[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12828″ img_size=”full” css=”.vc_custom_1715061163563{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]The Harmonised System of Nomenclature (HSN) is a global system used to classify products with names and numbers. It helps categorize goods for trade purposes. Each country has its own customs tariff schedule using HSN codes. In India, the Goods and Services Tax (GST) uses HSN codes to classify goods nationwide. This system simplifies the process of identifying and taxing goods under GST.

Let’s learn more about HSN codes, their format, and how they’re used in the GST system.

What is HSN Code?

An HSN code stands for Harmonised System of Nomenclature. It’s a code made up of 2, 4, 6, or 8 digits that categorizes over 5,000 products worldwide. In India, every item is assigned an HSN code under the GST system. Each code is unique and helps in managing taxes, filing returns, and other related tasks.

Importance of HSN Code

Here are some of the major reasons why HSN code is important:

Determines GST Rate: HSN code plays a crucial role in determining the applicable GST rate for products, ensuring businesses comply with tax regulations accurately.

Product Classification: It helps businesses correctly classify their products, facilitating streamlined operations and accurate tax calculations.

Accurate Tax Calculation: By providing a standardized classification system, HSN codes enable businesses to calculate the correct GST rate for their products, preventing miscalculations and potential penalties.

GST Invoicing Compliance: HSN codes are essential for GST invoicing compliance, ensuring that invoices contain accurate information regarding the classification of goods.

Simplified Documentation: With HSN codes, detailed descriptions of goods are no longer necessary, simplifying documentation processes for both businesses and tax authorities.

Enhanced Understanding: The use of HSN codes enhances understanding between businesses and tax authorities, as it provides a standardized method for identifying and categorizing goods.

Data Utilization: HSN code data can be utilized for various purposes, including policy-making, revenue collection, and analysis, contributing to efficient governance and economic decision-making.

Importance and Requirement of HSN Codes in Business

The HSN code serves to standardize the classification of goods worldwide, ensuring consistency across borders. In India, businesses with an annual turnover exceeding Rs.1.5 crore must use GST HSN codes. Additionally, it’s mandatory for businesses involved in import or export activities. Even for businesses below this turnover threshold, mentioning the GST HSN code on invoices is obligatory.

Moreover, as an internationally recognized classification system, the HSN code facilitates tracking of domestic and global trade movements. Governments utilize this data to formulate trade-related policies and for statistical analysis, enhancing decision-making processes.

The Structure of HSN Codes

Understand the structure of HSN codes below:

HSN Code Components

- HSN codes comprise six digits, with each digit representing a specific classification level.

- The first 2 digits denote the chapter, followed by 2 digits for the heading, and the last 2 digits for the subheading.

Classification Levels

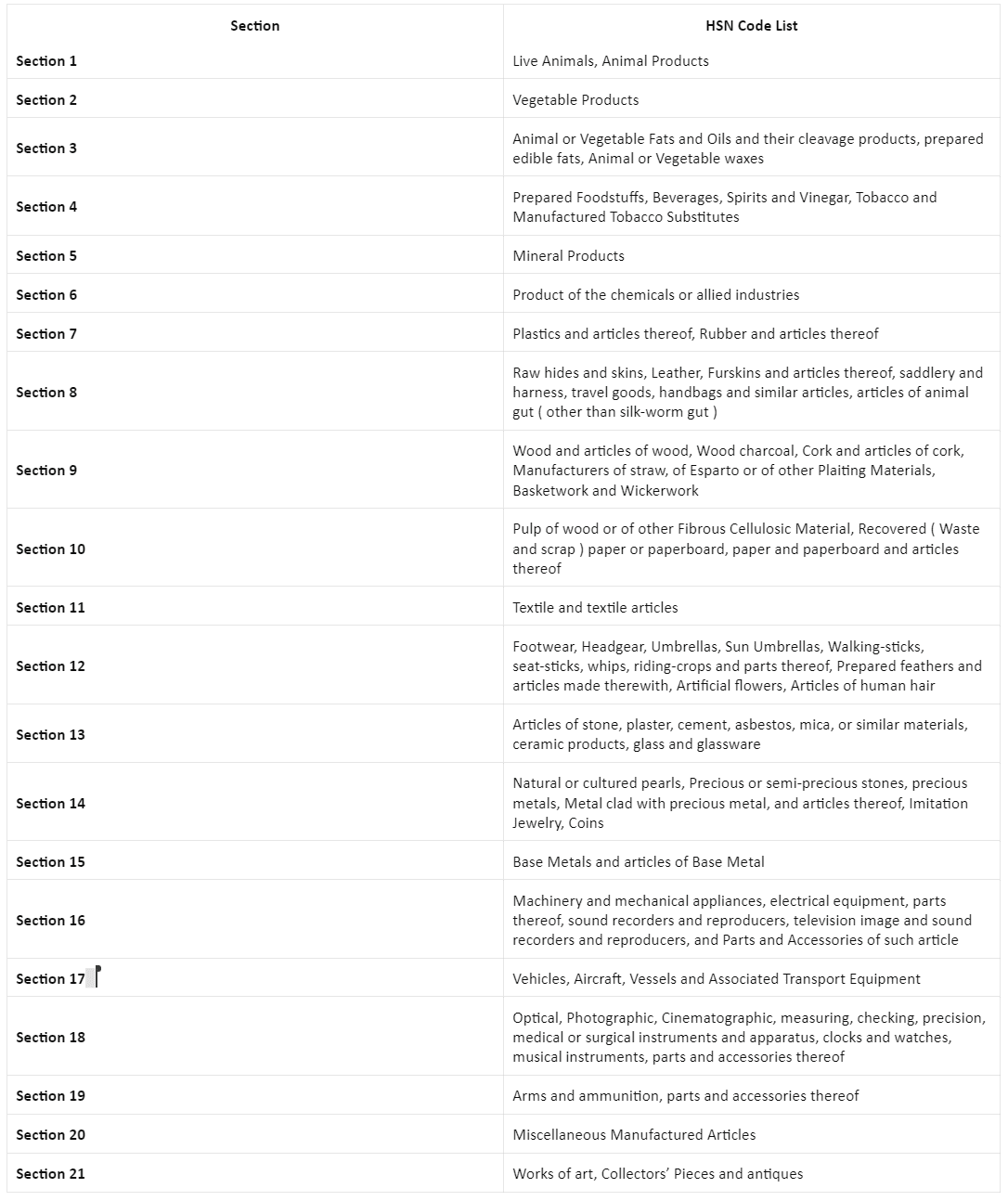

- Chapters: There are 21 chapters in total, with each chapter broadly categorizing goods across various industries.

- Headings: Within each chapter, there are 99 headings that further classify goods based on their characteristics.

- Subheadings: Under each heading, there are 1244 subheadings that provide detailed classification for specific types of goods.

Example: Television Set (HSN Code 85.28.12.11)

- Chapter (85): Represents the overarching category of electrical machinery and equipment.

- Heading (28): Refines the classification to television sets specifically.

- Subheading (12): Further specifies the type or model of the television set.

- Last 2 Digits (11): Sub-classifies the product for import and export purposes.

Example: Packet of Biscuits (HSN Code 1905)

Chapter (19): Corresponds to the broader category of food products.- Heading (05): Identifies the specific classification for biscuits.

- Note: Additional ingredients or variations may alter the HSN code, reflecting the specific characteristics of the product.

List of HSN Code List

Who Provides HSN Code?

The Harmonized System of Nomenclature (HSN) code is provided by the Directorate General of Foreign Trade (DGFT), serving as the primary authority for this classification system. Additionally, the HSN code can be accessed on the Central Board of Indirect Taxes and Customs (CBIC) website, offering convenient access for businesses and individuals requiring this information.

How to Use HSN Code Finder?

By following these simple steps below, you can efficiently use the HSN Code Finder tool to identify the correct HSN code for your products or services.

Step 1: Access the CBIC portal and log in to your account.

Step 2: In the search bar at the top of the page, enter a brief description of the goods or services your business deals with. For instance, if your business involves trading in cereals, type “Cereals” into the search box.

Step 3: Press enter to initiate the search. A list of goods or services matching your description will appear.

Step 4: Carefully review the list and select the item that best matches the description of your enterprise.

Step 5: Once you’ve identified the relevant item, note down the corresponding HSN code provided on the left side of the description column.

HSN Codes and GST

The HSN code, a globally recognized classification system, plays a crucial role in ensuring accurate classification and taxation of goods. Introduced by the Indian Government in 2017 under the GST regime, it has significantly improved the country’s tax structure by overcoming previous loopholes. Used to classify goods across various industries, the HSN code aids in levying taxes on goods and services throughout India. Additionally, GST rates categorize goods into different tax slabs.

Depending on their turnover, dealers are required to adopt 2, 4, 6, or 8-digit HSN codes for their commodities. Dealers with turnovers below Rs. 1.5 crore are exempt from HSN code adoption, while those with turnovers exceeding Rs. 5 crore must utilize 4-digit HSN codes. Moreover, to align with international standards, 8-digit HSN codes are mandatory for imports and exports under GST.

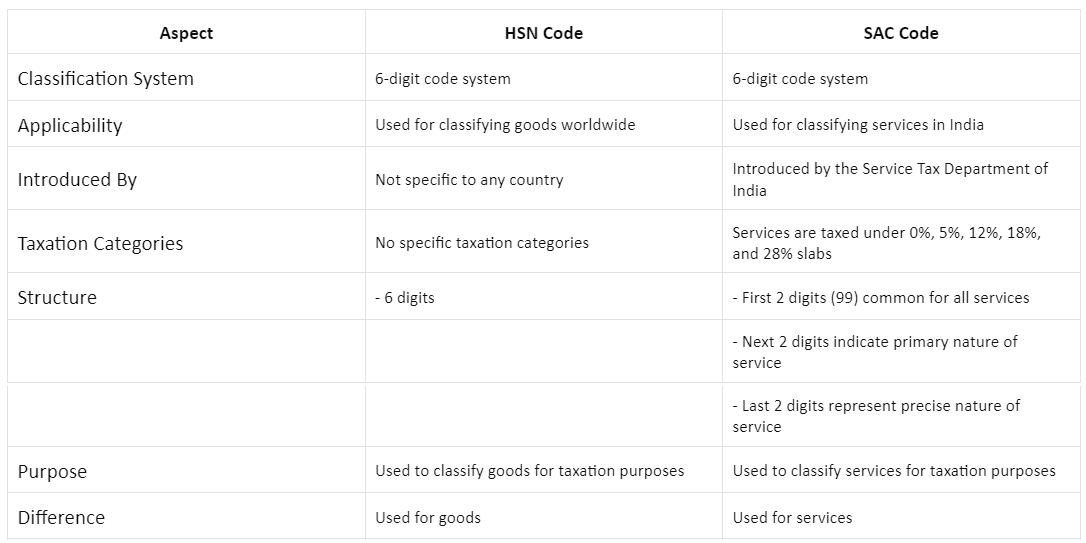

Difference Between HSN Code and SAC Code

Here’s the difference between HSN code and SAC code:

Conclusion

Understanding HSN codes and their role in the GST system is crucial for businesses operating in India. These codes streamline the process of classifying goods, determining applicable tax rates, and ensuring compliance with GST regulations. With the implementation of HSN codes, businesses can accurately calculate taxes, simplify invoicing procedures, and contribute to the overall efficiency of the tax system.

Moreover, the availability of online tools like the HSN Code Finder facilitates easy access to relevant classification information, further enhancing compliance and operational efficiency. Embracing HSN codes is not just a regulatory requirement but also a strategic approach towards fostering transparency and accountability in business transactions.[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]