[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12555″ img_size=”full” css=”.vc_custom_1712299290893{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Working capital loans are important financial tools for businesses to manage their day-to-day operations effectively. These loans provide the necessary funds to cover short-term expenses like payroll, inventory purchases, and utility bills. Understanding the types of working capital loans available is crucial for businesses seeking financial assistance.

In the world of working capital financing, various options cater to different business needs and circumstances. From secured loans backed by collateral to unsecured loans relying on creditworthiness, each type offers distinct advantages and considerations. Secured loans require assets like property or investments as security, offering lower interest rates but requiring a more extensive application process. On the other hand, unsecured loans do not necessitate collateral, providing faster access to funds but potentially at higher interest rates. Additionally, specialized forms like invoice factoring and letter of credit provide tailored solutions for specific financial challenges.

By exploring the types of working capital loans and their unique characteristics, businesses can make informed decisions to address their short-term financial requirements effectively.

What is a Working Capital Loan?

A working capital loan is a type of financing specifically designed to help businesses cover their day-to-day operational expenses. Unlike traditional loans that may be used for long-term investments or asset purchases, working capital loans are intended to address short-term needs like paying employees, purchasing inventory, covering utility bills, and meeting other immediate obligations.

These loans are essential for businesses to maintain smooth operations, especially during periods of fluctuating cash flow or unexpected expenses. Working capital loans typically have shorter repayment terms and may be secured or unsecured, depending on the lender and the borrower’s financial situation.

Businesses often seek working capital loans to bridge gaps in cash flow caused by seasonal fluctuations, rapid growth, or unforeseen circumstances. By providing access to quick funding, these loans help businesses seize opportunities for growth, manage emergencies, and sustain day-to-day operations without disrupting their business activities.

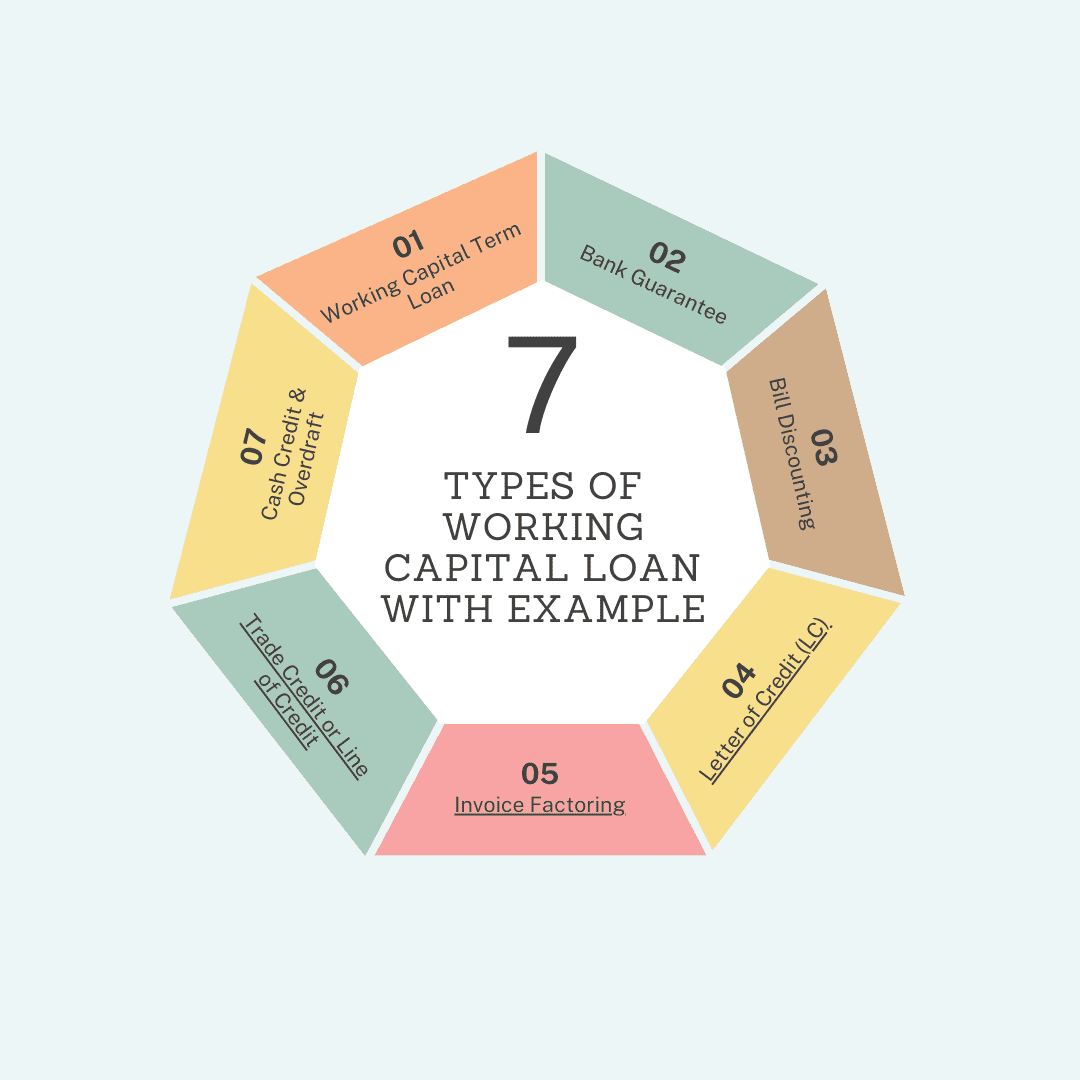

Types of Working Capital Loan With Example

Below we have mentioned the different types of working capital loan that are available in India for businesses:

- Working Capital Term Loan

- Bank Guarantee

- Bill Discounting

- Letter of Credit or LC

- Invoice factoring

- Trade Credit or Line of Credit

- Cash Credit & Overdraft

Working Capital Term Loan

This loan provides a fixed amount of money to cover a company’s short-term operational needs. It’s repaid over a set period with regular installments, helping businesses manage their cash flow by providing a predictable repayment schedule.

Example: Imagine a bakery that wants to expand its operations by purchasing new equipment and hiring additional staff to meet increasing demand for its specialty cakes. The bakery applies for a working capital term loan from a bank. With the loan, they buy the equipment and hire the necessary staff. Over the next few years, they repay the loan in monthly installments using a portion of their revenue. This helps the bakery manage its cash flow while investing in growth.

Pros:

- Provides a fixed amount of money for short-term operational needs.

- Helps in managing cash flow with predictable repayment schedule.

- Enables businesses to invest in growth initiatives.

- Offers flexibility in allocating funds for various expenses.

- Allows for the purchase of equipment and hiring staff to meet demand.

- Repayment in regular installments eases financial planning.

- Can improve creditworthiness with timely repayment.

Cons:

- Requires repayment over a set period, potentially limiting flexibility.

- Interest payments add to overall cost of borrowing.

- May require collateral or security for approval.

- Longer-term commitment compared to other financing options.

- Monthly installments could strain cash flow in lean months.

- Eligibility criteria and application process may be stringent.

- Failure to repay could harm credit rating and business reputation.

Bank Guarantee

This is a promise from a bank to cover a specific amount of debt if a borrower defaults. It’s often used in transactions where the borrower needs to assure the other party of their ability to fulfill a contract or payment obligation.

Example: A construction company secures a bank guarantee to bid for a large government infrastructure project. The guarantee assures the government that the construction company has the financial backing to complete the project as per the contract terms. This enables the company to win the bid and commence work, boosting its reputation and opening doors to more lucrative contracts.

Pros:

- Provides assurance to the other party regarding financial capability.

- Enhances credibility and trust in business transactions.

- Enables access to contracts and projects that require financial backing.

- Helps businesses secure bids and opportunities in competitive markets.

- Facilitates international trade by mitigating risk for buyers and sellers.

- Offers flexibility in terms of contract fulfillment and payment obligations.

- Can lead to increased business opportunities and revenue growth.

Cons:

- Requires payment of fees or collateral to obtain the guarantee.

- Limits liquidity as banks set aside funds to cover potential defaults.

- Defaulting on obligations could damage relationships with the bank.

- Strict terms and conditions may restrict flexibility in contracts.

- Non-performance or default may lead to legal consequences.

- Processing time for obtaining bank guarantees can be lengthy.

- Possibility of disputes or delays in claim settlements with the bank.

Bill Discounting

Also known as invoice discounting, this involves a business selling its accounts receivable (unpaid invoices) to a financial institution at a discount. It provides immediate cash flow by converting outstanding invoices into cash.

Example: A technology company has several outstanding invoices from its clients that won’t be paid for another 90 days. In need of immediate cash to cover operational expenses and invest in product development, the company opts for bill discounting. They sell their unpaid invoices to a financial institution at a slight discount, receiving the much-needed cash upfront to fuel their growth plans.

Pros:

- Provides immediate cash flow to cover operational expenses.

- Allows businesses to access funds without taking on additional debt.

- Improves liquidity by converting accounts receivable into cash.

- Helps businesses maintain steady cash flow during periods of slow payment.

- Offers flexibility in managing working capital and funding growth initiatives.

- Can be used to negotiate better terms with suppliers or take advantage of early payment discounts.

- Does not require collateral, making it accessible to businesses with limited assets.

Cons:

- Involves discounting invoices, resulting in a reduction of overall revenue.

- May be more expensive compared to traditional loans due to discounting fees.

- Could impact customer relationships if they are aware of the invoice discounting arrangement.

- Limited to the value of outstanding invoices, which may not fully meet financial needs.

- Requires careful management of cash flow to ensure future obligations can be met.

- Dependence on financial institutions for funding may result in reliance on external sources.

- Potential for administrative complexities and processing fees associated with invoice discounting.

LC is a guarantee from a bank that a seller will receive payment as long as they meet the terms and conditions outlined in the letter. It’s commonly used in international trade to ensure smooth transactions between buyers and sellers across borders.

Example: An Indian textile exporter secures a letter of credit from their bank to facilitate a trade deal with a buyer in the United States. The LC assures the buyer that once the goods are shipped and the required documentation is provided, payment will be made. This gives confidence to both parties, facilitating smooth international trade without concerns about payment risks.

Pros:

- Provides assurance of payment to the seller upon meeting specified conditions.

- Reduces payment risk for both buyers and sellers in international transactions.

- Facilitates smoother and more secure cross-border trade transactions.

- Helps build trust between parties involved in the trade deal.

- Allows for greater flexibility in negotiating trade terms and conditions.

- Enhances credibility of the seller in the eyes of the buyer.

- Enables businesses to expand their international market reach with confidence.

Cons:

- Involves fees and charges associated with establishing and managing the LC..

- Requires adherence to strict terms and conditions outlined in the letter..

- Potential delays in processing and verification of documentation..

- Complexity in navigating international trade regulations and banking procedures..

- Risk of discrepancies or disputes arising over compliance with LC terms..

- Limits flexibility in payment methods compared to other financing options..

- Dependency on the issuing bank’s reliability and creditworthiness.

Similar to bill discounting, invoice factoring involves selling unpaid invoices to a third party (a factor) at a discount. The factor then takes over the responsibility of collecting payment from customers, providing immediate cash to the business.

Example: A manufacturing company facing a cash crunch due to delayed payments from its customers decides to opt for invoice factoring. They sell their unpaid invoices to a factoring company, which advances them a significant portion of the invoice value immediately. This infusion of cash allows the manufacturer to pay its suppliers, cover operating costs, and continue production without disruptions.

Pros:

- Provides immediate cash flow by converting unpaid invoices into cash.

- Helps businesses maintain steady cash flow during periods of delayed payments.

- Allows for improved liquidity without taking on additional debt.

- Outsources the responsibility of collecting payments, reducing administrative burden.

- Offers flexibility in managing working capital and funding operational expenses.

- Can be used to negotiate better terms with suppliers or take advantage of early payment discounts.

- Provides access to cash without requiring collateral, making it accessible to businesses with limited assets.

Cons:

- Involves discounting invoices, resulting in a reduction of overall revenue.

- May be more expensive compared to traditional loans due to factoring fees.

- Could impact customer relationships if they are aware of the invoice factoring arrangement.

- Limited to the value of outstanding invoices, which may not fully meet financial needs.

- Dependence on factoring companies for funding may result in reliance on external sources.

- Potential for administrative complexities and processing fees associated with invoice factoring.

- Requires careful consideration of contract terms and conditions to ensure favorable terms.

Trade Credit or Line of Credit

This is an agreement between a supplier and a buyer allowing the buyer to purchase goods or services on credit terms. It helps businesses manage their cash flow by delaying payment until a later date.

Example: A retail store regularly purchases inventory from a wholesaler on credit terms. The wholesaler allows the store to defer payment for 30 days, giving them time to sell the merchandise before needing to pay. This trade credit arrangement enables the retail store to manage its cash flow effectively and stock up on inventory to meet customer demand.

Pros:

- Provides flexibility for businesses to purchase goods or services without immediate cash outlay.

- Helps manage cash flow by allowing payment to be deferred until a later date.

- Enables businesses to stock up on inventory and meet customer demand.

- May offer favorable terms such as discounts for early payment.

- Builds trust and strengthens relationships between buyers and suppliers.

- Allows businesses to negotiate better pricing or terms based on their purchasing volume.

- Supports business growth by providing access to essential goods and services without upfront payment.

Cons:

- May lead to increased reliance on credit, potentially impacting financial stability.

- Could result in higher overall costs due to interest or fees associated with extended credit.

- Risk of late payments impacting supplier relationships or incurring penalties.

- Limits available funds for other business expenses during the credit period.

- Requires careful monitoring of payment schedules to avoid missed deadlines.

- Dependency on supplier’s willingness to offer credit terms.

- Potential strain on cash flow if payment deadlines coincide with other financial obligations.

Cash Credit & Overdraft

Cash credit and overdraft facilities provide businesses with a revolving line of credit that they can draw upon as needed. Cash credit allows the borrower to withdraw funds up to a specified limit, while overdraft allows them to withdraw more than the available balance in their account, up to an agreed-upon limit. These facilities provide flexibility in managing day-to-day expenses and unexpected cash needs.

Example: A small business experiences a temporary cash shortfall due to unexpected expenses. Instead of struggling to meet payroll or delay payments to suppliers, they utilize their cash credit facility with the bank. This allows them to withdraw additional funds beyond their account balance, providing the necessary liquidity to tide over the challenging period until their cash flow improves.

Pros:

- Offers flexibility in accessing funds for day-to-day expenses and emergencies.

- Provides immediate liquidity without the need for collateral.

- Helps businesses manage cash flow fluctuations effectively.

- Allows for quick access to funds without lengthy approval processes.

- Facilitates timely payment of bills and suppliers, maintaining relationships.

- Offers convenience by integrating credit facility with existing bank account.

- Helps bridge temporary cash shortfalls and maintain business operations smoothly.

Cons:

- May incur higher interest rates compared to other financing options.

- Risk of overspending or dependency on credit, leading to financial strain.

- Requires responsible management to avoid accumulating excessive debt.

- Overdrafts may incur additional fees or charges for exceeding account balance.

- Dependence on bank’s discretion to approve or adjust credit limits.

- Potential impact on credit score if overdraft is utilized frequently.

- Failure to repay on time may lead to adverse consequences such as penalties or account closure.

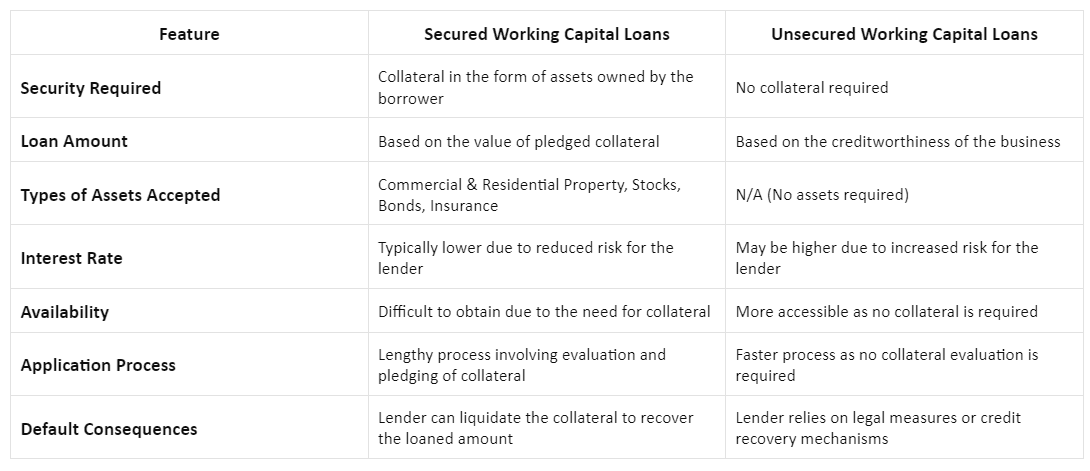

Comparison of Secured and Unsecured Working Capital Loans

When considering working capital loans, it’s essential to understand the differences between secured and unsecured options. This table comparison highlights key aspects to help businesses make informed decisions about their financing needs:

Understanding the various types of working capital loans and their unique characteristics is essential for businesses to effectively manage their financial needs. From secured loans backed by collateral to unsecured loans based on creditworthiness, each option offers distinct advantages and considerations. Additionally, specialized forms such as invoice factoring and letter of credit provide tailored solutions for specific challenges. By exploring these options and considering factors like interest rates, availability, and application processes, businesses can make informed decisions to address their short-term financial requirements efficiently and sustainably.[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]