[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12938″ img_size=”full” css=”.vc_custom_1716187977947{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]The volume of global trade has surged significantly since 1983, with goods exports skyrocketing from $1.8 trillion to a staggering $18.4 trillion. Additionally, services trade amounts to approximately $5.9 trillion, although experts indicate this estimate may be conservative. When accounting for both imports and exports, the average global trade per capita stands at an impressive $7000 annually. This remarkable expansion underscores the interconnectedness of economies worldwide. By utilizing the right payment methods in international trade, businesses can streamline processes, mitigate risks, and facilitate smoother transactions, ultimately contributing to the ongoing expansion and efficiency of global commerce.

The internet and technology have made running businesses easier, both at home and abroad. Nowadays, there are many payment options available for customers, sellers, and manufacturers. When it comes to international trade, there are legal processes and inspections required by both the exporting and importing countries.

So, it’s important to choose the right payment method that everyone agrees on, to make deals secure and trustworthy for both sides.

Key Takeaways

- Understanding the five main payment methods in international trade is essential for securing successful transactions.

- Cash in advance offers exporters full payment security but may deter buyers seeking flexible terms.

- Letters of credit provide assurance of payment from the buyer’s bank, enhancing financial security.

- Documentary collection offers a cost-effective alternative to LCs, streamlining payment procedures.

- Open account terms attract customers with flexible payment terms but expose exporters to payment risks.

- Consignments simplify logistics and expand market reach but may entail financial risks for exporters.

- Consider cash flow, legal requirements, product demand, and creditworthiness when choosing payment methods.

- Analyzing competitors’ offerings helps exporters tailor payment methods to remain competitive in the market.

What is International Trade

International trade refers to the exchange of goods, services, and capital across international borders. It involves the buying and selling of products and services between countries, often facilitated by businesses, governments, and various economic entities. International trade plays a crucial role in the global economy, promoting specialization, efficiency, and economic growth by allowing countries to capitalize on their comparative advantages and access resources and markets beyond their borders.

Five Main Payment Methods Used in International Trade

Discover the five main payment methods used in international trade: cash in advance, letters of credit, documentary collection, open accounts, and consignments. Explore further to learn about each method and their respective advantages and considerations.

1. Cash in Advance

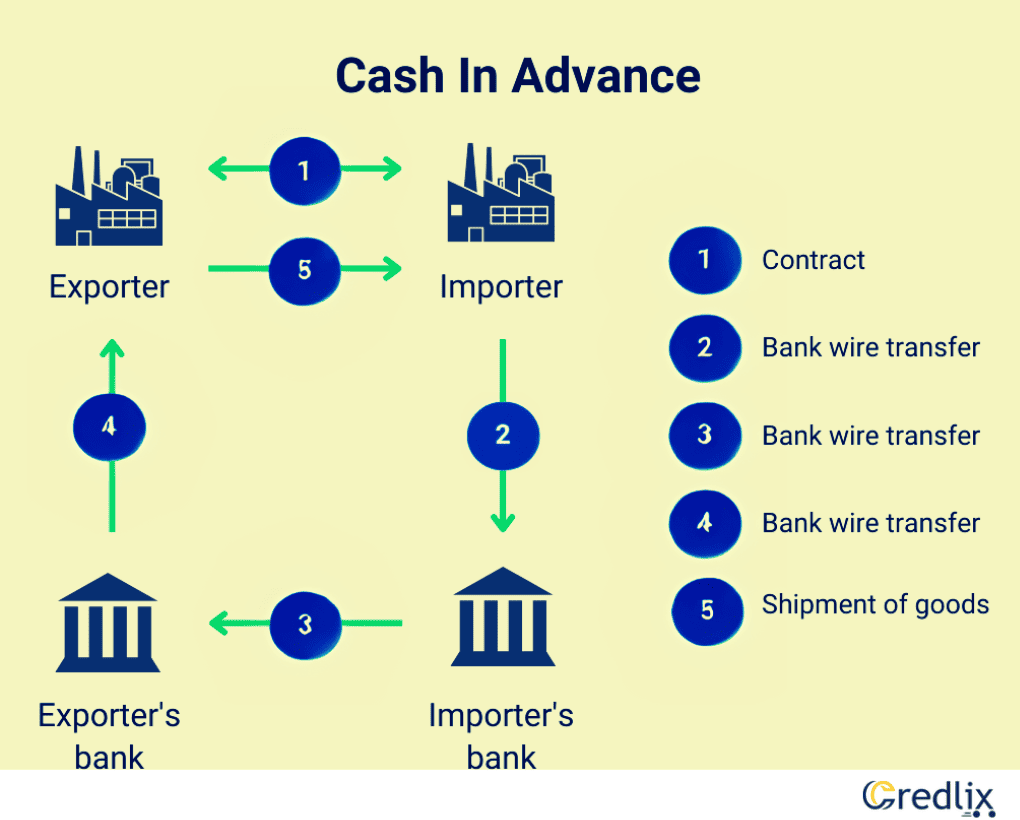

Cash In Advance (CIA), also known as advance payment or pre-payment, is widely regarded as one of the most secure methods of payment for sellers in international trade. In this arrangement, the buyer transfers the full invoice amount to the seller before the goods are shipped. While this places all transactional risk on the buyer, who pays for goods not yet received, it provides significant assurance for the seller.

By receiving payment upfront, sellers mitigate the risk of non-payment or payment delays, ensuring financial security and peace of mind. CIA enables sellers to streamline financial planning and cash flow management, while also facilitating faster order processing and fulfillment. However, for buyers, CIA may deter those seeking more flexible payment options and raise concerns about product quality or delivery reliability.

Pros:

- Ensures full payment security for exporters before shipment.

- Eliminates the risk of non-payment or payment delays.

- Provides financial stability and predictability for exporters.

- Simplifies financial planning and cash flow management.

- Helps build trust and credibility with customers.

- Reduces administrative burden associated with chasing payments.

- Enables faster order processing and fulfillment.

- Facilitates smoother logistics and shipping arrangements.

- Minimizes the need for credit checks and trade financing.

- Offers greater control over the sales process and transaction terms.

Cons:

- May deter potential buyers who prefer more flexible payment options.

- Could lead to loss of business opportunities to competitors offering better payment terms.

- Increases the burden of upfront costs and financial commitments for buyers.

- Raises concerns among buyers about product quality or delivery reliability.

- Limits the ability to negotiate favorable payment terms or discounts.

2. Letter of Credit

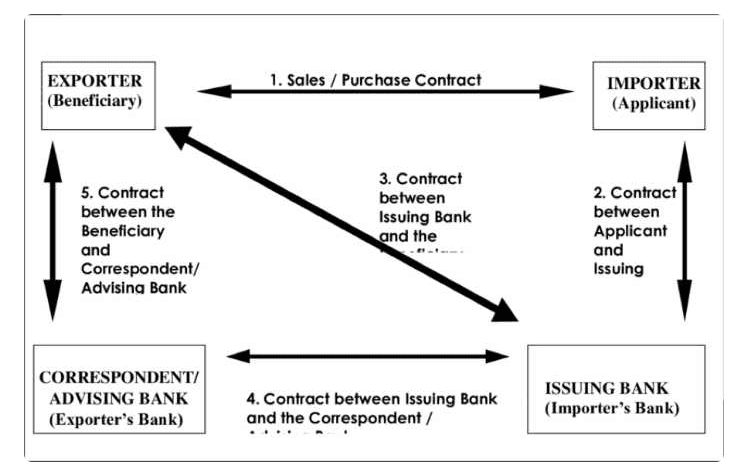

Letter of Credit (LC) is a widely embraced and secure payment method in international trade. Here, the customer’s bank provides a written commitment, assuring the exporter of payment upon fulfillment of agreed terms. This offers exporters assurance regarding the creditworthiness of the customer’s foreign bank before shipment.

The diagram below shows the interplay between payment methods and the trust-risk dynamic for both buyers and sellers. While the letter of credit stands out as the most dependable option for both parties, it may not be feasible for entities lacking credibility or for low-value transactions due to associated expenses.

Pros:

-

- Offers assurance of payment from the customer’s bank.

- Enhances financial security for exporters.

- Reduces the risk of non-payment.

- Facilitates trust between parties involved.

- Enables smoother transactions in international trade.

- Provides a standardized payment mechanism.

- Increases confidence in conducting business with new partners.

- Helps mitigate currency exchange risks.

- Allows for easier negotiation of trade terms.

- Streamlines documentation and paperwork processes.

Cons:

-

-

-

- Involves a time-consuming application and approval process.

- Requires adherence to strict documentation and compliance requirements.

- Can result in delays due to the need for verification and authentication.

- Incurs fees and charges associated with opening and managing the LC.

- Limits flexibility in payment terms compared to other methods like open accounts.

-

-

3. Documentary Collection

Documentary collection is a payment method in international trade where both parties involve their respective banks. The exporter’s bank, known as the remitting bank, works with the importer’s bank, called the collecting bank, to facilitate payment.

Once the exporter ships the products, they submit shipping documents and collection orders to their bank. These documents are then forwarded to the importer’s bank, along with payment instructions. The importer is notified of the payment obligation, and upon payment, the funds are transferred from the collecting bank to the remitting bank. Finally, the exporter receives payment from their bank.

Pros:

-

-

-

- Offers a more cost-effective alternative to Letters of Credit.

- Facilitates secure and regulated payment processing through bank intermediaries.

- Streamlines payment procedures, reducing administrative burdens for exporters.

- Provides a degree of payment assurance without the complexities of Letters of Credit.

- Enhances trust and confidence between trading partners due to bank involvement.

- Offers flexibility in payment terms and negotiation options.

- Helps expedite payment settlement by leveraging banking networks and infrastructure.

- Simplifies documentation and paperwork requirements for international transactions.

- Enables faster order processing and shipment, accelerating cash flow for exporters.

- Allows for better management of cash flow and financial planning due to predictable payment timelines.

-

-

Cons:

-

-

-

- Lack of importer verification increases the risk of non-payment or payment delays.

- Limited protection against cancellations, disputes, or non-acceptance of goods by the importer.

- May involve additional banking fees and charges, impacting overall transaction costs.

- Requires adherence to strict documentation and compliance standards, potentially leading to delays or errors.

- Dependency on the importer’s willingness and ability to fulfill payment obligations, which can be unpredictable in certain circumstances.

-

-

4. Open Account

Open Account is a payment method in international trade where goods are shipped to the importer before payment is due. The agreed-upon credit period, typically 30, 60, or 90 days, allows the importer to manage cash flow effectively. For exporters, this flexibility can attract customers in a competitive market.

Pros:

-

-

-

- Provides flexibility for importers to manage cash flow by setting the credit period.

- Attracts customers for exporters by offering flexibility in payment terms.

- Simplifies transaction process by eliminating the need for immediate payment.

- Facilitates larger transactions by spreading out payment over time.

- Enhances competitiveness in the market by offering favorable payment terms.

- Streamlines administrative processes by reducing paperwork associated with upfront payments.

- Allows importers to inspect goods before making payment, increasing buyer confidence.

- Encourages repeat business by fostering trust and loyalty between trading partners.

- Enables smoother business relationships by promoting mutual understanding and cooperation.

- Supports long-term partnerships by offering flexibility and convenience in payment arrangements.

-

-

Cons:

- Exposes exporters to the risk of delayed or non-payment, impacting cash flow.

- Increases financial risk for exporters, especially in uncertain economic conditions.

- Requires careful credit assessment of buyers to mitigate potential losses.

- May lead to disputes or disagreements over payment terms and conditions.

- Recommended primarily for established relationships where trust and reliability are assured.

5. Consignments

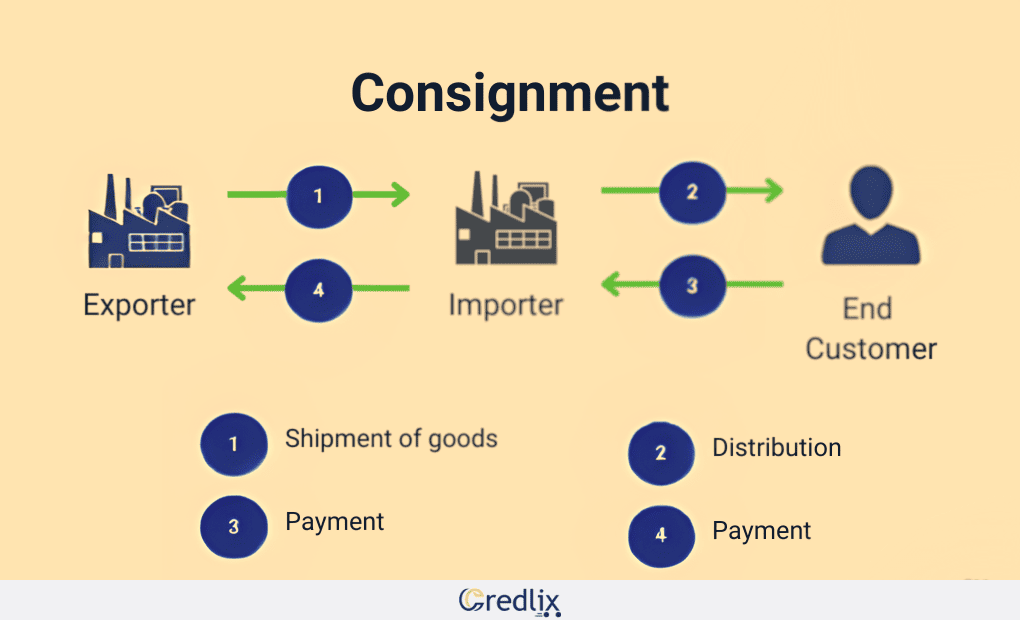

Consignments in international trade involve a payment method similar to open account, where payment is made to the exporter after the products have been sold by a foreign or third-party distributor to the end customer. Under this arrangement, the exporter retains ownership of the goods until they are sold by the distributor.

Pros:

- Reduces direct costs associated with inventory management for exporters.

- Simplifies logistics and storage, minimizing overhead expenses.

- Provides flexibility for exporters by allowing them to retain ownership of goods until sold.

- Expands market reach by leveraging foreign or third-party distributors.

- Enhances competitiveness by offering favorable terms to end customers.

- Facilitates faster market penetration through established distribution channels.

- Enables exporters to focus on core business activities rather than distribution.

- Promotes risk sharing between exporters and distributors.

- Offers potential for increased sales volume through wider distribution networks.

- Enhances brand visibility and recognition in new markets through distributor partnerships.

Cons:

- Lack of control over merchandise management may lead to uncertainties regarding product handling and presentation.

- No guarantee of payment to the exporter after goods are sold by the distributor, increasing financial risk.

- Potential for disputes or disagreements over sales performance and payment terms.

- Dependency on the distributor’s sales and marketing efforts for successful product placement.

- Requires careful selection and management of distributor relationships to ensure alignment with exporter’s goals and standards.

Choosing the Right Payment Method for Export Success

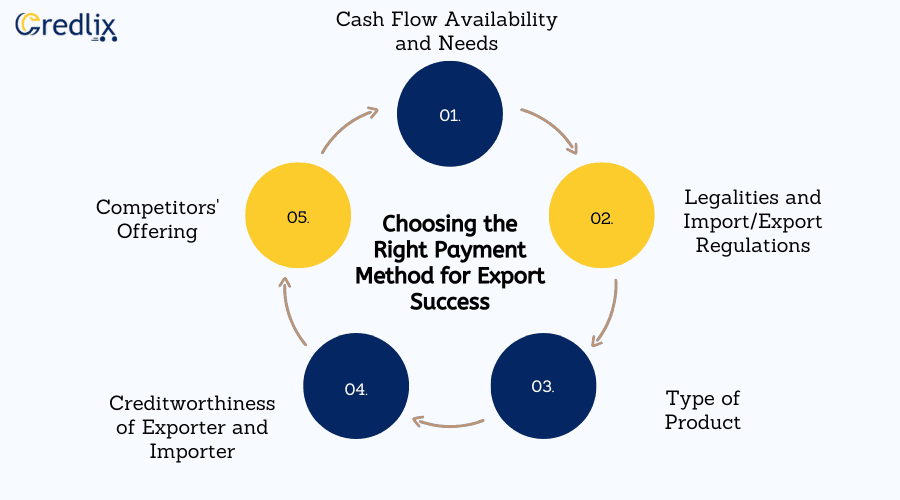

Choosing the right payment method for exports is crucial for ensuring smooth and successful international trade transactions. Here are some key factors to consider when making this decision:

Cash Flow Availability and Needs

Assessing the importer’s cash flow availability and needs is essential. Determine whether they can make immediate payment or require more time to settle the transaction. Understanding these factors helps in aligning payment terms with the importer’s financial capabilities.

Legalities and Import/Export Regulations

Consider the legal and regulatory requirements of the destination country. This includes understanding import/export regulations, customs procedures, tariffs, quotas, and any other trade barriers that may impact the payment process. Adhering to these regulations ensures compliance and avoids potential legal issues.

Type of Product

Evaluate the demand for the product in the importing country. Products in high demand may provide more flexibility in negotiating payment terms. Understanding market dynamics and consumer preferences helps in determining the most suitable payment method that aligns with the product’s market position and potential profitability.

Creditworthiness of Exporter and Importer

Assess the creditworthiness of both the exporter and the importer. A strong credit history and financial stability enhance trust and reliability in the business relationship. Conversely, poor creditworthiness may pose risks and impact the willingness of both parties to agree on favorable payment terms. Conducting thorough credit checks and assessments helps in mitigating potential risks associated with payment transactions.

Competitors’ Offering

Research and analyze the payment methods offered by competitors in the market. Understanding what payment terms and options are being provided by competitors provides valuable insights into industry standards and customer expectations. This information enables exporters to tailor their payment methods to remain competitive and attract potential buyers.

By carefully considering these factors, exporters can select the most appropriate payment method that meets the needs of both parties and facilitates smooth and successful international trade transactions.

Emerging Trends and Innovations in International Payment Methods

Here’s some information on the emerging trends and innovations in international payment methods:

A. Digital Payment Solutions

Digital payment solutions have revolutionized international trade by offering faster, more secure, and cost-effective transactions. Features such as instant fund transfers, multi-currency support, and integrated fraud detection mechanisms have made digital payments increasingly popular among businesses worldwide. Additionally, advancements in mobile payment technologies and the proliferation of e-wallets have further facilitated cross-border transactions, providing greater convenience and accessibility to traders.

B. Blockchain Technology in Trade Finance

Blockchain technology has emerged as a game-changer in trade finance, offering unparalleled transparency, security, and efficiency in payment processes. Through distributed ledger technology, blockchain enables seamless tracking of trade transactions, reducing the risk of fraud and error. Smart contracts executed on blockchain networks automate payment settlements, eliminating the need for intermediaries and reducing transaction costs. Moreover, blockchain-based platforms provide real-time visibility into the entire supply chain, enhancing trust and collaboration among trading partners.

C. Impact of Globalization on Payment Processe

Globalization has significantly influenced payment processes in international trade by fostering greater connectivity and standardization. With the advent of digitalization and the rise of e-commerce, cross-border transactions have become more frequent and complex. As a result, payment service providers and financial institutions have adapted to meet the evolving needs of businesses engaged in global trade. Additionally, the growing prevalence of alternative payment methods, such as digital wallets and cryptocurrency, reflects the shifting dynamics of the global economy and the increasing demand for innovative payment solutions.

Most Common Types of Payment Mode in International Trade

The most common payment method in international trade is the Letter of Credit (LC). This method offers assurance to exporters by involving the buyer’s bank, which provides a written commitment to ensure payment upon fulfilling agreed terms. LCs are widely embraced due to their security and reliability, mitigating the risk of non-payment and fostering trust between trading partners across borders.

Which is the Best Payment Type in International Trade?

Determining the best payment method in international trade depends on aligning with the specific requirements and risk tolerances of both the buyer and the seller. There is no best payment method; rather, the ideal choice varies based on factors such as transaction size, trust levels between parties, and regulatory considerations. Flexibility and adaptability are paramount, allowing stakeholders to select the most suitable method that balances security, convenience, and cost-effectiveness to ensure mutually beneficial transactions.

Final Note

Choosing the right payment method for international trade is crucial for ensuring smooth transactions and building trust between exporters and importers. Factors such as cash flow availability, legal regulations, product demand, and the creditworthiness of both parties should be carefully considered.

By understanding these factors and analyzing competitors’ offerings, exporters can select the most suitable payment method to meet their business goals and foster successful trade relationships. With careful consideration and strategic decision-making, exporters can navigate the complexities of international trade with confidence and achieve export success.

[/vc_column_text][vc_column_text]In the dynamic world of business, managing finances efficiently is key to ensuring sustained growth and success. One crucial aspect that often takes center stage is the management of receivables – the money owed to your business by customers.

This blog aims to shed light on the strategic use of financing receivables and the impactful practice of vendor financing, offering insights that are both accessible and beneficial to businesses of all sizes.

Financing Receivables:- What is Financing Receivables

Accounts receivable financing is a different way to get money compared to going to a regular bank. Basically, it’s a money move where you borrow cash using the money your customers owe you.

Here’s the deal: if your company is waiting for money to come in, but you need cash ASAP to cover your bills, accounts receivable financing steps in to help. It’s also great for businesses that don’t want to hassle with collecting money from people who owe them. Instead, they can pay a little fee and get the money right away.

In simple terms, it’s like turning the future money you’re expecting into real cash when you need it!

Types of Financing Receivables

Here are different types of financing receivables options that you need to understand:

Collateralized Loan Option

- If you have customers who owe you money, you can use these accounts as collateral for a loan from a financing company.

- When your customers settle their bills, you can use that money to pay off the loan.

Invoice Factoring Option

- Another way is to sell your accounts receivable to a factoring company.

- With a service known as invoice factoring, the factoring company buys your non-delinquent unpaid invoices.

- They pay you an upfront percentage, called the advance rate, of what your customers owe.

- The factoring company then collects payments directly from your customers, and once the accounts receivable are paid, they keep a small factoring fee and give you the remaining balance.

Advantages of Financing Receivables

Understand some of the benefits of financing receivables to help you make a wiser and informed decision:

Upfront Cash for Unpaid Accounts: With receivables financing, you receive immediate funds for invoices that your customers haven’t paid yet. It’s like getting a cash advance based on the money you’re expecting to receive in the future.

Potentially Lower Financing Costs: The financing rate in receivables financing may be more cost-effective compared to other borrowing options such as traditional loans or lines of credit. This can be particularly beneficial for businesses looking to manage their costs while accessing the necessary funds.

Relief from Unpaid Bill Collection: Opting for receivables financing can lift the weight of chasing down unpaid bills from your shoulders. Instead of spending time and resources on collections, a financing company takes on this task. It allows your business to focus on its core activities while ensuring a steady flow of working capital.

Ideal for Cash Flow Challenges: Receivables financing is a great solution for businesses facing cash flow issues. Whether you’re waiting for payments from customers or need quick funds to cover operational expenses, this option provides a flexible and accessible way to address cash flow gaps. It’s suitable for a variety of companies, regardless of their size or industry, offering a lifeline during financially challenging periods.

Disadvantages of Financing Receivables

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Requirement of Outstanding Invoices: To benefit from receivable financing, your business must have outstanding invoices, meaning customers owe you money. This financial option leverages these accounts receivable as assets that can be used to secure a loan or sell to a factoring company.

Importance of Clear Terms for Unpaid Accounts: Keeping clear and accurate records of the terms associated with unpaid accounts is crucial. This includes documenting when payments are expected, the amounts owed, and any specific conditions. Maintaining meticulous records is essential for the smooth process of receivable financing, ensuring transparency and accuracy in the transactions.

Impact of Credit History on Qualification: Qualifying for receivable financing may depend on your business’s credit history. If your business lacks a stable credit history, it could pose a challenge in accessing this form of financing. Lenders or factoring companies often assess the creditworthiness of a business before extending receivable financing. Having a stable credit history enhances your eligibility and may lead to more favorable terms. It emphasizes the importance of maintaining good financial standing to maximize the benefits of receivable financing.

Vendor Financing:- What is Vendor Financing?

Vendor financing, also known as supplier financing or trade credit, is a financial arrangement where a company obtains funding or extended payment terms from its suppliers. In this scenario, the vendor, or the supplier of goods or services, plays a crucial role in providing financial support to the purchasing company.

It’s a smart move when you’re buying a lot of big stuff. If you’re getting things like inventory for a store, computers, vehicles, or machinery, talk to your suppliers about financing deals. It’s like making a deal to pay for these things over time instead of all at once. This helps you avoid running low on cash and gives you the chance to grow your business while paying for the equipment. It’s a win-win!

Also Read : What Is a Vendor? Definition, Types, and Example

Benefits of Vendor Financing

Understand some of the benefits of vendor financing to help you make a wiser and informed decision:

Equipment Purchase without Upfront Payment: One big advantage of vendor financing is that it lets you buy the equipment you need without having to pay for it all upfront. Instead of emptying your wallet in one go, you can work out a deal with your vendor to spread the cost over time. This means you can get essential equipment for your business without a hefty immediate expense.

Preservation of Cash for Emergencies: By using vendor financing, you’re able to keep more cash on hand. This is crucial for dealing with unexpected emergencies or opportunities that may come up in your business journey. Preserving your cash flow provides a financial safety net, allowing you to handle unforeseen challenges without disrupting your day-to-day operations or long-term plans.

Also Read: How to Use Vendor Financing to Buy a Business?

Disadvantages of Vendor Financing

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Extended Payment Period: One downside of vendor financing is that your payments might stretch out over a long period. While this eases the immediate financial burden, it could mean you’re committed to paying for the equipment over an extended timeframe. This extended payment period may limit your financial flexibility and tie up resources that could be used for other business needs.

Risk of Equipment Retrieval: If you fall behind on your payments, there’s a risk that the vendor could take back the equipment. This is a significant concern because it means not keeping up with your agreed-upon payment schedule could result in losing the very equipment your business relies on. It emphasizes the importance of carefully managing your financial commitments to avoid potential disruptions to your operations.

Distinguishing Accounts Receivables Finance from Accounts Receivable Factoring

Navigating the world of turning accounts receivables into immediate cash flow can be a game-changer for businesses in need of quick funds. While both services share the common goal of providing timely financial solutions, it’s essential to understand their fundamental differences:

Nature of the Transactions

Accounts Receivables Finance (Invoice Financing)

Think of this as a loan. Your business uses its outstanding invoices as collateral to secure a loan. It’s a financial arrangement where you borrow against the money your customers owe you, providing a flexible solution to bridge financial gaps.

Accounts Receivable Factoring

In contrast, factoring involves the outright sale of your receivables. Factoring companies become the owners of the current asset – your unpaid invoices. They pay you a portion upfront (known as the advance), and then they collect the full amount directly from your customers.

Roles of the Service Providers

Factoring Companies

Factoring companies act as buyers of a business’s current assets, taking ownership of the accounts receivable. They assume the responsibility of collecting payments from your customers.

Accounts Receivable Financing Companies

On the other hand, companies providing accounts receivable financing act as financiers or lenders. They extend a loan to your business, using the outstanding invoices as collateral, without taking ownership of the receivables.

Scope of Application

Accounts Receivable Factoring

Factoring is specifically tailored for commercial financing. It is a solution designed for businesses looking to optimize their cash flow by selling their unpaid invoices in commercial transactions.

Final Words

In the world of business, managing finances wisely is the key to success. Whether it’s unlocking cash through accounts receivables financing or securing equipment with vendor financing, these financial tools offer both opportunities and considerations. Accounts receivables financing turns future money into immediate cash, ideal for addressing cash flow challenges.

Vendor financing, on the other hand, lets you spread the cost of essential equipment, preserving cash for emergencies. While each has its advantages, it’s crucial to weigh the pros and cons. Whether you’re considering accounts receivables financing or vendor financing, understanding these financial strategies empowers you to make informed decisions, propelling your business toward sustained growth and financial resilience.

Credlix is becoming a big player in helping businesses with money. We want to make small businesses stronger, so we offer really good financing solutions made just for them.

Also Read : What Is a Vendor? Definition, Types, and Example[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]