- December 9, 2024

- Posted by: admin

- Categories: Channel Financing, Blog

Trade receivables play a pivotal role in maintaining the financial health of any business. These represent the unpaid amounts owed by customers after purchasing goods or services on credit. For sellers, trade receivables are classified as current assets and reflect the revenue a business is expected to generate in the near future. Understanding and managing trade receivables effectively can significantly enhance a company’s cash flow, credibility, and operational efficiency.

This article delves into the meaning, importance, accounting process, financing options, and strategies to reduce trade receivables. By exploring these aspects in detail, businesses can better optimize their financial operations and minimize risks associated with delayed payments.

What Are Trade Receivables?

Trade receivables are the amounts customers owe a business after purchasing goods or services on credit. These are listed as current assets on a company’s balance sheet if the payment is expected within a year of the billing date. They are vital for tracking pending payments and ensuring consistent cash flow. In essence, trade receivables are the lifeblood of many businesses, bridging the gap between the time goods are delivered and payments are received.

Key Features of Trade Receivables:

- Represent short-term financial assets.

- Help businesses forecast revenue and cash flow.

- Essential for creating accurate financial reports.

Importance of Trade Receivables

Trade receivables are more than just numbers on a balance sheet. Their significance extends to several crucial aspects of a business’s operations:

1. Indicates Revenue Growth

Trade receivables signal the potential revenue a company can generate. By tracking these figures, businesses can estimate their future earnings, helping them plan expansions or investments effectively.

2. Addresses Cash Flow Issues

A consistent record of trade receivables enables businesses to anticipate and mitigate cash flow challenges. For instance, if payments are delayed, a company can take proactive measures like invoice discounting or factoring to maintain liquidity.

3. Builds Credibility

Accurate trade receivable records are essential for preparing detailed financial reports. These reports are scrutinized by investors, creditors, and stakeholders to gauge a company’s financial stability and creditworthiness.

Accounting for Trade Receivables

Trade receivables are recorded in the balance sheet under the “Accounts Receivable” section. The accounting process follows double-entry bookkeeping principles.

Example:

Suppose XYZ Ltd. issues an invoice of ₹5,000 for goods sold. Using double-entry accounting:

- The sales account is credited (revenue recognized) by ₹5,000.

- The trade receivables account is debited (asset recognized) by ₹5,000.

When the customer pays:

- The trade receivables account is reduced (credited) by ₹5,000.

- The cash account is increased (debited) by ₹5,000.

This method ensures all transactions are accurately reflected in the financial statements.

Components of Trade Receivables

Trade receivables typically include two primary components:

- Debtor Receivables: Amounts directly owed by customers.

- Bills Receivables: Formal agreements indicating a promise to pay at a future date.

The formula for calculating trade receivables is:

Trade Receivables = Debtor Receivables + Bills Receivables

Example:

If XYZ Ltd. has debtor receivables of ₹30,000 and bills receivables of ₹20,000, their total trade receivables will be: ₹30,000 + ₹20,000 = ₹50,000

Financing Trade Receivables

Managing cash flow can be challenging when trade receivables are high. Sellers often finance these receivables to ensure operational continuity.

Popular Financing Methods:

- Factoring: Selling receivables to a third party (factor) at a discount for immediate cash.

- Invoice Discounting: Using receivables as collateral for loans.

- Line of Credit: Obtaining a short-term credit line against receivables.

- Dynamic Discounting: Buyers pay early in exchange for discounts, benefiting both parties.

- Supply Chain Finance: A buyer-led solution offering flexible payment terms at low interest rates.

These methods help businesses access immediate liquidity while maintaining healthy cash flow.

Strategies to Reduce Trade Receivables

Effective cash flow management is critical for any business. To ensure buyers settle their payments on time, sellers can implement several strategies that make the payment process easier and encourage punctuality. Here’s how sellers can minimize delays and secure timely payments.

1. Offer Multiple Payment Options

To ensure buyers have no obstacles in making payments, sellers should provide a variety of payment methods. Options such as cash, credit cards, bank transfers, checks, and online payment systems make the process convenient for customers. When buyers can choose the most suitable method, they are more likely to pay promptly. For example, integrating digital wallets or online payment portals can significantly expedite the payment process.

2. Introduce Early Payment Incentives and Late Payment Penalties

Motivate buyers to pay before the due date by offering attractive early payment discounts. For instance, a seller might offer a 2% discount on invoices settled within the first 10 days. Conversely, impose late payment fees to discourage delays. For example, adding a 1% penalty for every week the payment is overdue can serve as a reminder for buyers to prioritize timely payments. This two-pronged approach balances encouragement and accountability, fostering promptness.

3. Send Invoices Immediately

Timeliness in issuing invoices is crucial. The moment a service is rendered or goods are delivered on credit, sellers should send the invoice to the buyer. Delayed invoicing often results in delayed payments, as it extends the payment timeline unnecessarily. A systematic invoicing process—whether automated or manual—can significantly reduce such delays, ensuring that buyers receive billing information promptly.

4. Utilize Reminder Systems

Buyers sometimes forget about pending payments. To address this, sellers can implement regular reminders through emails, SMS, or even phone calls. Automated reminder systems are particularly effective in maintaining communication. Sending polite but firm reminders about upcoming or overdue payments helps ensure buyers are aware of their obligations, reducing the risk of unintentional delays.

5. Request Partial Advance Payments

For high-value goods or long-term projects, sellers can minimize financial risks by asking for partial advance payments. This upfront payment not only reduces the seller’s financial exposure but also encourages buyers to commit to the agreed terms. For example, requiring 30% of the total amount upfront for a significant order creates a safety net for the seller while fostering trust between both parties.

6. Shorten Payment Terms

The standard payment terms can vary across industries, but reducing the payment period wherever possible can improve cash flow. For instance, shifting from a 60-day to a 30-day payment term can help accelerate revenue inflows. A shorter payment window ensures that funds are available sooner, allowing businesses to maintain liquidity and meet operational expenses without delays.

7. Initiate Direct Communication

If reminders and automated systems fail, direct communication with the buyer is often necessary. Sellers should not hesitate to call buyers who consistently neglect or ignore payment requests. A respectful conversation can help address misunderstandings, resolve disputes, or identify reasons for the delay. This proactive approach often leads to quicker resolutions and fosters stronger relationships.

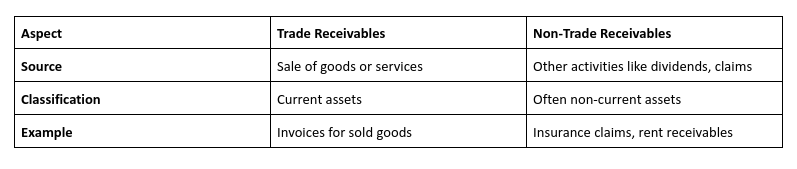

Trade Receivables vs. Non-Trade Receivables

While both are assets, trade receivables and non-trade receivables differ significantly:

FAQs on Trade Receivables

1. What is the difference between trade receivables and accounts payables?

Trade receivables are amounts owed to the seller by customers. In contrast, accounts payables are amounts the seller owes to vendors for supplies. Receivables are classified as assets, while payables are liabilities.

2. What is an aging schedule for receivables?

An aging schedule categorizes receivables based on the timeline of outstanding payments. This helps businesses identify overdue accounts and prioritize collections.

3. What is an allowance for doubtful accounts?

This is a reserve set aside to account for potential bad debts. It ensures that trade receivables are not overstated in financial statements.

4. Can trade receivables be negative?

Yes, negative trade receivables can occur due to customer overpayments or credit notes issued by the seller.

5. Why might trade receivables increase?

An increase indicates higher sales on credit. While this signals growth, excessive receivables may also indicate potential cash flow issues.

Conclusion

Trade receivables are a cornerstone of modern business operations. They not only represent future revenue but also play a critical role in determining a company’s financial health. By understanding their components, accounting methods, and effective management strategies, businesses can optimize cash flow and reduce risks associated with delayed payments.

By leveraging financing options like factoring or supply chain finance and adopting proactive measures such as early payment incentives and regular reminders, businesses can ensure timely collections and maintain financial stability. As a result, trade receivables become a tool not just for managing cash flow but also for driving sustainable growth.

Also Read: Financing Receivables and Using Vendor Financing to Improve Your Business Cash Flow