[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12013″ img_size=”full” css=”.vc_custom_1707213594450{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]When businesses seek the optimal factoring company to enhance cash flow, the common focus is negotiating the lowest rate. While pursuing a low rate seems logical, it may not be the most strategic approach for various reasons. While a low rate is essential, it’s just one element in the overall factoring cost.

Many factors promote low rates as a lure. Advertised rates like “starting from 1.95%” may catch attention, but they lack sufficient details for an informed decision. Additional fees, reduced advance rates, delayed funding, and limited value-added services can collectively elevate the funding cost, despite the appeal of a seemingly low rate.

Explore how forward-thinking invoice factoring companies offer maximum value at the most favorable cost.

What is Invoice Factoring?

Invoice factoring is a financial practice falling under debtor finance. In this arrangement, a business sells its accounts receivables (invoices) to a factor or factoring company at a slight discount, known as the factoring rate. This enables businesses to address current cash requirements promptly instead of waiting for payment based on the invoiced receivable’s specified payment terms.

Factoring Rate vs. Factoring Cost

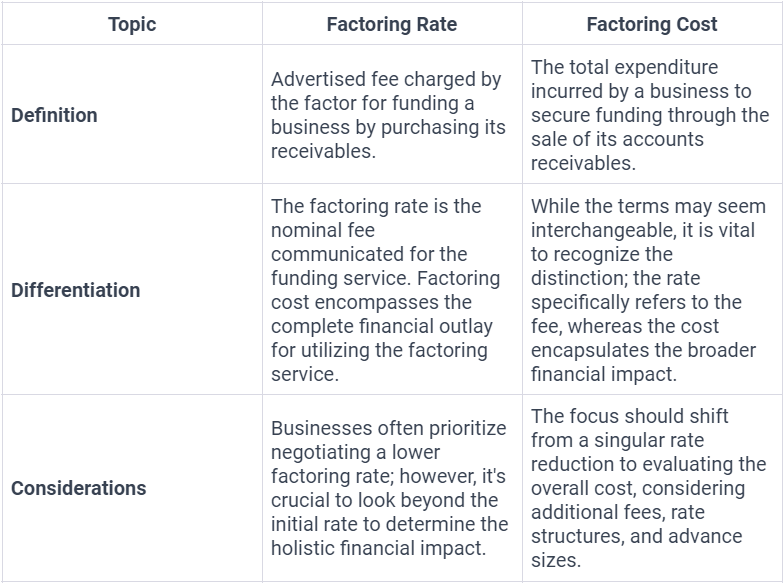

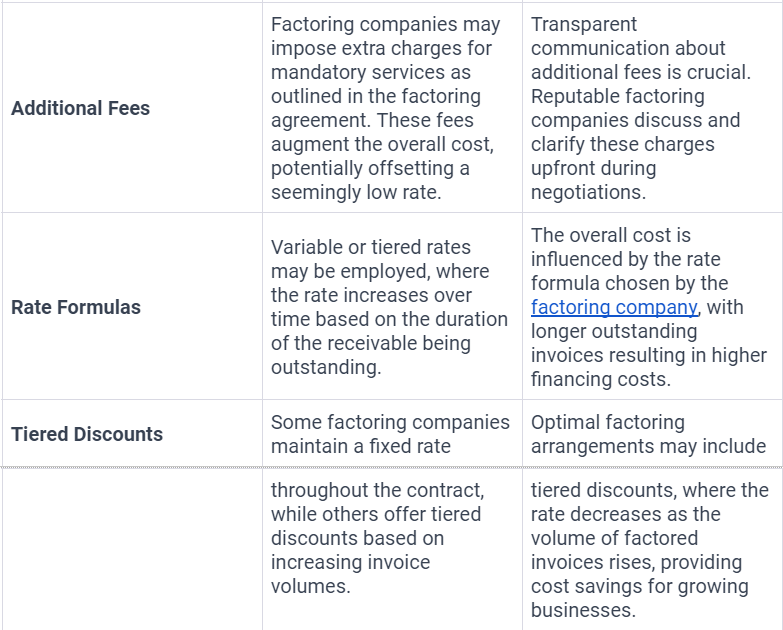

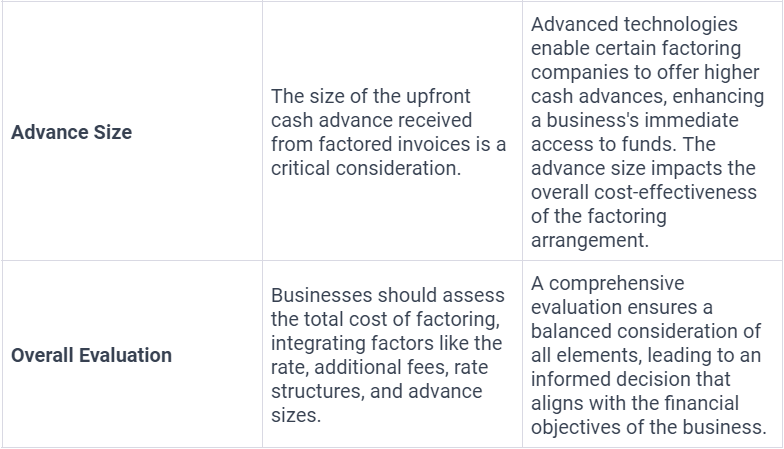

This detailed explanation of the table below clarifies the nuances between factoring rate and factoring cost, emphasizing the need for businesses to consider additional fees, rate structures, and advance sizes in evaluating the overall impact of a factoring arrangement.

Current Trends in Factoring Rates and Advances for 2024

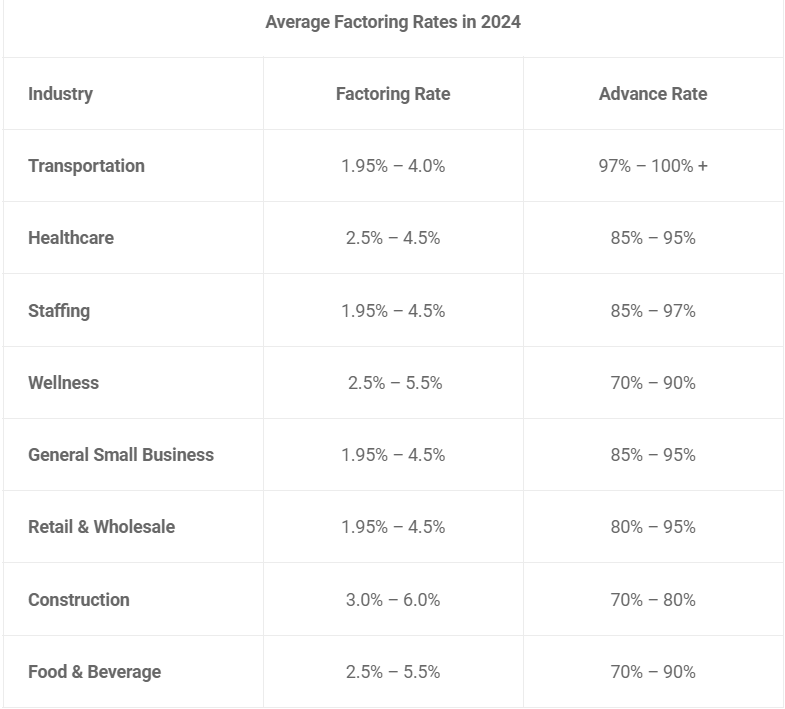

Factoring rates fluctuate based on industry, risk assessment, duration, advance percentage, transaction complexity, and volume. Companies with lower risk and straightforward receivables often enjoy lower rates and higher cash advances. In contrast, higher-risk companies or those with intricate receivables processing tend to encounter higher factoring rates.

Refer to the following table for standard rates and advances across key industries.

- The presented rates reflect the average for the initial 30 days of factoring receivables.

- Unless under a flat fee arrangement, rates are typically prorated depending on your customers’ payment timelines for invoices.

Maximizing Value with Industry-Focused Factoring

Discover the strategic benefits of industry-focused factoring, maximizing value for businesses through tailored solutions and optimized efficiency.

Ideal Industries: Certain industries align well with invoice factoring, presenting optimal opportunities for businesses to leverage this financial solution.

Expertise Matters: Factoring companies with specialized industry knowledge can enhance customer value by streamlining processes and maximizing efficiency.

Tailored Solutions: Industry-focused factoring providers understand the unique needs of businesses within their specialization, offering customized solutions for maximum impact.

Transportation Advantage: In sectors like transportation, experienced factoring companies may provide significantly high advance rates, sometimes reaching up to 100% of the invoice face value.

Efficiency Optimization: Industry specialization allows factoring companies to implement tailored strategies, optimizing efficiency and delivering enhanced value to their clientele.

Strategic Advance Rates: Tailored to industry dynamics, these specialized factoring services strategically determine advance rates to meet the specific needs and expectations of businesses within their focus.

Also Read: 5 Reasons To Choose Invoice Factoring Over Bank Loans

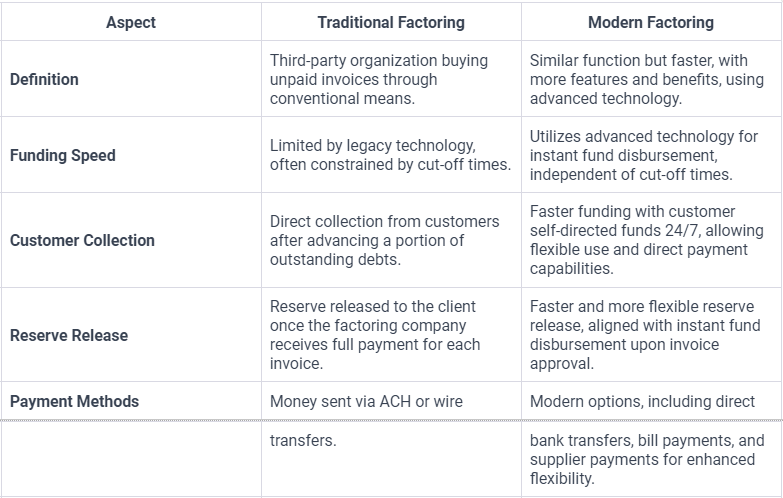

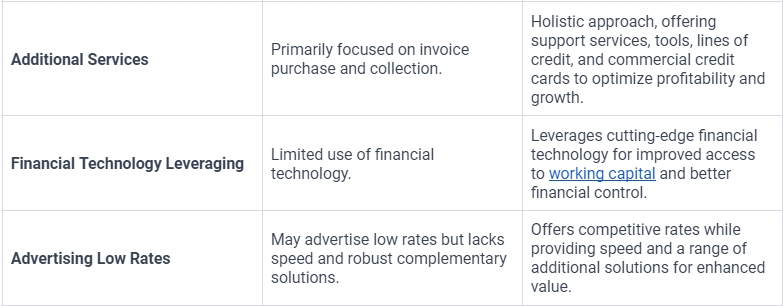

The Difference Between Traditional Factoring & Modern Factoring

Explore the evolution of factoring. Traditional Factoring involves conventional methods, while Modern Factoring employs advanced technology, offering speed, flexibility, and additional solutions for enhanced financial control and efficiency.

Final Words

Choosing the right factoring company involves looking beyond the surface of low rates. Understanding the distinction between factoring rate and cost is crucial. Modern factoring, driven by advanced technology, provides speed, flexibility, and added benefits. Industry-focused factoring maximizes value with tailored solutions, especially in sectors like transportation.

Evaluating average factoring rates in 2024 across various industries offers insights into the evolving financial landscape. Ultimately, businesses benefit from factoring companies that align with their specific needs, providing not just financing but holistic support for growth and financial control.

Also Read:Guide to How Invoice Factoring Works

Also Read:The Pros and Cons of Invoice Factoring for Business Owners[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]