- December 3, 2024

- Posted by: admin

- Categories: Channel Financing, Blog

For small and medium-sized enterprises (SMEs), maintaining a steady cash flow can often feel like a balancing act. With revenues not always aligning perfectly with short-term debts or bills, many businesses face liquidity challenges. When invoices remain unpaid for weeks or even months, the resulting cash crunch can disrupt operations. Factoring, a financial solution tailored for such situations, offers businesses a way out.

In this article, we’ll dive into the nuances of advance factoring and maturity factoring, explore their key features, and help you understand which option may suit your business needs better.

What is Factoring?

Factoring is a financial arrangement where a business sells its accounts receivables (unpaid invoices) to a third party, known as a factor, to secure immediate cash flow. This arrangement helps businesses address short-term liquidity needs without waiting for customers to settle invoices.

For SMEs, factoring can be a lifeline. Instead of delaying payroll, purchasing inventory, or missing bill payments due to unpaid invoices, businesses can rely on factors to bridge the gap.

Key Benefits of Factoring:

- Immediate access to working capital.

- Avoidance of traditional bank loans or credit lines.

- Outsourcing of accounts receivable management in some cases.

- Flexibility to focus on growth rather than collections.

Two common forms of factoring are advance factoring and maturity factoring. Let’s understand each in detail.

What is Advance Factoring?

In advance factoring, the factor pays the business a portion of the invoice value upfront, even before the invoice’s due date. The remaining balance is transferred once the invoice is settled, minus the factor’s fees.

This arrangement provides businesses with quick access to funds while offering some flexibility in managing cash flow.

Key Features of Advance Factoring:

Partial Payment in Advance:

The factor typically pays between 75% and 95% of the invoice value upfront. The remaining balance is settled after the customer clears the invoice.

With or Without Recourse:

- With Recourse: The business is responsible for any unpaid invoices, meaning the factor can demand repayment if the customer defaults.

- Without Recourse: The factor assumes the risk of customer non-payment.

Interest and Fees:

The factor charges fees based on the business’s financial health, invoice volume, and short-term interest rates.

Visibility to Buyers:

The arrangement can be structured to ensure that buyers remain unaware of the factoring deal, maintaining confidentiality.

Example of Advance Factoring in Action:

A retail supplier generates invoices worth ₹10,00,000 to its customers. To bridge a cash flow gap, the supplier approaches a factor, who pays ₹8,50,000 (85%) upfront. When the customer settles the invoice, the factor deducts its fees and pays the remaining amount to the supplier.

What is Maturity Factoring?

Maturity factoring, also known as collection factoring, is an arrangement where the factor pays the business the invoice value only when the invoice reaches its maturity date (the due date).

In this scenario, the factor handles the collection process, ensuring timely payments from customers. Unlike advance factoring, the business doesn’t receive any upfront payments in this arrangement.

Key Features of Maturity Factoring:

Payment on Invoice Maturity:

Businesses receive the full invoice value (minus fees) on or after the due date.

Risk Coverage:

Often structured as non-recourse, meaning the factor bears the risk of non-payment or bad debts.

Factors also handle bad debt losses, ensuring businesses are protected.

Collection Responsibility:

The factor takes over the responsibility of collecting payments from customers. This reduces the administrative burden for businesses.

Fees and Services:

Factors charge fees for their services, including bookkeeping, documentation, and collections.

Example of Maturity Factoring in Action:

An export business sells goods worth ₹20,00,000 and factors the invoices. The factor collects payment from the buyer on the invoice’s due date and transfers the funds to the business after deducting its fees.

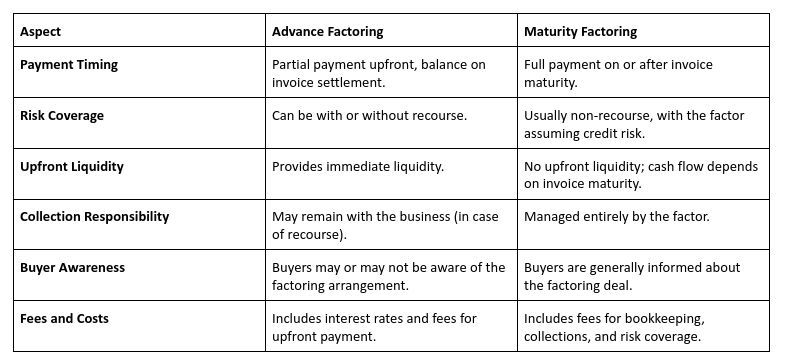

Key Differences Between Advance and Maturity Factoring

Advance factoring and maturity factoring are two key financial tools in factoring. Under advance factoring, a business gets immediate cash from a factor by leveraging uncollected and non-due receivables, paying a set interest rate. This is essentially a financing facility, helping businesses manage cash flow needs quickly. In contrast, maturity factoring ensures the business receives payment only after the collection period ends or on the collection day, whichever comes first. While advance factoring supports immediate liquidity, maturity factoring aligns payments with receivables’ actual timelines, offering flexibility. Both methods help businesses optimize cash flow and streamline financial operations.

When to Choose Advance Factoring?

Advance factoring is ideal for businesses that need immediate cash flow to manage operational expenses, purchase inventory, or invest in growth opportunities.

Consider Advance Factoring If:

- Your business faces frequent cash flow gaps.

- You need funds urgently to fulfill large orders or pay short-term debts.

- You’re confident that your customers will settle their invoices on time.

When to Choose Maturity Factoring?

Maturity factoring works well for businesses that can wait until the invoice due date for payment but want to outsource collections and reduce the risk of bad debts.

Consider Maturity Factoring If:

- You’re less concerned about immediate liquidity.

- You want to minimize the administrative burden of managing receivables.

- You’re looking to transfer the credit risk to the factor.

Advantages of Factoring for Businesses

Improved Cash Flow:

Factoring ensures businesses have steady cash flow even when customers delay payments.

Flexibility:

Both advance and maturity factoring offer tailored solutions based on business needs.

Focus on Core Operations:

By outsourcing collections and credit management, businesses can focus on growth and operations.

Credit Risk Mitigation:

Non-recourse factoring shields businesses from bad debt risks.

No Collateral Required:

Factoring relies on the strength of invoices rather than business assets, making it accessible to SMEs.

Challenges to Consider in Factoring

While factoring offers significant benefits, businesses should be mindful of the following:

Costs and Fees: Factoring can be expensive, with fees ranging from 1% to 5% of the invoice value.

Dependency on Invoice Quality: Factors assess the creditworthiness of your customers, not your business. Poor-quality invoices may lead to rejections.

Buyer Relationships: Customers may feel uneasy about dealing with factors, especially in maturity factoring where they pay the factor directly.

Conclusion

Both advance factoring and maturity factoring serve as powerful financial tools to help businesses manage cash flow effectively. Choosing the right option depends on your immediate liquidity needs, risk tolerance, and operational priorities.

For businesses needing quick access to funds, advance factoring is a go-to solution. On the other hand, maturity factoring offers the advantage of credit risk transfer and streamlined collections.

By understanding your financial goals and challenges, factoring can become a strategic part of your business’s financial management, ensuring smooth operations and sustained growth.

Also Read: What are the Different Types of Factoring in Financial Services?