[vc_row][vc_column][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column width=”2/3″ el_class=”post-details-sec”][vc_single_image image=”11899″][vc_column_text]Did you know that when goods cross the borders of India, they enter a realm of taxes known as customs duty? This levy, imposed by the government, plays a crucial role in regulating international trade. From gadgets to garments, almost everything arriving or departing the country is subject to specific customs duties. In India, the customs duty system is multifaceted, comprising various types of duties that cater to different aspects of trade.

This diverse range includes Basic Customs Duty, Countervailing Duty, Special Additional Duty, and more. Understanding these categories is essential for businesses and consumers alike, as they directly impact the cost of imported goods and influence the dynamics of cross-border commerce.

Explore the complete list of different customs duties in India to unravel the intricacies of this vital component of international trade regulation.

What is Custom Duty?

Custom duty is like a tax that the government puts on things coming in or going out of a country. When things come into a country, it’s called import duty, and when they go out, it’s called export duty. In India, the Central Government, specifically the Central Board of Excise and Customs, puts this tax on almost everything that comes into the country, except for some important stuff like life-saving drugs, fertilizers, and food grains. There are also some special plans that help companies by not making them pay this tax when they export things, so they can do better in the global market.

Overview of GST Reforms In India

Here are some of the major GST reforms in India you should be aware of:

- Since 2017, the Goods and Services Tax (GST) has replaced customs duty under the new regime in India.

- According to Article 269A of the Constitution of India, Integrated Goods and Services Tax (IGST) now replaces customs duty.

- The IGST on the import of goods and services is governed by the IGST Act, 2017.

- For services imported into India, the importer is required to pay the tax on a reverse charge basis.

- Import of goods, on the other hand, is subject to IGST under the Customs Act, 1962, and the Custom Tariff Act, 1975.

- The Customs Act, 1962, along with the Custom Tariff Act, 1975, outlines the legal framework for levying IGST on imported goods.

- This shift in the taxation structure aligns with the broader changes introduced by the GST regime, simplifying and streamlining the taxation process for imports in India.

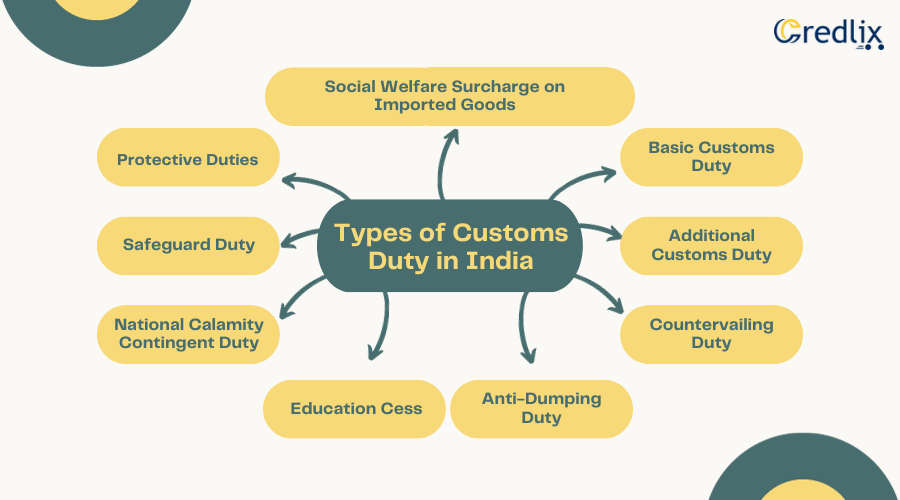

Types of Customs Duty in India

Before the GST system, customs duties had different parts like basic customs duty, extra customs duty, true countervailing duty, protective duty, education cess, and anti-dumping or safeguard duty. Some of these have now become part of the IGST system.

Now, with the new IGST system in place, the customs duty has changed. It includes things like basic customs duty, extra customs duty, and others. This shift has simplified how taxes work for goods coming in or going out of the country.

1. Basic Customs Duty

Definition: Basic Customs Duty (BCD) is the main tax applied to goods imported into India.

Abbreviation: BCD stands for Basic Customs Duty.

Primary Tax: It is the primary tax imposed on imported goods, influencing their overall cost upon entering India.

Legal Basis: The rates for BCD are specified in the Indian Customs Tariff Act.

Rate Variability: BCD rates vary based on the type of imported item, ranging from 5% to 40%.

Commodity Classification: The classification of the imported commodity determines the applicable BCD rate.

Significant Impact: BCD can have a substantial impact on the total landed cost of imported items.

Government Regulation: The Indian government uses BCD as a tool to regulate and control imports.

Revenue Source: BCD contributes to the government’s revenue collection from international trade.

Importance: Understanding BCD is crucial for businesses and consumers, as it directly affects the pricing and competitiveness of imported goods in the Indian market.

2. Additional Customs Duty or Special CVD

Alternate Name: Additional Customs Duty is also known as Special Countervailing Duty (CVD).

Alignment with Excise Duty: This duty is closely linked to Central Excise Duty, a tax applicable to goods produced within India.

Balancing Act: Additional Customs Duty acts as a balance by preventing imported goods from having an unfair advantage over those manufactured domestically.

Domestic Production: It ensures that goods produced within India are not disadvantaged in comparison to imported items.

Harmonization with Excise Duty: The structure of Additional Customs Duty aligns with the principles of Central Excise Duty.

Imported Goods Taxation: It specifically targets imported goods, regulating their pricing and market competitiveness.

Leveling the Playing Field: The primary goal is to create a level playing field for both domestically produced and imported goods.

Government Strategy: The imposition of Additional Customs Duty reflects the government’s strategy to support and protect domestic industries.

Complementary to Excise Duty: It complements the taxation approach of Central Excise Duty in maintaining fairness in the market.

Industry Impact: Understanding Additional Customs Duty is essential for businesses as it directly impacts the cost dynamics between locally produced and imported goods in the Indian market.

3. Countervailing Duty (CVD)

Distinct from Special CVD: Countervailing Duty (CVD) is different from Special CVD, serving a unique purpose.

Objective: CVD aims to neutralize subsidies offered by foreign governments on their exported goods.

Safeguard Measure: It acts as a safeguard against potential harm to domestic industries caused by subsidized foreign goods.

Counteracting Subsidies: The duty is designed to counterbalance the advantage gained by foreign exporters through government subsidies.

Protecting Domestic Industries: CVD is a protective measure to prevent unfair competition and damage to local industries.

System Gaming Prevention: It ensures that foreign countries cannot manipulate the international trade system by subsidizing their exports.

Strategic Safeguard: CVD plays a strategic role in maintaining a level playing field for both domestic and foreign producers.

Government Response: It reflects a proactive response by the importing country’s government to unfair trade practices.

Economic Impact: CVD directly influences the economic dynamics between imported and locally produced goods.

Fair Trade: Understanding Countervailing Duty is crucial for fostering fair trade practices and protecting the interests of domestic industries.

4. Anti-Dumping Duty

Purpose: Anti-Dumping Duty is imposed on foreign goods sold in India below their regular price in their home country.

Objective: The primary goal is to protect domestic industries from unfair competition and potential harm.

Pricing Concern: It addresses situations where foreign goods are priced lower than their standard value, preventing market distortion.

Protection Mechanism: Anti-Dumping Duty acts as a safeguard, shielding local industries from the adverse effects of unfair trade practices.

Foreign Pricing Practices: It targets instances where a foreign country engages in “dumping,” selling products at unusually low prices in the Indian market.

Leveling the Field: The duty is applied to restore fairness by preventing foreign products from gaining an unfair advantage due to low pricing.

Government Response: It signifies a proactive response by the Indian Government to maintain fair competition in the marketplace.

Market Distortion Prevention: Anti-Dumping Duty is a tool to prevent distortion in the market caused by unusually low-priced imports.

Trade Balance: It contributes to maintaining a balanced trade environment by discouraging predatory pricing.

Legal Framework: The imposition of Anti-Dumping Duty is guided by a legal framework that ensures a systematic approach to address pricing imbalances in international trade.

5. Education Cess

Fundamental Purpose: Education Cess is an extra fee added to customs duties, aiming to support educational programs in India.

Financial Support: It serves as a financial contribution towards the development of education in the country.

National Recognition: India, as a developing nation, acknowledges the significance of education in its growth and progress.

Rate Standardization: The usual rate of Education Cess is around 2% applied on the total customs duties.

Earmarked Funding: The funds collected through Education Cess are specifically designated for educational initiatives and improvements.

Social Investment: It represents a societal investment strategy, emphasizing the importance of education for national development.

Government Commitment: The imposition of Education Cess underscores the government’s commitment to enhancing educational opportunities.

Financial Allocation: The revenue generated from Education Cess contributes to the allocation of resources for educational infrastructure and programs.

Budgetary Consideration: The inclusion of Education Cess aligns with broader budgetary considerations for social development.

National Development: Understanding Education Cess is crucial for recognizing its role in fostering educational growth and contributing to the overall development of the nation.

6. National Calamity Contingent Duty

Emergency Preparedness Levy: National Calamity Contingent Duty (NCCD) is a duty imposed to create reserves for rapid deployment during national disasters or calamities.

Resource Building: The primary purpose of NCCD is to build up financial resources swiftly mobilizable during large-scale emergencies.

Percentage Basis: NCCD is typically calculated as a percentage of the value of imported goods.

Government Mandate: The government sets the rate of NCCD, and it can vary based on the type of commodity and the urgent social or environmental needs.

Emergency Response Fund: Funds collected through NCCD contribute to the creation of an emergency response fund for quick and effective disaster management.

Customs Duty Component: It forms an additional component of customs duty, emphasizing a proactive approach to national disaster preparedness.

Varied Rates: The rates of NCCD can differ, reflecting the government’s dynamic response to evolving social and environmental requirements.

Humanitarian Focus: NCCD highlights a humanitarian aspect by ensuring resources are readily available to aid affected communities during crises.

Legal Framework: The imposition of NCCD operates within a legal framework, guiding its application and utilization.

National Resilience: Understanding NCCD is essential for recognizing its role in enhancing the nation’s resilience to unforeseen disasters and calamities.

7. Safeguard Duty

Defensive Measure: Safeguard Duty, authorized by Section 8B of the Customs Tariff Act, acts as a defense shield for domestic industries.

Rapid Import Surge: It comes into play when there is a sudden and unforeseen surge in imports, helping protect local businesses.

Legal Foundation: The imposition of Safeguard Duty is based on the legal provisions outlined in the Customs Tariff Act.

Protection Period: The duty provides a protective period for the domestic industry to adapt and withstand unexpected pressures from foreign markets.

Adjustment Time: Its primary role is to give domestic businesses the time needed to adjust to the challenges posed by a sudden increase in imports.

Market Pressures: Safeguard Duty serves as a bulwark against external market forces that could potentially harm local industries.

Balancing Act: It ensures a balance between international trade interests and the protection of the domestic economy.

Regulatory Safeguard: Imposing Safeguard Duty is a regulatory response to maintain fair competition and economic stability.

Industry Resilience: The duty aims to enhance the resilience of domestic industries by providing a buffer against unforeseen market disruptions.

Adaptation Support: Understanding Safeguard Duty is crucial for businesses and policymakers to navigate challenges posed by sudden shifts in the import landscape and safeguard the interests of the domestic economy.

8. Protective Duties

Industry Safeguard: Protective Duties, as implied by the name, are designed to safeguard native or emerging industries from foreign competition.

Preservation Focus: Their primary purpose is to preserve and shield industries within the country from the impact of international competition.

Government Prescription: These duties are typically determined by the Indian Government, taking into account detailed examinations of market dynamics, competition, and potential effects on local industries.

Thorough Investigation: The imposition of Protective Duties involves a comprehensive investigation into various factors, ensuring a well-informed decision.

Strategic Decision: It reflects a strategic decision to support and nurture domestic industries, especially those in their early stages of development.

Market Dynamics: The duties consider the intricacies of market dynamics, aiming to maintain a balance between international trade and the protection of domestic economic interests.

Competitive Landscape: Understanding the competitive landscape is crucial in prescribing Protective Duties, ensuring fair competition while shielding vulnerable industries.

Industry Development: These duties contribute to the overall development of industries within the country by offering them a protective environment.

Adaptable Nature: Protective Duties can be adjusted based on the evolving economic scenario, providing flexibility to address changing industry needs.

Economic Balance: Recognizing the role of Protective Duties is essential for achieving a balanced economic ecosystem, fostering the growth and sustainability of indigenous industries.

9. Social Welfare Surcharge on Imported Goods

Consolidated Surcharge: Social Welfare Surcharge is a consolidated surcharge applied on the overall customs duties, taking the place of previous levies like Education Cess and Secondary and Higher Education Cess.

Revenue Generation: The primary objective is to generate revenue for the government’s social welfare programs, spanning healthcare, education, and poverty alleviation.

Substitution of Earlier Cesses: It replaces the earlier Education Cess and Secondary and Higher Education Cess, streamlining the surcharge structure for simplicity.

Government Initiatives: Funds collected through this surcharge directly contribute to supporting various government initiatives aimed at enhancing social welfare.

Comprehensive Approach: The duty takes a comprehensive approach, addressing multiple sectors crucial for societal development.

Public Services Funding: Revenue raised from Social Welfare Surcharge plays a vital role in funding public services that benefit the broader community.

Holistic Welfare Focus: The surcharge aligns with a holistic welfare focus, targeting diverse aspects of societal well-being.

Customs Duty Component: It forms an integral part of customs duties, emphasizing a commitment to social development through international trade.

Simplified Structure: The introduction of Social Welfare Surcharge simplifies the earlier complex structure, making it more transparent and streamlined.

Community Impact: Understanding the significance of this surcharge is crucial for recognizing its role in positively impacting communities through the support of essential social welfare programs.

Customs Duty Calculation Example

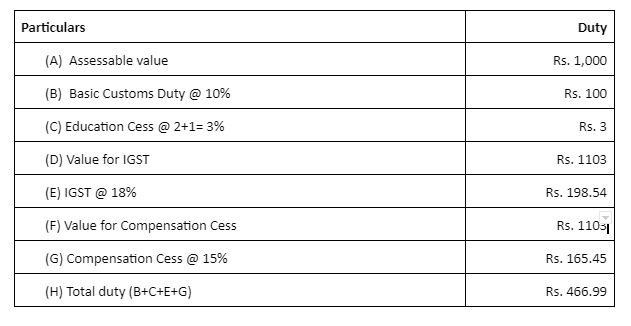

Let’s break down the customs duty calculation with a simple example. Imagine you’re importing goods valued at Rs. 1000. We’ll consider Basic Customs Duty (BCD) at 10% and Integrated Goods and Services Tax (IGST) at 18%.

Basic Customs Duty (BCD)

- BCD is a percentage of the assessable invoice value, which is Rs. 1000 in this case.

- 10% of Rs. 1000 (BCD rate) = Rs. 100

- So, Basic Customs Duty is Rs. 100.

Integrated Goods and Services Tax (IGST)

- IGST is applied to the total of the assessable invoice value and Basic Customs Duty.

- Total = Rs. 1000 (invoice value) + Rs. 100 (BCD) = Rs. 1100

- 18% of Rs. 1100 (Total) = Rs. 198

- So, IGST is Rs. 198.

Total Customs Duties and Taxes

- BCD + IGST = Rs. 100 (BCD) + Rs. 198 (IGST) = Rs. 298.

Therefore, in this example, the most likely applicable customs duty for the imported goods worth Rs. 1000 would be Rs. 298, considering 10% Basic Customs Duty and 18% Integrated Goods and Services Tax.

Final Words

Starting an import-export business? To outshine competitors, it’s crucial to smartly manage the costs of bringing goods in. Knowing the ins and outs of customs duties is your secret weapon—it can give you an advantage and save you a lot of money in the long haul.

By understanding these duties, you’ll be better equipped to optimize your expenses and make strategic decisions. So, if you’re diving into the world of international trade, mastering customs duties is your key to financial efficiency and staying one step ahead.

Also Read : What is Bill of Lading in Shipping and Exports?[/vc_column_text][/vc_column][vc_column width=”1/3″ el_class=”post-col”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_class=”post-col”][/vc_column][/vc_row]