- December 6, 2024

- Posted by: admin

- Categories: Export Financing, Blog

The e-way bill is a vital component of India’s Goods and Services Tax (GST) framework, introduced to streamline and monitor the movement of goods. Designed to ensure compliance, enhance transparency, and reduce tax evasion, an e-way bill is required for consignments worth ₹50,000 or more, barring a few exceptions. Below is an in-depth look at its various facets.

What is an E-Way Bill?

An e-way bill is an electronically generated document that accompanies consignments worth ₹50,000 or more during transportation. It includes key shipment details such as:

- Names and GSTIN of the consignor and consignee

- The origin and destination of the goods

- Route and transporter details

- Invoice or challan references

The bill is mandated under Rule 138 of the CGST Rules, 2017 for most goods, excluding those listed in Rule 138(14). This digital system ensures proper documentation and seamless transportation while reducing bottlenecks at checkpoints.

Why is the E-Way Bill Necessary?

The e-way bill serves multiple purposes, including:

- Shipment Monitoring: It provides detailed information about the consignment, reducing risks of theft or loss.

- Prevention of Tax Evasion: Authorities can track goods and ensure that appropriate taxes are paid.

- Regulatory Compliance: By mandating documentation, the e-way bill ensures all shipments align with GST norms.

Without the e-way bill, non-compliance can attract hefty penalties and disrupt the supply chain.

When Should an E-Way Bill Be Generated?

The e-way bill must be generated in the following scenarios:

- Supply Transactions: Movement of goods due to sales or business transactions.

- Returns or Stock Transfers: Goods moved without a sale, such as returns or internal stock transfers.

- Interstate Handicraft Movements: Even for goods valued below ₹50,000, handicraft dealers exempt from GST need an e-way bill for interstate transport.

Threshold Exemptions

Goods valued below ₹50,000 are generally exempt unless specified otherwise (e.g., interstate handicraft shipments).

Who Can Generate an E-Way Bill?

Three categories of individuals are eligible to generate an e-way bill:

1. Registered Persons

A GST-registered individual must generate an e-way bill for consignments worth ₹50,000 or more. Registered users can also voluntarily generate the bill for consignments below the threshold.

2. Unregistered Persons

Even unregistered suppliers must generate an e-way bill when dispatching goods of ₹50,000 or more. When dealing with a registered recipient, the recipient ensures compliance.

3. Transporters

Transporters must generate an e-way bill if the supplier hasn’t. Unregistered transporters must first enroll on the e-way bill portal to obtain a transporter ID, which is necessary for bill generation.

Contents of the E-Way Bill

The e-way bill consists of two parts:

Part A: Shipment Details

- Transaction Type: Supply, return, or transfer.

- Consignor and Consignee Information: GSTIN, names, and addresses.

- Item Details: Product name, quantity, HSN code, value, and applicable GST rates.

Part B: Transportation Details

- Mode of Transport: Road, rail, air, or ship.

- Vehicle or Transporter ID: Specifics of the carrier used.

Note: Part B is mandatory for interstate transport but may be optional for intrastate movement under certain conditions.

How to Generate an E-Way Bill?

Generating an e-way bill is a straightforward process that ensures compliance with GST regulations for transporting goods. Below is a detailed step-by-step guide:

1. Prerequisites

Before initiating the process, ensure you have:

- A valid GSTIN (Goods and Services Tax Identification Number).

- Access credentials for the e-way bill portal.

- Supporting documents such as the invoice, delivery challan, and transporter details (ID or vehicle number).

2. Log In to the E-Way Bill Portal

Visit the official e-way bill portal (ewaybillgst.gov.in) and log in using your credentials.

3. Select “Generate New”

Once logged in, navigate to the “e-Waybill” menu and click on “Generate New” to open the e-way bill generation form.

4. Fill in Part A

Part A captures shipment and transaction details:

- Transaction Type: Choose “Outward” for goods leaving your premises or “Inward” for receiving goods.

- GSTIN of Consignor/Consignee: Enter the GST details of the sender and recipient.

- Document Details: Provide the invoice or challan number and date.

- Item Details: Input details like product name, HSN code, quantity, and tax value.

5. Fill in Part B

Part B is for transport-related information:

- Mode of Transport: Select road, rail, air, or ship.

- Vehicle Number or Transporter ID: Include relevant details.

6. Review and Submit

Carefully verify all the entered details to avoid errors. Click “Submit” to generate the unique 12-digit e-way bill number.

7. Access and Share

Print or download the e-way bill to share it with the transporter and keep a copy for compliance.

E-way bills can also be generated via SMS, mobile apps, or APIs for bulk uploads, offering flexibility for different business needs.

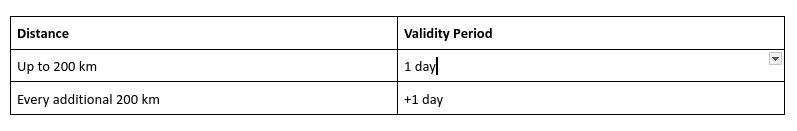

Validity of the E-Way Bill

The e-way bill’s validity depends on the distance to be covered:

Key Points:

- Validity starts when Part B is first updated.

- Bills expire at midnight of the last validity day.

- Extensions are allowed for unforeseen delays but must be done within 8 hours before or after expiry.

Documents Required for Generating an E-Way Bill

To generate an e-way bill under GST regulations, certain documents are mandatory to ensure the seamless and legal transportation of goods. Below is a detailed list of the required documents and their significance:

1. Tax Invoice, Bill of Supply, or Delivery Challan

Purpose: These documents serve as proof of the transaction or the movement of goods.

Details Included:

- GSTIN of the supplier and recipient

- Invoice number and date

- Description, quantity, and value of goods

- Applicable tax rates and amounts

For job work, branch transfers, or exports, a delivery challan might be used instead of an invoice.

2. Transporter ID or Vehicle Number

Purpose: To track the movement of goods during transit.

Details Required:

- If a transporter is used, their 15-digit Transporter ID (TRANSIN).

- For self-transportation, the vehicle registration number.

- This information is crucial for completing Part B of the e-way bill form.

3. GSTIN of the Consignor and Consignee

Purpose: To identify the parties involved in the transaction under GST laws.

Details Required:

- Supplier’s GSTIN (for outward supply).

- Recipient’s GSTIN (for inward supply).

- If the recipient is unregistered, mention “URP” (Unregistered Person).

4. HSN Code of Goods

Purpose: Classification of goods for GST compliance.

Details Required: The HSN (Harmonized System of Nomenclature) code corresponding to the goods being transported.

5. Place of Delivery (Pincode)

Purpose: To determine the distance for transportation and applicability of e-way bill requirements.

6. Mode of Transport

- Purpose: To specify how the goods are being transported (road, rail, air, or ship).

- Details Required: Transport document number, if applicable (e.g., railway receipt or airway bill).

Verification of Documents and Goods

Authorities may halt vehicles for verification. In such cases:

- The e-way bill copy or RFID scan suffices for compliance.

- Once physical verification is conducted, no further inspections are allowed unless flagged under specific circumstances.

Exemptions from E-Way Bill Requirements

An e-way bill isn’t required for:

- Goods listed in Annexure to Rule 138(14).

- Non-motorized transport.

- Shipments within 20 km under a delivery challan.

- Goods moved under customs supervision or the Ministry of Defense.

- Transit cargo to Nepal or Bhutan.

- Certain state-specific exemptions (e.g., fabric in Gujarat).

Penalties for Non-Compliance

Failure to generate or carry an e-way bill can result in:

- Minimum Penalty: ₹10,000.

- Higher Penalty: Equal to the tax evaded.

State-Specific E-Way Bill Regulations

While the e-way bill is implemented nationwide, certain states have introduced variations:

- Bihar: Threshold increased to ₹2,00,000.

- Gujarat & Goa: Exemptions for specific goods.

- West Bengal & Tamil Nadu: Threshold lowered to ₹1,00,000 for selected goods.

Conclusion

Generating an e-way bill is a critical compliance step under GST for the transportation of goods. Ensuring all necessary documents—such as the tax invoice, transporter ID, GSTIN details, and HSN code—are accurately prepared and uploaded is essential to avoid delays and penalties. These documents not only authenticate the transaction but also help streamline goods movement and maintain transparency.

Adhering to these requirements safeguards businesses against non-compliance risks and ensures smooth operations. By staying informed and organized, businesses can enhance efficiency and ensure uninterrupted supply chain processes while meeting all legal obligations under the GST framework.

FAQs on E-Way Bill

1. How to Extend E-Way Bill Validity?

Log in to the portal, select the “Extend Validity” option, and provide details such as the e-way bill number and reason for extension.

2. What is SKD/CKD in an E-Way Bill?

Semi Knocked Down (SKD) and Completely Knocked Down (CKD) refer to goods dismantled into parts for transportation. A consolidated invoice covers all parts.

3. Are E-Way Bills Needed for Intra-State Transport?

Intra-state requirements vary by state; some require bills for specific goods or thresholds

.

Also Read: Bill of Lading and Waybill: What’s the Big Difference (2024)