[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12618″ img_size=”full” css=”.vc_custom_1713164822992{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]When businesses engage in international trade, a major concern revolves around receiving timely payments. While offering goods and services on credit can spur business growth, the risk of non-payment often deters companies. To address this challenge and facilitate smoother transactions for exporters, negotiable instruments have become indispensable. These instruments serve as guarantees to sellers that payments, even when extended on credit, will be honored on time. Among these instruments, one notable example is the bill of exchange.

By utilizing negotiable instruments like bills of exchange, exporters can mitigate the uncertainty surrounding payments, allowing them to confidently expand their business across borders and seize growth opportunities without undue financial risk.

What is the Bill of Exchange?

A bill of exchange is a contractual document utilized in financial transactions, particularly in international trade, to ensure payment between parties. It represents a binding agreement where one party commits to pay a predetermined sum to another party, either upon demand or at a specified future date. This instrument serves as a safeguard against the risk of non-payment, commonly encountered in cross-border trade.

Bills of exchange can be issued by banks or individuals and are transferable through endorsements, providing flexibility and security in commercial transactions. In essence, a bill of exchange facilitates smoother trade by establishing a clear obligation for payment, thereby promoting trust and reliability between trading partners.

Importance of Bill of Exchange

The bill of exchange holds significant importance in international trade and finance for several reasons:

Facilitating Trade: Bills of exchange streamline commercial transactions by providing a secure method for ensuring payment. They enable businesses to extend credit terms to buyers while still guaranteeing receipt of funds, thus encouraging trade activities.

Risk Mitigation: In cross-border transactions, the risk of non-payment or delayed payment is a major concern for exporters. Bills of exchange mitigate this risk by creating a legally binding obligation on the buyer to pay the specified amount at a specified time, reducing uncertainty for the seller.

Enhancing Liquidity: Bills of exchange can be discounted or sold to financial institutions, providing exporters with immediate access to cash. This liquidity allows businesses to manage cash flow effectively, fulfill operational expenses, and seize growth opportunities without waiting for payment from buyers.

Credit Instrument: For buyers, bills of exchange serve as a form of credit instrument, allowing them to defer payment until a later date while still securing the goods or services they require. This flexibility in payment terms can facilitate larger transactions and foster stronger business relationships.

Legal Protection: Bills of exchange carry legal enforceability, providing a formal mechanism for resolving disputes in case of non-payment. They offer a clear record of the transaction terms and obligations, facilitating legal recourse if necessary.

Global Acceptance: Due to their widespread use and recognition in international trade, bills of exchange are accepted across borders, currencies, and legal jurisdictions. This universality makes them a versatile and reliable tool for conducting business globally.

Format of Bill of Exchange

A bill of exchange typically contains the following essential information:

Parties Involved: The names and addresses of the parties involved in the transaction, namely the drawer (seller/exporter), the drawee (buyer/importer), and the payee (to whom the payment is to be made). These details establish the contractual relationship between the parties.

Amount: The specific amount of money that the drawee is obligated to pay to the payee. This amount is typically stated in both numerical and written formats to prevent discrepancies or misunderstandings.

Date and Place of Issue: The date on which the bill of exchange is issued, as well as the place where it is issued. This information is crucial for determining the validity and timeline of the bill.

Date of Payment: The date on which the payment is due or the bill matures. This date indicates when the drawee is required to make the payment to the payee.

Payment Terms: Any specific terms or conditions related to the payment, such as whether it is payable upon sight (on demand) or at a specific future date, and any applicable interest rates or discounts.

Reference Number or Invoice Details: A reference number or other identifying information that links the bill of exchange to the underlying transaction, such as an invoice number or purchase order reference.

Signatures: The signatures of the drawer and the drawee, indicating their agreement to the terms and conditions of the bill of exchange. Additionally, there may be endorsements by subsequent holders of the bill, if it has been transferred or negotiated.

Legal Clauses: Any additional legal clauses or provisions that may be relevant to the transaction, such as jurisdictional clauses, dispute resolution mechanisms, or special instructions regarding acceptance and payment.

These details collectively establish the obligations and rights of the parties involved in the bill of exchange transaction, ensuring clarity, enforceability, and legal validity.

Role of the Issuer in a Bill of Exchange

A bill of exchange is initiated by the creditor or beneficiary, mandating the debtor or buyer to remit a predetermined sum within a stipulated time frame. As the issuer, the creditor establishes the terms and conditions of the payment obligation, including the amount owed and the due date.

This financial instrument serves as a directive from the issuer to the debtor, facilitating secure transactions and ensuring timely payment. Through the bill of exchange, the issuer asserts their right to receive payment, providing a structured framework for commercial dealings while mitigating the risk of non-payment.

Key Parties in a Bill of Exchange

Three essential parties play distinct roles in facilitating smooth and secure exchanges:

Drawer

The drawer, often the seller or creditor, initiates the bill of exchange by drafting or authorizing its creation. By doing so, the drawer issues an order directing the drawee to pay a specified amount to the designated payee. Essentially, the drawer functions as the initiator of the financial instrument, setting forth the terms of payment and initiating the transaction.

Drawee

The drawee, typically the buyer or debtor, is the party upon whom the bill of exchange is drawn. They are obligated to honor the payment directive outlined by the drawer. Upon presentation of the bill, the drawee is legally bound to settle the specified amount to the payee either upon sight (on demand) or at a predetermined future date. The drawee’s acceptance signifies their agreement to the payment terms.

Payee

The payee is the beneficiary designated to receive the payment specified in the bill of exchange. They are entitled to collect the funds owed by the drawee according to the terms of the instrument. In some cases, the payee may also be the drawer, particularly if the bill remains in the possession of the original creditor. However, if the bill is transferred or negotiated to a third party, that individual or entity becomes the payee entitled to receive the payment.

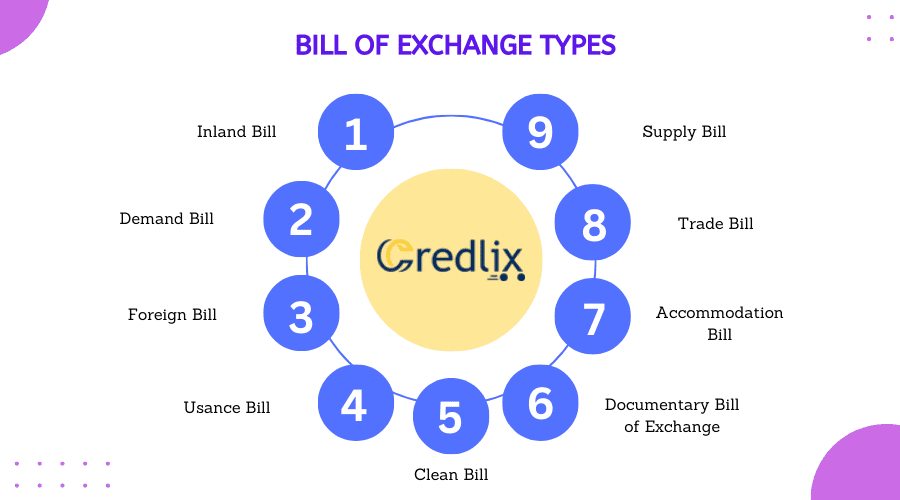

Bill of Exchange Types

Bills of exchange serve as essential instruments in commercial transactions, offering flexibility and security to traders. Understanding the diverse types of bills is crucial for navigating international trade effectively:

Inland Bill

An inland bill is drawn and settled within the same country. For instance, if a bill is drafted and paid in India, it qualifies as an inland bill, simplifying transactions within national borders.

Demand Bill

Demand bills necessitate immediate payment upon presentation without specifying a particular date. Payment is made promptly upon demand, ensuring flexibility in settling financial obligations.

Foreign Bill

Foreign bills involve transactions conducted beyond the issuer’s national boundaries. Export bills are drawn by exporters for overseas recipients, while import bills are drawn by foreign exporters for Indian buyers, adhering to distinct regulations.

Usance Bill

Usance bills stipulate a predetermined period within which the buyer must settle the credit purchase payment to the seller. These time-bound bills provide clarity on payment terms, facilitating smoother transactions.

Clean Bill

Clean bills lack accompanying documentary proof, leading to higher interest rates due to increased risk. They are issued without documentation, reflecting a higher level of trust between parties.

Documentary Bill of Exchange

Documentary bills are supported by relevant documentation verifying the authenticity of the trade transaction. Documents against acceptance (D/A) and documents against payment (D/P) bills offer varying degrees of assurance and flexibility.

Accommodation Bill

Accommodation bills serve as financial agreements between parties, offering assistance without involving actual trade transactions. They provide a means to raise credit without necessitating goods or services exchange.

Trade Bill

Trade bills are drawn to settle credit transactions between buyers and sellers, facilitating credit purchases and promoting trade relationships.

Supply Bill

Supply bills arise when goods are provided to governmental bodies by contractors or suppliers. These bills streamline transactions between suppliers and government entities, ensuring transparency and accountability.

Functions of Bill of Exchange

A bill of exchange serves multiple functions in commercial transactions:

Means of Payment: In international trade, a bill of exchange acts as a secure method of payment. It safeguards trade agreements from exchange rate fluctuations and assures payment to the specified recipient of a fixed sum of money.

Source of Funding: Bills of exchange also serve as a means of obtaining funds. When a bill stipulates payment at a future date, it can be discounted. The drawer can then sell the bill to a third-party institution, typically a bank, in exchange for immediate payment. The bank receives the payment from the drawee upon maturity of the bill.

Evidence of Transaction: Additionally, a bill of exchange serves as tangible evidence of a transaction. It provides proof of the financial obligation owed by the buyer or drawee to the payee. This documentation strengthens the legal validity of the transaction and facilitates dispute resolution if necessary.

Bill of Exchange With a Practical Example

Imagine a company based in Germany, called XYZ GmbH, specializes in manufacturing machinery. They have recently supplied a shipment of industrial equipment to a company in Japan, called ABC Corporation. The total value of the machinery is €100,000.

Creation of the Bill of Exchange:

XYZ GmbH, acting as the seller (drawer), decides to extend credit terms to ABC Corporation, the buyer (drawee). Instead of demanding immediate payment, XYZ GmbH opts to create a bill of exchange to formalize the payment agreement. They drafted a bill instructing ABC Corporation to pay €100,000 to XYZ GmbH within 90 days from the date of the bill.

Acceptance by the Drawee:

ABC Corporation, upon receiving the machinery and the bill of exchange, reviews the terms and agrees to the payment conditions. They accept the bill, signifying their commitment to paying the specified amount within the agreed timeframe.

Negotiation or Discounting:

XYZ GmbH may choose to negotiate or discount the bill of exchange to obtain immediate liquidity. They can approach a bank or financial institution and present the bill for discounting. The bank assesses the creditworthiness of ABC Corporation and XYZ GmbH before agreeing to discount the bill. Assuming the bank agrees, XYZ GmbH receives a discounted amount, slightly less than the face value of the bill, providing them with immediate funds to support their operations.

Payment and Settlement:

As the due date approaches, ABC Corporation prepares to settle the bill. On the maturity date specified in the bill of exchange, they transfer €100,000 to the bank or financial institution, which then remits the funds to XYZ GmbH. This completes the transaction, and XYZ GmbH receives the full payment owed for the machinery they supplied.

In this example, the bill of exchange facilitated a smooth and secure transaction between XYZ GmbH and ABC Corporation, allowing XYZ GmbH to extend credit terms while ensuring timely payment. It provided flexibility, liquidity, and assurance to both parties, demonstrating the practical utility of bills of exchange in international trade.

Also Read: Documents Required for Import-Export Customs Clearance

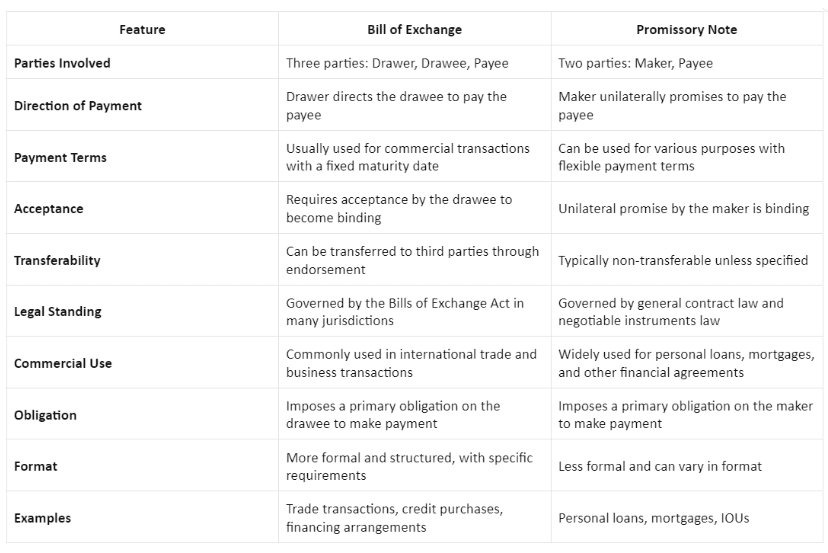

Difference Between a Bill of Exchange and a Promissory Note

This table highlights the key differences between a bill of exchange and a promissory note in terms of parties involved, payment direction, legal standing, commercial use, and other important aspects.

In conclusion, the bill of exchange stands as a cornerstone of international trade, providing a reliable framework for secure transactions and mitigating the risks associated with credit sales. Its versatility and legal enforceability make it an invaluable tool for businesses navigating the complexities of global commerce. Whether facilitating payments, accessing funds, or providing evidence of transactions, the bill of exchange plays a pivotal role in fostering trust and reliability among trading partners. With its enduring importance and practical utility, the bill of exchange remains a vital instrument in facilitating seamless trade relationships and driving economic growth on a global scale.

Also Read: 9 Documents Generated in Post Export Shipment Banking Activities[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]