[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”13085″ img_size=”full” css=”.vc_custom_1718175548358{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Did you know that global trade volume reached a staggering $19.48 trillion in 2020 as per World Trade Organization? Importing goods from international suppliers can be a lucrative business venture, but it often requires substantial upfront capital to fulfill purchase orders. This is where purchase order financing (PO financing) comes into play, offering a solution for businesses facing cash flow constraints.

Key Statistics on Purchase Order Financing

- According to a report by the Small Business Administration, over 27% of small businesses in the United States have reported cash flow issues as a major challenge. Purchase order financing can help alleviate these challenges by providing access to much-needed capital.

- The global purchase order financing market was valued at approximately $71.7 billion in 2020 and is projected to reach $106.2 billion by 2027, indicating a growing demand for this financing solution as per Fortune Business Insights.

What is Purchase Order Financing?

Purchase order financing is a funding option that allows businesses to finance the cost of fulfilling purchase orders from suppliers. Instead of relying solely on available capital or traditional loans, businesses can leverage purchase order financing to secure the necessary funds to fulfill orders and keep their operations running smoothly.

How Does Purchase Order Financing Work?

Purchase order financing is a financial arrangement designed to help businesses fulfill customer orders when they lack the necessary funds to do so. Here’s a detailed breakdown of how purchase order financing works:

Customer Places an Order: It all begins when a customer places an order for goods with a business. This could be anything from merchandise to raw materials needed for production.

Supplier Requires Payment: Once the order is received, the supplier typically requires payment upfront or upon delivery of the goods. This requirement can pose a challenge for businesses, especially if they don’t have sufficient cash on hand to cover the cost of the order.

Lack of Funds: This is where the problem arises. Due to cash flow constraints or other financial obligations, the business may find itself unable to fulfill the order using its own resources. This is where purchase order financing steps in to provide a solution.

Purchase Order Financing: To bridge the gap between customer orders and payment to suppliers, the business seeks purchase order financing from a lender. The lender evaluates the purchase order and the creditworthiness of the customer placing the order. If approved, the lender provides funds to cover the cost of purchasing the goods from the supplier.

Goods Delivered: With financing secured, the supplier proceeds to fulfill the order by delivering the goods to the business’s warehouse or directly to the customer, depending on the terms of the agreement.

Invoice Issued: Once the goods are received, the business issues an invoice to the customer for the goods delivered. This invoice includes the cost of the goods, any applicable taxes, and shipping fees.

Repayment: When the customer pays the invoice, the business receives the funds owed. It then uses these funds to repay the lender, along with any applicable fees or interest accrued during the financing period.

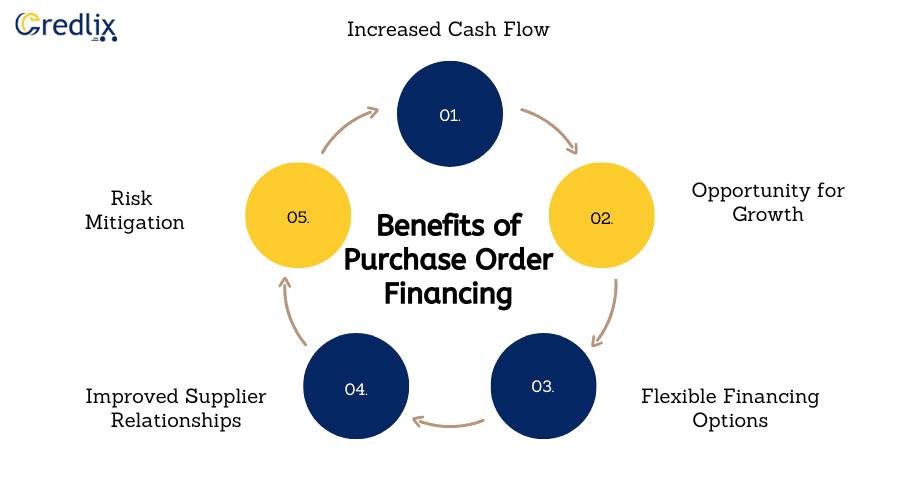

Benefits of Purchase Order Financing

Here are some of the major benefits of Purchase Order Financing:

Increased Cash Flow

Purchase order financing is a lifeline for businesses looking to finance their imports. By providing immediate access to funds, it allows businesses to fulfill import orders without depleting their existing capital reserves. This steady cash flow ensures uninterrupted operations and enables businesses to seize lucrative import opportunities without financial constraints.

Opportunity for Growth

Importing goods opens doors to new markets and revenue streams. With purchase order financing, businesses can capitalize on large or unexpected import orders that would otherwise be beyond their financial reach. This access to financing fuels growth initiatives, enabling businesses to expand their product offerings, enter new markets, and enhance their competitive edge on a global scale.

Flexible Financing Options

Purchase order financing offers flexibility tailored to the unique needs of import businesses. Whether it’s short-term financing for a specific import order or long-term arrangements to support ongoing import operations, businesses can customize financing terms to align with their import cycles and cash flow requirements. This flexibility empowers businesses to navigate import challenges and seize import opportunities with confidence.

Improved Supplier Relationships

Timely payment to international suppliers is paramount for maintaining strong supplier relationships. Purchase order financing ensures that businesses can fulfill import orders promptly, strengthening trust and reliability with suppliers. By honoring commitments and paying suppliers on time, businesses foster long-term partnerships and may even negotiate favorable terms or discounts for future import transactions.

Risk Mitigation

Importing goods comes with inherent risks, including financial strain or default on purchase orders. Purchase order financing acts as a risk mitigation tool, providing financial stability and protection against unforeseen challenges. By securing financing upfront, businesses can confidently fulfill import orders, mitigate the risk of supply chain disruptions, and uphold customer satisfaction.

Conclusion

Purchase order financing offers a valuable financial tool for businesses looking to finance their imports and fulfill customer orders effectively. By leveraging this financing option, businesses can overcome cash flow challenges, seize growth opportunities, and build stronger supplier relationships in today’s competitive global marketplace.

Also Read : A Complete Guide on Purchase Order Financing: What it is and How it works?[/vc_column_text][vc_column_text][/vc_column_text][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]