[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12486″ img_size=”full” css=”.vc_custom_1711692304152{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Understanding export policies and incentives can sometimes feel like solving a tricky puzzle. But amidst these schemes, the Remission of Duties and Taxes on Exported Products (RoDTEP) shines brightly as a great opportunity for exporters worldwide. Whether you’re a seasoned exporter or just starting out, knowing about RoDTEP is key to making the most of your exports.

Simply put, RoDTEP is a big deal. It’s meant to make Indian exports more competitive by refunding various taxes and duties paid during the export process. But don’t worry – RoDTEP isn’t as complicated as it sounds. It’s all about making trade easier and helping businesses grow.

In this guide, we’ll explain RoDTEP in plain language, covering its main parts, who can benefit from it, and how it can help your business. From when it started to how it affects exporters like you, we’ll make sure you understand everything you need to know. Whether you’re looking to grow your exports or improve what you’re already doing, RoDTEP could be just what you need to succeed in the global market.

So, get ready to learn about RoDTEP and how it can boost your exports like never before.

What is the RoDTEP Scheme?

The Remission of Duties or Taxes on Export Products (RoDTEP) scheme stands as a cornerstone of India’s export promotion efforts, offering significant benefits to exporters across various sectors. At its core, RoDTEP aims to alleviate the financial burden on exporters by providing reimbursements for taxes, duties, and levies incurred during the export process. This scheme represents a strategic move by the Indian government to incentivize and bolster the country’s export activities, fostering economic growth and global competitiveness.

RoDTEP serves as a vital tool for manufacturers and merchants, encouraging them to expand their export ventures by mitigating their tax liabilities. Unlike its predecessor, the Merchandise Exports from India Scheme (MEIS), RoDTEP covers a broader spectrum of duties and taxes levied at both the manufacturing and transportation stages. By encompassing previously unreimbursed charges under existing schemes, RoDTEP ensures a more comprehensive and equitable support system for exporters.

The decision to replace MEIS with RoDTEP was prompted by several factors, including compliance issues with the World Trade Organization’s (WTO) trade norms and limitations within the MEIS framework. The MEIS faced scrutiny due to its perceived inadequacies and inconsistencies, prompting challenges within the WTO. In response, the implementation of RoDTEP signifies a proactive approach to aligning India’s export policies with international standards while addressing the shortcomings of its predecessor.

Overall, the RoDTEP scheme represents a significant step forward in streamlining export procedures, fostering a conducive environment for exporters to thrive. By providing tangible financial benefits and addressing regulatory challenges, RoDTEP aims to empower exporters and propel India’s position in the global marketplace. Through its comprehensive coverage and strategic alignment with international trade norms, RoDTEP signifies a pivotal development in India’s export promotion landscape, offering promising opportunities for growth and expansion.

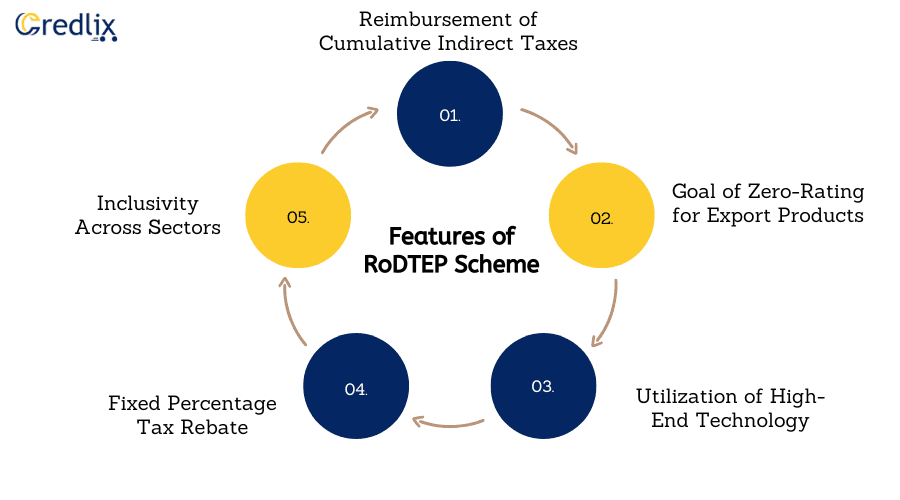

Features of RoDTEP Scheme

The RoDTEP (Remission of Duties or Taxes on Export Products) scheme is designed to provide comprehensive support to exporters, aiming to streamline export procedures and enhance competitiveness in the global market. Here are the key features of the RoDTEP scheme:

Reimbursement of Cumulative Indirect Taxes: Under the RoDTEP scheme, exporters are eligible for reimbursement of all cumulative indirect taxes incurred during the export process. This includes taxes such as Value Added Tax (VAT), Central Excise tax on fuel for electricity generation, mandi tax, and other applicable levies. By reimbursing these taxes, the scheme aims to reduce the financial burden on exporters and improve their profitability.

Goal of Zero-Rating for Export Products: One of the primary objectives of the RoDTEP scheme is to achieve zero-rating for all export products. Zero-rating refers to the practice of exempting exports from taxes and duties, thereby making them more competitive in international markets. By promoting zero-rating, the scheme aims to boost exports and enhance India’s competitiveness on the global stage.

Utilization of High-End Technology: The RoDTEP scheme leverages advanced technology, particularly the Risk Management System (RMS), to verify and track the records of exporters. The RMS ensures transparency and accountability in the implementation of the scheme, helping to prevent fraud and misuse of benefits.

Fixed Percentage Tax Rebate: Exporters eligible under the RoDTEP scheme receive a fixed percentage tax rebate based on the total Freight On Board (FOB) value of their exports. This rebate is calculated and stored in an electronic ledger, providing exporters with a transparent and efficient mechanism for claiming benefits.

Inclusivity Across Sectors: The RoDTEP scheme is not limited to specific industries or sectors. Manufacturers from all sectors, including labor-intensive industries such as textiles, can avail of the benefits under the scheme. This inclusivity ensures that exporters across various sectors can access support and incentives to boost their export activities.

Overall, the RoDTEP scheme’s features reflect a comprehensive and inclusive approach to export promotion, aimed at facilitating trade, reducing costs, and enhancing India’s competitiveness in the global marketplace.

Eligibility Criteria for the RoDTEP Scheme

The eligibility criteria for the RoDTEP (Remission of Duties or Taxes on Export Products) scheme are designed to encompass various aspects of export activities while ensuring inclusivity and transparency. Here’s a breakdown of who is eligible for the RoDTEP scheme:

Local Manufacturing and Export: The RoDTEP scheme applies to goods that are manufactured locally in India and subsequently exported. This means that products produced within the country’s borders and then shipped overseas are eligible for benefits under the scheme. However, services are not covered by RoDTEP, only goods.

Exclusion of Re-exported Goods: Goods that are re-exported, meaning products originally produced outside of India but passing through India during transportation, are not covered under the RoDTEP scheme. The scheme specifically targets goods manufactured domestically and exported directly from India.

Omni-Sectoral Coverage: The RoDTEP scheme is omni-sectoral, meaning it covers goods from all sectors of the economy. This inclusive approach ensures that exporters across various industries can benefit from the scheme, thereby maintaining a balanced and equitable distribution of incentives.

Eligibility for Manufacturers and Traders: Both manufacturer exporters, who produce goods for export, and merchant exporters or traders, who facilitate the export of goods produced by others, can avail of the benefits of the RoDTEP scheme. This broad eligibility criteria caters to a wide range of export-oriented businesses.

No Turnover Threshold: Unlike some other schemes, there is no maximum or minimum turnover threshold to claim the benefits under the RoDTEP scheme. This ensures that businesses of all sizes, from small-scale enterprises to large corporations, can participate in and benefit from the scheme.

Coverage of E-commerce Exports: Additionally, the RoDTEP scheme extends its coverage to goods exported through e-commerce platforms via courier services. This acknowledgment of the growing role of e-commerce in international trade ensures that exporters utilizing online channels can also access the benefits of the scheme.

Benefits of RoDTEP Scheme

The RoDTEP (Remission of Duties or Taxes on Export Products) scheme boasts several significant benefits for exporters, positioning it as a pivotal initiative in India’s export promotion landscape:

WTO Compliance

A notable advantage of the RoDTEP scheme is its compliance with the trade norms established by the World Trade Organization (WTO). Unlike its predecessor, the MEIS scheme, RoDTEP adheres to international standards, ensuring that India’s export policies are in line with global trade regulations.

This compliance not only enhances India’s reputation as a reliable trading partner but also mitigates the risk of trade disputes and penalties associated with non-compliance.

Technological Advancement

RoDTEP incorporates advanced technological features to streamline processes and enhance efficiency. Input credits under the scheme are managed through an electronic credit ledger, facilitating seamless transactions and minimizing paperwork.

Additionally, the Risk Management System (RMS) employs sophisticated algorithms to perform risk-based profiling of shipping bills. This allows for swift identification of high-risk transactions, reducing the need for physical intervention and expediting the export process.

Multi-Sectoral Coverage

One of the key strengths of the RoDTEP scheme is its multi-sectoral applicability. By encompassing goods from all sectors of the economy, RoDTEP ensures uniformity in the treatment of exports across industries.

This inclusive approach promotes balanced growth and development, enabling exporters from various sectors to access the benefits of the scheme and contribute to India’s overall export performance.

Automated Refund Module

The implementation of a fully automated refund module, as announced by the Ministry of Finance, is a significant step towards enhancing transparency and efficiency in the refund process. This module will be accessible to both the public and private sectors, providing a user-friendly platform for processing refund claims.

By eliminating manual intervention and reducing the incidence of double taxation, the automated refund module streamlines operations, enhances compliance, and improves the overall business environment for exporters.

Documents Required to Apply for RoDTEP Scheme

To apply for the RoDTEP (Remission of Duties or Taxes on Export Products) scheme, exporters are required to provide certain documents to ensure compliance and eligibility. These documents serve as essential evidence of the export transactions and facilitate the processing of benefits under the scheme. Here’s a detailed explanation of the documents required for applying for RoDTEP:

Shipping Bills: Shipping bills are crucial documents that detail the goods being exported, their quantity, value, destination, and other relevant information. These bills serve as proof of export and are required to be submitted to customs authorities during the export process. For RoDTEP scheme application, exporters need to provide copies of shipping bills related to their export transactions.

Electronic Bank Realization Certificate (eBRC): The eBRC is a digital certificate issued by banks that validates the realization of export proceeds. It serves as evidence that the exporter has received payment for the exported goods. Exporters need to submit copies of eBRCs for the export transactions covered under the RoDTEP scheme to demonstrate the actual realization of export proceeds.

Digital Signature Certificate (DSC) – Class 3: A Class 3 Digital Signature Certificate is a secure electronic key that authenticates the identity of the exporter in online transactions. It ensures the security and integrity of documents submitted electronically. Exporters are required to possess a Class 3 DSC to digitally sign the application forms and other relevant documents for RoDTEP scheme registration.

Registration Cum Membership Certificate (RCMC): The RCMC is a certificate issued by Export Promotion Councils or Commodity Boards to validate an exporter’s registration with them. It signifies the exporter’s membership and eligibility for various export promotion schemes and benefits. Exporters need to provide a copy of their RCMC as part of the application process for the RoDTEP scheme to establish their legitimacy and eligibility for benefits.

How to Apply for RoDTEP Scheme Online?

Applying for the RoDTEP (Remission of Duties or Taxes on Export Products) scheme online is a straightforward process that can be completed through the ICEGate website (icegate.gov.in). This process is quite similar to applying for the Rebate of State & Central Taxes and Levies (RoSCTL) scheme. Here’s a step-by-step guide on how to apply for the RoDTEP scheme online:

Access the ICEGate Website: Begin by logging on to the ICEGate website (icegate.gov.in), which serves as the online portal for various customs-related services and schemes. Ensure you have a stable internet connection and access to a computer or mobile device.

Obtain a Class 3 Individual Digital Signature Certificate (DSC): Before proceeding with the application, you’ll need to acquire a Class 3 Individual type Digital Signature Certificate. This certificate serves as a secure electronic key that authenticates your identity in online transactions. Make sure your DSC is valid and properly installed on your computer or device.

File the Application: Once logged in to the ICEGate portal, navigate to the section for applying for the RoDTEP scheme. Follow the prompts to initiate the application process. Use your Class 3 Individual DSC to digitally sign the application forms and ensure the security and integrity of your documents.

Attach Required Documents: As part of the application process, you’ll need to attach all the necessary documents specified for RoDTEP scheme application. These documents typically include shipping bills, Electronic Bank Realization Certificates (eBRCs), Registration Cum Membership Certificate (RCMC), and any other relevant paperwork. Ensure that all documents are scanned and uploaded in the required format.

Link Documents to Application: After attaching the required documents, link them to the corresponding sections of your application. This ensures that all necessary documentation is associated with your RoDTEP scheme application and facilitates the processing of your request.

Submit the Application: Once you’ve completed all the necessary steps and attached the required documents, review your application to ensure accuracy and completeness. Then, submit the application electronically through the ICEGate portal.

Understanding the Working of RoDTEP Scheme

Here’s a simplified step-by-step explanation of how the RoDTEP (Remission of Duties or Taxes on Export Products) scheme works:

Step 1: Creating the RoDTEP Credit Ledger

- Exporters initiate the process by logging onto the ICEGate portal using their Class 3 Digital Signature Certificate (DSC).

- New users register themselves on the portal before logging in.

- After logging in, exporters select the ‘RoDTEP’ option from the scheme name drop-down menu to create a credit ledger account.

- The credit ledger account allows exporters to manage their benefits under the RoDTEP scheme.

- Step 2: Declaration in Shipping Bills

- Exporters must declare ‘RoDTEPY’ on shipping bills to claim RoDTEP benefits. Alternatively, they declare ‘RoDTEPN’ if they choose not to avail the benefits.

- Failure to specify either option on the shipping bill results in no reimbursement for the exporter.

Step 3: Claim Processing & Scroll Generation

- After the carrier files the Export General Manifest (EGM), shipping bills undergo profiling by the Risk Management System (RMS).

- Based on the RMS assessment, shipping bills are either sent for officer intervention or directly to respective scroll queues.

- Once scrolls are generated, the reimbursement amount becomes available as credits on the ICEGate portal.

- Step 4: Generating & Using Scrips

- Exporters convert credits on the portal into credit scrips.

- Each exporter receives a unique Scrip ID, and entries are recorded in the credit ledger upon scrip generation.

- Scrips are categorized into different types:

1.Active Scrips: Currently unused credits.

2.Utilized Scrips: Credits that have been used by the exporter.

3.Transferred Scrips: Credits transferred and approved by the recipient.

4.Transfer Pending: Credits awaiting approval by the recipient.

5.Transfer Rejected: Credits rejected by either party.

6.Expired: Credits that have passed their expiration date.The RoDTEP scheme streamlines the process of reimbursing exporters for taxes and duties paid during the export process. By following these steps, exporters can manage their benefits efficiently and optimize their participation in the scheme.

RoDTEP Scheme Exclusion for EOU & SEZ Units

Currently, the RoDTEP scheme does not encompass exports by SEZ (Special Economic Zone) and EOU (Export Oriented Units) units. However, there is considerable industry demand for the inclusion of these units within the scheme.

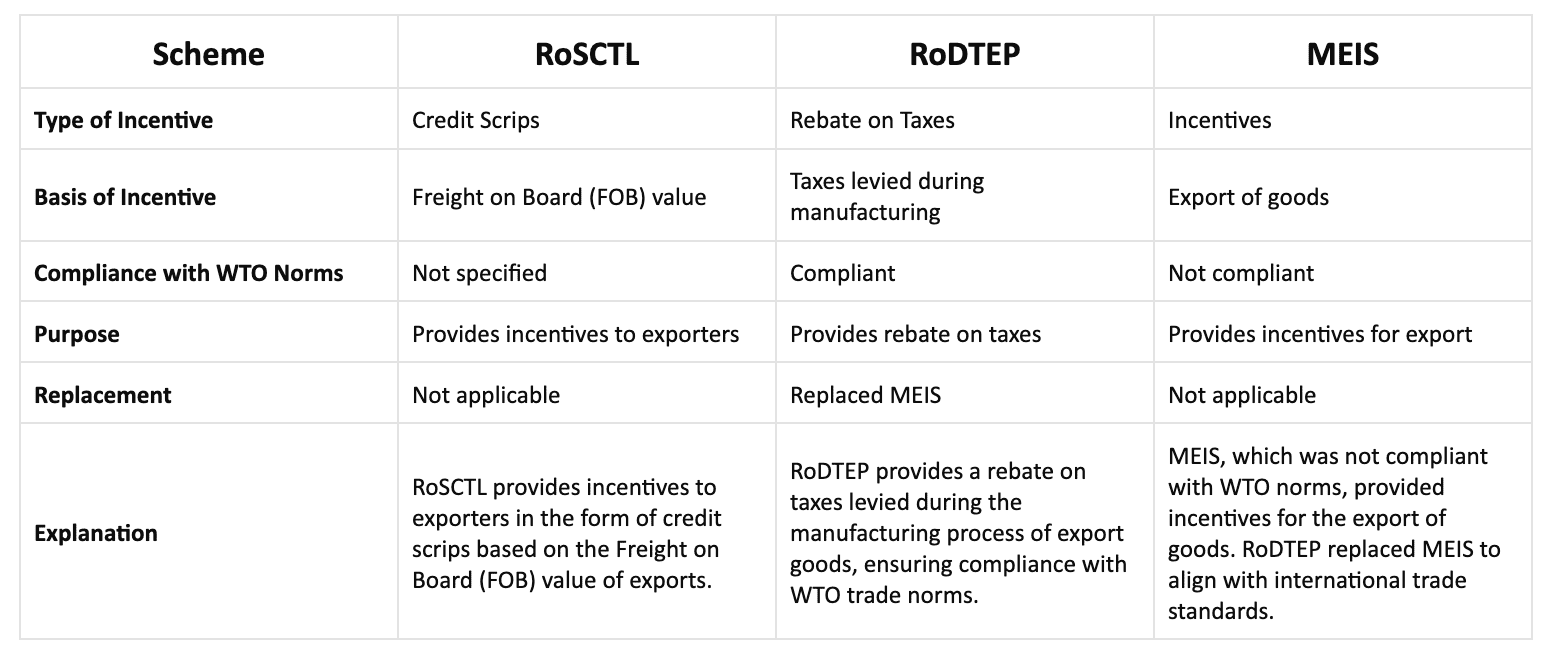

Difference between RoDTEP Scheme, MEIS, and RoSTCL Scheme

Conclusion

In conclusion, the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme stands as a beacon of hope and opportunity for exporters in India. By providing a streamlined process for reimbursement of taxes and duties incurred during the export process, RoDTEP aims to bolster India’s export competitiveness on the global stage. From its inception to its practical implementation, RoDTEP represents a significant stride towards simplifying export procedures and empowering businesses to thrive in the international market.

As exporters navigate through the maze of export policies and schemes, understanding RoDTEP becomes paramount. Whether you’re a seasoned exporter or just starting out, the benefits of RoDTEP are tangible and can significantly impact your export ventures. By leveraging the scheme’s features and adhering to eligibility criteria, exporters can unlock new avenues for growth and expand their presence in the global marketplace.

However, it’s essential to stay informed and adapt to changes in export policies. While RoDTEP offers promising opportunities, exporters must also consider the evolving landscape of trade regulations and compliance standards. By staying abreast of updates and leveraging available resources, exporters can maximize the benefits of RoDTEP and chart a course towards sustainable export success.[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]