[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12662″ img_size=”full” css=”.vc_custom_1713506484012{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Established in 1981, Export Oriented Units (EOUs) signify an important component of India’s strategy to strengthen exports, foreign exchange reserves, and employment opportunities. Seamlessly integrated within the framework of the Foreign Trade Policy, specifically Chapter 6, EOUs operate alongside Electronics Hardware Technology Parks (EHTPs), Software Technology Parks (STPs), and Bio-Technology Parks (BTPs).

Collectively referred to as the EOU scheme, these entities serve as dynamic engines propelling India’s export-oriented growth. Under this scheme, registered units are mandated to export their entire production, save for a portion earmarked for the Domestic Tariff Area (DTA).

By fostering a conducive environment for production and trade, EOUs contribute significantly to the country’s economic vitality, aligning with broader objectives of economic diversification and global competitiveness. This strategic alignment not only augments India’s presence in the global marketplace but also fortifies its position as a key player in the international trade landscape, fostering sustainable growth and prosperity.

What are the Objectives of the EOU Scheme?

Here are the main objectives of EOU Scheme:

Conducive Ecosystem: EOUs benefit from a supportive environment tailored to their needs, facilitating smoother operations and growth opportunities.

Regulatory Benefits: Units enjoy waivers and preferential treatment in compliance and taxation, easing the regulatory burden and enhancing business efficiency.

Foreign Exchange Inflow: Export activities foster a steady influx of foreign exchange, bolstering the nation’s economic resilience and global standing.

Employment Generation: By promoting export-driven enterprises, the scheme contributes to job creation, addressing unemployment concerns and enhancing livelihoods.

Supply Chain Enhancement: EOUs play a pivotal role in optimizing the supply chain, from sourcing raw materials to delivering finished products to the Domestic Tariff Area (DTA), thereby streamlining logistics and boosting overall trade efficiency.

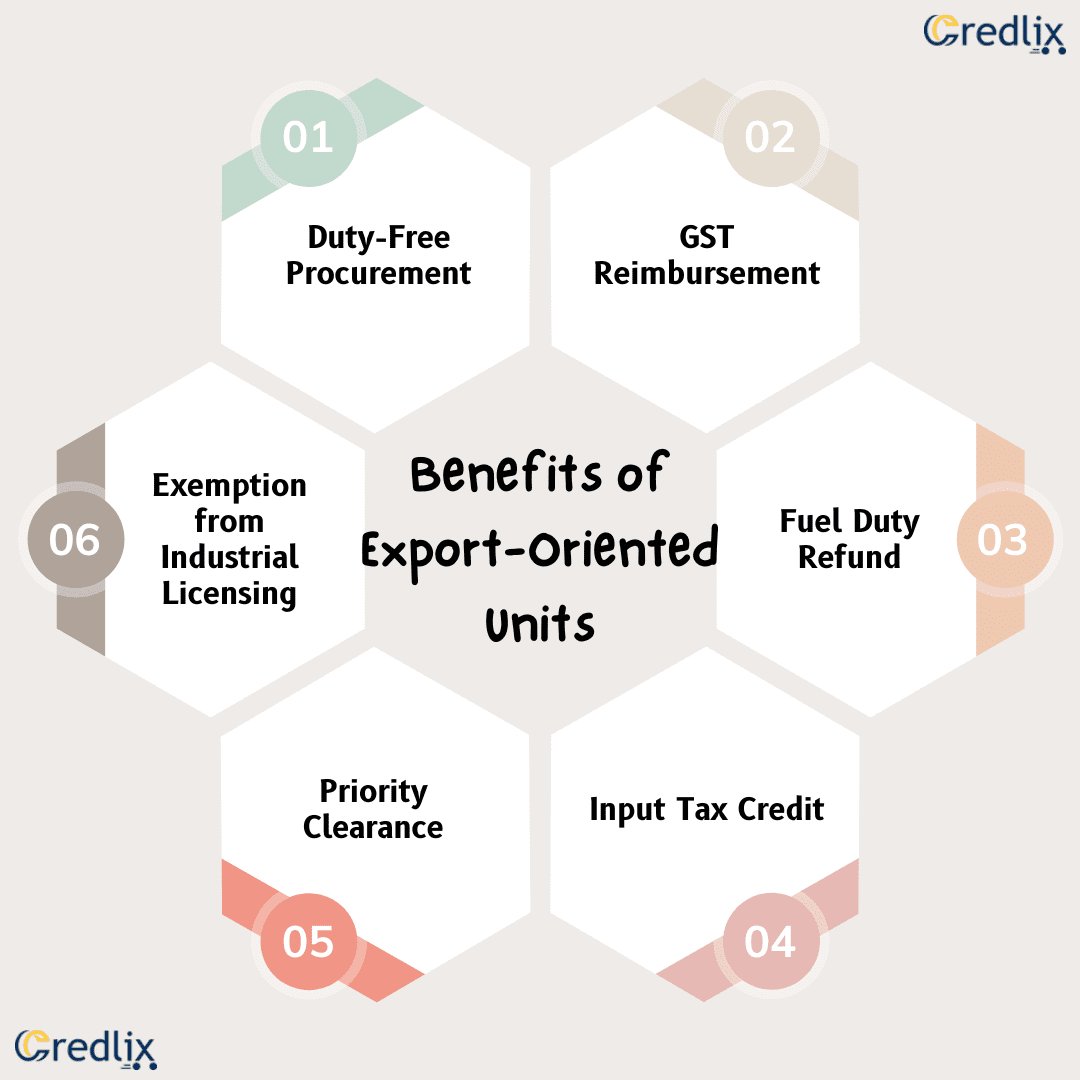

Benefits of Export-Oriented Units

Here are some of the major benefits of Export Oriented Units:

Duty-Free Procurement: EOUs benefit from duty exemptions on the purchase of raw materials and capital goods sourced domestically or imported, enhancing cost-effectiveness and competitiveness in global markets. This facilitates seamless procurement processes and encourages efficient production practices.

GST Reimbursement: EOUs are eligible to claim reimbursement on the Goods and Services Tax (GST) amounts they pay, providing financial relief and incentivizing export-oriented activities. This contributes to improved cash flow and operational sustainability for EOU enterprises.

Fuel Duty Refund: If EOUs purchase fuel from domestic oil companies and incur duties, they have the privilege to claim refunds on these duties. This alleviates financial burdens and encourages the utilization of domestically sourced fuels, promoting energy sustainability and cost-efficiency.

Input Tax Credit: EOUs have the advantage of claiming input tax credits on both goods and services utilized in their production processes. This fosters a conducive environment for investment and innovation, as it reduces the overall tax burden and encourages efficient resource allocation.

Priority Clearance: EOUs enjoy priority-based clearance facilities, expediting the movement of goods across borders and minimizing delays in the export process. This streamlined clearance mechanism enhances operational efficiency and enables timely delivery to international markets.

Exemption from Industrial Licensing: Unlike manufacturing units reserved for the Small Scale Industry (SSI) sector, EOUs are exempt from the requirement of obtaining industrial licenses. This regulatory flexibility facilitates smoother business operations and eliminates bureaucratic hurdles, allowing EOUs to focus on their core competencies and market expansion strategies.

Also Read: What are Export Finance Risks in India?

Setting up an Export Oriented Unit (EOU): The Complete Process

Setting up an Export Oriented Unit (EOU) involves several key steps and considerations:

Application Process: To establish an EOU, an application must be submitted to the Board of Approval. Upon approval, a Letter of Permission is issued, granting a two-year window for construction and machinery installation, extendable by another year. Positive foreign exchange earnings must be achieved within five years of operations commencement.

Minimum Investment: A minimum investment of one crore rupees in plant and machinery is required for EOUs, except for Software Technology Parks, Electronics Hardware Technology Parks, Biotechnology Parks, and sectors like agriculture, animal husbandry, IT, handicrafts, services, etc.

Location Requirements: EOUs must be situated at least 25 kilometers away from standard urban areas, unless located within industrial zones or dealing with non-polluting products or services.

Industry Focus: Initially, EOUs were predominantly in sectors like textiles, food processing, electronics, etc. However, they now span across manufacturing, engineering, agriculture, services, software, trading, and more.

Special Licensing: Certain sectors such as weapons, defense equipment, atomic, narcotics, etc., require special licenses obtained through application to the Development Commissioner.

Bonding Period: EOUs are licensed for manufacturing and export within a bonded period of five years, extendable by an additional five years upon approval from the Development Commissioner, and further extended upon request to the Commissioner/Chief Commissioner of Customs.

Also Read: Everything About Export Finance Scheme

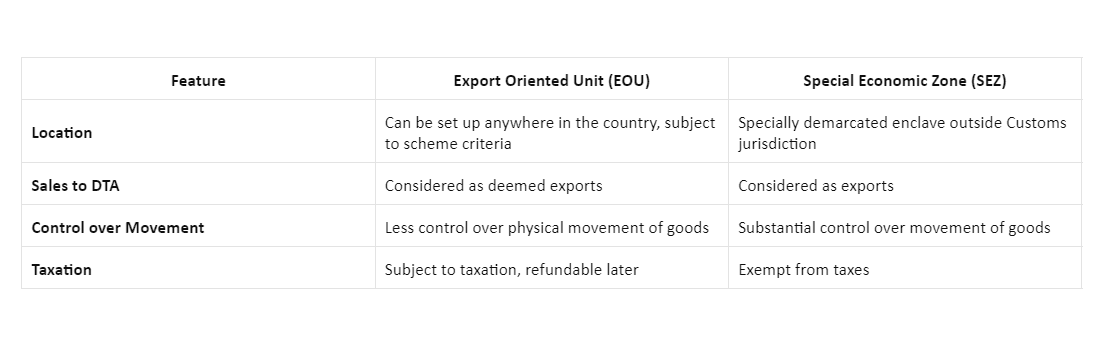

Difference between EOU and SEZ

This table below provides a concise comparison between Export Oriented Units (EOUs) and Special Economic Zones (SEZs), highlighting their differences in location, sales to Domestic Tariff Area (DTA), control over movement of goods, and taxation.

GST Implications for Export Oriented Units (EOUs)

In the area of Goods and Services Tax (GST), Export Oriented Units (EOUs) navigate specific regulations:

Taxation on Supplies: Suppliers to EOUs are required to levy GST on goods supplied. However, EOUs have the flexibility to either claim input tax credit on GST paid for supplies to the Domestic Tariff Area (DTA) or seek a refund for the GST amount.

GST Payment on Sales to DTA: EOUs are obligated to remit GST on eligible sales to the DTA, unless the transaction involves zero-rated supplies, which are exempt from GST.

Inter-EOU Transactions: GST applies even in transactions between EOUs, as per GST regulations, treating such transactions akin to regular sales.

Customs Duty Exemption: EOUs enjoy exemption from primary customs duty on imports, providing a favorable environment for their operations and trade activities.

The Export Oriented Units (EOU) scheme demonstrated significant positive impact during its initial two decades until the introduction of the Special Economic Zone (SEZ) scheme. However, over the subsequent decade, its contribution to overall exports witnessed a decline, turning negative around 2011-12, coinciding with the withdrawal of tax benefits under the Income Tax Act.

Unlike Free Trade Zones and Export Processing Zones, which imposed specific locational restrictions, EOUs provided exporters with the freedom to establish export businesses in locations of their preference. Additionally, EOUs offered a diverse array of industrial sectors for exporters to choose from when setting up their export-oriented units, further enhancing flexibility and opportunities within the scheme.

Also Read: What is Export Finance in International Marketing?[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]