[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12924″ img_size=”full” css=”.vc_custom_1715930625085{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In international trade, when an importer buys goods from another country, they need important documents to get those goods at their local port. One crucial document is the bill of lading (BL), which the shipping company gives to the exporter after checking the goods. The exporter then sends this BL and other necessary papers to the importer. Without these documents, the importer can’t get their goods.

Sometimes, there are problems. The documents might not reach the importer on time, or they could even get lost during shipping. In such situations, the importer can go to a bank for help. The bank provides something called a “shipping guarantee.” This guarantee ensures that the goods will be released to the importer even if there are issues with the documents. With the shipping guarantee, the importer can take possession of the goods and move them out of the port smoothly.

In simple terms, a shipping guarantee is like insurance. It helps the importer get their goods even if there are problems with the paperwork. This way, the importer can receive and use the products they’ve bought without any unnecessary delays.

What Is a Shipping Guarantee?

A shipping guarantee is a helpful solution for importers when goods arrive at the port before their original documents. Normally, importers need these documents to get their goods through customs and other procedures. But if the ship arrives early and the documents are late, the importer has to wait. Waiting too long means paying extra charges called demurrage fees. These fees can be quite high, especially if the goods stay at the port longer than expected.

To avoid these extra charges, importers can go to a bank for a shipping guarantee. The bank provides this guarantee against a credit line. It means the bank promises to share responsibility for the goods with the importer. With the shipping guarantee, importers can take their goods from the port to their warehouse without needing the original documents. This helps them avoid paying demurrage fees and protects against losing goods, especially if they are perishable.

Benefits of a Shipping Guarantee

Here are some of the major benefits of shipping guarantee:

Avoid Demurrage Charges

Demurrage charges can quickly accumulate if goods remain at the port longer than expected due to delays in receiving shipping documents. By utilizing a shipping guarantee, importers can bypass these charges, thereby saving significant costs and ensuring that their budget remains intact for other business needs.

Timely Goods Receipt

With a shipping guarantee in place, importers can expedite the receipt of their goods upon arrival at the port, even if the original documents are delayed. This allows for seamless transportation of goods to their warehouses without the need to wait for the formalities associated with document processing, enabling importers to maintain operational efficiency.

Reduced Financial Burden

The avoidance of demurrage fees through a shipping guarantee alleviates the financial burden on importers. By minimizing unexpected expenses, importers can better manage their financial resources and allocate funds strategically to support various aspects of their business operations, such as inventory management or marketing initiatives.

Enhanced Cash Flow

By preventing demurrage charges, a shipping guarantee helps to improve cash flow for importers. With reduced financial strain resulting from unnecessary penalties, importers can maintain a healthier cash flow position, enabling them to invest in growth opportunities or manage day-to-day expenses more effectively.

Risk Mitigation

Swiftly moving goods out of the port with the assistance of a shipping guarantee reduces the risk of loss or damage, particularly for perishable items. Importers can mitigate the potential financial and logistical challenges associated with damaged or spoiled goods by ensuring their timely and secure receipt at the warehouse.

Flexibility in Operations

Shipping guarantees provide importers with greater flexibility in managing their logistics operations. By streamlining the import process and circumventing delays caused by document discrepancies, importers can adapt to changing market conditions more efficiently and maintain a competitive edge in their industry.

Improved Trade Relations

By facilitating the timely receipt of goods and minimizing disruptions in the import process, shipping guarantees contribute to positive trade relations between importers, suppliers, and shipping companies. Importers can build and sustain strong partnerships based on reliability and trust, fostering long-term collaborations that benefit all parties involved in the supply chain.

Who Can Provide a Shipping Guarantee?

In simple terms, a shipping guarantee can be obtained from the importer’s bank or the bank that issued the letter of credit for the transaction. To get a shipping guarantee, the importer must have a credit line established with the bank. Once the importer’s bank receives the original shipping documents from the exporter’s bank, they provide the importer with the bill of lading and other necessary documents in exchange for the shipping guarantee.

Bank Requirements To Obtain a Shipping Guarantee

To apply for a shipping guarantee, certain conditions must be fulfilled:

Legally Approved Business License: The importing business must possess a legally approved business license, along with valid certifications demonstrating the legitimacy and scope of its operations.

Settlement by Letter of Credit: The settlement for the shipment of goods must be conducted through a letter of credit, ensuring a secure transaction process.

Established Credit Line: The importer must maintain a credit line with the bank or have a single credit extension approved by the issuing bank to qualify for a shipping guarantee.

Submission of Application and Documents: The importer is required to submit an application for a shipping guarantee along with copies of the commercial invoice and bill of lading to the bank.

Acknowledgment of Document Discrepancies: The importer must agree to accept any possible discrepancies in the presentation of documents as part of the application process.

Undertaking for Return of Guarantee: Additionally, the importer is obligated to submit an undertaking stating their commitment to return the original shipping guarantee, duly discharged by the carrier, upon receipt of the original bill of lading.

Step-by-Step Guide to the Shipping Guarantee Process

Understand the step-by-step guide to the shipping guarantee process below:

Application Submission

The process commences when the importer realizes that the shipment will arrive at the destination port before the shipping documents. The importer submits an application for a shipping guarantee to their banking institution, with whom they have an established credit line.

Application Review

Upon receiving the application, the bank reviews it along with copies of the invoice and bill of lading provided by the importer.

Shipping Guarantee Issuance

After completing the review process, the bank issues the shipping guarantee to the importer, confirming their commitment to bear joint liability for the cargo.

Goods Collection: Armed with the shipping guarantee, the importer collects the goods from the carrier at the port, clears customs formalities, and transports the cargo to their warehouse.

Document Review

Once the original shipping documents arrive at the importer’s bank, the bank carefully examines them to ensure compliance with the terms of the shipping guarantee.

Document Handover

Upon satisfactory review, the bank hands over the shipping documents to the importer, enabling them to proceed with further processing.

Substitution Process

With the original bill of lading in hand, the importer substitutes it for the shipping guarantee at the shipping company’s office.

Return of Guarantee

Finally, the importer returns the original shipping guarantee to the issuing bank, completing the process.

How To Obtain a Shipping Guarantee in Case of Lost Documents?

In the event of lost shipping documents during transit, importers can still proceed with obtaining a shipping guarantee, albeit with additional requirements. They must provide supplementary documents, including a letter from the shipper explaining the circumstances of the lost bill of lading. Additionally, a court order may be necessary, directing the carrier or shipping company to deliver the goods based on a surety bond.

Importers may also need to submit a Letter of Indemnity, absolving the carrier from liability as per the terms of the original bill of lading. These measures help facilitate the issuance of a shipping guarantee despite the loss of documents.

Obtaining a Duplicate Bill of Lading for Shipping Guarantee

To secure a shipping guarantee, importers must acquire a copy of the bill of lading, a crucial document in the process. They can obtain this duplicate set by formally requesting the shipping company. However, the shipping company typically requires an indemnity letter, absolving them of liability in case the original bills resurface.

Importers must provide this letter, along with any other necessary documentation, and may be subject to a predetermined indemnity bond amount set by the shipping company. This ensures compliance and facilitates the issuance of a shipping guarantee.

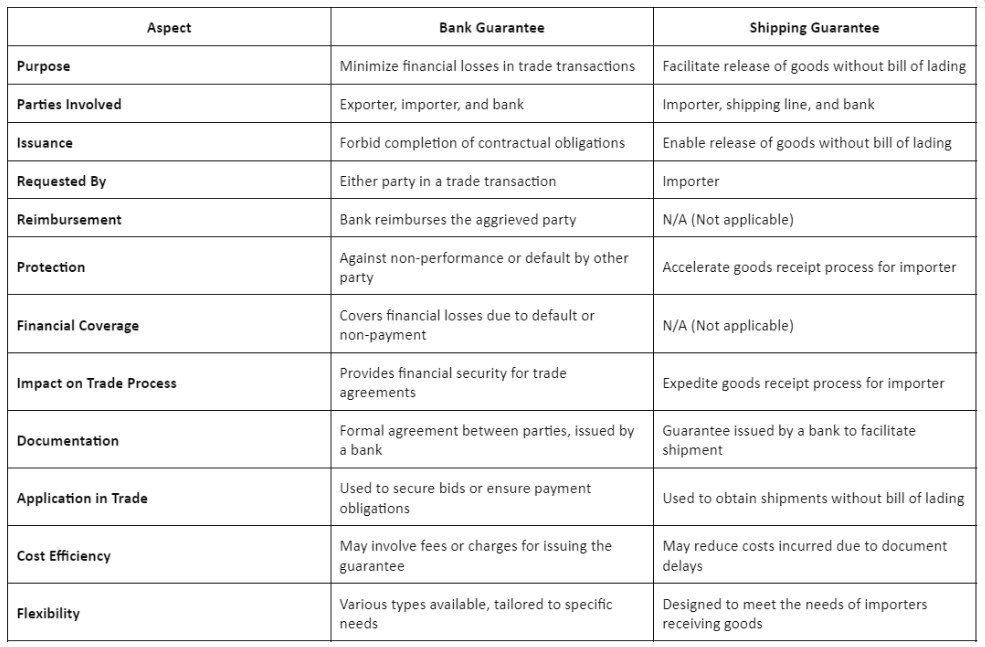

Difference Between a Bank Guarantee and a Shipping Guarantee

This table below provides a comprehensive overview of the differences between bank guarantees and shipping guarantees, covering aspects such as purpose, parties involved, issuance, reimbursement, protection, documentation, and application in trade.

Conclusion

Shipping guarantees play a pivotal role in facilitating smooth import-export transactions by ensuring timely receipt of goods, minimizing financial burdens, and mitigating risks associated with document discrepancies or loss. Importers benefit from enhanced operational efficiency, reduced demurrage charges, and improved cash flow, thus enabling them to maintain competitiveness in the global marketplace.

By understanding the process, benefits, and differences between bank guarantees and shipping guarantees, importers can navigate international trade with greater confidence and reliability, fostering mutually beneficial relationships across the supply chain.

Also Read: Shipping Bill | Understand the Meaning, Types and Format[/vc_column_text][vc_column_text]In the dynamic world of business, managing finances efficiently is key to ensuring sustained growth and success. One crucial aspect that often takes center stage is the management of receivables – the money owed to your business by customers.

This blog aims to shed light on the strategic use of financing receivables and the impactful practice of vendor financing, offering insights that are both accessible and beneficial to businesses of all sizes.

Financing Receivables:- What is Financing Receivables

Accounts receivable financing is a different way to get money compared to going to a regular bank. Basically, it’s a money move where you borrow cash using the money your customers owe you.

Here’s the deal: if your company is waiting for money to come in, but you need cash ASAP to cover your bills, accounts receivable financing steps in to help. It’s also great for businesses that don’t want to hassle with collecting money from people who owe them. Instead, they can pay a little fee and get the money right away.

In simple terms, it’s like turning the future money you’re expecting into real cash when you need it!

Types of Financing Receivables

Here are different types of financing receivables options that you need to understand:

Collateralized Loan Option

- If you have customers who owe you money, you can use these accounts as collateral for a loan from a financing company.

- When your customers settle their bills, you can use that money to pay off the loan.

Invoice Factoring Option

- Another way is to sell your accounts receivable to a factoring company.

- With a service known as invoice factoring, the factoring company buys your non-delinquent unpaid invoices.

- They pay you an upfront percentage, called the advance rate, of what your customers owe.

- The factoring company then collects payments directly from your customers, and once the accounts receivable are paid, they keep a small factoring fee and give you the remaining balance.

Advantages of Financing Receivables

Understand some of the benefits of financing receivables to help you make a wiser and informed decision:

Upfront Cash for Unpaid Accounts: With receivables financing, you receive immediate funds for invoices that your customers haven’t paid yet. It’s like getting a cash advance based on the money you’re expecting to receive in the future.

Potentially Lower Financing Costs: The financing rate in receivables financing may be more cost-effective compared to other borrowing options such as traditional loans or lines of credit. This can be particularly beneficial for businesses looking to manage their costs while accessing the necessary funds.

Relief from Unpaid Bill Collection: Opting for receivables financing can lift the weight of chasing down unpaid bills from your shoulders. Instead of spending time and resources on collections, a financing company takes on this task. It allows your business to focus on its core activities while ensuring a steady flow of working capital.

Ideal for Cash Flow Challenges: Receivables financing is a great solution for businesses facing cash flow issues. Whether you’re waiting for payments from customers or need quick funds to cover operational expenses, this option provides a flexible and accessible way to address cash flow gaps. It’s suitable for a variety of companies, regardless of their size or industry, offering a lifeline during financially challenging periods.

Disadvantages of Financing Receivables

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Requirement of Outstanding Invoices: To benefit from receivable financing, your business must have outstanding invoices, meaning customers owe you money. This financial option leverages these accounts receivable as assets that can be used to secure a loan or sell to a factoring company.

Importance of Clear Terms for Unpaid Accounts: Keeping clear and accurate records of the terms associated with unpaid accounts is crucial. This includes documenting when payments are expected, the amounts owed, and any specific conditions. Maintaining meticulous records is essential for the smooth process of receivable financing, ensuring transparency and accuracy in the transactions.

Impact of Credit History on Qualification: Qualifying for receivable financing may depend on your business’s credit history. If your business lacks a stable credit history, it could pose a challenge in accessing this form of financing. Lenders or factoring companies often assess the creditworthiness of a business before extending receivable financing. Having a stable credit history enhances your eligibility and may lead to more favorable terms. It emphasizes the importance of maintaining good financial standing to maximize the benefits of receivable financing.

Vendor Financing:- What is Vendor Financing?

Vendor financing, also known as supplier financing or trade credit, is a financial arrangement where a company obtains funding or extended payment terms from its suppliers. In this scenario, the vendor, or the supplier of goods or services, plays a crucial role in providing financial support to the purchasing company.

It’s a smart move when you’re buying a lot of big stuff. If you’re getting things like inventory for a store, computers, vehicles, or machinery, talk to your suppliers about financing deals. It’s like making a deal to pay for these things over time instead of all at once. This helps you avoid running low on cash and gives you the chance to grow your business while paying for the equipment. It’s a win-win!

Also Read : What Is a Vendor? Definition, Types, and Example

Benefits of Vendor Financing

Understand some of the benefits of vendor financing to help you make a wiser and informed decision:

Equipment Purchase without Upfront Payment: One big advantage of vendor financing is that it lets you buy the equipment you need without having to pay for it all upfront. Instead of emptying your wallet in one go, you can work out a deal with your vendor to spread the cost over time. This means you can get essential equipment for your business without a hefty immediate expense.

Preservation of Cash for Emergencies: By using vendor financing, you’re able to keep more cash on hand. This is crucial for dealing with unexpected emergencies or opportunities that may come up in your business journey. Preserving your cash flow provides a financial safety net, allowing you to handle unforeseen challenges without disrupting your day-to-day operations or long-term plans.

Also Read: How to Use Vendor Financing to Buy a Business?

Disadvantages of Vendor Financing

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Extended Payment Period: One downside of vendor financing is that your payments might stretch out over a long period. While this eases the immediate financial burden, it could mean you’re committed to paying for the equipment over an extended timeframe. This extended payment period may limit your financial flexibility and tie up resources that could be used for other business needs.

Risk of Equipment Retrieval: If you fall behind on your payments, there’s a risk that the vendor could take back the equipment. This is a significant concern because it means not keeping up with your agreed-upon payment schedule could result in losing the very equipment your business relies on. It emphasizes the importance of carefully managing your financial commitments to avoid potential disruptions to your operations.

Distinguishing Accounts Receivables Finance from Accounts Receivable Factoring

Navigating the world of turning accounts receivables into immediate cash flow can be a game-changer for businesses in need of quick funds. While both services share the common goal of providing timely financial solutions, it’s essential to understand their fundamental differences:

Nature of the Transactions

Accounts Receivables Finance (Invoice Financing)

Think of this as a loan. Your business uses its outstanding invoices as collateral to secure a loan. It’s a financial arrangement where you borrow against the money your customers owe you, providing a flexible solution to bridge financial gaps.

Accounts Receivable Factoring

In contrast, factoring involves the outright sale of your receivables. Factoring companies become the owners of the current asset – your unpaid invoices. They pay you a portion upfront (known as the advance), and then they collect the full amount directly from your customers.

Roles of the Service Providers

Factoring Companies

Factoring companies act as buyers of a business’s current assets, taking ownership of the accounts receivable. They assume the responsibility of collecting payments from your customers.

Accounts Receivable Financing Companies

On the other hand, companies providing accounts receivable financing act as financiers or lenders. They extend a loan to your business, using the outstanding invoices as collateral, without taking ownership of the receivables.

Scope of Application

Accounts Receivable Factoring

Factoring is specifically tailored for commercial financing. It is a solution designed for businesses looking to optimize their cash flow by selling their unpaid invoices in commercial transactions.

Final Words

In the world of business, managing finances wisely is the key to success. Whether it’s unlocking cash through accounts receivables financing or securing equipment with vendor financing, these financial tools offer both opportunities and considerations. Accounts receivables financing turns future money into immediate cash, ideal for addressing cash flow challenges.

Vendor financing, on the other hand, lets you spread the cost of essential equipment, preserving cash for emergencies. While each has its advantages, it’s crucial to weigh the pros and cons. Whether you’re considering accounts receivables financing or vendor financing, understanding these financial strategies empowers you to make informed decisions, propelling your business toward sustained growth and financial resilience.

Credlix is becoming a big player in helping businesses with money. We want to make small businesses stronger, so we offer really good financing solutions made just for them.

Also Read : What Is a Vendor? Definition, Types, and Example[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]