[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12284″ img_size=”full” css=”.vc_custom_1709704651261{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Once you’ve found suitable buyers for your export products, another critical aspect for the exporter is determining the terms of payment. This constitutes a fundamental part of any trade agreement, requiring the exporter and importer to come to terms regarding the final payment. Negotiations often play a significant role in reaching a mutually beneficial agreement on export payment terms between the buyer and seller.

For new exporters, invoicing poses risks as it specifies the total product amount and the preferred payment method. Export payment terms can be more intricate and fraught with risk due to factors such as physical distance and differing laws and legalities between the two parties, especially if they are from different countries. Hence, there exists a wide variety of export payment terms that both exporters and importers can leverage. These terms, though mutually agreed upon, can differ significantly from one another. Some may favor the exporter, while others may be more advantageous to the importer.

The selection of export payment terms is also influenced by the existing relationship and trading history between the two parties. As such, determining the appropriate payment term can be crucial for the success of the export transaction. It is essential to carefully evaluate the various payment terms available and choose the one that best aligns with the interests and requirements of both the exporter and importer.

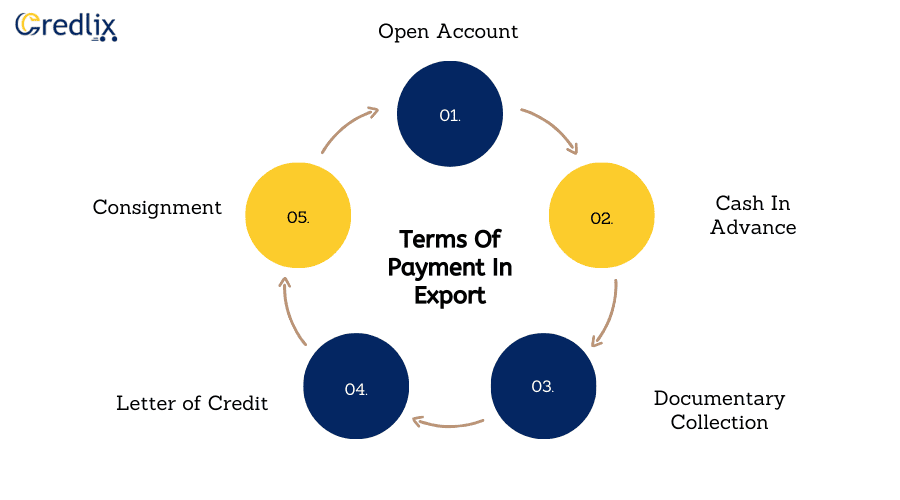

Terms Of Payment In Export

Let’s explore various payment terms commonly used in export transactions. These terms dictate how payment is made between exporters and importers and play a vital role in shaping the dynamics of international trade agreements.

Terms of payment in export refer to the agreed-upon conditions between the exporter and importer regarding the method and timing of payment for exported goods or services. These terms play a crucial role in international trade agreements and can vary based on negotiation and relationship dynamics.

1. Open Account

In the realm of export transactions, one prevalent term of payment is known as the “open account.” Unlike other methods, this approach is rooted in trust and is particularly advantageous to the buyer or importer. The fundamental principle underlying an open account transaction is that payment is deferred until after the goods have been received by the buyer.

Essentially, the parties involved agree upon a specified credit period, typically denoted by a certain number of days, during which the buyer is granted time to settle the invoice. This credit period allows for flexibility in payment scheduling, easing financial strain on the buyer in the immediate aftermath of the transaction.

One notable feature of the open account method is the temporal gap between the receipt of the purchase order and the final payment(s). This interim period is dedicated to production and shipping processes, during which the goods are prepared and dispatched to the buyer. Consequently, the seller incurs costs and invests resources upfront, bearing the risk until payment is received.

While the open account payment term may be advantageous to the buyer, affording them the luxury of paying after the goods have been received, it poses challenges for the exporter. The delay in receiving payment creates a significant time gap during which the exporter must manage their finances without the incoming revenue. This liquidity strain can be particularly burdensome for small or cash-strapped businesses.

Despite its drawbacks, the open account method remains a popular choice in certain scenarios. It is often preferred by parties with established trust and longstanding relationships, where the risk of default is minimal. Additionally, exporters may opt for this method when there is a promise of future high-volume transactions, mitigating the short-term financial strain through anticipated long-term gains.

2. Cash In Advance

In contrast to the open account approach, cash in advance is a payment method where goods are shipped only after the buyer completes payment, either in full or partially. The seller must receive confirmation of payment before proceeding with the shipment. This method heavily favors the exporter, offering assurance of payment before any goods are released. However, it presents a substantial risk for the importer, who must pay upfront without the guarantee of receiving satisfactory goods or services.

Despite its advantages for the exporter, the cash-in-advance method may deter potential buyers due to the financial burden and lack of flexibility it imposes. Thus, while providing a secure payment mechanism, it may limit market accessibility and competitiveness for exporters.

3. Documentary Collection

The third payment term in export transactions is known as documentary collection, which involves the participation of a third party, typically a bank. In this method, both the exporter and importer engage their respective banks. Here’s how it works:

First, the exporter ships the products to the importer and submits the shipping documents to their own bank, along with collection orders. The exporter’s bank then forwards these documents to the importer’s bank, accompanied by relevant instructions.

Subsequently, the importer’s bank notifies the importer of the pending payment and collects the amount owed. Once the payment is received, the importer’s bank transfers the funds to the exporter’s bank. Finally, the exporter’s bank disburses the payment to the exporter.

There are two primary types of documentary collections:

Cash Against Documents (CAD): In this scenario, the importer is required to make payment “due at sight,” meaning they must pay before the documents are released by their own bank or the collecting bank. This ensures that the exporter receives payment before the goods are released to the importer.

Documents Against Acceptance (D/A): With this payment term, there is an agreed-upon arrangement allowing the importer to defer payment until a specified future date. In this case, the exporter presents a time draft to the importer, who accepts it, promising to pay at a later date. After acceptance, the shipping documents are released to the importer by the bank.

While documentary collection provides a structured and relatively secure method of payment for both exporters and importers, it still entails certain risks and complexities. Importers may face the challenge of ensuring timely payment to avoid delays in receiving the goods, while exporters must trust that importers will honor their commitments to pay on time. Therefore, careful consideration of the specific terms and conditions, as well as the trustworthiness of all parties involved, is essential in utilizing documentary collections effectively in export transactions.

4. Letter of Credit

A widely used payment method in export transactions is the letter of credit (LC), valued for its reliability and widespread acceptance in global trade. Here’s how it works:

When using a letter of credit, the buyer’s bank issues a document known as the letter of credit, which serves as a commitment to the exporter. Essentially, this letter assures the seller that payment will be made in a timely manner upon fulfillment of specified conditions.

The letter of credit outlines the terms and conditions agreed upon by both parties, including details such as the amount of payment, shipping dates, and required documents. Once the exporter has met these conditions and provided the necessary documentation, the buyer’s bank is obligated to make payment to the exporter.

The letter of credit offers security to both the buyer and the seller. For the exporter, it ensures that they will receive payment for the goods or services provided, as long as they fulfill the terms outlined in the letter of credit. Meanwhile, the buyer can rest assured that payment will only be made once the goods have been shipped and the required documents have been submitted.

Overall, the letter of credit is a trusted and efficient payment method in international trade, providing assurance to both parties and facilitating smooth transactions across borders.

5. Consignment

Consignment payment is a method used in exports where a third-party distributor is involved.

Here’s how it works:

Instead of selling directly to the buyer, the exporter gives their goods to a foreign distributor who then sells them to the end customer. The exporter receives payment only after the goods have been sold.

This method is akin to the open account payment approach, where trust plays a crucial role. It’s important to choose a reliable and reputable distributor to minimize risks. Additionally, having insurance in place is advisable to safeguard against any potential losses.

Final Note

Selecting the right terms of payment in export is vital for the success of international trade transactions. Each method offers its own advantages and considerations, catering to the needs and preferences of both exporters and importers. Whether it’s the trust-based open account, secure letter of credit, or distributor-dependent consignment, careful evaluation and negotiation are essential. By understanding the nuances of each payment term and considering factors such as trust, risk tolerance, and financial stability, exporters can make informed decisions to ensure smooth and mutually beneficial trade agreements.

It’s crucial to prioritize transparency, communication, and adherence to agreed-upon terms to foster strong relationships and facilitate seamless transactions across borders. With the right approach and diligence, exporters can navigate the complexities of payment terms and unlock opportunities for growth and success in the global marketplace.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]