- December 6, 2024

- Posted by: admin

- Categories: Invoice discounting, Blog

Factoring is a financial solution that allows businesses to access immediate cash by selling their unpaid invoices or accounts receivable to a third-party entity called a factor. This arrangement benefits businesses with cash flow challenges, enabling them to meet short-term obligations like payroll and supplier payments without waiting for customers to clear invoices.

In this detailed article, we’ll explore how factoring works, its types, benefits, challenges, and how it compares to bill discounting.

What is Factoring?

Factoring is a monetary transaction where a business sells its unpaid invoices to a factoring company at a discounted rate. The factor pays the business an upfront amount, often a significant percentage of the invoice value, and takes on the responsibility of collecting payment from the customers.

Example of Factoring

Let’s consider a small business, Raj Corporation, which sells goods worth ₹1,00,000 to a customer with payment due in 30 days. However, Raj Corporation needs immediate cash to pay employees and suppliers. To bridge this gap, the business decides to factor the invoice.

- Invoice Value: ₹1,00,000

- Factoring Deal: The factor agrees to purchase the invoice for ₹95,000.

- Upfront Payment: Raj Corporation receives ₹90,000 immediately.

- Factoring Fee: ₹5,000

Once the customer pays the invoice, the factor deducts its fee of ₹5,000 and remits the remaining ₹5,000 to Raj Corporation. This process helps Raj Corporation maintain its cash flow without waiting for 30 days.

Types of Factoring

Factoring comes in various forms, each tailored to specific business needs. Here’s a closer look:

1. Recourse Factoring

In recourse factoring, the client (business selling the invoices) retains responsibility for unpaid invoices. If the customer defaults, the business must repay the factor.

- Pros: Lower fees compared to other types.

- Cons: Higher risk for the client.

2. Non-recourse Factoring

In non-recourse factoring, the factor assumes the risk of non-payment. If a customer defaults, the business is not held liable.

- Pros: Risk protection for the business.

- Cons: Higher fees due to increased risk for the factor.

3. Full-Service Factoring

Full-service factoring goes beyond financing. The factor handles additional responsibilities, including credit checks, collections, and record-keeping.

- Pros: Saves time and resources for businesses.

- Cons: Higher costs compared to traditional factoring.

4. Maturity Factoring

Here, the factor purchases invoices but does not advance cash immediately. The client receives funds only after customers pay the invoices.

- Pros: Lower costs due to no upfront payment.

- Cons: Delayed cash flow for the client.

5. Advance Factoring

In advance factoring, the factor provides an upfront payment (a portion of the invoice value) and collects the full amount from customers upon invoice maturity.

- Pros: Quick access to cash.

- Cons: Higher fees due to advance payments.

Benefits of Factoring

Factoring is a financial service that enables businesses to sell their receivables (invoices) to a third party (called a factor) at a discount to receive immediate cash. It is a vital tool for businesses to manage their working capital and cash flow efficiently. Below is a detailed explanation of the benefits of factoring:

1. Improved Cash Flow

Factoring provides immediate cash for invoices, which helps businesses maintain a steady cash flow without waiting for customers to pay.

How it Helps:

- Businesses can meet operational expenses like salaries, rent, and utilities without delays.

- It eliminates the uncertainty of payment cycles, especially in industries with long payment terms (e.g., manufacturing, logistics).

Example: A company with invoices worth ₹50 lakh receivable in 60 days can factor them and receive ₹48 lakh immediately, ensuring smooth operations.

2. No Additional Debt

Unlike loans, factoring is not a debt; it involves selling an asset (accounts receivable). This means the company’s balance sheet is not burdened with additional liabilities.

Advantages:

- Improves financial ratios like debt-to-equity.

- No repayment obligations or interest costs.

Ideal For:

Startups or SMEs with limited access to traditional loans or credit.

3. Access to Quick Funding

Factoring is faster than traditional financing methods like loans or credit lines, as it primarily depends on the creditworthiness of the debtor (customer) rather than the business itself.

Why It Matters:

- Businesses can secure funding in a few days, compared to weeks or months for bank loans.

- It’s particularly useful in emergencies or when scaling operations.

4. Supports Business Growth

Factoring enables businesses to take on more orders and expand operations without worrying about immediate working capital constraints.

How It Drives Growth:

- Businesses can purchase raw materials, hire additional staff, or invest in infrastructure.

- Ensures companies do not lose opportunities due to a lack of funds.

5. Risk Management

Factoring can include non-recourse options where the factor assumes the risk of non-payment by customers. This reduces the financial risk for businesses.

Benefits:

- Shields businesses from bad debts.

- Allows companies to focus on operations rather than debt collection.

Example: A company factors invoices worth ₹20 lakh. If a customer defaults, the factor absorbs the loss under a non-recourse agreement.

6. Streamlined Accounts Receivable Management

Factoring companies often handle collections on behalf of businesses, saving time and resources.

Advantages:

- Reduces the administrative burden of chasing payments.

- Improves relationships with customers, as factoring companies follow professional collection practices.

7. Flexibility in Financing

Factoring is scalable, meaning the amount of funding grows as the business generates more receivables.

Why It’s Flexible:

- Businesses can factor invoices as needed, without long-term commitments.

- No fixed repayment schedule, unlike loans.

8. Helps Maintain Creditworthiness

Since factoring is not a loan, businesses can maintain or even improve their credit scores by ensuring smooth payment of other obligations like vendor bills, employee salaries, and taxes.

Impact:

- Positive credit history.

- Better access to other financing options in the future.

9. Strengthens Vendor Relationships

Immediate access to cash allows businesses to pay suppliers on time or even early, potentially qualifying for early payment discounts.

Benefits:

- Builds stronger supplier relationships.

- Enhances credibility and trust in the market.

10. Suitable for High-Growth Industries

Factoring is ideal for industries experiencing rapid growth where businesses have high receivables but need quick cash to sustain their growth momentum.

Examples:

E-commerce: High volume of sales but delayed payment cycles from marketplaces.

Manufacturing: Large orders with extended payment terms.

Challenges of Factoring

Despite its benefits, factoring has certain drawbacks that businesses should consider:

- High Costs: Factoring fees can be substantial, especially for businesses with multiple invoices.

- Reduced Profit Margins: The discount applied to invoice values reduces the total amount businesses receive.

- Risk of Non-payment (Recourse Factoring): In recourse factoring, businesses bear the risk if customers fail to pay.

- Loss of Control: The factor assumes control over invoice collections, which may affect customer relationships.

- Selective Invoice Purchase: Factors may reject certain invoices, particularly from high-risk customers, limiting funding options.

What is Bill Discounting?

Bill discounting, often compared to factoring, involves selling a bill of exchange (e.g., promissory notes) to a financial institution at a discount. Unlike factoring, bill discounting typically involves a single document rather than a collection of invoices.

Example of Bill Discounting

Akash Corporation has a bill of exchange worth ₹5,00,000 due in 60 days. It sells this bill to a bank for ₹4,95,000, receiving immediate cash. The bank collects the full amount from the drawee upon maturity.

Types of Bill Discounting

Bill discounting is a financing option that allows businesses to convert their receivables, such as bills of exchange or promissory notes, into immediate cash before their maturity date. There are several types of bill discounting, each catering to specific business needs. Below is a detailed explanation of these types:

1. Bill Discounting Backed by Letter of Credit (LC)

This type of bill discounting is supported by a letter of credit issued by the buyer’s bank. A letter of credit serves as a guarantee that the payment will be made to the seller, reducing the risk involved.

Features:

- The seller gets immediate payment by discounting the bill with their bank.

- The bank relies on the letter of credit as a security measure.

Advantages:

- Low risk for the financial institution since payment is guaranteed by the buyer’s bank.

- Suitable for international trade, where trust and security are critical.

Example: A seller in India exports goods to a buyer in the USA. The buyer’s bank issues an LC guaranteeing payment, enabling the seller to discount the bill and receive cash immediately.

2. Clean Bill Discounting

In this type, there is no additional security or guarantee backing the bill. The financial institution relies solely on the creditworthiness of the drawer and the buyer.

Features:

- No collateral or guarantee is required other than the bill itself.

- Higher risk for the financial institution, leading to stricter evaluation of the parties involved.

Advantages:

- Faster processing as no additional documentation for guarantees is required.

- Suitable for businesses with established reputations and trustworthy buyers.

Challenges:

- Limited to businesses with excellent credit profiles.

3. Invoice Bill Discounting

Here, businesses discount invoices raised for goods or services rendered. It is essentially a form of factoring but focuses on specific invoices.

Features:

- Immediate cash is provided against unpaid invoices.

- Popular among small and medium enterprises (SMEs) with recurring clients.

Advantages:

- Boosts working capital by converting receivables into cash.

- Involves minimal paperwork.

Example: A vendor delivers goods worth ₹10,00,000 to a retailer and raises an invoice payable in 60 days. The vendor discounts the invoice with a financial institution and receives ₹9,50,000 upfront.

4. Documentary Bill Discounting

In this type, the bill of exchange is backed by documents such as shipping receipts, insurance certificates, or other trade-related documents.

Features:

- The documents act as collateral, reducing the risk for the financial institution.

- Common in international trade transactions.

Advantages:

- Increased security as tangible documents back the transaction.

- Helps exporters maintain liquidity during trade cycles.

Example: An exporter ships goods to a buyer and submits shipping documents along with the bill to the bank. The bank discounts the bill and releases funds to the exporter.

5. Demand Bill Discounting

Demand bills, also known as sight bills, are payable immediately upon presentation to the drawee. When businesses discount such bills, they receive instant cash.

Features:

- The drawee is expected to make payment on-demand or upon receipt of the bill.

- Lesser waiting period compared to term bills.

Advantages:

- Ideal for businesses needing immediate liquidity.

- Minimizes risk since payment is expected upon presentation.

6. Usance Bill Discounting

A usance bill is a bill of exchange payable at a future date. Usance bill discounting involves selling this bill to a financial institution for immediate cash.

Features:

- Payment is deferred to a future date agreed upon by the parties involved.

- Discounting provides upfront cash flow.

Advantages:

- Allows businesses to fulfill financial obligations while waiting for the bill to mature.

- Common in domestic and international trade.

Example: A manufacturer issues a usance bill with a 90-day maturity period. The manufacturer discounts the bill to get immediate funds.

Benefits of Bill Discounting

Bill discounting is a financial service that allows businesses to raise funds by selling their trade receivables (bills of exchange) to a financial institution at a discount before the due date. It helps businesses manage liquidity, cash flow, and operational stability. Below is a detailed explanation of its benefits:

1. Immediate Access to Cash

Bill discounting provides businesses with immediate cash against their unpaid bills, which are due at a future date.

How It Works:

Businesses submit bills of exchange (post-dated customer invoices) to a financial institution or bank. The institution pays a discounted amount upfront, and the full payment is collected from the customer on the due date.

Why It’s Important:

- Helps businesses avoid cash flow shortages.

- Ensures availability of funds for operational expenses like salaries, raw materials, and utilities.

2. Maintains Liquidity Without Additional Debt

Unlike loans, bill discounting is not treated as a liability on the balance sheet. It allows businesses to leverage their receivables without increasing their debt.

Advantages:

- No impact on credit score.

- Businesses can secure funding without collateral, depending on the creditworthiness of the customer.

3. Cost-Effective Financing

The discount rate (interest charged on the bill amount) is often lower than the interest rate for traditional loans, making bill discounting a cost-effective option.

Why It’s Beneficial:

- Reduces the cost of capital for businesses.

- No hidden charges or long-term interest burdens.

4. Accelerates Business Growth

With immediate cash flow, businesses can reinvest funds into growth activities such as expanding operations, upgrading equipment, or increasing inventory.

How It Drives Growth:

- Businesses can take on larger orders without worrying about delays in customer payments.

- Improves overall financial agility.

5. Improved Cash Flow Management

Bill discounting helps businesses bridge the gap between sales and cash collection, ensuring uninterrupted operations.

Key Benefits:

- Reduces the working capital cycle.

- Avoids cash shortages, especially during peak demand periods.

6. Reduces Credit Risk

By selling receivables to a financial institution, businesses can transfer the risk of customer default (in some cases, depending on the agreement).

Non-Recourse Discounting:

In non-recourse agreements, the financial institution assumes the risk of non-payment by the customer.

Impact:

- Reduces the financial strain on businesses in case of customer insolvency.

7. Enhances Supplier and Vendor Relationships

With improved cash flow, businesses can pay suppliers on time or even take advantage of early payment discounts.

Advantages:

- Builds stronger supplier trust and partnerships.

- Positions the business as a reliable partner in the supply chain.

8. No Collateral Requirement

Bill discounting typically does not require businesses to pledge assets as collateral, as the receivables themselves serve as security.

Why It Matters:

- Ideal for small and medium enterprises (SMEs) that lack tangible assets for collateral.

- Reduces barriers to accessing finance.

9. Boosts Financial Efficiency

Outsourcing receivables management to financial institutions simplifies financial processes for businesses.

How It Helps:

- Reduces administrative burden.

- Allows the business to focus on core activities like sales, marketing, and production.

10. Flexible Financing Option

Bill discounting is highly flexible, as businesses can discount bills as and when needed.

Advantages:

- No fixed borrowing schedule, unlike traditional loans.

- Suitable for seasonal businesses or industries with fluctuating cash flow needs.

11. Competitive Edge in the Market

With steady cash flow, businesses can meet customer demands promptly, maintain quality, and expand their market share.

Why It’s Valuable:

- Avoids delays in project execution or product delivery.

- Improves customer satisfaction and retention.

12. Helps Businesses Build Creditworthiness

Timely payment of obligations with funds from bill discounting enhances a business’s reputation in the market.

Long-Term Benefits:

- Strengthens relationships with creditors and investors.

- Facilitates better access to credit in the future.

Risks of Bill Discounting

- Costly Transaction: The discounting fee reduces profit margins.

- Legal Implications: Personal guarantees may lead to legal issues in case of default.

- Bad Debt Risk: If the buyer defaults, the business bears the loss.

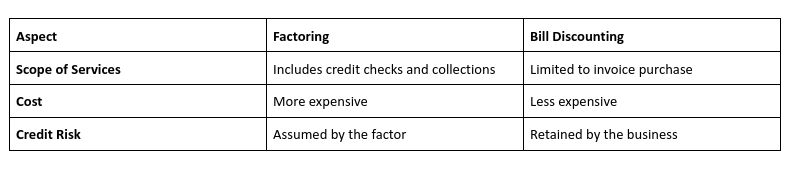

Factoring vs. Bill Discounting: Key Differences

Why Choose Factoring Over a Loan?

Quick Cash Access: Factoring provides immediate funds, unlike loans that require lengthy approval processes.

No Collateral Needed: Invoices serve as security, making factoring suitable for asset-light businesses.

Improved Risk Management: Factors assume credit risk, reducing financial uncertainty.

Conclusion

Factoring and bill discounting are valuable financial tools for businesses seeking immediate cash flow solutions. While factoring offers a comprehensive package with added services, bill discounting is a straightforward arrangement for short-term funding.

Understanding the nuances of both options helps businesses make informed decisions tailored to their needs. By leveraging these tools effectively, companies can manage cash flow, fulfill obligations, and ensure sustained growth.