Let’s take a closer look at forfaiting financing in international trade. It’s basically a smart way for businesses to deal with the uncertainties of buying and selling across borders. In this exploration, we’ll break down how it works, why it’s useful, and what it means for companies in today’s global market. So, grab a cup of coffee and let’s dive in!

Who is a Forfaiter?

A forfaiter is essentially a key player in forfaiting transactions, facilitating deals between exporters and importers. This individual or company steps in to handle, sell, or guarantee the payment obligations of the importer, providing a layer of security for the exporter.

In return for managing the risks of international trade, the forfaiter earns a margin. Think of them as the middleman in import-export deals, ensuring smooth transactions across borders. Many banks and financial institutions also act as forfaiters, streamlining international trade processes.

What is Forfaiting?

Forfaiting is a smart way for exporters to get paid faster for their goods sold abroad. Here’s how it works: instead of waiting for their foreign buyers to pay up, exporters sell their future payments to a forfaiter at a discount. The forfaiter then collects the full payment from the importer when it’s due. What’s neat about forfaiting is that it’s a “no risk” deal for the exporter—if the importer doesn’t pay, the forfaiter can’t come after them for the money.

This is a big help for exporters because they can use the cash right away instead of waiting for payment. It’s especially handy for big deals worth $100,000 or more. Plus, it’s a popular choice for exports going to risky markets. Forfaiting lets exporters offer longer payment terms to their buyers, which can make their deals more attractive. So, it’s a win-win for everyone involved!

Also Read: Export Factoring vs. Forfaiting

Eligibility Criteria For Forfaiting Transaction

To engage in a forfaiting transaction, a forfaiter typically requires specific information:

Buyer Details: The nationality and identity of the buyer involved in the transaction are essential for assessing risk and legal obligations.

Product Description: Clear details about the products being sold are necessary for understanding the nature of the transaction and assessing its viability.

Contract Value and Currency: Information regarding the value of the contract and the currency involved helps in evaluating the financial aspects of the deal.

Contract Duration: This includes the start date, duration, credit period, and the schedule of payments, including any agreed-upon interest rates. These details are crucial for determining the terms of the forfaiting agreement.

Evidence of Debt: Documentation such as promissory notes, bills of exchange, or letters of credit provides evidence of the debt owed by the buyer, which is necessary for the forfaiting process.

Guarantor Details: The identity of any guarantor or avalor providing security for the payment further informs the risk assessment and decision-making process for the forfaiter.

Having access to these details enables the forfaiter to evaluate the transaction, assess the associated risks, and make informed decisions regarding the forfaiting agreement.

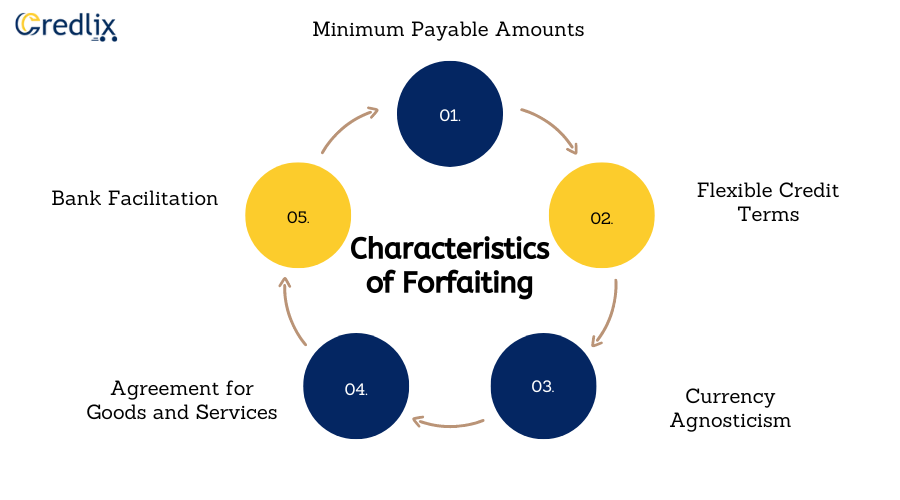

Characteristics of Forfaiting

Here are the characteristics of forfaiting:

Minimum Payable Amounts: Forfaiting transactions typically involve substantial minimum payable amounts, usually set at either US$250,000 or US$500,000, making it suitable for larger-scale commercial endeavors.

Flexible Credit Terms: Importers are provided with a flexible credit period ranging from six months to seven years, allowing ample time for payment fulfillment and accommodating the complexities of international trade.

Currency Agnosticism: Forfaiting transactions can be conducted in any major convertible currency, such as USD, CAD, EUR, etc., ensuring adaptability to diverse economic landscapes and currencies.

Agreement for Goods and Services: A formal agreement outlining the terms and conditions of the supply of goods and services forms the basis of a forfaiting transaction, ensuring clarity, transparency, and legal enforceability.

Bank Facilitation: Banks play a crucial role by issuing Letters of Credit (LCs) or guarantees to importers, typically in the importer’s home country, providing tangible assurances of payment and enhancing trust among the parties involved.

When Forfaiting Happens?

Forfaiting happens when an exporter faces cash flow problems or urgently needs funds. It can also occur when the exporter wants to avoid the risk of the importer failing to pay. So, forfaiting steps in to help exporters who need quick cash or want to safeguard against payment uncertainties.

Features of Forfaiting

Forfaiting transactions exhibit several key features:

Discounted Non-Recourse Basis: Forfaiting transactions are always conducted at a discount and are non-recourse, meaning the exporter sells the receivables without any obligation to repurchase them.

Importer Payment Guarantee: The importer’s payment obligation is backed by a guarantee from their local bank. Payment receipt is typically evidenced by exchange bills, promissory notes, or Letters of Credit (LCs).

Two Financing Options: Forfaiting offers two types of financing: fixed-rate and floating-rate, providing flexibility to exporters based on their preferences and market conditions.

Suited for High-Value Exports: Forfaiting is particularly suitable for high-value exports, encompassing capital goods for manufacturing, consumer durables, vehicles for transport, and even large-scale construction contracts for export.

Immediate Cash Receipt: Exporters typically receive cash immediately after shipping the goods, contingent upon the submission of required documentation, streamlining cash flow management and mitigating payment delays.

How does Forfaiting Work?

The forfaiting process involves several sequential steps that facilitate the smooth execution of international trade transactions. Here’s a more detailed explanation:

Selection of Forfaiter: Initially, the exporter identifies a suitable forfaiter with whom to finance the transaction. This selection is crucial as it establishes the foundation for the forfaiting agreement, which outlines the terms and conditions of the transaction.

Forfaiting Agreement: Upon choosing the forfaiter, the exporter and the forfaiter enter into a formal agreement that delineates the rights, obligations, and responsibilities of each party involved in the transaction. This agreement serves as a contractual framework guiding the entire forfaiting process.

Agreement Between Importer and Exporter: Simultaneously, an agreement is forged between the importer and the exporter, setting forth the terms of the trade, including payment obligations, delivery schedules, and other pertinent details.

Guarantee from Importer’s Bank: To facilitate the trade, the importer obtains a guarantee from their local bank, assuring the exporter of payment. This guarantee acts as a financial safeguard, enhancing trust and mitigating risks for all parties involved.

Shipment of Goods: With the necessary agreements and guarantees in place, the exporter proceeds to ship the package of goods to the importer’s location, adhering to the terms stipulated in the trade agreement.

Submission of Documents to Forfaiter: Upon shipment, the exporter submits the requisite shipping and financial documents to the forfaiter. These documents serve as evidence of the completed transaction and are crucial for the forfaiter to initiate payment.

Payment to Exporter by Forfaiter: Upon receipt of the documents, the forfaiter disburses the agreed-upon sum to the exporter. In exchange, the forfaiter gains complete control over the shipment documents, enabling them to enforce the payment terms at maturity.

Presentation of Documents to Importer’s Bank: At maturity, typically the agreed-upon payment date, the forfaiter presents the shipment documents to the importer’s bank for payment collection.

Payment Collection and Routing: The importer’s bank collects the payment from the importer and subsequently routes the received funds to the forfaiter as per the terms outlined in the forfaiting agreement.

Documents Required for Forfaiting

Documents required for forfaiting include:

- Letter of guarantee or aval.

- Signed copy of the commercial invoice.

- Sales agreement or payment schedule copy.

- Letter of assignment and notification to the guarantor.

- Shipping documents like receipts, railway bills, airway bills, bills of lading, and documents of title.

In some cases, where aval is not recognized, an importer may provide a guarantee letter. Alternatively, a guarantor may endorse with a blank endorsement, or a standby Letter of Credit (LC) may be used.

Example of Forfaiting

Consider a scenario where Exporter Y is facing a liquidity crunch but has a sales contract with Importer X, with payment terms set at 90 days. To navigate this situation, Exporter Y seeks assistance from their bank, Bank A, for forfaiting.

In this arrangement, Importer X must approach their local bank, Bank B, to provide a guarantee for the transaction. Once Exporter Y ships the goods and submits the required documents to Bank A, they receive payment for the sales contract, albeit at a discounted rate, thereby addressing their liquidity concerns.

Upon maturity, after the 90 days, Bank A, acting as the forfaiter, initiates the collection process by approaching Importer X’s bank, Bank B, for payment. Bank B then transfers the payment received from Importer X to Bank A, completing the forfaiting transaction and ensuring a smooth trade process for all parties involved.

Cost Included in Forfaiting

Cost elements in forfaiting typically include:

Discount Rate: The discount rate represents the cost of funds for the forfaiter and is applied to the face value of the receivables. It accounts for factors such as the time value of money, credit risk, and market conditions.

Fees and Charges: Forfaiting transactions may involve various fees and charges, including arrangement fees, processing fees, and handling charges. These fees compensate the forfaiter for their services and cover administrative expenses.

Insurance Premiums: Exporters may opt to purchase trade credit insurance to protect against the risk of non-payment by the importer. The cost of insurance premiums, if applicable, is considered a cost element in forfaiting.

Legal and Documentation Costs: There may be expenses associated with drafting, reviewing, and processing legal documents, such as forfaiting agreements, sales contracts, and shipping documents. These costs contribute to the overall expense of the forfaiting transaction.

Opportunity Cost: Forfaiters incur opportunity costs by advancing funds to the exporter at a discount, foregoing potential alternative investment opportunities that may offer higher returns.

Currency Exchange Costs: Forfaiting transactions involving multiple currencies may entail currency exchange costs, including conversion fees and exchange rate fluctuations, which impact the overall cost of the transaction.

Risk Premiums: Forfaiters assess the credit risk associated with the transaction and may charge a risk premium to compensate for the perceived risk of non-payment by the importer.

Types of Forfaiting

Here are the different types of Forfaiting:

Promissory Notes: Promissory notes serve as formal payment commitments issued by importers to exporters, guaranteeing future payments. They provide a written assurance of payment and are legally binding.

Bills of Exchange: Similar to promissory notes, bills of exchange are written orders obligating importers to pay exporters a specified amount within a predetermined time frame. They serve as negotiable instruments and facilitate trade transactions by providing a mechanism for payment.

Account Receivables: Account receivables represent outstanding payments owed to exporters by importers for goods or services rendered. While they have not yet been settled, they constitute a valuable asset on the exporter’s balance sheet, which can be converted into cash through forfaiting arrangements.

Letters of Credit (LC): Letters of Credit are financial instruments issued by banks or financial institutions, serving as a guarantee of payment to exporters. In a forfaiting context, the exporter may receive payment based on the assurance provided by the LC, regardless of the importer’s ability to fulfill payment obligations.

Benefits of Forfaiting

Forfaiting offers several benefits to exporters, importers, and financial institutions involved in international trade transactions. Some of the key advantages include:

Enhanced Cash Flow: Forfaiting allows exporters to convert their trade receivables into immediate cash, providing them with much-needed liquidity to finance ongoing operations, invest in growth opportunities, or meet financial obligations.

Risk Mitigation: Forfaiting transfers the credit risk associated with trade receivables from the exporter to the forfaiter or financial institution. This helps exporters mitigate the risk of non-payment by importers due to factors such as insolvency, political instability, or currency fluctuations.

Improved Working Capital Management: By accelerating cash inflows, forfaiting enables exporters to optimize their working capital management. This can lead to better inventory management, reduced reliance on short-term financing, and enhanced financial stability.

Facilitates Sales Expansion: Forfaiting provides exporters with the flexibility to offer favorable payment terms to importers, thereby making their products or services more attractive in international markets. This can help exporters expand their customer base and increase sales volumes.

Competitive Advantage: Exporters who utilize forfaiting can gain a competitive edge by offering more attractive financing options compared to competitors. This can lead to increased market share and improved profitability in the global marketplace.

Simplifies Trade Transactions: Forfaiting streamlines the trade finance process by providing a straightforward mechanism for financing international trade transactions. This simplification reduces administrative burdens and transactional complexities for all parties involved.

Access to Foreign Markets: Forfaiting facilitates trade with buyers in foreign markets by providing exporters with confidence in receiving payment and mitigating the risks associated with cross-border transactions. This encourages exporters to explore new markets and expand their global reach.

Disadvantages of Forfaiting

While forfaiting offers numerous advantages, there are also some disadvantages associated with this financing method:

Higher Cost of Capital: Forfaiting often involves higher financing costs compared to traditional bank loans or other forms of trade finance. The discount rate applied to forfaiting transactions may be relatively high, particularly for transactions involving higher risk or longer payment terms.

Limited Access for Small Businesses: Forfaiting transactions typically involve larger-scale trade deals and minimum transaction sizes, which may limit access to smaller businesses with lower transaction volumes. This can restrict the availability of forfaiting as a financing option for smaller exporters.

Complexity of Documentation: Forfaiting transactions require comprehensive documentation, including sales contracts, shipping documents, and financial instruments. The complexity of documentation and administrative requirements can be cumbersome, particularly for exporters unfamiliar with forfaiting processes.

Loss of Control over Receivables: When forfaiting trade receivables, exporters relinquish control over these assets to the forfaiter. This loss of control may limit the exporter’s ability to manage credit terms, negotiate payment schedules, or pursue collections directly from the importer in case of payment delays or disputes.

Currency Exchange Risk: Forfaiting transactions involving multiple currencies expose exporters to currency exchange risk. Fluctuations in exchange rates between the currency of the exporter and the currency of the importer can impact the effective yield of the forfaiting transaction and may result in losses if not properly managed.

Dependence on Forfaiter’s Credit Evaluation: Exporters rely on the creditworthiness and risk assessment capabilities of the forfaiter to evaluate the credit risk associated with the importer. If the forfaiter’s evaluation provides inaccurate or insufficient information, the exporter may face increased risk of non-payment.

Limited Flexibility in Financing Terms: Forfaiting typically involves fixed financing terms, including discount rates, payment schedules, and maturity dates. This lack of flexibility may not align with the unique financing needs or preferences of exporters, particularly in dynamic or uncertain market conditions.

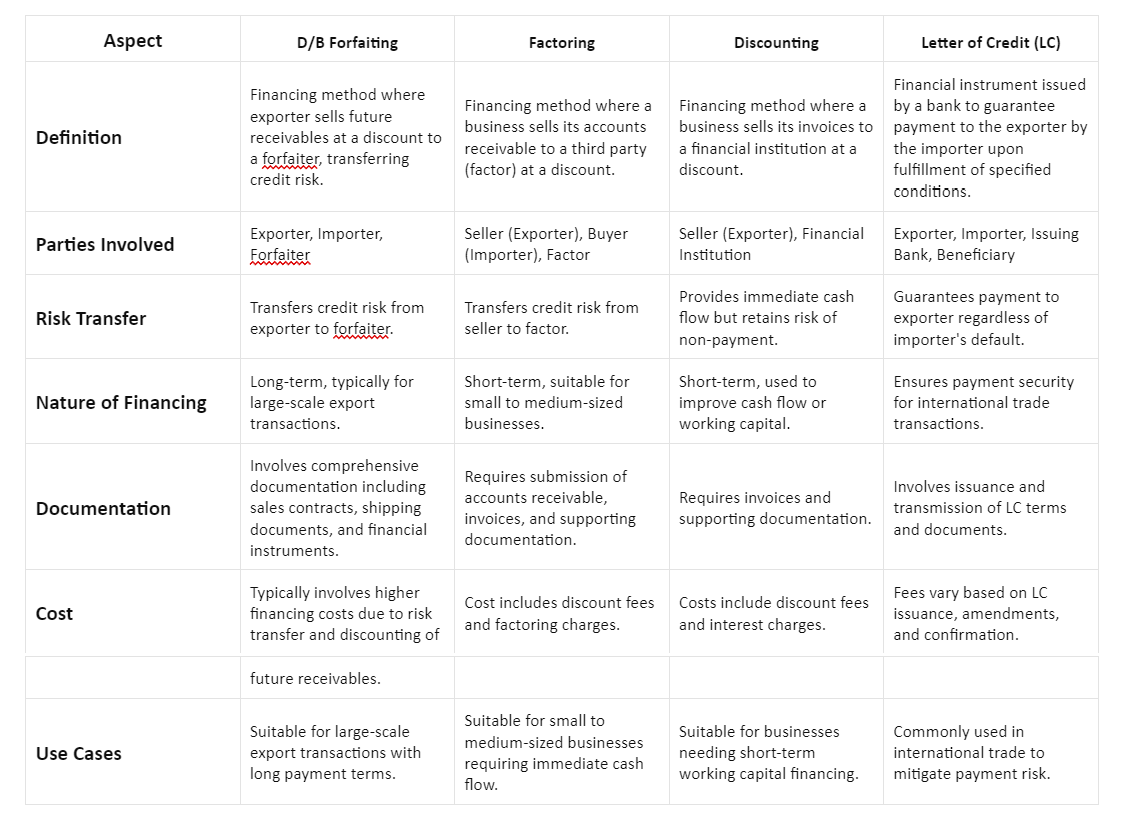

D/B Forfaiting, Factoring, Discounting, and Letter of Credit

Here’s a comparison of D/B Forfaiting, Factoring, Discounting, and Letter of Credit for your easy understanding:

In conclusion, forfaiting financing serves as a valuable tool for businesses engaged in international trade, offering a strategic approach to managing cash flow, mitigating risks, and facilitate smoother transactions across borders. By leveraging forfaiting, exporters can accelerate cash inflows, enhance liquidity, and expand their global reach, while importers benefit from flexible payment terms and enhanced trade relationships. While forfaiting presents certain complexities and considerations, its advantages outweigh the disadvantages, making it a preferred choice for businesses navigating the challenges of global commerce. With its ability to provide immediate financial support, mitigate credit risks, and streamline trade processes, forfaiting remains a cornerstone of modern international trade finance.