- October 7, 2024

- Posted by: admin

- Categories: Channel Financing, Blog

In today’s financial world, flexibility in managing credit is crucial for both individuals and businesses. One of the most popular tools to provide such flexibility is revolving credit. Whether you’re a business looking for ways to finance operations or an individual managing personal expenses, understanding the ins and outs of revolving credit, revolving credit facilities, revolving letters of credit, and revolving lines of credit can be extremely beneficial.

In this comprehensive guide, we’ll explore what revolving credit is, how it works, and its various forms, including the revolving letter of credit and revolving credit facility. By the end, you’ll have a better understanding of how these tools can help you manage cash flow and credit more effectively.

What is Revolving Credit?

Revolving credit is a type of credit that gives borrowers a maximum credit limit, allowing them to borrow, repay, and borrow again as long as they stay within the approved limit. Unlike traditional loans, which are a one-time transaction, revolving credit offers ongoing access to funds.

How Does Revolving Credit Work?

When you are approved for a revolving credit facility, the lender provides you with a maximum credit limit, say $10,000. You can borrow any amount up to that limit. As you repay the borrowed amount, the funds become available again for future use. This “revolving” nature of the credit ensures that you have access to cash whenever you need it without reapplying for a loan each time.

Examples of Revolving Credit

- Credit Cards: The most common example of revolving credit is a credit card. You can borrow money, repay it, and then borrow again as long as you stay within your credit limit.

- Home Equity Lines of Credit (HELOC): Another popular form of revolving credit where homeowners borrow against the equity in their homes.

The key advantage here is flexibility. You don’t need to take out a new loan for every expense—revolving credit offers a continuous source of funds.

The Revolving Line of Credit

A revolving line of credit is a flexible loan from a financial institution that allows a borrower to withdraw funds, repay them, and withdraw them again as needed. It’s typically used by businesses to manage cash flow for working capital or by individuals for personal expenses.

How Does a Revolving Line of Credit Differ from Traditional Loans?

With a traditional loan, you borrow a fixed amount of money, repay it over a set period, and once the loan is repaid, the transaction is over. A revolving line of credit, on the other hand, allows you to access funds repeatedly as long as you stay within your limit.

For businesses, this can be a lifesaver for covering unexpected expenses or ensuring that operations run smoothly during slower months.

Key Features of a Revolving Line of Credit:

- Ongoing Access: You can continuously withdraw money up to your limit.

- Interest Payments: You only pay interest on the amount borrowed, not the full credit limit.

- Flexible Repayment: As long as you make the minimum payments, you have flexibility in repaying the debt.

For example, a business may have a $50,000 revolving line of credit and only use $20,000 one month, then repay it before borrowing another $10,000 in the next. This flexibility helps manage short-term liquidity challenges without needing to apply for a new loan each time.

Also Read: Lines of Credit for International Trade

Revolving Letter of Credit

A revolving letter of credit is typically used in international trade to ensure that multiple shipments are financed under one credit arrangement. It allows the buyer to make several transactions over a period, up to a pre-determined limit.

How Does it Work?

Let’s say a company imports goods from abroad on a regular basis. Instead of obtaining a new letter of credit for each shipment, the revolving letter of credit allows multiple shipments to be financed under the same agreement, saving time and administrative costs.

It is particularly useful for businesses that need a steady supply of goods over time. The letter automatically renews as the shipments occur, up to the agreed limit.

Types of Revolving Letters of Credit:

- Cumulative: The credit is replenished with each payment made.

- Non-cumulative: The available credit does not carry over if not used.

The revolving letter of credit adds an extra layer of convenience and security in trade finance, ensuring smooth international transactions without the hassle of repeated paperwork.

Also Read: Letter of Credit (LC)

What is a Revolving Credit Facility?

The Basics of a Revolving Credit Facility

A revolving credit facility is a pre-approved loan facility that businesses or individuals can draw on as needed. It’s similar to a revolving line of credit, but it is often used more by businesses for operational needs. It ensures that companies have access to funds when they need them without the need to reapply each time.

How Does a Revolving Credit Facility Work?

Think of a revolving credit facility as a safety net. A business might not need immediate funds, but having a credit facility ensures they can access capital when the need arises. This could be for emergency repairs, inventory purchases, or other operational expenses. Once they draw on the facility, they can repay the borrowed amount, and the credit limit is restored for future use.

Key Features of a Revolving Credit Facility:

- Flexibility: The business can access funds whenever they need them.

- Interest: Interest is only paid on the borrowed amount, not the total credit limit.

- Renewable: Once the debt is repaid, the facility is available again.

For instance, a company with seasonal sales peaks may draw on a revolving credit facility to purchase inventory ahead of their busy season and then repay it when sales come in.

Benefits of Revolving Credit

Here are some of the major benefits of revolving credit:

1. Flexibility in Borrowing

One of the greatest advantages of revolving credit is its flexibility. Whether you’re a business needing to manage cash flow or an individual facing unexpected expenses, you can access the funds you need when you need them without undergoing lengthy application processes.

2. Interest on What You Use

Unlike traditional loans, where you’re charged interest on the entire borrowed amount, revolving credit only charges interest on the portion of the funds you use. This can save businesses and individuals a significant amount of money.

3. Emergency Funding

Revolving credit is ideal for covering unexpected or emergency expenses. It acts as a financial safety net, ensuring that you always have access to funds when needed.

4. Helps Build Credit

For businesses and individuals alike, responsibly managing a revolving line of credit can help build and improve your credit score. Timely payments and keeping credit utilization low show lenders that you’re financially responsible.

Drawbacks of Revolving Credit

Here are some of the drawbacks of revolving credit to consider:

1. High Interest Rates

The convenience of revolving credit often comes with higher interest rates compared to traditional loans. If you don’t pay off your balance quickly, the interest can add up over time.

2. Potential for Overspending

Because revolving credit offers easy access to funds, there’s a temptation to overspend. It’s essential to use revolving credit wisely and only for necessary expenses.

3. Variable Interest Rates

Many revolving credit facilities come with variable interest rates, meaning your payments could increase if interest rates rise.

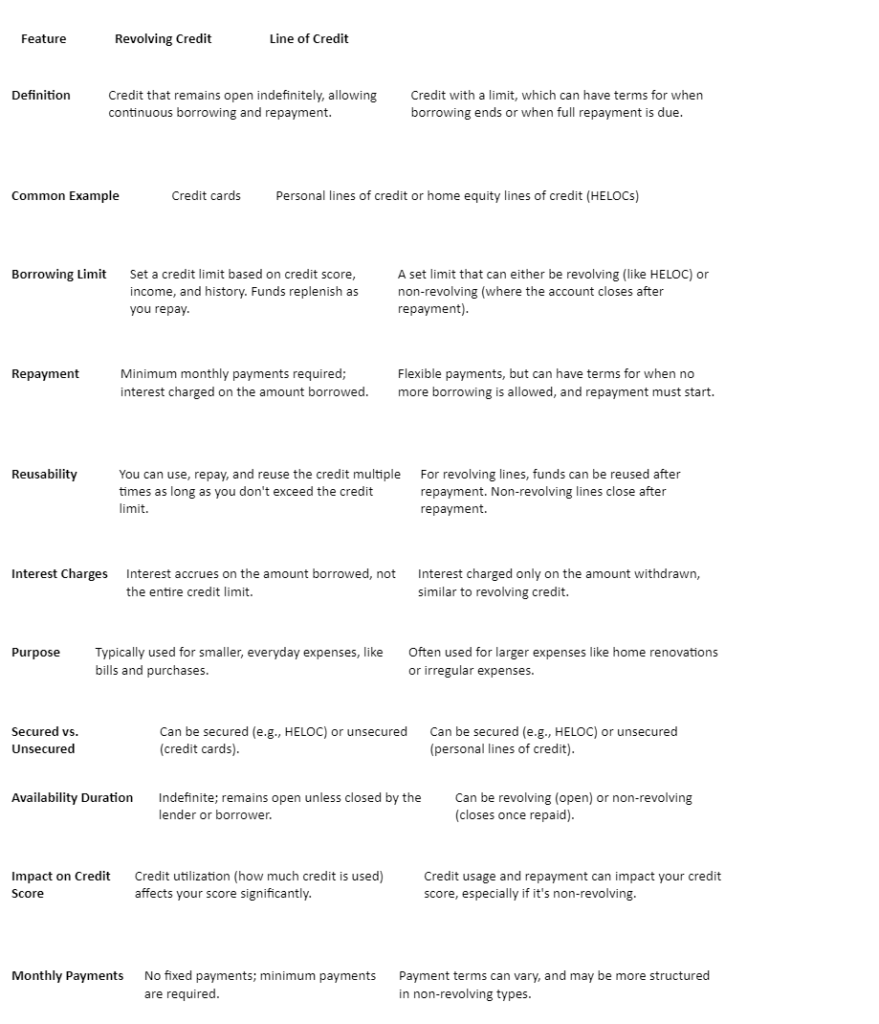

Comparison Table Between Revolving Credit and a Line of Credit

Here’s a simple and clear comparison table between revolving credit and a line of credit based on the reference content:

Conclusion

Revolving credit, in all its forms—whether it’s a revolving line of credit, a revolving letter of credit, or a revolving credit facility—offers immense flexibility and convenience for both individuals and businesses. Understanding the differences and applications of these revolving credit tools can help you manage your finances better, whether it’s for personal use, business expansion, or trade finance.

By knowing when and how to use revolving credit effectively, you can leverage it as a financial tool to support growth, manage cash flow, and safeguard against financial uncertainties.

So, whether you’re managing a household budget or running a business, revolving credit can provide the liquidity and flexibility you need to navigate today’s complex financial landscape.