[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12843″ img_size=”full” css=”.vc_custom_1715244337881{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]A Letter of Indemnity is a legal document used to protect one party from financial loss or damage caused by another party’s actions or inactions. It’s like a safety net in business transactions, ensuring that if something goes wrong, the indemnified party won’t bear the brunt of the consequences alone.

The process of creating a Letter of Indemnity typically involves outlining the specific terms of indemnification, including what events or actions trigger the indemnity, the extent of financial responsibility, and any other relevant conditions.

Sample formats for Letters of Indemnity can vary depending on the nature of the transaction or agreement, but they generally include clear language outlining the rights and responsibilities of each party involved.

Understanding the ins and outs of Letters of Indemnity is crucial for businesses and individuals engaging in agreements where there’s potential for risk or liability. This introductory guide aims to demystify this important legal document and provide clarity on its meaning, process, and sample formats.

Understanding Letter of Indemnity

A Letter of Indemnity, often abbreviated as LOI, is a legal document used in business transactions to safeguard against potential financial losses or damages.

Purpose: The main goal of an LOI is to provide assurance to one party (let’s call them Party ‘A’) that they won’t suffer financially if the other party (Party ‘B’) fails to meet their obligations in the agreement.

Content: This document outlines specific provisions and conditions that will be followed if something goes wrong. It typically details what actions or events could lead to financial loss or damage, and how compensation or protection will be provided.

Drafting: LOIs are usually drafted by third-party institutions like banks or insurance companies. These external entities agree to step in and provide financial compensation if Party ‘B’ doesn’t fulfill their part of the deal.

Protection: For Party ‘A’, the LOI acts as a safety net. It ensures that they won’t be left hanging if Party ‘B’ fails to fulfill their obligations, minimizing their risk and potential losses.

Clarity: LOIs are crucial for clarity in business transactions. They spell out the specific measures and clauses that can be used to protect both parties from financial harm.

Purpose of a Letter of Indemnity

The main purpose of a Letter of Indemnity (LOI) is to make sure that everyone involved in a contract follows the rules and sticks to their promises, so nobody ends up losing money during a deal. The whole point of writing this document is to stop losses caused by someone else’s mistakes.

An LOI lays out clear steps to protect the innocent party from any financial harm that might happen during the deal, as agreed upon in the contract. So, it’s basically like a safety plan to keep everyone’s pockets safe when doing business.

What is a Letter of Indemnity in Shipping?

In shipping, a Letter of Indemnity (LOI) is a document that shields one party from liability claims brought by another. When goods are transported, the carrier might issue an LOI to the shipper to safeguard the consignment from potential damage, particularly on risky routes. If an accident occurs, the carrier isn’t held responsible for any harm to the goods. This legal arrangement provides assurance to both parties involved in the shipping process, outlining responsibilities and mitigating risks.

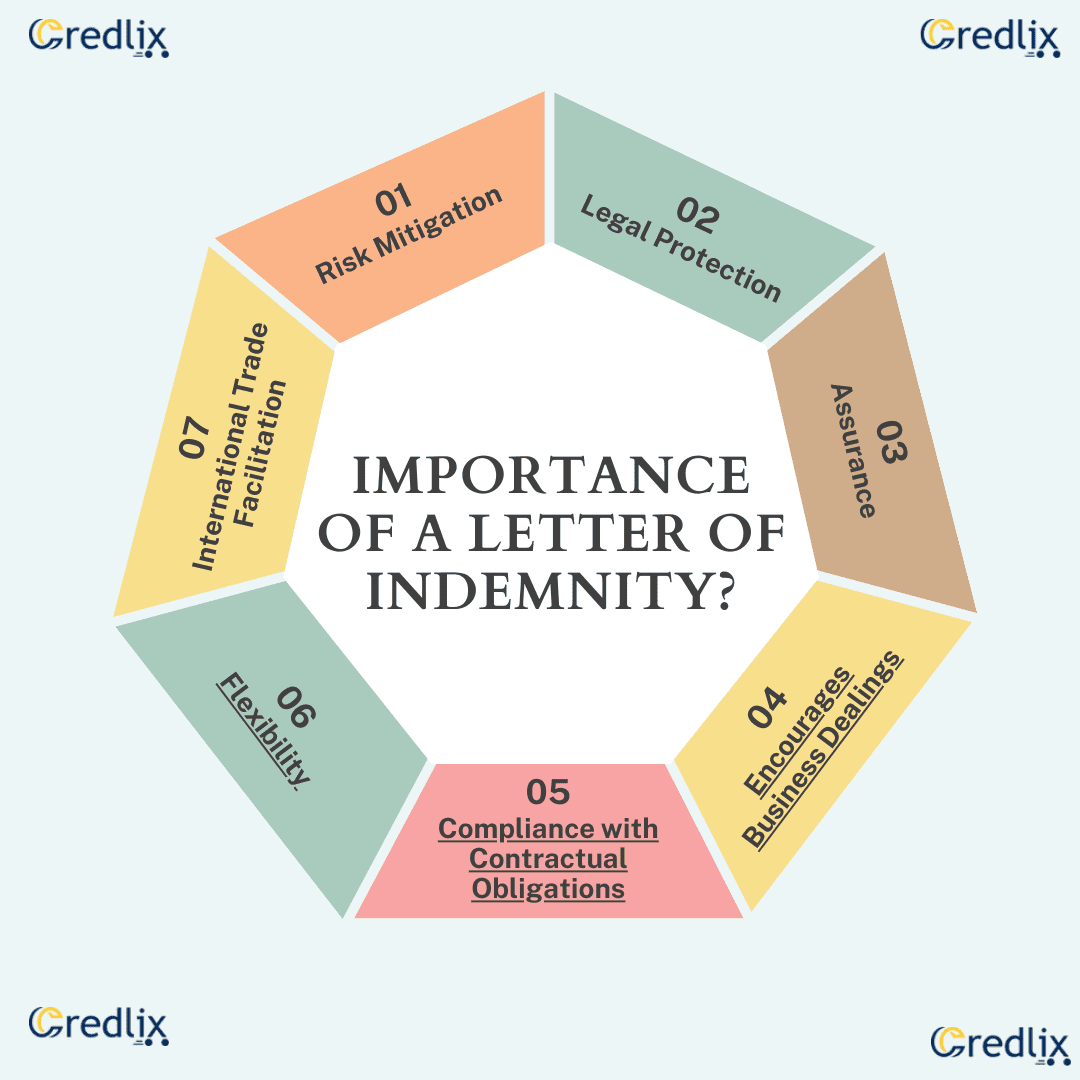

Importance of a Letter of Indemnity?

Following are some of the major reasons why a letter of Indemnity is important:

Risk Mitigation: A Letter of Indemnity (LOI) helps mitigate financial risks associated with business transactions by outlining the responsibilities of each party and providing a mechanism for compensation in case of breaches or losses.

Legal Protection: It offers legal protection by clearly defining the terms and conditions of indemnification, reducing ambiguity and potential disputes between parties.

Assurance: An LOI provides assurance to parties involved in a contract that they will be compensated for any losses incurred due to the actions or inactions of the other party, thus fostering trust and confidence in the transaction.

Encourages Business Dealings: By offering a safety net against potential losses, LOIs encourage businesses to engage in transactions that might otherwise be considered risky, thus facilitating commerce and trade.

Compliance with Contractual Obligations: It ensures compliance with contractual obligations by specifying the consequences of failing to meet agreed-upon terms, thereby promoting accountability and adherence to agreements.

Flexibility: LOIs can be tailored to suit the specific needs and requirements of different transactions, allowing parties to customize indemnification provisions according to their preferences and risk tolerance.

International Trade Facilitation: In international trade, where risks such as transportation uncertainties and political instability are prevalent, LOIs play a crucial role in providing financial protection and enabling smoother cross-border transactions.

What is a Letter of Indemnity Bond?

A Letter of Indemnity bond is like a promise between two parties involved in shipping. It says that if something unexpected happens during the shipping process that causes financial loss, one party will cover the costs for the other party. So basically, it’s a way to make sure both sides are protected financially if something goes wrong.

What is a Letter of Indemnity Insurance?

A Letter of Indemnity insurance serves as an extra safety net in shipping agreements, shielding parties from liability if they need to deviate from their agreed-upon duties. This insurance kicks in during specific situations, such as when goods must be delivered to a location different from the one stated on the Bill of Lading (BOL), when there are errors in the documentation, or when split BOLs are utilized. Essentially, it provides added protection and peace of mind by covering unforeseen circumstances that may arise during the shipping process, ensuring parties are safeguarded against financial repercussions.

Who Issues a Letter of Indemnity?

A Letter of Indemnity is issued by third-party entities such as banks or insurance companies. These institutions draft and prepare the LOI to provide compensation to either party involved in a shipping transaction if the other party fails to fulfill the terms of the contract. Acting as intermediaries, banks and insurance companies play a crucial role in facilitating agreements and ensuring financial security for all parties involved in the shipping process.

Who Signs a Letter of Indemnity?

Usually, a witness signs a Letter of Indemnity (LOI). But if the items being shipped are really valuable, it’s better to have someone from an insurance company or a bank sign it instead of just a witness.

How to Get a Letter of Indemnity?

Typically, you can get a Letter of Indemnity (LOI) by contacting your bank or an insurance company. They’re the ones who usually prepare and draft LOIs, so reaching out to them is the way to go.

How Does a Letter of Indemnity Work?

Here’s how a letter of Indemnity works:

Agreement Basis: When two parties agree to a shipping contract, each has obligations to fulfill.

Risk of Breach: If one party breaches the contract or its terms, the other may suffer losses, like financial loss or damaged goods.

Protection Mechanism: An LOI shields both parties from such losses, ensuring the innocent party isn’t held responsible for any loss incurred.

Reassurance: It provides precise reassurance to the innocent party, securing them from liabilities arising from breaches in the contract.

How to Write a Letter of Indemnity?

Here’s how to write a letter of Indemnity:

Date and Execution: Start by writing the date when the document is being signed.

Jurisdiction Statement: Include a statement specifying that the agreement will be governed by the laws of a particular state to avoid confusion later.

Confirmation of Contract: Begin by confirming the existence of the contract with the other party and your acceptance of its terms. Explain the consequences if you fail to fulfill your obligations and outline measures to prevent loss to the other party. Provide specific details and offer alternative solutions if possible.

Conclusion

Understanding the significance and workings of a Letter of Indemnity is important in navigating business transactions safely. This legal document acts as a shield against potential financial losses, offering assurance and clarity to parties involved in agreements. From mitigating risks to providing legal protection, the LOI facilitates smoother transactions and fosters trust among stakeholders. By adhering to the guidelines for drafting and obtaining an LOI, businesses and individuals can navigate contractual obligations with confidence, knowing they’re safeguarded against unforeseen circumstances.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]