[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12220″ img_size=”full” css=”.vc_custom_1709117137786{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]The internet and technology have made running businesses easier, both at home and abroad. Nowadays, there are many payment options available for customers, sellers, and manufacturers. When it comes to international trade, there are legal processes and inspections required by both the exporting and importing countries.

So, it’s important to choose the right payment method that everyone agrees on, to make deals secure and trustworthy for both sides.

Five Main Payment Methods Used in International Trade

Discover the five main payment methods used in international trade: cash in advance, letters of credit, documentary collection, open accounts, and consignments. Explore further to learn about each method and their respective advantages and considerations.

1. Cash in Advance

Cash in advance terms of payment in international trade offer exporters a reliable way to eliminate credit risk. With this method, payment is received before products are shipped to the customer, typically through wire transfers or credit cards for international sales.

Pros:

- Ensures full payment security for exporters before shipment.

- Eliminates the risk of non-payment or payment delays.

- Provides financial stability and predictability for exporters.

- Simplifies financial planning and cash flow management.

- Helps build trust and credibility with customers.

- Reduces administrative burden associated with chasing payments.

- Enables faster order processing and fulfillment.

- Facilitates smoother logistics and shipping arrangements.

- Minimizes the need for credit checks and trade financing.

- Offers greater control over the sales process and transaction terms.

Cons:

- May deter potential buyers who prefer more flexible payment options.

- Could lead to loss of business opportunities to competitors offering better payment terms.

- Increases the burden of upfront costs and financial commitments for buyers.

- Raises concerns among buyers about product quality or delivery reliability.

- Limits the ability to negotiate favorable payment terms or discounts.

2. Letter of Credit

Letter of Credit (LC) is a widely embraced and secure payment method in international trade. Here, the customer’s bank provides a written commitment, assuring the exporter of payment upon fulfillment of agreed terms. This offers exporters assurance regarding the creditworthiness of the customer’s foreign bank before shipment.

Pros:

- Offers assurance of payment from the customer’s bank.

- Enhances financial security for exporters.

- Reduces the risk of non-payment.

- Facilitates trust between parties involved.

- Enables smoother transactions in international trade.

- Provides a standardized payment mechanism.

- Increases confidence in conducting business with new partners.

- Helps mitigate currency exchange risks.

- Allows for easier negotiation of trade terms.

- Streamlines documentation and paperwork processes.

Cons:

- Involves a time-consuming application and approval process.

- Requires adherence to strict documentation and compliance requirements.

- Can result in delays due to the need for verification and authentication.

- Incurs fees and charges associated with opening and managing the LC.

- Limits flexibility in payment terms compared to other methods like open accounts.

3. Documentary Collection

Documentary collection is a payment method in international trade where both parties involve their respective banks. The exporter’s bank, known as the remitting bank, works with the importer’s bank, called the collecting bank, to facilitate payment.

Once the exporter ships the products, they submit shipping documents and collection orders to their bank. These documents are then forwarded to the importer’s bank, along with payment instructions. The importer is notified of the payment obligation, and upon payment, the funds are transferred from the collecting bank to the remitting bank. Finally, the exporter receives payment from their bank.

Pros:

- Offers a more cost-effective alternative to Letters of Credit.

- Facilitates secure and regulated payment processing through bank intermediaries.

- Streamlines payment procedures, reducing administrative burdens for exporters.

- Provides a degree of payment assurance without the complexities of Letters of Credit.

- Enhances trust and confidence between trading partners due to bank involvement.

- Offers flexibility in payment terms and negotiation options.

- Helps expedite payment settlement by leveraging banking networks and infrastructure.

- Simplifies documentation and paperwork requirements for international transactions.

- Enables faster order processing and shipment, accelerating cash flow for exporters.

- Allows for better management of cash flow and financial planning due to predictable payment timelines.

Cons:

- Lack of importer verification increases the risk of non-payment or payment delays.

- Limited protection against cancellations, disputes, or non-acceptance of goods by the importer.

- May involve additional banking fees and charges, impacting overall transaction costs.

- Requires adherence to strict documentation and compliance standards, potentially leading to delays or errors.

- Dependency on the importer’s willingness and ability to fulfill payment obligations, which can be unpredictable in certain circumstances.

4. Open Account

Open Account is a payment method in international trade where goods are shipped to the importer before payment is due. The agreed-upon credit period, typically 30, 60, or 90 days, allows the importer to manage cash flow effectively. For exporters, this flexibility can attract customers in a competitive market.

Pros:

- Provides flexibility for importers to manage cash flow by setting the credit period.

- Attracts customers for exporters by offering flexibility in payment terms.

- Simplifies transaction process by eliminating the need for immediate payment.

- Facilitates larger transactions by spreading out payment over time.

- Enhances competitiveness in the market by offering favorable payment terms.

- Streamlines administrative processes by reducing paperwork associated with upfront payments.

- Allows importers to inspect goods before making payment, increasing buyer confidence.

- Encourages repeat business by fostering trust and loyalty between trading partners.

- Enables smoother business relationships by promoting mutual understanding and cooperation.

- Supports long-term partnerships by offering flexibility and convenience in payment arrangements.

Cons:

- Exposes exporters to the risk of delayed or non-payment, impacting cash flow.

- Increases financial risk for exporters, especially in uncertain economic conditions.

- Requires careful credit assessment of buyers to mitigate potential losses.

- May lead to disputes or disagreements over payment terms and conditions.

- Recommended primarily for established relationships where trust and reliability are assured.

5. Consignments

Consignments in international trade involve a payment method similar to open account, where payment is made to the exporter after the products have been sold by a foreign or third-party distributor to the end customer. Under this arrangement, the exporter retains ownership of the goods until they are sold by the distributor.

Pros:

- Reduces direct costs associated with inventory management for exporters.

- Simplifies logistics and storage, minimizing overhead expenses.

- Provides flexibility for exporters by allowing them to retain ownership of goods until sold.

- Expands market reach by leveraging foreign or third-party distributors.

- Enhances competitiveness by offering favorable terms to end customers.

- Facilitates faster market penetration through established distribution channels.

- Enables exporters to focus on core business activities rather than distribution.

- Promotes risk sharing between exporters and distributors.

- Offers potential for increased sales volume through wider distribution networks.

- Enhances brand visibility and recognition in new markets through distributor partnerships.

Cons:

- Lack of control over merchandise management may lead to uncertainties regarding product handling and presentation.

- No guarantee of payment to the exporter after goods are sold by the distributor, increasing financial risk.

- Potential for disputes or disagreements over sales performance and payment terms.

- Dependency on the distributor’s sales and marketing efforts for successful product placement.

- Requires careful selection and management of distributor relationships to ensure alignment with exporter’s goals and standards.

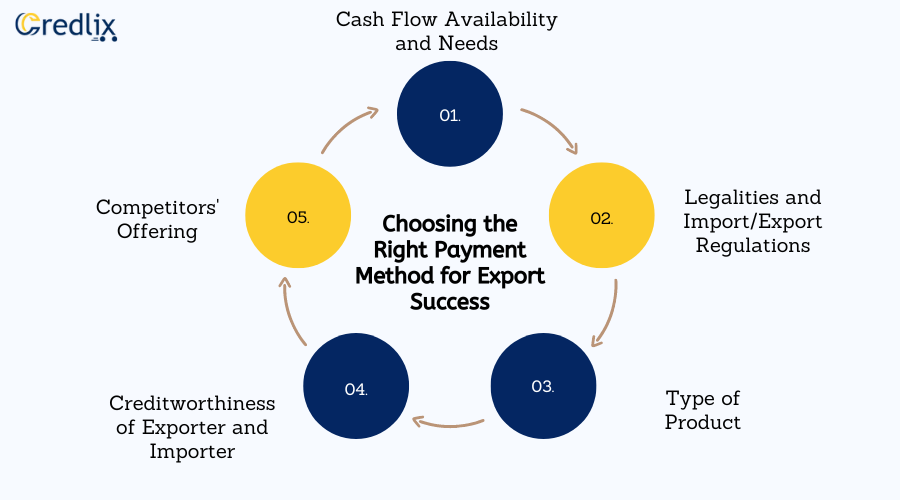

Choosing the Right Payment Method for Export Success

Choosing the right payment method for exports is crucial for ensuring smooth and successful international trade transactions. Here are some key factors to consider when making this decision:

Cash Flow Availability and Needs

Assessing the importer’s cash flow availability and needs is essential. Determine whether they can make immediate payment or require more time to settle the transaction. Understanding these factors helps in aligning payment terms with the importer’s financial capabilities.

Legalities and Import/Export Regulations

Consider the legal and regulatory requirements of the destination country. This includes understanding import/export regulations, customs procedures, tariffs, quotas, and any other trade barriers that may impact the payment process. Adhering to these regulations ensures compliance and avoids potential legal issues.

Type of Product

Evaluate the demand for the product in the importing country. Products in high demand may provide more flexibility in negotiating payment terms. Understanding market dynamics and consumer preferences helps in determining the most suitable payment method that aligns with the product’s market position and potential profitability.

Creditworthiness of Exporter and Importer

Assess the creditworthiness of both the exporter and the importer. A strong credit history and financial stability enhance trust and reliability in the business relationship. Conversely, poor creditworthiness may pose risks and impact the willingness of both parties to agree on favorable payment terms. Conducting thorough credit checks and assessments helps in mitigating potential risks associated with payment transactions.

Competitors’ Offering

Research and analyze the payment methods offered by competitors in the market. Understanding what payment terms and options are being provided by competitors provides valuable insights into industry standards and customer expectations. This information enables exporters to tailor their payment methods to remain competitive and attract potential buyers.

By carefully considering these factors, exporters can select the most appropriate payment method that meets the needs of both parties and facilitates smooth and successful international trade transactions.

Final Note

Choosing the right payment method for international trade is crucial for ensuring smooth transactions and building trust between exporters and importers. Factors such as cash flow availability, legal regulations, product demand, and the creditworthiness of both parties should be carefully considered.

By understanding these factors and analyzing competitors’ offerings, exporters can select the most suitable payment method to meet their business goals and foster successful trade relationships. With careful consideration and strategic decision-making, exporters can navigate the complexities of international trade with confidence and achieve export success.[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]