- December 9, 2024

- Posted by: admin

- Categories: Export Financing, Blog

The world of international trade relies on clearly defined terms to ensure smooth transactions between buyers and sellers across borders. One such crucial term is DDP Incoterm, which stands for Delivery Duty Paid. As one of the 11 trade terms introduced by the International Chamber of Commerce (ICC) under the Incoterms 2020, DDP provides a structured approach to responsibilities, costs, and risks in international shipping. This article will explore DDP in detail, breaking down its processes, responsibilities, and benefits for buyers and sellers.

What is DDP Incoterm?

DDP Incoterm is a trade agreement term where the seller assumes maximum responsibility for the delivery process. This means the seller bears all costs, risks, and legal obligations involved in ensuring that goods are delivered to the buyer at the agreed-upon destination.

This term is unique because the seller handles not only export formalities but also import duties, taxes, and customs clearance. DDP can be applied to any mode of transport, including road, air, sea, or multimodal transport.

Key Features of DDP Incoterm

Seller Assumes All Costs and Risks

Under DDP, the seller covers all expenses, including packaging, loading, transportation, customs duties, taxes, and insurance, until the goods reach the buyer’s designated location.

Buyer’s Minimal Involvement

This arrangement heavily favours the buyer, who has little to no responsibility until the goods arrive. However, the buyer should stay informed and ensure that the seller meets all obligations.

Importance of the Place of Delivery

The place of delivery is critical under DDP. It marks the point where the seller’s responsibilities end, and the buyer assumes risk and responsibility. The delivery point could be a port, warehouse, or any location agreed upon in the contract.

How Does the DDP Process Work?

Under DDP, the seller oversees the entire shipment process, from the place of origin to the agreed destination in the buyer’s country. Here’s how the process typically unfolds:

Place of Destination:

The delivery destination is negotiated between the buyer and seller. It could be the buyer’s warehouse, a specific port, or another location in the importing country.

Shipment Procedure:

The seller organizes and pays for every step of the transportation process:

- Loading the goods at the origin.

- Transporting them to the port.

- Clearing customs for export and import.

- Delivering the goods to the final destination.

Customs Formalities:

The seller ensures all legal and customs-related formalities are completed. This includes paying import duties, Value Added Tax (VAT), and any other local taxes.

Risk Transfer:

The risk of goods remains with the seller until delivery to the agreed destination. After that, it transfers to the buyer.

Seller’s Responsibilities Under DDP

The seller shoulders most responsibilities under DDP Incoterm. Here’s a detailed breakdown:

Loading and Unloading

- At the origin, the seller oversees the loading of goods onto transport.

- The seller also prepares and reloads goods for shipment as needed.

Transport and Delivery

- The seller arranges transportation from the origin to the buyer’s location.

- This includes covering costs for freight, terminal handling, and delivery.

Customs Duties and Taxes

- The seller pays for customs clearance in both the exporting and importing countries.

- Duties like GST, VAT, or excise taxes are included in the seller’s obligations.

Insurance

- Although DDP does not mandate insurance for the buyer, the seller often secures insurance to facilitate customs clearance.

Documentation

The seller provides all required documents, such as:

- Bill of Lading

- Commercial Invoice

- Export and Import Licenses

- Insurance Certificate

Notices

The seller must notify the buyer about transportation and delivery timelines.

Buyer’s Responsibilities Under DDP

While the buyer’s responsibilities are minimal, they play a role in ensuring a smooth transaction:

Unloading Goods

- If the designated place of delivery is the buyer’s port, the buyer unloads the goods and may handle further transportation to their warehouse.

Notifying the Seller

- The buyer informs the seller of the delivery location and ensures clear communication regarding timelines.

Assisting in Customs (Optional)

- In some cases, the buyer might assist with customs clearance if local knowledge or documents are needed.

Costs in DDP

DDP (Delivery Duty Paid) is one of the 11 Incoterms established by the International Chamber of Commerce (ICC). It places the maximum responsibility on the seller, making it the most seller-favorable trade term. Under DDP, the seller is responsible for delivering goods to the agreed destination, which could be the buyer’s premises or a port in the buyer’s country. This means the seller covers all associated costs, including shipping, insurance, customs duties, and taxes for both export and import.

The seller’s obligations include paying for the freight, handling export and import customs procedures, and clearing the goods through customs. The risk remains with the seller until the goods are delivered to the agreed-upon location, at which point the risk and responsibility shift to the buyer.

While DDP offers ease to the buyer, it may result in the buyer being overly dependent on the seller, particularly for managing local taxes or customs. However, the buyer’s obligations are limited to receiving the goods and taking care of the unloading at the destination.

DDP is commonly used when the seller is familiar with local customs regulations and logistics in the buyer’s country, ensuring a smooth delivery process. This Incoterm is favored for door-to-door delivery.

Transfer of Risk under DDP

- Seller’s Responsibility: The seller bears all risks and responsibilities until the goods are delivered to the agreed destination.

- Risk Transfer Point: Risk shifts to the buyer only after the goods have been delivered to the agreed destination (port or buyer’s premises).

- During Transport: While goods are in transit, the seller is responsible for any damages, losses, or delays.

- Post-Delivery: After delivery, the buyer assumes all risks, including any damage or loss that may occur from the destination point onward.

- No Transfer until Delivery: The transfer of risk is tightly linked to the delivery, not the departure.

Advantages of DDP (Delivery Duty Paid)

Seller Control Over the Entire Process

The seller assumes complete responsibility for the goods, from export customs clearance to delivery at the agreed destination. This ensures that the buyer has minimal involvement in logistics management.

Ease for the Buyer

DDP minimizes the buyer’s workload as the seller handles all logistics, including customs duties, taxes, and transport. This is particularly advantageous for buyers unfamiliar with the customs procedures in the seller’s country.

Transparency in Pricing

With DDP, the seller includes all costs (freight, insurance, customs duties, taxes) in the price, offering a clear and predictable total cost for the buyer. This reduces the risk of hidden costs or surprises.

Faster Customs Clearance

The seller, familiar with their own country’s export regulations, can often expedite the customs clearance process. They are also typically better equipped to handle complex documentation requirements.

Reduced Risk of Delivery Delays

Since the seller handles the entire shipping process, including dealing with any delivery delays, the buyer can focus on receiving the goods rather than managing logistics disruptions.

Preferred for International Trade

DDP is ideal for international transactions where the buyer is located in a foreign country and prefers not to manage the complexities of customs or delivery logistics themselves.

Challenges of DDP

- High Responsibility for Sellers: Sellers must navigate complex import/export regulations and bear significant risks.

- Limited Buyer Control: Buyers may have limited visibility or control over transportation and customs processes.

- Potential for Miscommunication: Clear communication is essential to avoid disputes about delivery timelines and responsibilities.

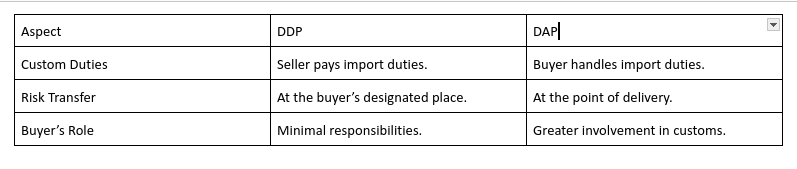

Difference Between DDP and DAP

DAP (Delivered at Place) is another Incoterm often compared with DDP.

FAQs on DDP Incoterm

1. When should you use DDP?

Use DDP when the seller wants to manage the entire shipping process, and the buyer prefers minimal involvement.

2. Who pays the freight charges in DDP?

The seller pays all freight charges under DDP.

3. Does DDP include VAT?

Yes, VAT is included and handled by the seller, unless specified otherwise in the agreement.

4. Is DDP door-to-door delivery?

Yes, DDP can be a door-to-door arrangement where the seller ensures delivery to the buyer’s exact location.

5. What documents are required for DDP?

The seller provides essential documents like the Bill of Lading, Commercial Invoice, and Insurance Certificate.

Conclusion

The DDP Incoterm is a highly buyer-friendly arrangement that simplifies international trade by placing maximum responsibility on the seller. From handling transportation and customs clearance to bearing all associated costs and risks, the seller ensures the goods reach the buyer without hassle. While convenient for buyers, DDP can be complex for sellers, requiring expertise in logistics and compliance.

Understanding DDP is essential for businesses engaged in global trade, enabling them to negotiate terms effectively and ensure smooth operations. Whether you are a buyer seeking ease or a seller aiming to provide exceptional service, DDP remains a valuable tool in the world of international commerce.