[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11641″ img_size=”full” css=”.vc_custom_1702875530037{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]The cash conversion cycle is like a money journey for businesses. It starts with buying stuff to make products and ends when you get paid by customers. But keeping this cycle healthy isn’t always simple. Businesses can face problems like holding onto products for too long, taking a while to make and sell things, customers paying late, and not managing money well.

So, it’s important for businesses to understand and make this cash journey better. That way, they can be better with money, make more profit, and avoid money problems.

What Is Cash Conversion Cycle?

The Cash Conversion Cycle (CCC) refers to the time it takes for a business to convert its investments in raw materials and other production-related costs into cash through sales and subsequent customer payments. It is a crucial metric for assessing the efficiency of a company’s working capital management.

The Three Pillars of the Cash Conversion Cycle

The Cash Conversion Cycle involves three key components:

Days Inventory Outstanding (DIO): This assesses how quickly a company sells its entire inventory. A lower DIO is better, indicating efficient inventory turnover.

Days Sales Outstanding (DSO): DSO measures how long it takes for a company to collect payment from customers after a sale. A lower DSO signals effective payment collection and improved cash flow management.

Days Payable Outstanding (DPO): This gauges how long a company takes to pay its suppliers. A higher DPO is advantageous, suggesting extended payment periods that can positively impact cash flow.

Optimizing the cash conversion cycle is vital for businesses, leading to improved financial efficiency, increased profitability, and effective liquidity management.

Cash Conversion Cycle Practical Example

The Cash Conversion Cycle (CCC) formula is a key tool for understanding a business’s cash flow dynamics. The formula is expressed as:

CCC= Days Sales of Inventory (DSI)+Days Sales Outstanding (DSO)−Days Payable Outstanding (DPO)

Let’s break down this formula using a practical example:

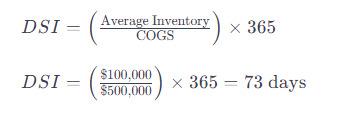

Days Sales of Inventory (DSI)

Suppose a company has an average inventory of $100,000, and its Cost of Goods Sold (COGS) is $500,000 annually. The DSI is calculated as:

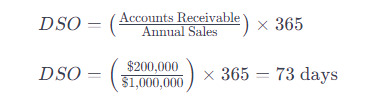

Days Sales Outstanding (DSO)

Assuming the company has annual sales of $1,000,000 and an accounts receivable balance of $200,000, the DSO is calculated as:

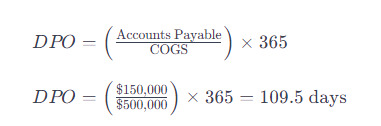

Days Payable Outstanding (DPO)

If the accounts payable balance is $150,000 and the COGS is $500,000, the DPO is calculated as:

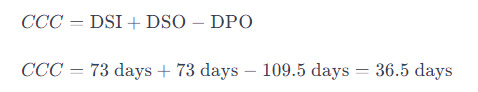

Now, applying these values to the CCC formula:

In this example, the cash conversion cycle is 36.5 days, signifying the time it takes for the company to convert investments in inventory into cash flow from sales.

Cash Conversion Cycle For Company’s Management

The cash conversion cycle is a valuable tool for gauging how efficiently a company’s management handles its working capital. It indicates how effectively a company transforms its investments in inventory and other resources into cash flow from sales.

If a company has a shorter cash conversion cycle, it usually means the management is doing a good job. It shows that the company can quickly turn its investments into cash. This happens when they handle their inventory well, get paid fast by customers, and have good deals with suppliers. In simple terms, it means the company is in control of its money, can take care of short-term needs, invest in growing, and stay financially healthy.

On the flip side, if a company has a longer cash conversion cycle, it might mean there are some issues in how things are managed. This could be because things like inventory don’t get sold as quickly, customers take their time paying, or the company takes a while to pay its bills. A longer cycle can stress a company’s money flow, making it harder to handle bills or plan for big moves.

Looking at the cash conversion cycle helps people like investors and company owners check how well a company is doing. It’s like a health check for the company’s operations, money situation, and how good the management is. This check gives us clues about how smartly a company uses its resources and manages its money to make more cash.

By keeping an eye on and making the cash cycle work better, companies can find ways to do things better, use their money smarter, and make their overall money performance better.

Inventory Turnover & Cash Conversion Cycle

Inventory turnover plays a crucial role in influencing the Cash Conversion Cycle (CCC). Let’s break down how it works:

1. Faster Inventory Turnover

Effect on CCC: If a company can sell its inventory quickly, it shortens the time it takes to turn investments into cash.

Positive Impact: Faster inventory turnover generally leads to a shorter CCC, indicating efficiency in converting goods into cash. This is good for cash flow and overall financial health.

2. Slower Inventory Turnover

Effect on CCC: When inventory sits for a longer time before being sold, it lengthens the cash conversion cycle.

Negative Impact: Slower turnover increases the time it takes to recover the money invested in inventory, potentially impacting cash flow and extending the CCC.

3. Balancing Act

Optimizing Inventory Levels: Finding the right balance is crucial. Holding too much inventory ties up cash, while having too little may result in stockouts.

Impact on CCC: Efficient inventory management positively impacts CCC, allowing the company to maintain a healthier cash flow and meet financial obligations promptly.

4. Continuous Monitoring

Effect on CCC: Regularly assessing and adjusting inventory practices is essential for keeping the CCC in check.

Positive Impact: Monitoring ensures that the company adapts to changes in demand, avoids overstocking, and maintains a streamlined cash conversion process.

In essence, inventory turnover directly affects how quickly a company can convert its investments into cash. A well-managed inventory contributes to a more efficient cash conversion cycle, positively influencing a company’s financial performance.

Negative Cash Conversion Cycle

A negative cash conversion cycle happens when a company gets money from customers before it has to pay its suppliers. This means the company can use the cash from sales to run its operations, cover expenses like buying inventory, all before it has to settle payments with suppliers. This is good for the company because it serves as a quick financing source and boosts its ability to handle short-term money needs, making its financial position stronger.

Strategies for Enhancing Your Cash Conversion Cycle

Here are some effective strategies for enhancing your cash conversion cycle:

Efficient Inventory Management

- Regularly analyze sales trends and adjust inventory levels accordingly.

- Adopt just-in-time inventory systems to minimize excess stock and associated carrying costs.

Negotiate Favorable Payment Terms

- Engage in open communication with suppliers to explore extended payment terms.

- Leverage strong relationships to negotiate early payment discounts.

Prompt Invoicing and Collections

- Implement automated invoicing systems for timely billing.

- Establish a systematic approach to follow up on outstanding payments and encourage early settlements.

Streamline Order Fulfillment

- Evaluate and optimize the entire order-to-cash process, from order placement to delivery.

- Utilize technology to track orders in real-time, reducing fulfillment delays.

Utilize Technology Solutions

- Invest in inventory management software for accurate demand forecasting.

- Implement technology tools to automate routine tasks, minimizing errors and delays.

Customer Credit Policies

- Define clear credit terms and communicate them transparently to customers.

- Regularly assess customer creditworthiness to minimize the risk of late payments.

Supplier Relationships

- Develop strong relationships with key suppliers based on trust and reliability.

- Explore opportunities for bulk purchasing discounts or extended payment periods.

Continuous Process Improvement

- Conduct regular audits of operational processes to identify bottlenecks or inefficiencies.

- Implement continuous improvement strategies to enhance overall workflow.

Cash Flow Forecasting

- Develop a comprehensive cash flow forecast based on historical data and future projections.

- Use forecasting tools to anticipate potential cash flow gaps and plan accordingly.

Final Words

The Cash Conversion Cycle (CCC) is a financial guide crucial for businesses, navigating the conversion of investments into cash through components like DIO, DSO, and DPO. Optimizing the CCC is imperative, reflecting operational health, efficiency, and financial resilience. Efficient inventory management, negotiated payment terms, and technology integration streamline the CCC, enhancing overall financial performance.

A negative cash conversion cycle signifies financial strength, using incoming cash before settling supplier payments for quick financing. The outlined strategies offer practical approaches for CCC enhancement, fostering financial agility, risk reduction, and sustained growth in the dynamic economic landscape.

FAQs

What is the Cash Conversion Cycle (CCC)?

The CCC is a financial metric guiding businesses in converting investments into cash through inventory, sales, and payment cycles.

How does a negative CCC benefit a company?

A negative CCC indicates financial strength, allowing a company to use incoming cash for operations before settling supplier payments, serving as quick financing.

Why is optimizing the CCC important for businesses?

Optimizing the CCC showcases operational health, efficiency, and financial resilience, leading to increased profitability and adept liquidity management.

What role does inventory management play in the CCC?

Efficient inventory management shortens the CCC by ensuring quick turnover, positively impacting cash flow and overall financial performance.

How does negotiation of payment terms affect the CCC?

Negotiating favorable payment terms lengthens the CCC, providing extended periods for cash flow management and positively impacting overall financial health.

What is the significance of technology in streamlining the CCC?

Technology integration enhances CCC efficiency by automating processes, minimizing errors, and ensuring a streamlined workflow for improved financial performance.

Can the CCC be used to assess a company’s financial health?

Yes, the CCC is a valuable tool for assessing a company’s operational efficiency, financial health, and management effectiveness in transforming investments into cash.

How often should a company monitor and optimize its CCC?

Regular monitoring and optimization of the CCC are essential for businesses, ensuring adaptability to changes, risk reduction, and sustained growth in the dynamic economic landscape.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]