- November 28, 2024

- Posted by: admin

- Categories: Export Financing, Blog

International trade can seem daunting, especially for first-time traders, with its intricate processes and specialized terminology. Among the critical terms traders encounter are FOB (Free On Board) and CIF (Cost, Insurance, and Freight), two common Incoterms published by the International Chamber of Commerce (ICC). These terms play a pivotal role in defining the responsibilities, risks, and costs borne by sellers and buyers in international trade transactions.

In this article, we will break down FOB and CIF, explain their significance, and help you understand how to choose the right one for your trade.

What Are Incoterms?

Incoterms (International Commercial Terms) are standardized rules developed by the ICC to facilitate global trade by defining the responsibilities of sellers and buyers. These terms clarify who pays for shipping, insurance, and customs duties, and at what point the risk of goods transfer between the two parties.

Among the many Incoterms, FOB and CIF are particularly popular for shipping goods across international borders. Understanding the nuances of these terms ensures smoother trade operations and minimizes disputes.

What is an FOB Incoterm?

The FOB term stands for “Free on Board,” and it is used to define the point at which the risk and responsibility for goods transfer from the seller to the buyer. Under this incoterm, the seller is responsible for the goods until they are loaded onto a vessel at the port of origin. The buyer then takes on the risk and costs of shipping, including transportation and insurance, once the goods are on board.

Types of FOB

FOB Origin (FOB Shipping Point):

Under FOB Origin, the buyer takes responsibility for the goods once they are dispatched from the seller’s location. In this case, the title of ownership and risk transfer from the seller to the buyer as soon as the goods are loaded onto the vessel. The buyer is responsible for the cost of shipping and any damages or losses that occur after that point.

FOB Destination:

With FOB Destination, the seller maintains the responsibility and risk until the goods reach the buyer’s destination port. In this case, the seller takes on the costs of shipping, including freight and insurance, and assumes the risk until the goods are safely delivered to the agreed-upon destination.

While FOB originally applied to goods transported by sea, its usage has expanded to include other modes of transportation like air and land.

How FOB Affects International Trade?

When negotiating FOB terms, it’s crucial for both parties—buyer and seller—to clearly define the port of origin or destination in the contract. These terms influence several factors like:

Freight Charges: The buyer or seller will need to account for different shipping costs depending on whether the FOB is at origin or destination.

Risk and Responsibility: The transfer of responsibility is an important aspect of FOB. If the goods are damaged or lost after the specified point, the party responsible for shipping the goods will bear the costs.

What is a CIF Incoterm?

CIF stands for “Cost, Insurance, and Freight.” It is an international shipping agreement where the seller is responsible for covering the costs of shipping, insurance, and freight charges until the goods reach the destination port. CIF is specifically used for goods transported by sea or waterways and doesn’t apply to other modes of transport like air or land.

Under the CIF agreement, the seller assumes full responsibility for the cargo during its transit until it reaches the buyer’s port. The seller will also cover the insurance costs to protect the goods during transportation. However, once the goods reach the destination port, the buyer assumes responsibility for the goods.

Responsibilities Under CIF:

Seller’s Responsibilities:

The seller must handle and pay for the following:

- Costs of shipping the goods to the destination port.

- Insurance coverage for the goods during transit.

- Freight charges and handling of goods until they are loaded onto the ship.

Buyer’s Responsibilities:

The buyer is responsible for the following once the goods reach the destination port:

- Any duties, taxes, or customs fees incurred at the destination.

- Transportation costs from the destination port to the final delivery point.

- Risk of damage or loss after the goods have reached the destination port.

CIF is often preferred by buyers who lack shipping expertise or those who prefer not to deal with insurance and freight. The seller, on the other hand, may find CIF beneficial when they have easier access to shipping arrangements and can offer buyers a more comprehensive deal by including freight and insurance in the price.

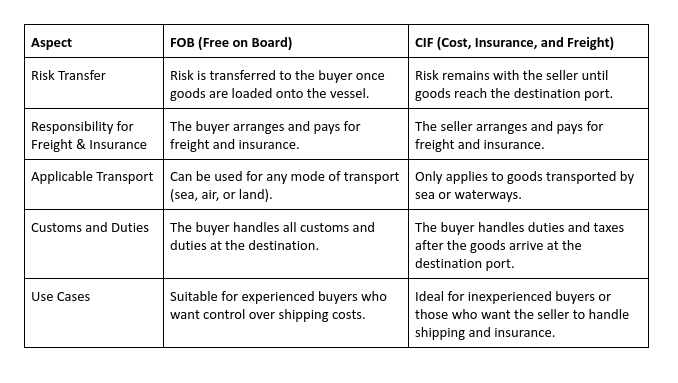

Key Differences Between FOB and CIF

Choosing Between FOB and CIF

The choice between FOB and CIF depends on several factors including the nature of the goods, the experience of the parties involved, and their preferences regarding risk and control over shipping logistics. Here are some considerations for when each incoterm might be appropriate:

When to Choose FOB:

FOB is typically chosen when the buyer is more experienced or when they want greater control over the shipping process. It allows the buyer to handle transportation arrangements and negotiate better rates with shipping companies. FOB is also beneficial for buyers who have their own preferred insurance providers or want to handle the risk and responsibility from the moment the goods leave the seller’s premises.

Example: A company in India (the seller) is exporting products to the US. The seller and the buyer agree on FOB Mumbai. This means that the buyer assumes responsibility once the goods are loaded onto the vessel in Mumbai. The buyer also arranges and pays for the shipping, insurance, and customs duties upon arrival in the US.

When to Choose CIF:

CIF may be preferable when the buyer is new to international trade or lacks experience in shipping and insurance. In this case, the seller handles the shipping and insurance, making it easier for the buyer to focus on other aspects of the business. CIF is also ideal when the seller has better access to shipping services or deals with large volumes of goods.

Example: A company in the US orders goods from a supplier in Japan, and the supplier offers the shipment under CIF terms. The seller will arrange and pay for the shipping and insurance, and the buyer assumes responsibility once the goods arrive at the destination port in the US.

Costs and Price Value in FOB vs. CIF

The costs associated with FOB and CIF are structured differently:

FOB Costs:

The seller is responsible for the cost of the goods, packaging, and loading onto the vessel. The buyer then bears the responsibility for shipping, insurance, and other costs during transit.

CIF Costs:

The seller covers the cost of goods, packaging, insurance, freight, and shipping until the goods reach the destination port. The buyer only needs to handle customs duties, taxes, and transportation to the final destination.

In both cases, the cost of shipping and insurance will impact the price of the goods. The seller typically incorporates the cost of freight and insurance into the price for CIF agreements, while buyers may negotiate directly for shipping and insurance charges in FOB agreements.

Choosing Between FOB and CIF

Factors to Consider

- Risk Appetite: Buyers with higher risk tolerance may prefer FOB, while risk-averse buyers might choose CIF.

- Bargaining Power: Stronger negotiation skills can help buyers secure better deals under FOB.

- Access to Resources: Sellers with easier access to vessels might find CIF more convenient.

- Experience: New traders often prefer CIF for its simplicity.

Conclusion

Understanding the distinctions between FOB and CIF Incoterms is vital for smooth international trade. Each term offers unique advantages and suits different trading scenarios. While FOB empowers buyers with control and cost-saving opportunities, CIF simplifies logistics for inexperienced buyers by shifting the burden to the seller.

Ultimately, the choice between FOB and CIF depends on the nature of the goods, the experience of the parties, and their willingness to assume risks. By carefully analyzing your trade requirements, you can select the most suitable Incoterm and ensure a seamless trading experience.