supply chain finance fosters collaboration between buyers, suppliers, and financial institutions, creating a win-win situation where all parties benefit from improved cash flow and financial stability.

Risk Mitigation: Supply chain finance programs often involve risk assessment and credit monitoring of suppliers, helping to mitigate the risk of supplier default or insolvency.

Automation and Efficiency: Supply chain finance solutions leverage technology to automate and streamline payment processes, reducing administrative burden and improving efficiency.

Overall, supply chain finance plays a critical role in enhancing financial liquidity, optimizing working capital, and strengthening relationships across the supply chain, ultimately driving operational efficiency and competitiveness for businesses.

Also Read: What Can CFOs Do to De-Risk Supply Chain Finance in 2021

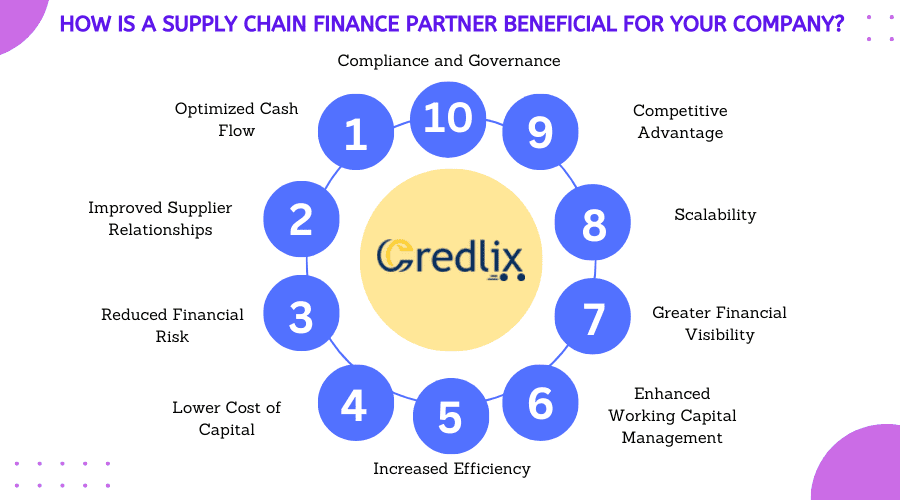

How is a Supply Chain Finance Partner Beneficial for Your Company?

A supply chain finance partner can offer several benefits to your company:

Optimized Cash Flow: Supply chain finance solutions enable your company to optimize its cash flow by providing early payment options to suppliers while extending payment terms for buyers. This flexibility can help improve working capital management and liquidity.

Improved Supplier Relationships: By offering early payment options and reducing payment uncertainty, supply chain finance can strengthen relationships with suppliers. This can lead to better collaboration, increased trust, and enhanced supplier loyalty.

Reduced Financial Risk: Supply chain finance partners often conduct thorough risk assessments of suppliers, helping your company mitigate financial risks such as supplier insolvency or default. This can protect your business from disruptions and losses.

Lower Cost of Capital: Supply chain finance programs typically offer financing at more favorable rates compared to traditional sources such as bank loans or lines of credit. This can result in lower borrowing costs and improved financial efficiency for your company.

Increased Efficiency: Supply chain finance solutions automate and streamline payment processes, reducing administrative burden and manual errors associated with traditional invoice processing. This can free up resources and improve operational efficiency.

Enhanced Working Capital Management: Supply chain finance enables your company to better manage its working capital by optimizing the timing of payments and receipts. This can help balance cash flows and minimize the need for costly short-term financing.

Greater Financial Visibility: Supply chain finance platforms often provide real-time visibility into transaction data, cash flows, and supply chain performance. This visibility enables better decision-making and risk management across the supply chain.

Scalability: A supply chain finance partner can scale its services to accommodate your company’s growth and evolving needs. Whether you’re expanding into new markets or increasing transaction volumes, a flexible finance solution can adapt to support your business.

Competitive Advantage: Implementing supply chain finance can give your company a competitive advantage by improving financial agility, reducing costs, and strengthening supplier relationships. This can help differentiate your business in the marketplace.

Compliance and Governance: Supply chain finance partners often have robust compliance and governance frameworks in place to ensure adherence to regulatory requirements and industry standards. Working with a reputable partner can help your company mitigate compliance risks.

Overall, partnering with a supply chain finance provider can unlock various strategic and financial benefits for your company, enabling you to optimize cash flow, mitigate risks, and enhance operational efficiency across the supply chain.

How to Choose a Supply Chain Finance Partner for Your Company

Choosing the right supply chain finance partner for your company is crucial for optimizing cash flow, reducing risk, and improving overall financial efficiency. Here’s a comprehensive guide in 21 steps to help you make the best decision:

Define Your Objectives: Clearly outline your company’s goals and objectives for implementing supply chain finance. Are you looking to optimize working capital, reduce costs, mitigate risks, or improve supplier relationships?

Assess Your Needs: Evaluate your current supply chain finance processes and identify areas for improvement. Determine the specific services and solutions you require from a finance partner.

Understand Your Supply Chain: Gain a deep understanding of your supply chain ecosystem, including suppliers, buyers, and other stakeholders. Consider factors such as geographic reach, industry-specific requirements, and transaction volumes.

Research Potential Partners: Conduct thorough research to identify potential supply chain finance partners. Consider factors such as reputation, experience, financial stability, and technological capabilities.

Evaluate Financing Options: Explore different financing options offered by potential partners, such as dynamic discounting, supply chain finance programs, invoice factoring, and reverse factoring. Assess the flexibility and suitability of each option for your company’s needs.

Consider Technology Solutions: Look for supply chain finance partners that offer advanced technology solutions, such as cloud-based platforms, automated workflows, and real-time analytics. These tools can streamline processes and enhance visibility across the supply chain.

Assess Risk Management Capabilities: Evaluate the risk management capabilities of potential partners, including credit risk assessment, fraud detection, and compliance monitoring. Ensure that the partner has robust security measures in place to protect sensitive financial data.

Review Pricing Structure: Understand the pricing structure of supply chain finance services, including fees, interest rates, and other charges. Compare pricing options from different partners to ensure competitive rates and transparent terms.

Consider Scalability: Choose a supply chain finance partner that can scale with your business as it grows. Ensure that the partner has the capacity to accommodate increasing transaction volumes and expanding supplier networks.

Evaluate Customer Support: Assess the quality of customer support provided by potential partners, including responsiveness, accessibility, and expertise. Ensure that the partner offers timely assistance and guidance to address any issues or concerns.

Check References and Case Studies: Request references and case studies from potential partners to validate their track record and success stories. Speak with existing clients to gain insights into their experiences and satisfaction levels.

Assess Integration Capabilities: Consider the integration capabilities of potential partners with your existing systems and software applications. Choose a partner that can seamlessly integrate with your ERP, accounting, and procurement systems.

Understand Legal and Regulatory Compliance: Ensure that potential partners comply with relevant legal and regulatory requirements, such as anti-money laundering laws, data privacy regulations, and industry standards. Verify the partner’s certifications and accreditations.

Negotiate Terms and Contracts: Negotiate terms and contracts with potential partners to ensure alignment with your company’s needs and objectives. Clarify key provisions such as service levels, performance guarantees, and termination clauses.

Assess Track Record and Stability: Evaluate the track record and stability of potential partners, including their financial performance, industry reputation, and longevity in the market. Choose a partner with a proven track record of success and sustainability.

Consider Industry Expertise: Look for supply chain finance partners with expertise in your industry or sector. They should understand the unique challenges and requirements of your business environment, enabling them to provide tailored solutions.

Evaluate Transparency and Reporting: Assess the transparency and reporting capabilities of potential partners, including access to real-time data, customizable reports, and performance dashboards. Ensure that you can monitor and track the progress of your supply chain finance program effectively.

Assess Cultural Fit: Consider the cultural fit between your company and potential partners, including shared values, communication styles, and strategic alignment. Choose a partner that aligns with your company culture and values collaboration and transparency.

Consider Geographic Coverage: Evaluate the geographic coverage of potential partners to ensure that they can support your supply chain operations across different regions and markets. Choose a partner with a global footprint if your business operates internationally.

Seek Input from Stakeholders: Involve key stakeholders from finance, procurement, and supply chain management in the decision-making process. Gather input and feedback to ensure that the chosen supply chain finance partner meets the needs of all stakeholders.

Perform Due Diligence: Finally, conduct thorough due diligence on potential partners before making a decision. Review contracts, conduct background checks, and seek legal advice if necessary to mitigate risks and ensure a successful partnership.

By following these 21 steps, you can effectively evaluate and choose the right supply chain finance partner for your company, setting the stage for improved financial performance and operational efficiency.

Risk Factors to Keep in Mind To Choose a Supply Chain Finance Partner for Your Company

When choosing a supply chain finance partner for your company, it’s crucial to consider various risk factors to ensure a successful and sustainable partnership. Here are some key risk factors to keep in mind:

Financial Stability: Assess the financial stability of potential partners to mitigate the risk of partner insolvency or default. Look for partners with a strong balance sheet, positive cash flow, and a history of financial reliability.

Credit Risk: Evaluate the credit risk associated with your suppliers and assess the partner’s ability to effectively manage and mitigate credit risk. Ensure that the partner conducts thorough credit assessments and implements robust risk management practices.

Operational Risk: Consider the operational risk inherent in supply chain finance processes, such as errors in invoice processing, system downtime, or disruptions in payment flows. Choose a partner with proven operational resilience and contingency plans to mitigate these risks.

Regulatory Compliance: Ensure that potential partners comply with relevant legal and regulatory requirements, including anti-money laundering laws, data privacy regulations, and industry-specific regulations. Verify the partner’s compliance practices and certifications to mitigate regulatory risk.

Security and Fraud Risk: Assess the partner’s security measures and fraud detection capabilities to mitigate the risk of data breaches, unauthorized access, or fraudulent activities. Look for partners with robust security protocols and proactive fraud prevention measures.

Reputational Risk: Consider the partner’s reputation and track record in the industry to mitigate reputational risk for your company. Conduct due diligence on the partner’s history, customer reviews, and past performance to assess their credibility and reliability.

Scalability Risk: Evaluate the partner’s capacity to scale their services and infrastructure to accommodate your company’s growth and evolving needs. Ensure that the partner can handle increasing transaction volumes and expanding supplier networks without compromising service quality or performance.

Dependency Risk: Assess the level of dependency on the supply chain finance partner and evaluate alternative options to mitigate dependency risk. Diversify your partnerships or consider contingency plans in case of disruptions or changes in the partner’s offerings.

Cultural and Strategic Alignment: Consider the cultural fit and strategic alignment between your company and potential partners to mitigate compatibility risk. Choose partners that share similar values, communication styles, and long-term objectives to foster a collaborative and productive partnership.

Contractual Risk: Review the terms and conditions of the partnership agreement carefully to mitigate contractual risk. Clarify key provisions such as service levels, performance guarantees, termination clauses, and dispute resolution mechanisms to ensure alignment with your company’s interests and expectations.

By considering these risk factors and conducting thorough due diligence, you can choose a supply chain finance partner that effectively mitigates risks and contributes to the success and resilience of your company’s supply chain operations.

Also Read: Supply Chain Finance Hacks To Transform Your Sourcing

Final Note

Selecting the right supply chain finance partner is a strategic decision that can significantly impact your company’s financial health and operational efficiency. By following the comprehensive 21-step guide outlined above, you can navigate the selection process with confidence and diligence. Remember to define clear objectives, assess your company’s needs, research potential partners thoroughly, and prioritize factors such as technology, risk management, and scalability.

Collaboration with a reliable and compatible supply chain finance partner can unlock numerous benefits, including optimized cash flow, enhanced supplier relationships, and improved competitiveness. With careful consideration and informed decision-making, you can establish a successful partnership that drives tangible value for your business and its supply chain ecosystem.

Also Read: An Economic Winter for MSMEs? Is Your Supply Chain Finance Prepared?

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]