[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11939″ img_size=”full” css=”.vc_custom_1706595644550{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Getting into the export business means you’ll need a good amount of money because there are many costs involved. The whole process takes time, and you’ll have to spend money at each stage. After you send out your products, there’s another part called post-shipment that involves serious money talks and dealing with banks.

When you send out your products, you partner with a person called a Clearing and Forwarding (C&F) agent. Think of them as your export buddy who helps your stuff get to its destination. Once your goods are on their way with the C&F agent, the post-shipment part starts. It’s like the aftermath or the “what happens next” part of the story.

Picture the C&F agent as the guide for your products through the export journey. After that journey, the post-shipment activities become important, kind of like the encore after a big show. See these activities as different episodes in a series, with discussions about money and a bunch of banking stuff. It’s not just about sending things away; it’s like a financial story unfolding, with each step adding a new twist to your export tale.

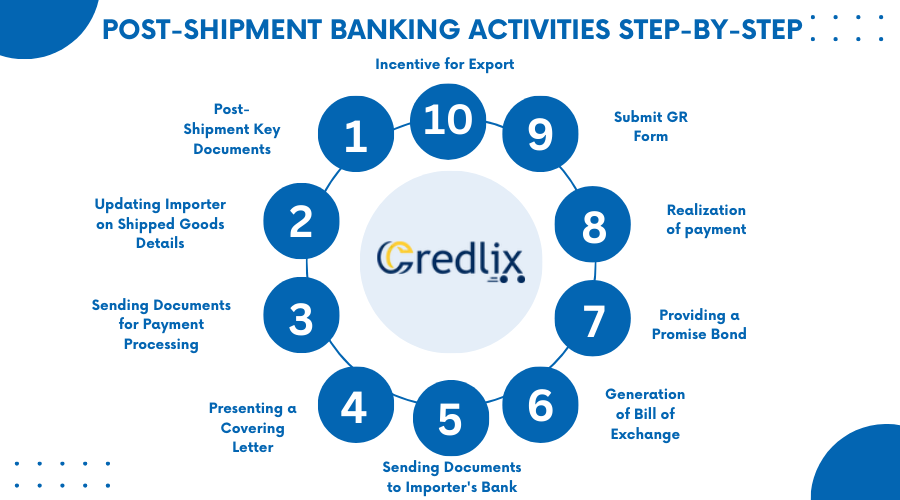

Post-Shipment Banking Activities Step-by-Step

Here’s a step-by-step guide of post-shipment banking activities for you all.

Step 1: Post-Shipment Key Documents

In the post-shipment phase, the collaboration between the exporter and the Clearing and Forwarding (C&F) agent unfolds through several crucial stages. The initial step, known as Stage 1, involves the C&F agent submitting essential documents to the exporter following the shipment of goods. Here’s a breakdown of the key documents:

Original Letter of Credit (LC), Export Order, or Contract: The foundational documents outlining the terms and conditions of the export transaction.

Copies of Bill of Lading (Both Negotiable and Non-Negotiable): These documents serve as a receipt for shipped goods, detailing the type, quantity, and destination.

Duplicate Copy of ARE-I Form (Application for Removal of Excisable Goods for Export): A critical document for the official removal of excisable goods for export by air, sea, post, or land.

Export Promotion Copy of the Shipping Bill: Essential paperwork facilitating the export promotion process.

Drawback Copy of the Shipping Bill: A crucial document for claiming a drawback, providing exporters with a refund of certain duties, taxes, or fees paid during the import process.

Understanding and processing these documents mark the initial stage of the post-shipment phase, ensuring a smooth progression through the intricate export landscape.

Step 2: Updating Importer on Shipped Goods Details

In the second stage of the post-shipment process, ensuring a seamless transfer of goods takes center stage. The exporter plays a pivotal role by furnishing the importer with comprehensive details regarding the shipment. This information serves to facilitate a prompt and hassle-free receipt of the goods upon their arrival.

The exporter’s communication to the importer encompasses vital details, including:

Date of Shipment or Transport: Providing clarity on when the goods commenced their journey ensures proper coordination.

Name of Vessel/Flight Number, Vehicle Details, or Post Details: Precise identification of the mode of transportation aids in tracking and receiving the goods efficiently.

Name of Seaport, Airport, or Border Post: Depending on the chosen method of export, specifying the destination point enhances the importer’s readiness for the goods’ arrival.

Additionally, the exporter includes a copy of the non-negotiable Bill of Lading, a crucial document validating the shipped goods. This proactive sharing of information not only expedites the import process but also fosters a transparent and cooperative relationship between the exporter and the importer.

Step 3: Sending Documents for Payment Processing

The exporter’s subsequent action involves presenting the required documents to their bank for payment processing. This procedure is instigated to secure payment from the importer’s bank account.

These essential documents, collectively known as the ‘Negotiable Set of Documents,’ are pivotal for facilitating payment realization. The exporter’s bank initiates the process with the importer’s bank upon receiving this set of documents, a practice commonly termed ‘Negotiation of the Documents.’

The following documents are typically submitted to the exporter’s bank to commence the payment realization process:

- Commercial Invoice

- Bill of Lading

- Consular Invoice

- Certificate of Origin

- Dock Receipt, Warehouse Receipt, Airway Bill, or Transport Bill

- Inspection Certificate

- Destination Statement

- Insurance Certificate

- Export Packing List

- IEC Certificate

Step 4: Presenting a Covering Letter

To make things easy for the bank, send all the mentioned documents to your bank along with a covering letter. This letter should list the documents in order and explain why you’re sending them. This simple step helps the bank understand what’s going on and makes the whole process smoother for you as the exporter.

It’s like giving them a roadmap to follow, ensuring they quickly get the gist of your submission. This way, you’re making things convenient for the banking authorities, and it works in your favor by speeding up the process.

Step 5: Sending Documents to Importer’s Bank

Once the exporter hands over the Negotiable Set of Documents to the bank, the Negotiation of the Documents kicks in. The bank carefully checks all the papers provided by the exporter.

If everything looks good, the bank starts the negotiation process with the importer’s bank, following the terms of the importer’s Letter of Credit (LC). After this, the bank gives the exporter a bank certificate and a verified copy of the commercial invoice. It’s like a stamp of approval, confirming that all is in order and signaling a successful step in the payment process.

Step 6: Generation of Bill of Exchange

Following a careful review of the mentioned documents, a Bill of Exchange is created, often referred to as the ‘Documentary Bill of Exchange.’ There are two types of this bill:

Sight Draft: In this scenario, the exporter directs the bank to release all pertinent documents only upon receiving payment from the importer. It’s like a “show me the money first” arrangement.

Usance Draft: Here, the exporter instructs the bank to hand over the relevant documents to the importer after the acceptance of the Bill of Exchange. It’s a bit different, allowing the importer to access the documents before making the payment, but with the commitment to pay later.

Step 7: Providing a Promise Bond

If an exporter wants quick payment from the bank, they can do it by giving something called an indemnity bond. This bond is like a promise to the bank. The exporter promises the bank that if, for some reason, they don’t get paid by the importer’s bank, the exporter will cover the loss. It’s a bit like saying, “Hey bank, don’t worry.

If the money doesn’t come from the other bank, I’ll make sure you’re not left in the lurch. I’ll even take care of any extra money you could have gotten if everything went smoothly.” So, it’s a security measure for the bank and a guarantee from the exporter.

Step 8: Realization of payment

Once the importer’s bank gets the documentary Bill of Exchange, it sends out the payment, whether it’s a sight draft or usance draft. The exporter’s bank then gets the money from the importer’s bank and adds it to the exporter’s account. It’s like a smooth exchange – the importer’s bank gets the documents, and in return, the exporter gets paid.

This happens whether the exporter wanted the money upfront (sight draft) or agreed to get paid a bit later (usance draft). It’s a straightforward process of give and take, making sure everyone gets what they need.

Step 9: Submit GR Form

Once the exporter gets paid, they need to hand in the GR form to the Reserve Bank of India (RBI). This form spills the beans about the just-finished export deal, detailing all the important info. The exporter’s bank takes care of this and sends it to the RBI. Then, the RBI checks if everything in the form is right.

If it’s all good, the RBI marks the export deal as done and dusted. So, it’s like the final paperwork – saying, “Hey RBI, here’s the scoop on the export deal,” and once they give it a thumbs up, the exporter can consider it officially wrapped up.

Step 10: Incentive for Export

If the exporter qualifies for an export incentive, they need to apply for it with the right authority. To do this, they have to submit a claim along with the necessary documents and a bank certificate.

This is like saying, “Hey, I did this export, and I meet the criteria for a reward.” Including the correct paperwork and a bank certificate supports their claim. It’s a straightforward process, making sure everything is in order to get the well-deserved incentive for their export efforts.

Final Words

The journey of an export transaction involves various post-shipment banking activities, each playing a crucial role in the exporter’s financial tale. From collaborating with the Clearing and Forwarding agent to submitting key documents, navigating payment processes, and completing necessary paperwork, it’s like episodes in a series, with each step contributing to a successful export story.

Ensuring transparency, cooperation, and timely submission of required documents are key ingredients for a smooth post-shipment phase. It’s a financial storyline where every detail matters, leading to the final steps of payment realization, regulatory compliance, and potential incentives for a job well done.

Also Read : Key Factors to Look for When Evaluating Export Factoring Services[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]