[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12527″ img_size=”full” css=”.vc_custom_1712123114173{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]When you’re dealing with international trade and shipping, terms like FOB and CIF come into play. They basically determine when the goods switch ownership from the seller to the buyer, and who’s responsible for the costs and risks while the goods are on their way. So, FOB and CIF help decide who foots the bill and takes on the risks during transit.

Key Information About FOB

-

- Free on Board (FOB) indicates the transfer of ownership of goods and determines liability for damages during shipping.

- “FOB Origin” signifies that the buyer assumes risk once the seller ships the product.

- “FOB Destination” means the seller retains risk until the goods reach the buyer.

- FOB terms have implications for inventory, shipping, and insurance costs.

What Is Free on Board (FOB)?

Free on Board (FOB) is a term used in shipping to decide who’s responsible for goods at different points in the delivery process. There are two main types:

FOB Origin or FOB Shipping Point: This means the buyer takes ownership and risk as soon as the seller ships the goods. If anything happens during transit, like damage or loss, it’s the buyer’s problem.

FOB Destination: Here, the seller keeps ownership and responsibility until the goods reach the buyer safely.

So, depending on whether it’s FOB Origin or FOB Destination, either the buyer or the seller is in charge of the goods during shipping.

FOB Components

When we talk about FOB, there are two main types: FOB shipping point and FOB destination. These terms cover all the costs related to getting your goods from one place to another. This includes things like transporting the goods to the port, loading them onto the ship, the actual sea freight, insurance, unloading at the destination port, and even the transportation costs up to the final spot.

Now, let’s break down some common ways these costs are handled:

Collect: The buyer pays the transportation charges.

Prepaid and Add: Here, the seller foots the bill upfront, but the buyer gets reimbursed by adding the charges to the invoice.

Prepaid and Allow: The seller covers the transportation charges and can even factor them into the contract price.

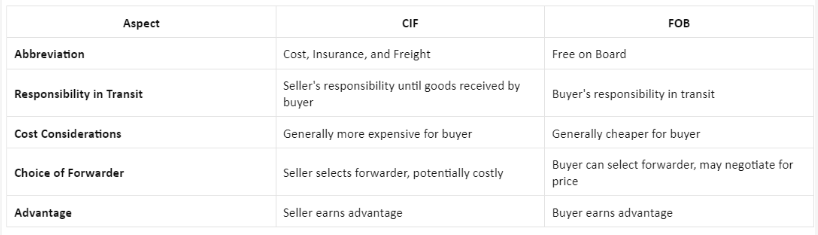

FOB vs. CIF in Invoice

CIF places the responsibility on the seller until the goods reach the buyer, making it potentially more expensive for the buyer as the seller chooses the forwarder. In contrast, FOB places responsibility on the buyer, allowing them to select the forwarder and potentially negotiate better prices, giving the buyer an advantage in terms of cost control.

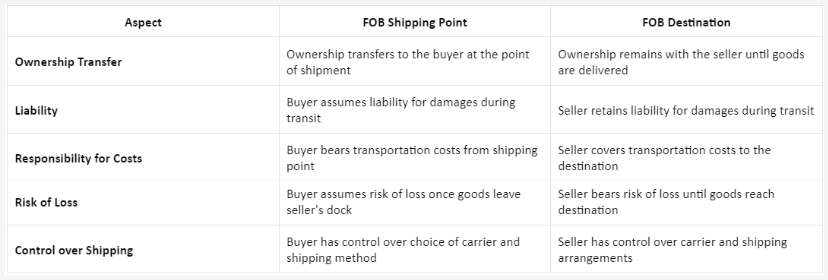

Difference Between FOB Shipping Point and FOB Destination

FOB (Free on Board) Shipping Point and FOB Destination are terms used in shipping agreements to determine when ownership of goods transfers from the seller to the buyer and who bears the risk during transit.

FOB Shipping Point: With FOB Shipping Point, also known as FOB Origin, ownership and liability for the goods transfer from the seller to the buyer at the point of shipment. This means that once the goods are loaded onto the carrier at the seller’s shipping dock, the buyer assumes responsibility for any damages or loss that may occur during transit. The seller is only responsible for the goods until they are handed over to the carrier.

FOB Destination: Conversely, FOB Destination places the responsibility for the goods on the seller until they reach the buyer’s specified destination. In this arrangement, the seller retains ownership and liability for the goods until they are delivered to the buyer’s designated location. Any risks or damages during transit are the seller’s responsibility to bear.

Now, let’s break down the key differences between FOB Shipping Point and FOB Destination in a table:

While both FOB Shipping Point and FOB Destination determine when ownership transfers and who bears the risk during shipping, they differ in terms of when ownership changes hands, liability for damages, responsibility for costs, risk of loss, and control over shipping arrangements.

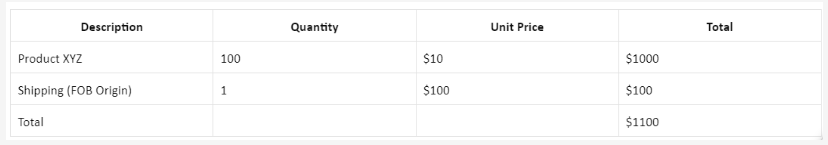

Example of Using FOB in an Invoice

Here’s a simple example of how FOB might be used in an invoice:

In this example:

-

-

- The buyer is purchasing 100 units of Product XYZ at a unit price of $10, totaling $1000.

- The seller is shipping the goods under FOB Origin terms, meaning the buyer assumes responsibility for the goods once they’re shipped from the seller’s location.

- The shipping cost is $100, making the total invoice amount $1100, with the shipping cost included.

-

This invoice illustrates how FOB terms are indicated alongside shipping costs to clarify the responsibility for the goods during transit.

When to Choose FOB for Import-Export

When choosing FOB for import-export, experienced buyers in international trade often opt for this option. These buyers typically have established relationships with logistics and forwarding agents at the port of destination. In FOB agreements, sellers are responsible for delivering goods to the nearest port, after which they’re considered delivered. One major perk of FOB is that buyers can negotiate freight services to secure the best prices.

In essence, it’s advantageous to buy FOB and sell CIF in international trade. This approach allows buyers to have greater control over shipping costs and ensures smoother transactions. Overall, FOB offers flexibility and cost-saving opportunities, making it a preferred choice for savvy import-export professionals.

Common FOB Misunderstandings

Learn about some of the common FOB misunderstandings that you should be aware of:

FOB Doesn’t Cover Everything

FOB shipping doesn’t include all costs. For example, with a FOB shipping point, the buyer pays for things like freight and insurance after the goods leave the shipping point.

FOB Doesn’t Decide Legal Issues

FOB terms don’t say where legal disputes should be handled. This needs to be clearly stated in the contract.

FOB Shipping Point Isn’t Always Great for Sellers

Even though FOB shipping point shifts risk to the buyer, it can hurt a seller’s reputation and sales. While shipping costs drop, many buyers don’t like this arrangement, especially for big or fragile orders.

FOB Destination Doesn’t Mean the Seller Pays Everything

Under FOB destination, the seller faces higher costs, but they can include shipping costs in the price. Plus, the buyer might indirectly cover freight and insurance expenses.

The Impact of FOB Terms on Accounting and Inventory Management

FOB terms not only determine who foots the bill for shipping but also affect how a business keeps track of its inventory.

When goods are shipped FOB shipping point, the sale is considered done once the carrier picks up the items. This means the seller records the sale right away, while the buyer adds the goods to their inventory, even if they haven’t physically received them yet.

On the other hand, if goods are shipped FOB destination, the seller waits to record the sale until the goods reach the buyer’s location. Similarly, the buyer waits to add the goods to their inventory until they arrive and are checked.

Understanding the intricacies of FOB in export is crucial for navigating international trade smoothly. Whether it’s determining ownership transfer, negotiating shipping terms, or managing inventory and accounting, FOB plays a pivotal role. By grasping the distinctions between FOB Shipping Point and FOB Destination, as well as recognizing common misunderstandings, import-export professionals can make informed decisions to optimize their operations. Ultimately, leveraging FOB terms effectively empowers businesses to streamline logistics, control costs, and ensure successful transactions in the global marketplace.[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]