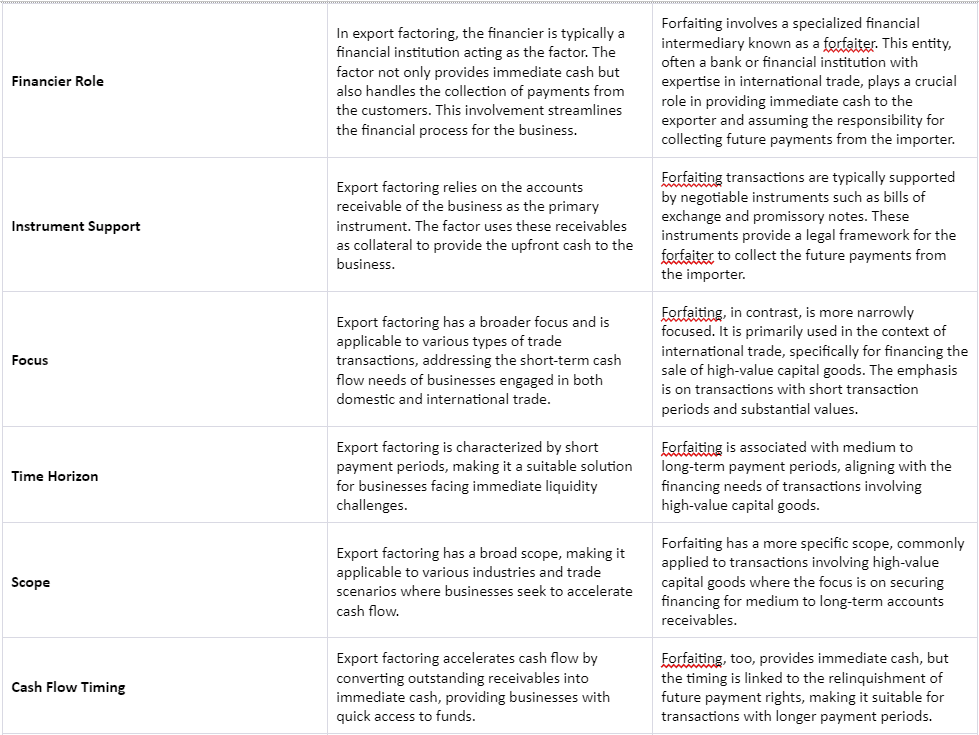

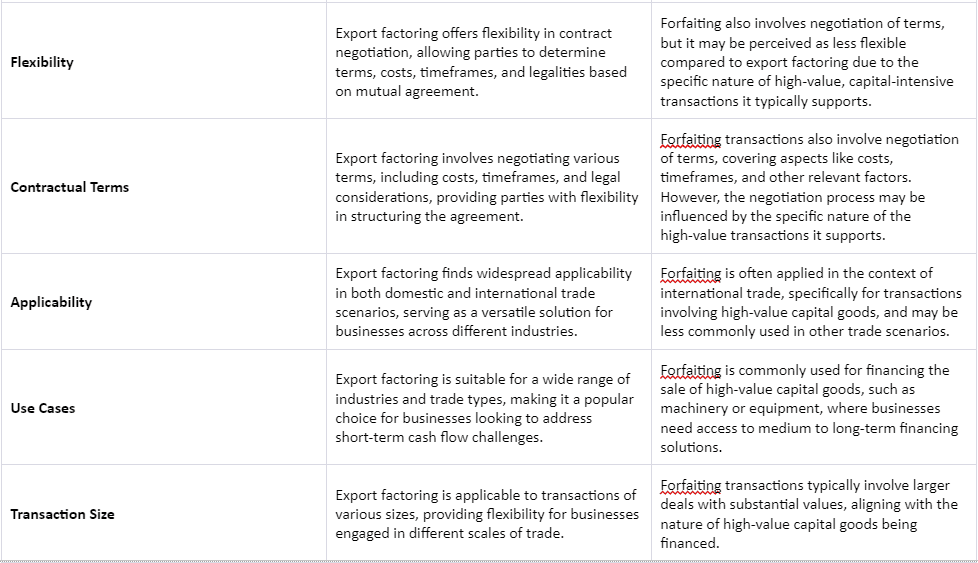

[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12087″ img_size=”full” css=”.vc_custom_1707806380496{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Export financing is crucial in international trade, ensuring businesses have the capital needed to sustain operations and handle payment complexities. Two primary methods in this realm are factoring and forfaiting. Despite occasional interchangeable use, they differ in nature, concept, and scope. Factoring involves businesses selling accounts receivable at a discount to receive immediate cash, with the factor assuming non-payment risk.

On the other hand, forfaiting is a form of export financing where exporters relinquish the right to receive full payment from an importer in exchange for instant cash from a forfaiter. The forfaiter, a specialist in global trade, supports transactions with negotiable instruments like bills of exchange. Recognizing these distinctions is vital for exporters to make informed decisions in their trade financing endeavors.

Let’s understand both these concepts in this blog.

What is Export Factoring?

Factoring is a financial strategy that enables businesses to enhance their cash flow by promptly receiving payment for their accounts receivable. Instead of waiting for customers to settle their invoices, businesses can opt to sell these outstanding invoices to a third party known as a factor. This factor, usually a financial institution, purchases the invoices at a discounted rate. In exchange, the factor assumes the risk of potential non-payment and provides an upfront payment to the business, ensuring a more immediate and reliable cash flow.

This financial practice is applicable to both domestic and international trade scenarios. Factoring allows for negotiation flexibility in contract terms, allowing parties involved to set parameters such as costs, timeframes, legal considerations, and other relevant terms.

Also Read: How Does Export Factoring Work

What is Forfaiting?

Forfaiting is a way for exporters to get quick cash from their sales. Instead of waiting for customers to pay over time, exporters give up their right to the full payment. They do this with the help of a forfaiter, a financial expert in global trade. The forfaiter gives them instant cash in return for the future payment from the importer. This deal usually involves things like bills of exchange and promissory notes.

Forfaiting is mainly used for selling big things, especially expensive items with short payment timelines. It’s handy when businesses need immediate cash but have to wait a while for customers to pay them for goods or services.

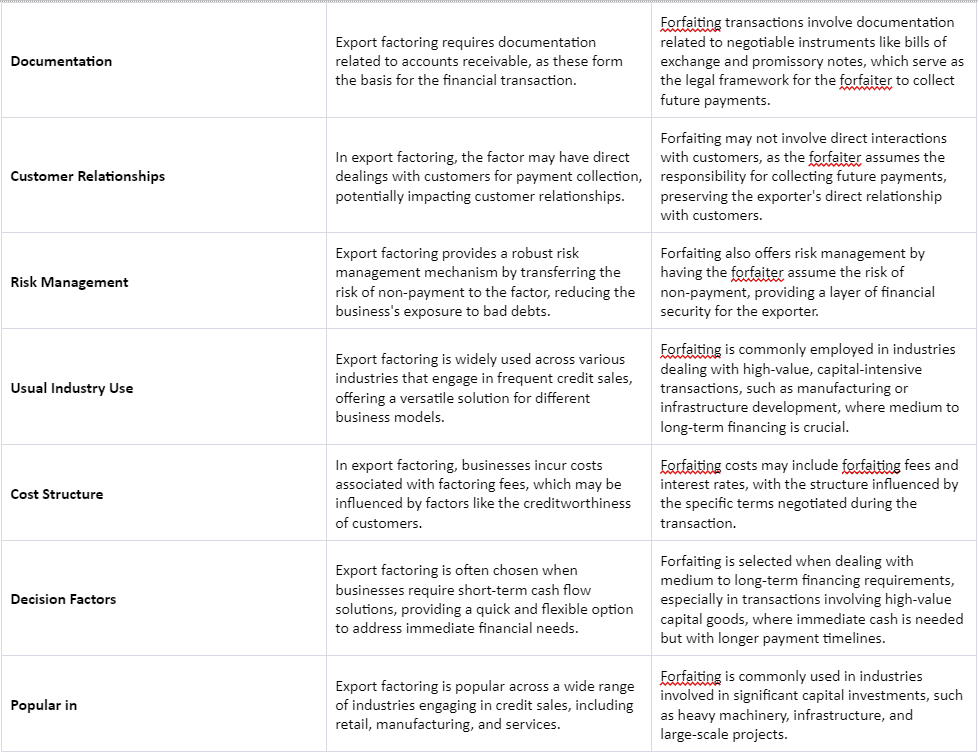

Difference Between Export Factoring and Forfaiting

Understand the difference between export financing and forfaiting in the table below:

Conclusion

Export factoring and forfaiting are vital instruments in the realm of international trade finance, each tailored to meet specific business needs. While export factoring addresses short-term cash flow challenges by facilitating the immediate conversion of receivables, forfaiting focuses on medium to long-term financing, especially for high-value capital goods transactions.

Also Read: Advantages of Export Factoring

Recognizing the differences between these methods is imperative for exporters to make informed decisions aligning with their trade financing requirements. Whether navigating short-term liquidity issues or securing funding for substantial transactions, choosing between export factoring and forfaiting hinges on the distinct financial objectives and timelines of businesses engaged in global trade.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]