[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12569″ img_size=”full” css=”.vc_custom_1712557761693{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]At the 39th GST Council meeting, the GST rate on mobile phones and accessories was raised from 12% to 18% starting April 1, 2020. Additionally, Budget 2023 proposed an increase in import duty on materials used for making phones, further impacting prices. In this article, we delve into the GST rates for mobile phones and accessories, the import duty’s effect, and whether GST on mobile phones can be claimed as input tax credit.

These measures contribute to higher mobile phone prices, affecting consumers and businesses alike. Understanding these changes is crucial for navigating the evolving landscape of mobile phone taxation and pricing.

How GST Affected Mobile Phone Prices

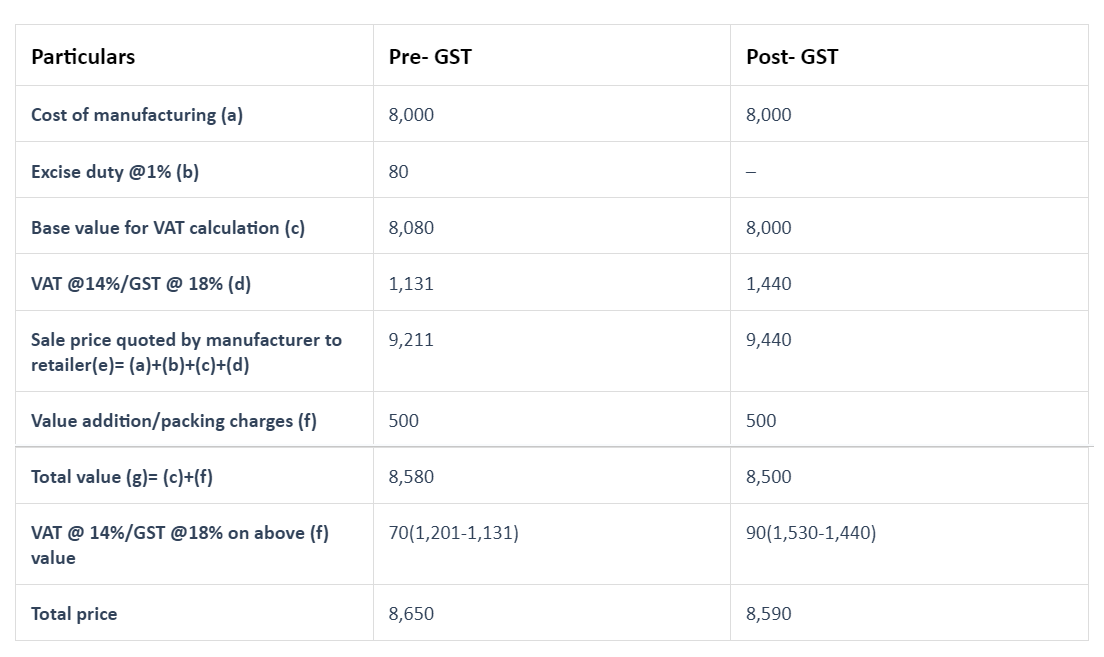

Before GST, mobile phones were subject to excise and VAT, with varying rates across states, making it challenging to establish a consistent price. However, GST brought uniformity by imposing the same tax rate nationwide. This allows for a standard price to be set for mobile phones across the country. Currently, the GST rate on mobile phones stands at 18%, ensuring simplicity and consistency in pricing for consumers.

Comparing Mobile Phone Prices: Pre-GST vs. Post GST

Here’s a quick comparison between mobile phone prices pre-GST and post GST.

“GST made mobile phones cheaper by getting rid of tax-on-tax.”

GST Applicable on Mobile Phones

GST has been a big change for India’s economy, making taxes simpler. Now, every mobile phone, whether it’s a smartphone or a basic feature phone, is subject to GST without any exceptions. This means that all phones are taxed at the same rate under GST, helping to create a more uniform tax system for mobile devices.

CGST, SGST, and IGST on Mobile Phone Purchases

When buying a mobile phone from a dealer in the same state or Union Territory, like Mr. X, you pay both CGST and SGST, each at 9%. However, if purchasing from a dealer in another state or Union Territory, you pay IGST at 18%. For example, when buying from an e-commerce vendor. This distinction in tax rates depends on whether the transaction occurs within the same state (intra-state) or across different states (inter-state), ensuring clarity and consistency in taxation for mobile phone purchases under the GST system.

Nature of Composite Supply

Under GST, a composite supply refers to a supply consisting of two or more goods or services that are naturally bundled together and typically provided together in the ordinary course of business. These items cannot be supplied separately. Within a composite supply, one component is considered the principal supply, and its GST rate determines the tax treatment for the entire supply when invoiced.

For mobile phones, the handset is commonly supplied alongside accessories like the charger and USB cable, essential for its operation. Therefore, the GST rate applicable to the mobile phone also extends to these accessories. This ensures uniformity in taxation for the complete bundle of goods.

However, some brands may include additional items such as earphones with the mobile phone, which are not inherently bundled and fall under the category of mixed supplies. In such cases, the GST treatment may differ, as these items are not essential for the basic functioning of the mobile phone.

Understanding the nature of composite supply is vital for businesses to determine the appropriate GST treatment for bundled goods and ensure compliance with GST regulations.

By identifying the principal supply and considering the nature of the bundled goods, businesses can accurately apply the relevant GST rates and fulfill their tax obligations under GST.

Value of Supply to Compute GST on Mobile Phones

Value of Supply: Under GST, the value of supply refers to the money collected by the seller from the buyer for selling goods or services. When dealing with related parties, GST is charged based on the transaction value, which is the amount that unrelated parties would typically transact for similar goods or services.

Exchange Offers: Smartphone dealers often offer exchange programs where customers can trade in their old phones for new ones by paying the price difference. While this reduced price was not taxable under the previous VAT regime, GST now considers barter transactions as part of the supply. This means that even the reduced price in exchange offers is subject to GST. For instance, if a new phone is sold for Rs. 20,000 in exchange for an old phone, which would have cost Rs. 25,000 without exchange, GST will be charged on the full value of Rs. 25,000.

Exclusion of Discounts: Discounts such as trade discounts or quantity discounts are common in business transactions. These discounts, if clearly stated on the invoice, are excluded from the taxable value for GST purposes. However, for discounts to be excluded, they must be reflected on the relevant invoices, and any Input Tax Credit (ITC) claimed on the discount must be reversed as per the credit note. This ensures that only the actual value of the goods or services sold is subject to GST, without including any discounts provided.

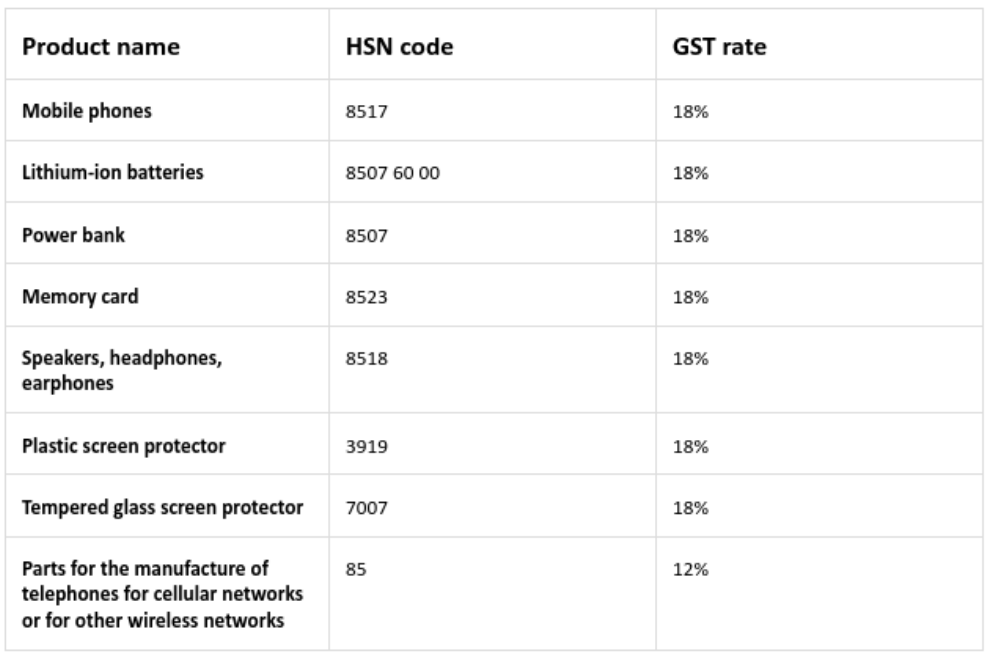

GST Rates on Mobile Phones and Its Related Products

In the pre-GST era, smartphone prices fluctuated due to varying state taxes. However, under GST, a consistent 18% tax rate is applied nationwide. Mobile phones and accessories fall under HSN chapter 85, with HSN code 8517 specifically assigned to them. Below are the GST rates for mobile phones and accessories.

GST on Import of Mobile Phones

In Budget 2023, a welcome change was made to the import duty on certain components used in manufacturing mobile phones. The duty on camera lenses and various parts, including the camera module, was reduced to nil, down from the previous 2.5% customs duty. This move aims to encourage local manufacturing and reduce production costs for mobile phone manufacturers.

Furthermore, the duty exemption for the import of lithium-ion cells, crucial for making batteries or battery packs of cellular mobile phones, was extended until March 31, 2024. This extension provides a continued incentive for the import of essential components necessary for mobile phone production.

However, Budget 2020 brought some adjustments. Previously, mobile phones were exempted from a 10% social welfare surcharge. However, the Union Budget 2020 reinstated this surcharge on imported mobile handsets, in addition to the existing 20% basic customs duty. Consequently, this made imported mobile phones more expensive compared to locally manufactured ones, aligning with the government’s focus on promoting domestic production.

When importing mobile phones, the value for calculating the Integrated Goods and Services Tax (IGST) is determined by adding the assessable value of the goods, basic customs duty, and any other applicable duty under current laws. This comprehensive approach ensures that all imports of mobile phones are subject to the appropriate taxation, contributing to the overall price increase of imported mobile phones in India.

These changes in import duties reflect the government’s efforts to boost local manufacturing, reduce dependency on imports, and promote the Make in India initiative. While they may lead to short-term price adjustments, the long-term benefits include job creation, economic growth, and a stronger domestic manufacturing ecosystem.

Claiming Input Tax Credit (ITC) on Mobile Phones: Conditions and Requirements

Input tax credit (ITC) can indeed be claimed on mobile phones, provided certain conditions are met. Firstly, the mobile phone must be purchased for business purposes and used in the course of business activities. Additionally, the tax invoice must contain essential details such as the company’s name, address, GSTIN, HSN code, and the GST amount charged.

Furthermore, the buyer company’s information, including name, address, and GSTIN, must also be present on the invoice. It’s crucial to ensure compliance with other ITC rules, including the receipt of the mobile device by the recipient, and confirmation that the supplier has filed GST returns and paid the due tax to the government.

Impact of GST on Mobile Phone Prices: Benefits and Challenges

The implementation of GST has significantly impacted mobile phone prices in India. Previously, under the VAT regime, mobile phones were subject to varying tax rates across states, ranging from 5% to as high as 14%. This led to price disparities, with consumers often opting to purchase from dealers in states with lower tax rates.

However, with the introduction of GST, a uniform tax rate of 18% is applied nationwide, bringing consistency to mobile phone prices across the country. While this has made mobile phones slightly more expensive, it has also eliminated the cascading effect of taxes, resulting in overall tax savings for businesses and consumers alike.

Despite the benefits of uniform pricing and tax savings, there are still unresolved issues surrounding GST’s impact on mobile phone prices. Some consumers may find the higher tax rate burdensome, particularly those accustomed to lower tax rates in certain states. Additionally, concerns remain regarding the overall affordability of mobile phones, especially for budget-conscious consumers. Addressing these issues will be crucial for ensuring the smooth transition and continued success of GST in the mobile phone industry.

Benefits to Smartphone Dealers Under GST

Sales Growth: With mobile phones becoming an essential commodity, dealers with GST registration witness an increase in sales volume due to the rising demand for smartphones.

Competitive Environment: Uniform tax rates under GST foster healthy competition among smartphone dealers, leading to better pricing strategies and enhanced customer service.

Level Playing Field: The standardization of tax rates across the nation eliminates the advantage enjoyed by dealers in states with lower VAT rates, creating a fair playing field for all.

Reduced Online Advantage: Previously, e-commerce players capitalized on the disparity in VAT rates by sourcing mobile phones from states with lower taxes. However, under GST, the gap between online and retail prices has narrowed, mitigating the online advantage.

Simplified Taxation: The implementation of GST streamlines the taxation process for smartphone dealers, making it simpler and more efficient to comply with tax regulations.

Enhanced Business Efficiency: With a simplified taxation system, smartphone dealers can focus more on business operations and growth strategies, rather than navigating complex tax structures.

Improved Consumer Confidence: The transparency and standardization brought about by GST instill greater confidence in consumers, leading to increased trust and loyalty towards authorized smartphone dealers.

The implementation of GST has revolutionized the taxation system for mobile phones in India. While it has led to uniform pricing and tax savings, there are challenges and unresolved issues to address. Despite this, GST has brought numerous benefits for smartphone dealers, including sales growth, a competitive environment, and simplified taxation. Moving forward, it will be essential to address consumer concerns and ensure continued success by fostering transparency, efficiency, and fairness in the mobile phone industry under the GST regime.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]