[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11817″ img_size=”full” css=”.vc_custom_1704795161920{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Export factoring is a financial arrangement that provides a solution for businesses engaged in international trade to manage their cash flow effectively. It involves the sale of accounts receivable to a third-party financial institution, known as a factor, in exchange for immediate cash.

This mechanism helps exporters mitigate the risks associated with delayed payments and ensures a steady flow of working capital. Within the realm of export factoring, two prominent options exist: recourse and non-recourse factoring.

In this blog, we will delve into the intricacies of both, examining their features, benefits, and considerations.

Understanding Export Factoring

Export factoring serves as a strategic financial tool for businesses involved in cross-border trade. It offers a mechanism for companies to convert their credit sales into cash, allowing them to meet operational expenses and invest in growth without waiting for customer payments.

How Export Factoring Works

There’s a working mechanism of export factoring that’s explained below:

Agreement:

- Exporters make a deal with a special financial partner called a “factoring company.”

- This agreement outlines the terms and conditions under which the factoring company will help the exporter with their cash flow.

Sale of Receivables:

- Exporters often sell products or services to other companies in different countries, and these transactions result in “accounts receivable.” These are essentially promises from buyers to pay for the goods or services at a later date.

- In export factoring, the exporter decides to sell these accounts receivable to the factoring company. This means they’re turning their future expected payments into immediate cash.

Immediate Cash:

- Once the factoring company buys these accounts receivable, they don’t make the full payment to the exporter. Instead, they provide immediate cash, usually a certain percentage (let’s say 80-90%) of the total amount of the invoices. This quick infusion of cash helps the exporter with their immediate financial needs.

Collection:

- Now, the responsibility of collecting the full payment from the buyers shifts to the factoring company. They take on the task of following up with the buyers and making sure they fulfill their payment obligations.

Final Payment:

- When the buyer pays the full invoice amount, the factoring company deducts its fee. This fee is the cost for the financial services provided, including the immediate cash, risk management, and collection efforts.

- After deducting their fee, the factoring company remits the remaining amount to the exporter. This final payment completes the export factoring process.

Types: Recourse Factoring and Non-Recourse Factoring

There are two types of export factoring.

Recourse Factoring

Recourse factoring is a common form of export factoring where the exporter remains partially liable for the buyer’s non-payment. In the event of default, the exporter must buy back the receivables or compensate the factor for the unpaid amount.

Features of Recourse Factoring

Key features of recourse factoring:

Limited Risk Transfer

In recourse factoring, while the factor takes on the responsibility of collecting payments, the exporter retains the risk of non-payment. If a buyer doesn’t pay, the exporter may need to repurchase the receivables or compensate for the unpaid amount.

Lower Costs

Recourse factoring tends to have lower fees compared to non-recourse factoring. This is because the exporter shares the risk of buyer non-payment with the factoring company, resulting in a more cost-effective financial arrangement.

Flexibility in Invoice Selection

Recourse factoring offers greater flexibility for exporters in choosing which invoices to factor. This allows businesses to tailor the arrangement based on their specific cash flow needs, selecting invoices that align with their risk tolerance and overall financial strategy.

Customizable Credit Terms

Recourse factoring arrangements are often more adaptable in terms of credit terms. Exporters may have the flexibility to negotiate the duration of the agreement or specific conditions under which they would be liable for repurchasing receivables. This customization aligns the arrangement more closely with the exporter’s business model and financial preferences.

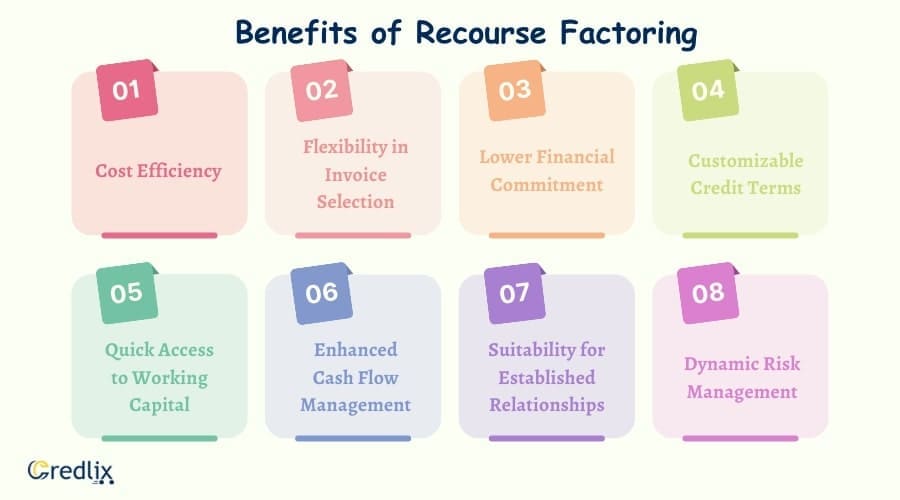

Benefits of Recourse Factoring

If you go for recourse factoring, you can enjoy the following benefits:

Cost Efficiency:

The reduced fees associated with recourse factoring contribute to overall cost efficiency, making it a financially prudent choice for exporters.

Flexibility in Invoice Selection:

Recourse factoring provides exporters with increased flexibility in selecting the specific invoices they want to factor, allowing for a tailored approach to their cash flow needs.

Lower Financial Commitment:

Due to the shared risk model, recourse factoring often requires a lower financial commitment from exporters, making it more accessible for businesses with varying financial capacities.

Customizable Credit Terms:

Recourse factoring arrangements often allow for greater customization of credit terms, enabling exporters to negotiate terms that align closely with their business goals and financial preferences.

Quick Access to Working Capital:

The expedited nature of recourse factoring ensures that exporters gain quick access to working capital, helping them meet immediate financial obligations and seize growth opportunities.

Enhanced Cash Flow Management:

Recourse factoring aids in maintaining a steady and predictable cash flow, providing exporters with the financial stability necessary for effective business operations and strategic decision-making.

Suitability for Established Relationships:

Recourse factoring is well-suited for exporters with established and trusted buyer relationships, as the shared risk model allows for a more collaborative approach to managing payment uncertainties.

Dynamic Risk Management:

The fact that exporters retain a portion of the risk in recourse factoring allows for dynamic risk management strategies. Businesses can adjust their risk exposure based on specific market conditions or changes in buyer creditworthiness.

Considerations for Recourse Factoring

Before opting for recourse factoring, you should keep the following points in mind:

Check Your Buyers:

Before using recourse factoring, make sure to check if your buyers are reliable and can be trusted to pay on time. This helps in reducing the risk of not getting paid.

Plan for Risks:

Think ahead about what might happen if a buyer doesn’t pay. Have a backup plan in case things don’t go as expected. This could involve finding other ways to get money or talking to the factoring company about the situation.

Keep an Eye on the Market:

Pay attention to what’s happening in the market. If things change, like the economy or the industry you’re in, it could affect your buyers’ ability to pay. Being aware allows you to adjust your plans accordingly.

Prepare for Financial Impact:

Understand how not getting paid might affect your money situation. This means thinking about how it could impact the money you have coming in and how it might affect your overall financial health.

Be Ready with Backup Plans:

Have plans in place for what you’ll do if something goes wrong. This could involve having other ways to get money or having a strategy to deal with any financial challenges that may come up.

Non-Recourse Factoring

Non-recourse factoring provides exporters with a higher level of risk protection, as the factor assumes the risk of buyer non-payment. In this scenario, the exporter is not obligated to repurchase the receivables in case of default.

Features of Non-Recourse Factoring

Full Risk Transfer:

In non-recourse factoring, the factor takes on the entire risk of non-payment. This means that if a buyer doesn’t pay, the factor absorbs the financial loss, providing complete protection to the exporter.

Higher Costs:

Non-recourse factoring generally involves higher fees compared to recourse factoring. The increased fees reflect the elevated risk undertaken by the factoring company, ensuring that the exporter is shielded from the financial impact of buyer default.

Stricter Buyer Criteria:

Non-recourse factoring often requires more stringent criteria when evaluating the creditworthiness of buyers. Factors may be more selective in approving invoices for non-recourse arrangements, emphasizing the importance of having buyers with strong credit profiles.

Limited Flexibility in Invoice Selection:

Unlike recourse factoring, where exporters often have flexibility in choosing which invoices to factor, non-recourse factoring may offer limited flexibility. Factors may have stricter criteria, and exporters might have fewer options in selecting specific invoices for the arrangement. This highlights the need for careful evaluation of buyer creditworthiness.

Benefits of Non-Recourse Factoring

If you go for non-recourse factoring, you can enjoy the following benefits:

Reduced Credit Risk:

If you choose non-recourse factoring, you get extra protection. The factoring company takes on the risk of your buyers not paying, so you don’t have to worry about losing money if a buyer defaults.

Confidence in Getting Paid:

With non-recourse factoring, you can be more confident about getting paid. The factoring company ensures that even if your buyer doesn’t pay, you won’t be left with financial losses.

Peace of Mind:

Non-recourse factoring brings peace of mind. You can focus on your business without constantly stressing about the possibility of buyers not fulfilling their payments.

Stable Finances:

Your financial situation becomes more stable with non-recourse factoring. Knowing that the factor will cover non-payment risks allows you to plan your budget and expenses more confidently.

Easier Planning:

Planning becomes easier when you have a reliable source of income. Non-recourse factoring gives you that assurance, making it simpler to plan for the future and make strategic business decisions.

No Impact on Profitability:

If a buyer doesn’t pay, it won’t affect your profitability. The factoring company absorbs the impact, ensuring that your business remains financially healthy and continues to make a profit.

Smooth Cash Flow:

Non-recourse factoring ensures a steady and predictable cash flow. This consistency is crucial for meeting your day-to-day expenses, paying your bills, and investing in the growth of your business.

Time and Resource Allocation:

You can allocate your time and resources more efficiently. Since the factor takes care of the risk, you can focus on running your business and using your resources for activities that drive growth rather than worrying about collections.

Considerations for Non-Recourse Factoring

Before opting for non-recourse factoring, you should keep the following points in mind:

Cost Analysis: Exporters must carefully evaluate the cost implications of non-recourse factoring and determine if the added protection justifies the higher fees.

Eligibility Criteria: Non-recourse factoring may require stricter buyer creditworthiness criteria, limiting the pool of eligible invoices.

Factors Influencing the Choice Between Recourse and Non-Recourse Factoring

A. Industry Dynamics: The nature of the industry and market conditions can influence the choice between recourse and non-recourse factoring. Industries with higher credit risks may lean towards non-recourse options.

B. Buyer Relationships: Exporters with established and trustworthy buyer relationships may opt for recourse factoring, leveraging lower costs and greater flexibility.

C. Financial Position: The financial health and stability of the exporter play a crucial role. A financially robust company may be more inclined to absorb the risk associated with recourse factoring.

D. Risk Appetite: Exporters must assess their risk tolerance and choose the factoring option that aligns with their risk appetite and business strategy.

Conclusion

Export factoring offers valuable financial support to businesses engaged in international trade. The choice between recourse and non-recourse factoring depends on various factors, including risk tolerance, cost considerations, and the nature of buyer relationships. Both options have their merits, and exporters must carefully evaluate their specific needs and circumstances to make an informed decision. By understanding the nuances of recourse and non-recourse factoring, businesses can optimize their cash flow, reduce credit risks, and navigate the complexities of international trade with greater confidence.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]