- January 7, 2025

- Posted by: admin

- Categories: Channel Financing, Blog

If you are planning to start a new business, one of the initial steps is to establish a legitimate business entity recognized by law. The type of business entity you choose depends on various factors such as the size of the business, number of stakeholders, compliance costs, efforts involved, and the acceptability of the structure in targeted markets. Here’s an in-depth guide to help you navigate the process.

Guidelines for Starting a Business Entity

Appointment of Directors:

The shareholders of a company collectively decide on appointing a director. According to the Companies Act, any individual can serve as a company director, provided they meet the legal requirements.

Legal Assistance:

While hiring a lawyer, Chartered Accountant (CA), or Company Secretary (CS) is not mandatory, their assistance can simplify the process, especially for those unfamiliar with registration procedures.

Registration Requirements:

Operating a business without registration is permissible but limits access to government benefits. Registration enables obtaining licenses, tax credentials, and compliance with legal norms.

Banking Constraints:

Businesses operating with a personal savings account face restrictions on transactional payments. A current account registered under the business’s name is essential for smooth operations.

Naming the Business:

Choosing a unique and legally compliant name is critical. In India, a company’s name can typically be changed only after a minimum term of three years.

Types of Business Entities in India

India recognizes several business entity structures, including Sole Proprietorships, Partnerships, Limited Liability Partnerships (LLPs), Private Limited Companies, Public Limited Companies, Co-operative Societies, and Hindu Undivided Families (HUF). Let’s explore these entities in detail.

1. Sole Proprietorship

A Sole Proprietorship is the simplest and most straightforward form of business. It is ideal for single owners looking to establish and operate a small-scale business with minimal compliance requirements. The proprietor is solely responsible for the business’s liabilities.

Documents Required:

- PAN Card

- Aadhaar Card

- Import Export Code (IEC Code)

- Bank Account Statement

- Cancelled Cheque

- GST Registration Certificate

- Registered Office Proof

Steps to Register:

- Apply for a PAN Card in the proprietor’s name.

- Select a unique name for the business.

- Purchase a domain name if operating online.

- Open a business bank account.

- Obtain a business license from local authorities.

- Register with the state tax authority for taxable goods.

- Apply for an Employer Identification Number (EIN) if hiring employees.

- Secure appropriate insurance for business risks.

Tax Compliance:

The business becomes taxable once its income exceeds the minimum threshold defined under the applicable income tax slabs.

2. Partnership Firm

A Partnership Firm involves two or more individuals pooling resources to establish a business. Governed by the Indian Partnership Act, 1932, registering a partnership is optional but recommended for added legal benefits.

Key Features:

- Maximum of 20 partners.

- Partners are personally liable unless registered as a Limited Liability Partnership (LLP).

Documents Required:

- Partnership Deed

- PAN Card

- ID Proof of Partners (Aadhaar Card, Passport, Driving License, etc.)

- Firm Address Proof

- GST Registration Certificate

- Bank Account Details

Steps to Register:

- Draft and finalize a Partnership Deed.

- Define the profit-sharing ratio and capital contributions.

- Decide the type of partners (general, limited, salaried, etc.).

- Register the firm with the Registrar of Firms.

- Obtain necessary licenses and permits.

- Apply for an EIN if applicable.

Compliance:

- Partnership firms must adhere to GST, TDS, ESI, and PF regulations, alongside undergoing income tax assessments and audits.

3. Limited Liability Partnership (LLP)

An LLP combines the benefits of a partnership and a corporate structure. It is a popular choice due to its limited liability feature and suitability for export businesses.

Key Features:

- No limit on the number of partners.

- Compliance requirements are stricter compared to traditional partnerships.

Documents Required:

- ID Proof, Address Proof, and Residence Proof of Partners

- Passport-Size Photographs

- Registered Office Address Proof

- Digital Signature Certificate (DSC)

- PAN Card of Partners

- GST Registration Certificate

- Current Account Details

Steps to Register:

DPIN Application:

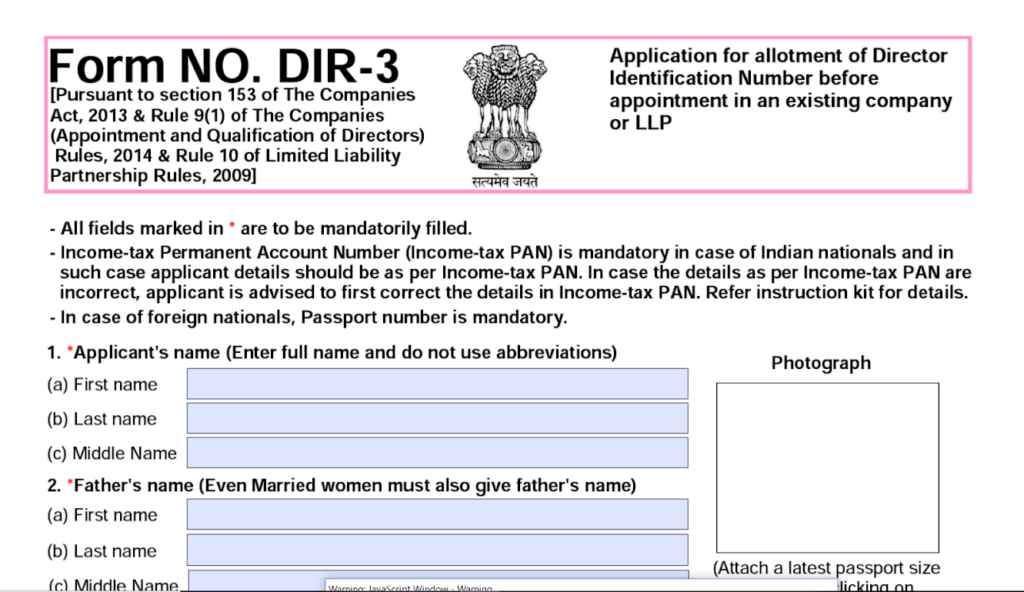

Each partner must apply for a Designated Partner Identification Number (DPIN) by submitting the e-form DIR-3 (refer to Fig. 1). If you already have a Director Identification Number (DIN), it can serve as your DPIN. First-time users must register on the portal under the appropriate user category.

Digital Signature Certificate (DSC):

All LLP filings require a Digital Signature. You can obtain a DSC from a licensed certifying authority. This is essential for secure online submissions.

MCA Portal Registration:

Once you acquire a DSC, it must be registered with the LLP application on the Ministry of Corporate Affairs (MCA) portal.

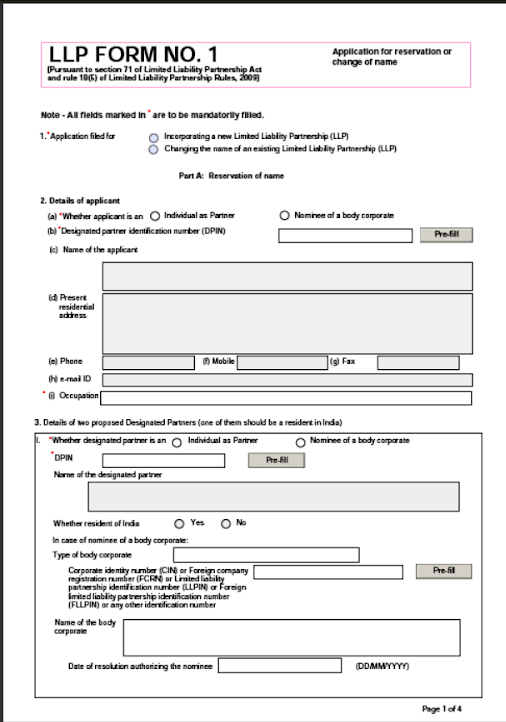

Filing Form 1 and Form 2:

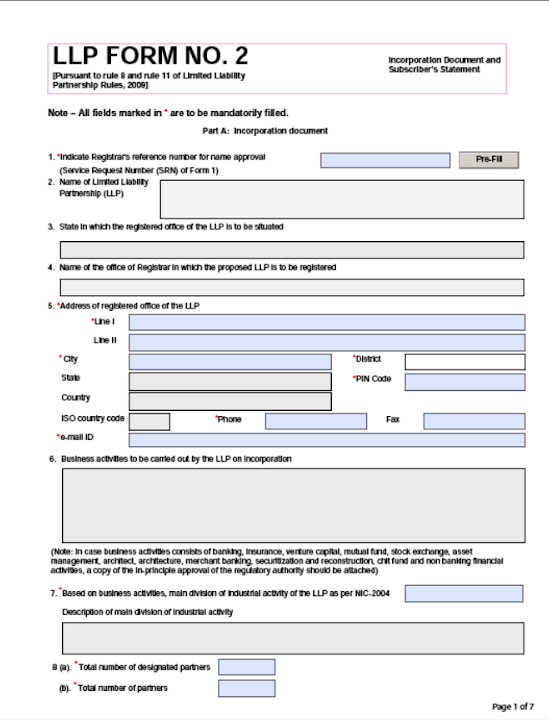

Form 2: After the name approval, submit this form to incorporate the LLP. Once approved, the form’s status on the portal will change to “Approved.”

Filing the Initial LLP Agreement:

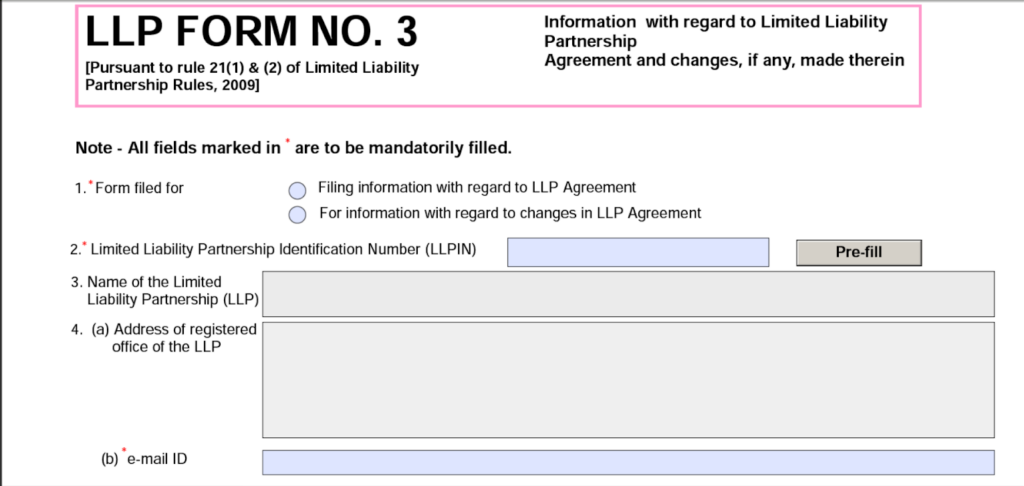

Within 30 days of incorporation, you must file the initial LLP agreement using Form 3. This step is crucial to formalize the terms of the partnership.

Additional Registrations for Export Businesses:

- IEC Code

- Registration cum Membership Certificate (RCMC)

4. Private Limited Company (Pvt Ltd)

Private Limited Companies are independent legal entities offering perpetual existence and limited liability to shareholders. They are suitable for businesses seeking funding from investors.

Key Features:

- Requires at least two directors and a maximum of 200 shareholders.

- Minimum capital requirement of Rs. 1,00,000.

- Can raise funds through equity rather than loans.

Documents Required:

- Passport-Sized Photograph

- Aadhaar Card

- PAN Card

- DIN (Director Identification Number)

- NOC (No Objection Certificate)

- Utility Bills (not older than two months)

- Office Address Proof

- MOA (Memorandum of Association) and AOA (Articles of Association)

Steps to Register:

- Obtain a Digital Signature Certificate (DSC).

- Apply for DIN for directors.

- Select a company name and check for availability.

- Draft and finalize the MOA and AOA.

- Apply for PAN and TAN.

- Submit documents and pay fees to the Registrar of Companies (ROC).

- Receive the Certificate of Incorporation.

5. Public Limited Company

A Public Limited Company allows businesses to raise funds from the public by selling shares. It is ideal for capital-intensive industries.

Key Features:

- Minimum of seven shareholders and three directors.

- Higher compliance and statutory requirements compared to Pvt Ltd Companies.

Documents Required:

- PAN Card

- Aadhaar Card

- ID Proof and Address Proof of Directors and Shareholders

- Registered Office Address

- NOC

- MOA and AOA

- DSC and DIN

Steps to Register:

- Obtain DSC and DIN for directors.

- Select a company name and submit it for approval.

- File the incorporation documents with the ROC.

- Pay the registration fees.

- Apply for the Certificate of Commencement of Business.

6. Co-operative Society

Co-operative societies are suitable for promoting collective interests in sectors such as agriculture and handicrafts. These entities enjoy tax exemptions and deductions under the Income Tax Act.

Documents Required:

- PAN Card

- Aadhaar Card

- List of Promoter Members

- Copy of Proposed Bye-Laws

- Address Proof

- Utility Bill

- MOA and AOA

Steps to Register:

- List at least 10 members.

- Select a name for the society.

- Apply to the registration authority with required documents.

- Submit bank account details.

- Receive the Certificate of Registration.

7. Hindu Undivided Family (HUF)

An HUF is ideal for businesses run by family members. Governed by Hindu Law, HUFs enjoy unique tax benefits.

Documents Required:

- PAN Card of the HUF

- Proof of Identity and Address of the Karta (head of the family)

- Bank Account Details

- Deed of Partition (if applicable)

Steps to Register:

- Create a HUF deed mentioning all members.

- Apply for a PAN card in the HUF’s name.

- Open a bank account under the HUF name.

- Comply with tax registration requirements.

Conclusion

Choosing the right business entity is a critical step in starting your entrepreneurial journey. Whether you’re a solo entrepreneur, a group of partners, or a family-run business, understanding the legal, tax, and compliance requirements of different entities can save you time and resources. By following this detailed guide, you can establish a business entity that aligns with your goals and ensures smooth operations.

Also Read: Business Loans