- June 27, 2024

- Posted by: admin

- Categories: Purchase order financing, Blog

According to the World Trade Organization, over 80% of global trade relies on some form of trade finance, including letters of credit. Letters of credit are important tools that help make international trade safer for both buyers and sellers. They act like a financial guarantee from a bank, promising that the seller will get paid for their goods or services as long as certain conditions are met.

There are two main types of letters of credit: revocable and irrevocable. Understanding the difference between them is important for businesses that want to trade internationally. Each type offers different levels of security and flexibility, and choosing the right one can help make international business transactions smoother and more secure.

What is a Letter of Credit?

A Letter of Credit (LC) is a financial document issued by a bank or financial institution that ensures a seller will be paid as long as they fulfill certain terms and conditions. The issuing bank guarantees payment to the seller, providing security if the buyer fails to pay or meet the contract terms. Letters of credit are crucial in international trade, as they offer protection for both buyers and sellers.

Revocable Letter of Credit

A revocable letter of credit is a type of LC that can be changed or canceled by the issuing bank at any time without prior notice to the seller (beneficiary). Here are some key points about revocable letters of credit:

Flexibility: The issuing bank or the buyer can amend or cancel the LC without consulting the seller. This offers flexibility to the buyer but poses a risk to the seller.

Risk: The seller faces higher risk because the payment guarantee can be withdrawn or altered unexpectedly.

Usage: Revocable LCs are rarely used in international trade due to the uncertainty they create for the seller.

Security: There is limited security for the seller, making it less attractive for exporters who want assurance of payment.

Cost: Generally less costly than irrevocable LCs due to lower security features.

Irrevocable Letter of Credit

An irrevocable letter of credit cannot be changed or canceled without the agreement of all parties involved (buyer, seller, and issuing bank). Here are the main features of irrevocable letters of credit:

Stability: Provides a stable payment guarantee to the seller, as changes require consent from all parties.

Security: Offers more security to the seller, as the bank’s commitment to pay is firm unless all parties agree to any changes.

Popularity: Widely used in international trade because of the assurance it provides to the seller regarding payment.

Conditions: Any amendments or cancellations must be mutually agreed upon, ensuring that the seller’s interests are protected.

Cost: Typically more expensive than revocable LCs due to higher security and assurance levels.

Also Read: The Intricacies of Back-to-Back Letters of Credit: A Comprehensive Overview

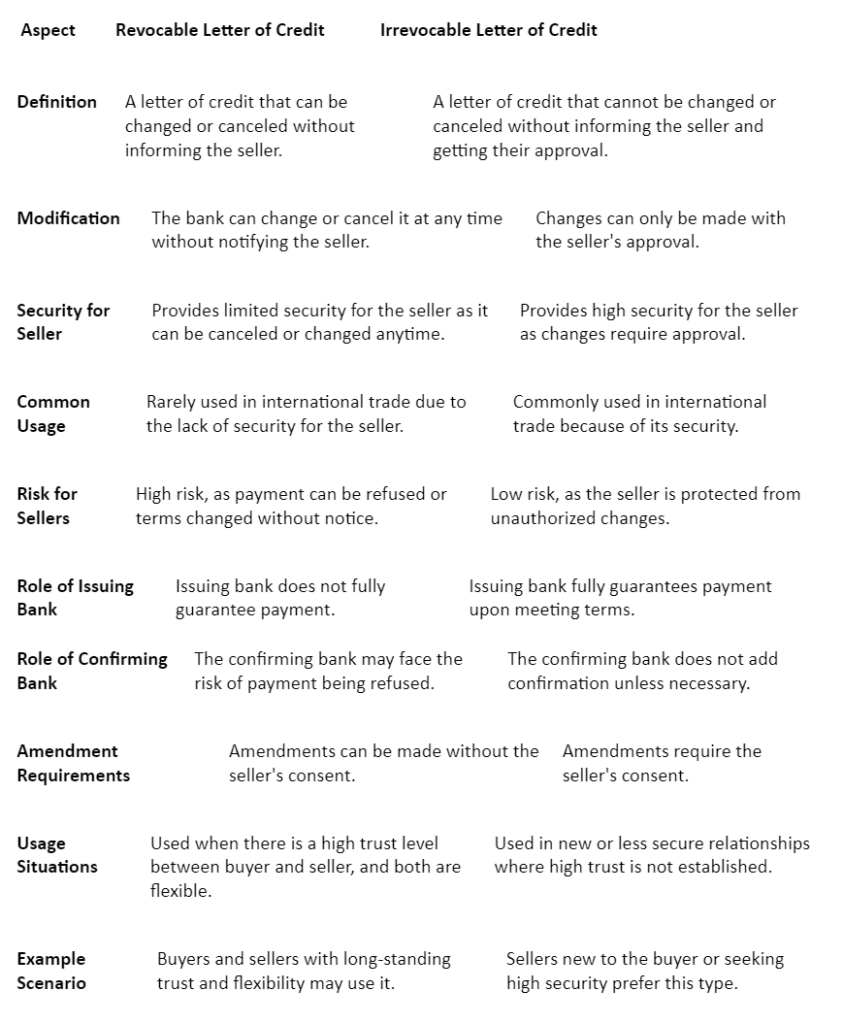

D/B Revocable And Irrevocable Letter Of Credit

There are two main types of letters of credit: Revocable and Irrevocable. Let’s look at the differences between them in a simple and informative table:

Also Read: LC at Sight: Meaning & Complete Process

Conclusion

Revocable and irrevocable letters of credit play important roles in international trade. Revocable LCs offer flexibility but come with high risk due to potential changes without notice. Irrevocable LCs provide greater security by ensuring any changes must be agreed upon by the seller, making them a preferred choice for most international transactions. Understanding the differences helps businesses choose the right type to ensure safe and smooth transactions.

Also Read: Diverse Types of Export Letters of Credit