- April 5, 2024

- Posted by: admin

- Categories: Supply chain financing, Blog

[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12556″ img_size=”full” css=”.vc_custom_1712297521377{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Debt factoring, also known as invoice factoring or accounts receivable factoring, is a financial strategy employed by businesses to improve cash flow by selling their unpaid invoices to a third party at a discount. This allows businesses to access immediate funds that are tied up in accounts receivable, rather than waiting for customers to pay their invoices.

The advantages of debt factoring are evident, as it provides businesses with quick access to working capital, enabling them to meet immediate financial obligations and invest in growth opportunities. Additionally, debt factoring can save time and resources by outsourcing the task of collecting payments from customers to the factoring company.

However, there are also disadvantages to consider. While debt factoring resolves short-term cash flow issues, it may reduce overall profitability due to the fees charged by factoring companies. Moreover, businesses may lose control over the collection process and risk damaging customer relationships if the factoring company handles payments in a manner that is perceived negatively.

To better understand debt factoring, let’s delve into its advantages, disadvantages, and explore some real-world examples of how businesses utilize this financing strategy.

What is Debt Factoring?

Debt factoring is a way for businesses to turn their unpaid invoices into cash without waiting for their customers to pay up. Here’s how it works:

Let’s say you run a business and you’ve provided goods or services to your customers on credit, meaning they’ll pay you later. But while you’re waiting for them to pay, you might need money to keep your business running smoothly.

That’s where debt factoring comes in. You can sell those unpaid invoices to a third party, like a factoring company, at a slightly discounted price. In return, the factoring company gives you a chunk of cash upfront, usually around 80% of the total value of the invoices.

Now, the factoring company takes on the responsibility of collecting the full payment from your customers. Once they receive the payment from your customers, they deduct their fees, which typically range from 1% to 5%, and give you the remaining amount.

So, debt factoring gives you quick access to the money that’s tied up in your unpaid invoices, helping you cover your expenses and keep your business running smoothly. It’s not the same as taking out a loan because you’re not borrowing money that you’ll have to pay back later — instead, you’re just getting an advance on the money you’re already owed.

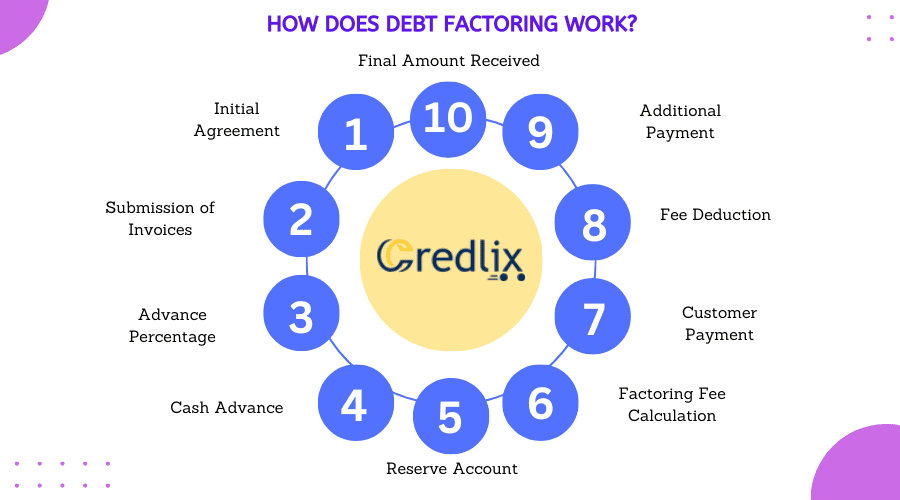

How Does Debt Factoring Work?

These steps explain how debt factoring works, providing businesses with immediate cash flow while allowing the factoring company to earn revenue through fees.

Initial Agreement: You, as a business owner, enter into an agreement with a factoring company. This agreement outlines the terms of the arrangement, including the percentage of the invoice value you’ll receive upfront and the factoring fee structure.

Submission of Invoices: You submit your outstanding invoices to the factoring company. These are the invoices that your customers owe you for goods or services provided on credit.

Advance Percentage: The factoring company reviews your invoices and decides the advance percentage, usually around 80% to 90% of the total invoice value. In our example, let’s say they advance 90% of a $100,000 invoice.

Cash Advance: You receive the cash advance from the factoring company, which is typically wired directly to your business bank account. In this case, you would receive $90,000.

Reserve Account: The factoring company sets aside the remaining percentage, in this example, 10% ($10,000), in a reserve account. This amount serves as a buffer against any unpaid invoices or disputes with customers.

Factoring Fee Calculation: The factoring company calculates the factoring fee, which is typically a percentage of the total invoice amount. Let’s assume a fee of 1% per week until the customer pays.

Customer Payment: Your customer pays the invoice amount directly to the factoring company. The factoring company then deposits the payment into a designated account.

Fee Deduction: For each week it takes your customer to pay, the factoring company deducts the factoring fee from the reserve account. In this case, after four weeks, the fee would amount to $4,000 ($1,000 per week x 4 weeks).

Additional Payment: After deducting the fees, the factoring company releases the remaining amount in the reserve account to you. In our example, this would be $6,000 ($10,000 – $4,000).

Final Amount Received: In total, you receive $96,000 ($90,000 upfront + $6,000 from the reserve account) of the original $100,000 invoice value. The factoring company earns $4,000 in fees. The effective APR, considering the fees and the duration until payment, is calculated to be 57.23%.

Example of Debt Factoring

Imagine you’re running a lemonade stand, and you have regular customers who come by and buy lemonade on credit. This means they can take the lemonade now and pay you later.

However, you need money to buy more lemons and cups to keep your stand running smoothly. But you don’t have enough cash on hand because your customers haven’t paid you yet.

So, you decide to reach out to a friend, let’s call them the Lemonade Bank, who offers to buy your unpaid invoices (the IOUs from your customers) at a discount. This means your friend will give you some cash right away, maybe 80% of the total amount owed by your customers.

Now, with that cash, you can buy more lemons and cups to keep your stand going. Meanwhile, your friend, the Lemonade Bank, will collect the full payment from your customers when it’s due.

Once your customers pay the Lemonade Bank the full amount, your friend will take a small fee for their service, say 20% of the total invoice amount. Then, they’ll give you the remaining 20% of the money they collected from your customers.

In the end, you got the cash you needed upfront to keep your lemonade stand running smoothly, and your friend, the Lemonade Bank, made a little profit for helping you out. That’s basically how debt factoring works!

Debt Factoring Charges

When it comes to debt factoring, the charges can vary based on different factors like the size of the invoices, how reliable your customers are in paying, what industry your business is in, and how well your business is doing overall.

Typically, there are two main fees you need to know about:

Advance: This is a percentage of the total invoice amount that you get upfront when you use debt factoring. On average, it’s usually around 75% to 85% of the invoice value.

Rate: This is the cost of using debt factoring, and it’s usually calculated as a percentage of the total invoice amount. Rates typically fall between 1.5% to 4% for every 30 days that your invoice remains unpaid.

So, when you’re considering debt factoring, you’ll need to factor in these charges to understand how much it’ll cost you and whether it’s the right choice for your business.

Advantages of Debt Factoring

Understand the advantages of debt factoring:

Easy Access to Working Capital: Debt factoring provides quick access to cash, helping businesses overcome cash flow shortages caused by unpaid invoices.

Saves Time: Businesses save time by outsourcing the task of chasing late payments to debt factoring companies, allowing them to focus on core operations.

Accelerates Growth: With improved cash flow, businesses can reinvest in growth opportunities, leading to accelerated expansion and increased revenues.

Improves Cash Flow: Debt factoring improves cash flow by converting unpaid invoices into immediate funds, enabling businesses to meet their financial obligations promptly.

Risk Mitigation: Debt factoring reduces the risk of bad debts by transferring the responsibility of collecting payments to the factoring company, which may impose penalties for late payments.

Flexible Financing: Factoring arrangements are flexible and can be tailored to suit the specific needs of businesses, providing a customizable financing solution.

No Debt Incurred: Unlike loans, debt factoring does not involve borrowing money, preventing businesses from accumulating additional debt on their balance sheets.

Enhances Creditworthiness: Access to cash through debt factoring can improve a business’s creditworthiness by enabling them to meet financial obligations and invest in growth initiatives.

No Collateral Required: Debt factoring does not require businesses to put up collateral, making it accessible to companies with limited assets or those unable to secure traditional financing.

Supports MSMEs: Debt factoring is particularly beneficial for small and medium-sized enterprises (MSMEs) facing cash flow challenges due to sales made on credit, providing them with a short-term liquidity solution.

Disadvantages of Debt Factoring

Understand the disadvantages of debt factoring:

Decreased Profit Margin: The fees charged by debt factoring companies reduce the overall profit margin for businesses, impacting their bottom line.

Short-Term Debt: Debt factoring immediately puts businesses in debt, which may become problematic if customers dispute invoices or make late payments.

Impact on Customer Service: Businesses may lose control over the payment collection process, potentially impacting customer relationships and satisfaction.

Risk of Recourse: In some cases, businesses may be liable to repurchase invoices from the factoring company if customers fail to pay, adding to their financial burden.

Higher Cost of Financing: The cost of debt factoring, including fees and interest rates, can be higher compared to traditional financing options like bank loans.

Loss of Confidentiality: Factoring arrangements may require businesses to disclose sensitive financial information to the factoring company, compromising confidentiality.

Limited Usefulness for High-Risk Customers: Debt factoring may not be suitable for businesses with high-risk customers or industries prone to frequent payment disputes.

Potential for Overreliance: Depending too heavily on debt factoring as a source of financing can create dependency and limit alternative funding options.

Complexity of Contracts: Factoring agreements can be complex, with terms and conditions that may not always be favorable to businesses.

Not Suitable for Long-Term Financing: Debt factoring is primarily a short-term solution for immediate cash flow needs and may not be suitable for long-term financing requirements.

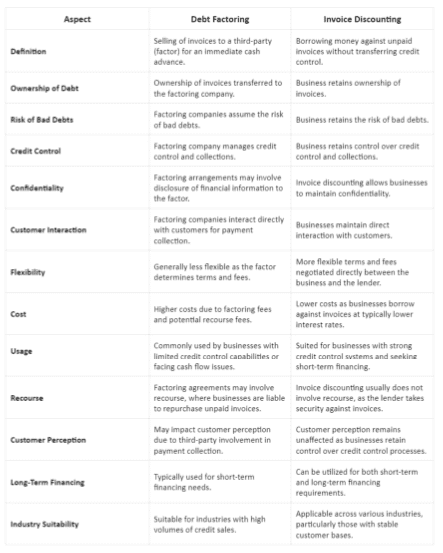

Debt Factoring Vs. Invoice Discounting

This table below provides an elaborate comparison between debt factoring and invoice discounting, covering various aspects such as ownership of debt, risk of bad debts, credit control, confidentiality, customer interaction, flexibility, cost, usage, recourse, customer perception, long-term financing suitability, and industry applicability.

Should You Opt For Debt Factoring?

Debt factoring can be a valuable tool for small and medium-sized businesses seeking to improve their working capital cycle in the short term. If your business is facing temporary cash flow challenges and aiming to accelerate growth, debt factoring could be a suitable solution.

However, it’s essential to weigh the pros and cons carefully before deciding to engage with a debt factoring company. Understanding the terms and offerings of different factoring companies is crucial to ensure that debt factoring aligns with your business needs and goals.[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]