Based on the most recent data, export factoring volume in India surged from Rs. 5,324 crore in 2014-15 to Rs. 11,847 crore in 2019-20, with a notable compounded annual growth rate (CAGR) of 17.3%. This upward trend is a result of businesses increasingly seeking solutions to enhance cash flow management and minimize non-payment risks in global trade.

India’s engagement in global trade has shown consistent growth, evident in the country’s total exports climbing from USD 314.31 billion in 2018-19 to USD 290.63 billion in 2019-20. With an expanding number of Indian businesses venturing into international trade, there’s a clear indication of rising demand for export factoring services.

On the journey of international trade? Exciting, but it comes with its own set of challenges, especially in managing cash flow. Enter Export Factoring, your financial ally in this global venture. Picture this: faster cash, reduced risk, and the freedom to focus on what you do best—growing your business.

In this blog, we’ll unravel the magic behind Export Factoring, showcasing how it empowers businesses to thrive in the world of exports. From boosting cash flow to navigating the complexities of cross-border transactions, we’ll delve into the advantages that make Export Factoring a game-changer.

Get ready to discover a financial tool that not only eases the process but also propels your business towards unprecedented growth. Welcome to the realm of Export Factoring – where financial solutions meet global success!

Key Takeaways

- India’s export factoring volume is on the rise, reflecting the need for better cash flow management in global trade.

- More Indian businesses are entering global markets, driving up the demand for export factoring services.

- Export factoring serves as a crucial financial ally, offering quick cash flow and risk reduction for businesses in international trade.

- Export factoring involves selling receivables to a third party at a discount, aiding exporters with immediate liquidity.

- Recourse and non-recourse factoring offer different risk-sharing options for exporters.

- Export factoring offers improved cash flow, reduced risk, efficient working capital management, and professional credit assistance.

- Technological advancements and emerging trends shape the future of export factoring, offering growth opportunities for businesses.

What is Export Factoring?

Export factoring is a financial transaction in which a company (the exporter) sells its accounts receivable, or invoices, to a third-party financial institution (the factor) at a discount. This practice is often used by businesses engaged in international trade to improve cash flow and mitigate the risks associated with selling goods or services on credit terms to overseas buyers.

Export Factoring in the Current Scenario

Exporters in India are embracing export factoring, leading to increased demand within the country. Despite this positive trend, the global growth of export factoring in India remains sluggish. While local exporters are increasingly comfortable with this financing option, the pace of adoption on the international stage suggests that there is potential for further expansion. Addressing the factors contributing to this slower growth could unlock greater opportunities for Indian exporters in the global market.

How Export Factoring Works?

Here’s how the export factoring works in simple steps.

Step 1: Partnership with a Factor

As an exporter, you establish a partnership with a financial institution known as a factor. This collaboration involves an agreement where the factor agrees to purchase your accounts receivable or invoices at a discounted rate.

Step 2: Fulfilling Orders

You proceed with fulfilling orders from your customers located in different countries, just as you had planned. This could involve manufacturing goods, providing services, or delivering products to your international clientele.

Step 3: Handing Over Invoices to the Factor

Once you’ve completed the transactions with your foreign customers, you transfer the invoices or bills representing the amounts owed by these customers to the factor. In exchange, the factor provides you with an upfront payment, which typically constitutes a percentage of the total invoice value.

Step 4: Allocation of Funds

Upon receiving the upfront payment from the factor, you allocate a portion of these funds to settle your immediate expenses and obligations, such as operational costs or supplier payments. The remaining funds serve as working capital, allowing you to finance future export orders, invest in business expansion, or address any cash flow needs.

Also Read: Why is Export Factoring Important to Your Business?

Types of Export Factoring

There are generally two main types of export factoring: recourse factoring and non-recourse factoring. Let’s break down each type:

Recourse Factoring

What Is It: In recourse factoring, the exporter remains responsible for the payment if the foreign buyer fails to pay the invoice. If the buyer defaults, the exporter has to buy back the receivable from the factor.

Key Feature: It’s a bit riskier for the exporter, but the factoring fees are usually lower.

Non-Recourse Factoring

What Is It: With non-recourse factoring, the factor assumes the credit risk. If the foreign buyer doesn’t pay due to insolvency or other specified reasons, the exporter is not obligated to buy back the receivable. The factor absorbs the loss.

Key Feature: Offers more security for the exporter, but the factoring fees tend to be higher due to the assumed risk.

How To Implement Export Factoring the Best Way?

Choose Wisely: Select a reputable export factor with extensive experience in international trade finance. Consider factors such as their track record, financial stability, global network, and responsiveness to your needs.

Know the Terms: Carefully review and understand all terms and conditions of the factoring agreement before signing. Pay close attention to discount rates, advance rates, factoring fees, recourse clauses, and any other obligations.

Stay Transparent: Maintain open and transparent communication with the export factor throughout the partnership. Provide accurate and timely information about your business, clients, and invoicing procedures to ensure smooth operations.

Integrate Planning: Incorporate export factoring into your overall financial and growth strategies. Assess how factoring aligns with your goals, working capital needs, and cash flow forecasts. Consider the impact on your credit score, financial statements, and overall business performance.

Monitor Progress: Regularly evaluate the performance of the export factor to ensure compliance with the terms of the agreement. Monitor key metrics such as invoice processing time, collection success rate, and responsiveness to inquiries or concerns. Take prompt action to address any issues or concerns that arise.

Tap Global Expertise: Leverage the export factor’s expertise and global resources to navigate the complexities of international trade. Seek advice and assistance on market intelligence, regulatory compliance, and currency exchange. Utilize their network of contacts and partners to explore new markets and expand your customer base.

Educate Your Team: Ensure that all members of your team understand the benefits of export factoring and their roles in the process. Provide training to employees in operations, finance, and sales on how to effectively integrate factoring into their daily tasks and communicate with the export factor.

Adapt as Needed: Continuously assess the effectiveness of your export factoring arrangement and make adjustments as necessary. Evaluate its impact on your financial performance, customer relationships, and business objectives. Identify areas for improvement and explore ways to enhance the efficiency and effectiveness of your factoring strategy over time.

Major Benefits of Export Factoring

Below are some of the major advantages of export factoring.

Improved Cash Flow

Export factoring provides immediate cash by advancing a percentage of the invoice value. This helps exporters maintain a healthy cash flow, allowing them to cover operational expenses, invest in growth, and seize new opportunities.

Reduced Credit Risk

With non-recourse export factoring, the factor assumes the risk of non-payment by the foreign buyer. This protects the exporter from losses due to buyer insolvency or default, enhancing financial stability.

Efficient Working Capital Management

Export factoring facilitates efficient working capital management by converting accounts receivable into immediate cash. This liquidity enables businesses to meet short-term obligations and pursue additional export orders.

Access to Professional Credit Management

Export factors often provide credit management services, including credit assessments of foreign buyers. This expertise helps exporters make informed decisions and minimize the risk of dealing with unreliable or financially unstable customers.

Focus on Core Business Activities

By outsourcing receivables management and collection to the factor, exporters can concentrate on their core business activities, such as production, marketing, and product development, rather than spending resources on debt recovery.

Flexible Financing

Export factoring offers flexibility in financing, allowing exporters to choose between recourse and non-recourse options based on their risk tolerance. This adaptability makes it a versatile financial tool for various business scenarios.

Enhanced Sales Opportunities

Offering favorable credit terms to international buyers can make a business more competitive. Export factoring enables exporters to extend credit without compromising their cash flow, potentially attracting more customers and expanding market share.

Streamlined Collections

Factors specialize in collections, ensuring timely and effective recovery of receivables. This minimizes the exporter’s involvement in the often complex and time-consuming process of chasing payments across international borders.

Mitigation of Currency Risk

Export factors may offer currency conversion services, helping exporters manage the risk associated with fluctuating exchange rates. This feature is particularly valuable when dealing with international transactions involving different currencies.

Credit Insurance

Some export factoring arrangements include credit insurance, further protecting exporters against the risk of non-payment. This insurance coverage adds an extra layer of security and peace of mind for businesses engaged in cross-border trade.

Challenges and Limitations of Export Factoring

With advantages, certain challenges and limitations of export factoring follow which you should be aware of.

Potential Risks Associated with Export Factoring

Export factoring entails risks like non-payment by importers, currency fluctuations, and geopolitical instability. Factors must assess importer creditworthiness diligently to mitigate default risks.

Common Challenges Faced by Exporters

Exporters often encounter complexities in the factoring process, negotiation hurdles, and funding delays. Discrepancies in invoice verification can disrupt cash flow.

Strategies for Mitigating Risks and Overcoming Challenges

Strategies include vetting factors, maintaining communication, and providing accurate documentation. Diversifying customer base, considering credit insurance, and staying informed are vital to navigate challenges effectively.

Also Read: How Export Factoring Empowers a Small Business to Conquer International Markets

Export Factoring vs. Letters of Credit

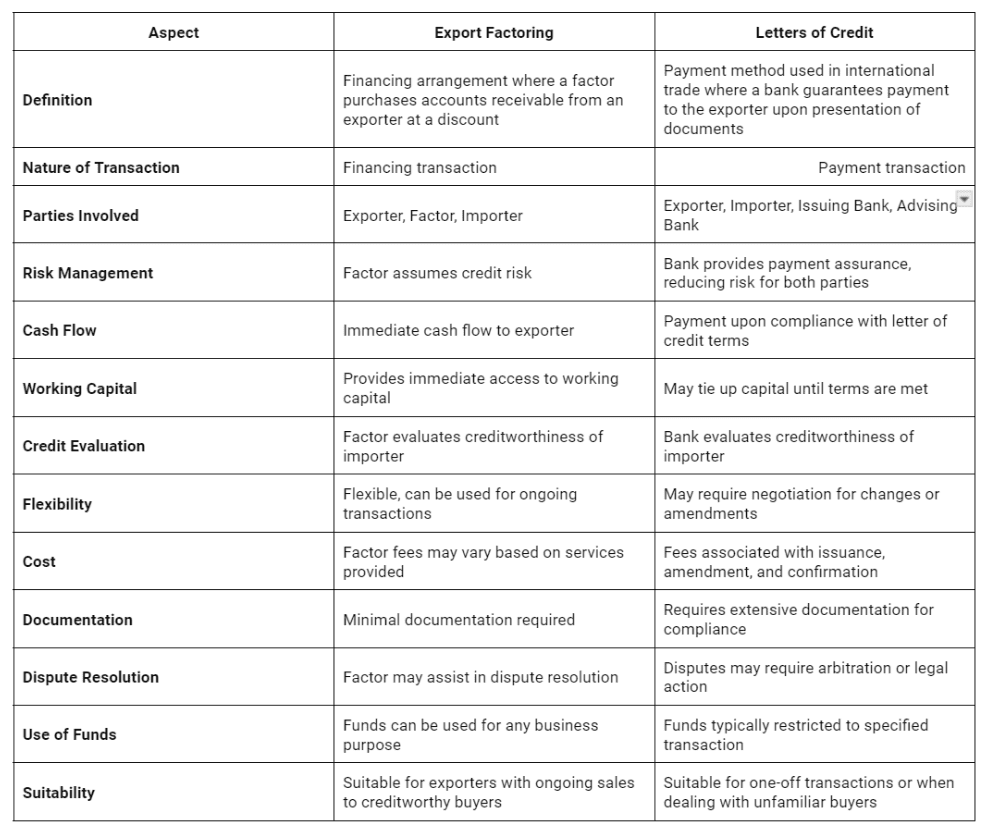

The table below provides a comprehensive comparison between Export Factoring and Letters of Credit, covering various aspects including nature of transaction, parties involved, risk management, cash flow, working capital, credit evaluation, flexibility, cost, documentation, dispute resolution, use of funds, and suitability.

Future Trends and Innovations in Export Factoring

Explore and understand some of the future trends and innovations in Export Factoring to level up your strategy and make wiser decisions:

A. Technological Advancements Impacting Export Factoring

Technological advancements are reshaping export factoring, with digital platforms and automation tools streamlining processes and enhancing efficiency. Blockchain technology offers increased transparency and security, while AI and machine learning enable more accurate risk assessment. These advancements facilitate faster funding, reduced administrative burdens, and greater accessibility to financing solutions.

B. Emerging Trends in Global Trade and Finance

Global trade and finance are witnessing a shift towards sustainability and ethical sourcing practices, driven by increasing consumer demand. Export factors are adapting by incorporating sustainability criteria into their risk assessment frameworks. The rise of e-commerce and cross-border trade platforms presents new opportunities for export factoring, particularly for SMEs participating in global online marketplaces.

C. Opportunities for Growth and Expansion in the Export Factoring Industry

Despite challenges, the export factoring industry remains poised for growth. Emerging markets offer untapped potential, with factors expanding their presence and forging strategic partnerships. The growing awareness and adoption of export factoring among SMEs present a significant opportunity for market expansion. Regulatory reforms aimed at promoting trade finance further enhance growth prospects. By capitalizing on these opportunities and embracing innovation, export factors can position themselves for sustained success.

Unlock Your Export Potential with Credlix

Credlix makes exporting easy for businesses by providing the money you need. We help you handle more orders from buyers effortlessly. Our simple solutions, like getting money for your invoices and financing your purchase orders, don’t require you to give any collateral. It’s really simple with us.

Conclusion

Export Factoring is a practical tool for businesses in global trade. It brings quick cash, reduces risks, and allows a focus on growth. While Indian exporters are catching on, there’s room for more global adoption. Export Factoring simplifies financial processes and accelerates business growth. Whether you’re experienced or starting, it’s a reliable way to navigate international trade challenges. Credlix offers straightforward solutions, making the process even simpler for businesses aiming to thrive in the global market.

Also Read: How Export Factoring is Better Than Bank Loans

FAQs

Why choose export factoring?

Export factoring offers businesses a solution to alleviate the challenges associated with payments and finances, providing the essential working capital required to carry on operations. Securing cash credit or loans can be challenging in the international financial sector, prompting many sellers to turn to export factoring. In India, export factoring is typically facilitated by Non-Bank Financial Companies (NBFCs), predominantly funded by financial institutions.

What makes export factoring different from forfaiting?

Export factoring involves selling all invoices to a factor, which includes handing over all accounts receivable. On the other hand, forfaiting entails surrendering all rights to trade receivables tied to international transactions to a specialized trade financing company. In essence, while both methods offer financial solutions for international trade, the distinction lies in the extent of rights relinquished and the parties involved in the transaction.

How can export factoring benefit your business?

Export factoring offers a swift solution for businesses to access funds needed for growth. By factoring in foreign receivables, businesses receive immediate payment from the factor instead of waiting for weeks or months for payment from importers. This accelerates cash flow and provides the necessary liquidity to fuel business expansion and operations.[/vc_column_text][vc_column_text]In the dynamic world of business, managing finances efficiently is key to ensuring sustained growth and success. One crucial aspect that often takes center stage is the management of receivables – the money owed to your business by customers.

This blog aims to shed light on the strategic use of financing receivables and the impactful practice of vendor financing, offering insights that are both accessible and beneficial to businesses of all sizes.