[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11991″ img_size=”full” css=”.vc_custom_1706867388818{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]The HSN (Harmonized System of Nomenclature) is a global classification system for goods and services, established by the World Customs Organization (WCO). It streamlines the assessment of customs duties and taxes.

In India, the HSN code for rent is 997212, placed under ‘Rental services of personal and household goods.’ This code specifically relates to ‘Leasing or rental services concerning machinery and equipment.’

This classification is crucial for identifying the tax obligations associated with rental income, offering clarity in the taxation of common business practices, such as property or asset renting, and ensuring compliance with various tax regulations and charges.

Understanding the HSN Code for Rent

The HSN (Harmonized System of Nomenclature) code for rent stands as a universal guide, streamlining the classification of an array of rental services. Specifically labeled as 997212, this code serves as a pivotal tool for categorizing diverse rental services, including commercial and residential properties, machinery, vehicles, furniture, and construction equipment.

Within this system, the HSN code for rent brings clarity to the taxation landscape. For businesses engaged in renting services, it plays a crucial role in determining the applicable tax rates. Under the Goods and Services Tax (GST) framework in India, most rental services, such as property, machinery, and vehicles, are subject to an 18% GST rate. Notably, renting furniture and household goods carries a slightly lower GST rate of 12%.

Beyond its application in the GST system, the HSN code for rent holds significance in the broader context of India’s tax structure. It contributes to simplifying tax procedures, reducing the likelihood of evasion, and fostering a more business-friendly environment.

As businesses navigate the complex terrain of rental services, understanding the HSN code for rent becomes paramount. Whether dealing with property, machinery, or vehicles, this classification system ensures a standardized approach, fostering transparency and compliance in the realm of indirect taxation.

Also Read: HSN Code Search By Product Name

Tax Implications on Rental Income

For businesses in the rental sector, the HSN code for rent plays a pivotal role in determining the applicable tax rates. Typically set at 18%, the Goods and Services Tax (GST) applies to various rental services, encompassing property, machinery, and vehicles.

Notably, renting furniture and household goods comes with a slightly reduced GST rate of 12%. This distinction in rates underscores the importance of understanding the HSN code for businesses engaged in providing diverse rental services, offering clarity on the tax implications that govern their income.

Factors Influencing Tax Liability

Beyond the crucial role played by the HSN code in determining tax rates for rental services, various factors contribute to the overall tax liability on rental income. Key among these factors are the nature and value of the rental service provided. The nuanced nature of the service, whether it involves commercial property, residential spaces, machinery, or other assets, can influence the tax obligations.

Additionally, rental income doesn’t solely fall under the realm of Goods and Services Tax (GST). It is also subject to scrutiny under the Income Tax Act, 1961. This broader perspective on taxation necessitates a comprehensive understanding of the specific nature and details of the rental transaction.

The Income Tax Act outlines the applicable rates and provides a framework for individuals or entities to declare and fulfill their tax obligations regarding rental income. Therefore, businesses involved in rental services need to navigate not only the HSN code intricacies but also consider the diverse factors shaping their overall tax liability in accordance with income tax regulations.

Role of HSN Code in GST System

Embedded within India’s expansive Goods and Services Tax (GST) system, the HSN code for rent serves as a linchpin in streamlining taxation processes. Its inclusion is instrumental in simplifying the overall tax structure, curbing evasion, and fostering a more business-friendly environment.

The HSN code is not merely a classification tool but an integral component of the broader GST framework, contributing significantly to the efficiency and transparency of the taxation system. Its incorporation aligns with the overarching goals of the GST system, enhancing simplicity and promoting a conducive atmosphere for seamless business operations.

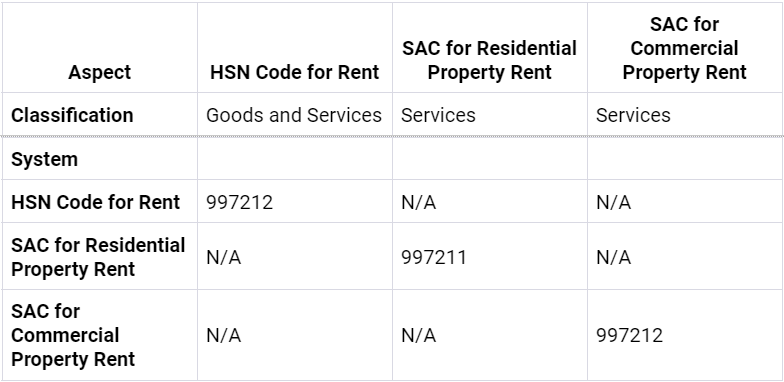

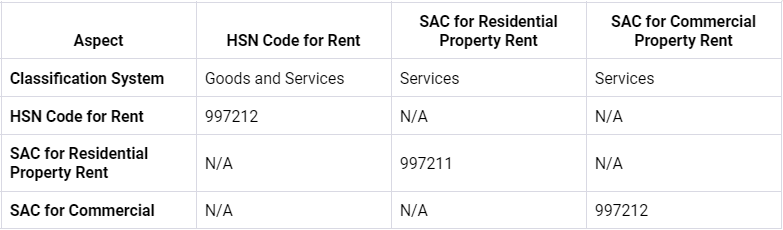

Distinction Between HSN Code and SAC for Rent

Differentiating from the Services Accounting Code (SAC), the HSN code specifically classifies goods and services.

In the taxation landscape under the GST regime, the HSN code and SAC serve distinct purposes. While the HSN code (997212) specifically classifies goods and services related to rent, the SAC system specializes in classifying services. Notably, residential property rent falls under SAC 997211, and commercial property rent falls under SAC 997212. Understanding this differentiation is crucial for businesses engaged in rental services, ensuring accurate categorization and compliance within the GST framework.

Conclusion

Understanding the HSN code for rent is like having a clear map for rental services. It guides businesses through tax complexities in the GST system and India’s broader tax structure. Whether dealing with property, machinery, or other rentals, mastering these codes ensures transparency and compliance. It’s like having a tool that makes business operations smoother and financial matters clearer. So, as businesses venture into the rental world, knowing these codes becomes a key to navigating taxes effortlessly, creating a business environment that’s easy to manage and understand.

FAQs

What is the HSN code for rent?

The HSN code for rent in India is 997212. It falls under the category of “Rental services of personal and household goods,” specifically classified as “Leasing or rental services concerning machinery and equipment.

Which rental services fall under the HSN code for rent?

The HSN code for rent covers various services, encompassing the renting of commercial or residential property, machinery, vehicles, furniture and household goods, and construction equipment and tools.

What is the Goods and Services Tax (GST) rate for rental services?

For most rental services, such as commercial or residential property, machinery, and vehicles, the GST rate is 18%. Notably, renting furniture and household goods incurs a lower GST rate of 12%.

Does rental income attract income tax?

Indeed, rental income falls under the purview of income tax as per the Income Tax Act, 1961. The tax rate is determined by the individual or entity’s income slab, considering applicable deductions. This means the amount of tax paid depends on the earnings and eligible deductions, ensuring a fair and personalized approach to income tax on rental earnings.

What is the difference between HSN code for rent and SAC for rent?

Can I claim deductions against rental income for income tax purposes?

Absolutely. You can claim specific deductions, including property tax paid and interest on a housing loan, against your rental income for income tax purposes. These deductions provide opportunities to reduce taxable income, ensuring a fair and nuanced approach to income tax on rental earnings.

How can businesses ensure compliance with the HSN code for rent and other tax regulations?

To ensure compliance, businesses should familiarize themselves with relevant laws and regulations, uphold meticulous record-keeping practices, and submit precise tax returns punctually. Seeking guidance from a tax consultant or professional is advisable to guarantee adherence to the HSN code for rent and other tax regulations. This comprehensive approach not only fosters compliance but also contributes to the smooth functioning of business operations within the legal framework.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]