[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12673″ img_size=”full” css=”.vc_custom_1713768327185{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In the world of global trade, smooth financial transactions are key. To make it easy and seamless, AD Code (Authorized Dealer) Registration comes into play. A better grasp of AD can make it very convenient for you. Understanding and mastering this process doesn’t have to be daunting.

Our guide is here to simplify AD Code Registration and Format, making it easy to grasp. From why AD Codes matter for international transactions to how to handle the necessary paperwork, we’ve got you covered.

Join us on this journey as we explore the ins and outs of AD Code Registration, helping you confidently navigate the global market and expand your business horizons.

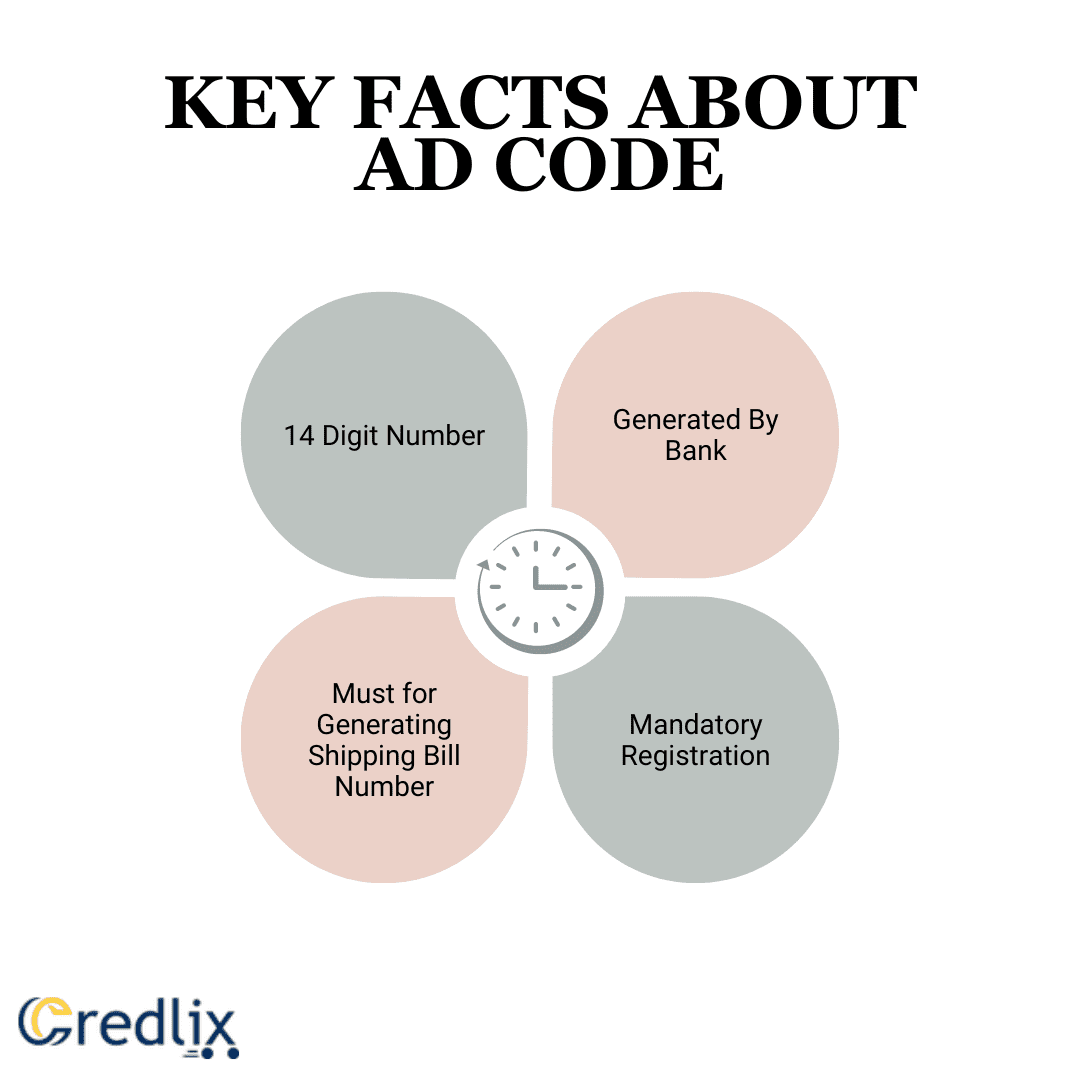

Key Facts About AD Code

Here are some of the key facts about AD Code:

14 Digit Number: An AD Code (Authorized Dealer Code) consists of a unique 14-digit numerical sequence. This alphanumeric code serves as a distinct identifier for each business entity’s transactions related to foreign trade.

Generated By Bank: AD Codes are generated and provided by authorized banks to their customers. When a business opens a current account with a bank, the bank assigns an AD Code to that account, linking it to the business’s international transactions.

Mandatory Registration: Registering for an AD Code is mandatory for businesses engaging in import and export activities. Without an AD Code, businesses cannot conduct foreign trade transactions through authorized channels.

Must for Generating Shipping Bill Number: AD Code is a prerequisite for generating a shipping bill number. When exporting goods, businesses need to provide their AD Code to the customs authorities to obtain a shipping bill number, which is essential for clearing goods through customs and facilitating their shipment to international destinations.

What is AD Code?

An AD Code (Authorized Dealer Code) is a 14-digit numerical identifier issued by your bank, linked to your business’s current account. It’s necessary to register an AD Code at each port where your goods undergo customs clearance. During customs processing, your Customs House Agent (CHA) will request the AD Code specific to that port. This code streamlines financial transactions and ensures compliance with customs regulations.

AD Code With an Example

Let’s say you own a company called “Global Imports Inc.,” based in Delhi, India, and you frequently import goods through various ports across the country. Your company holds a current account with XYZ Bank.

When you import goods through the Mumbai port, your Customs House Agent (CHA) handling the clearance process will request your AD Code specific to Mumbai. This AD Code, provided by XYZ Bank, serves as a unique identifier for your business transactions related to the Mumbai port. It ensures smooth financial transactions and compliance with customs regulations during the import process.

Similarly, if you import goods through the Chennai port, your CHA will request the AD Code specific to Chennai, which would also be provided by XYZ Bank. Each AD Code corresponds to a specific port, simplifying the customs clearance process and streamlining your import operations across different locations.

Benefits of AD Code in Export

Understand the benefits of AD code in Export:

Facilitates Customs Clearance: Having an AD Code streamlines the customs clearance process for exporters, enabling smoother and quicker processing of export shipments.

Enables Access to Foreign Exchange: AD Code allows exporters to access foreign exchange services provided by authorized banks, facilitating international trade transactions.

Ensures Compliance: AD Code registration ensures compliance with regulatory requirements, as it is a mandatory prerequisite for conducting export transactions through authorized channels.

Simplifies Documentation: With an AD Code, exporters can easily complete export documentation, including filing shipping bills and obtaining export certificates, reducing administrative hassles.

Facilitates Export Incentives: Exporters with an AD Code are eligible to avail themselves of various export incentives and benefits provided by government schemes, enhancing competitiveness in international markets.

Improves Transparency: AD Code registration enhances transparency in export transactions, as all financial transactions are linked to a unique identifier, reducing the risk of errors and fraud.

Expedites Payment Realization: Having an AD Code facilitates the smooth realization of export proceeds, as banks can easily track and process payments related to export transactions.

Supports Online Transactions: AD Code enables exporters to conduct online transactions related to export documentation and foreign exchange transactions, offering convenience and efficiency.

Enhances Credibility: Possessing an AD Code enhances the credibility of exporters in the international market, signaling compliance with regulatory standards and facilitating trust among trading partners.

Opens Access to Export Finance: With an AD Code, exporters can access export finance facilities such as pre-shipment and post-shipment finance, enabling them to fulfill export orders and expand their business globally.

Also Read: Everything About Export Finance Scheme

How to Apply for an AD Code

Here’s a detailed step-by-step guide on how to apply for an AD Code:

Identify a Suitable Bank: Look for a bank that deals in foreign currency or is authorized as a dealer for forex transactions. Ensure the bank has branches at the ports from which you intend to export your goods.

Prepare a Letter to the Bank: Draft a formal letter addressed to the branch manager of the chosen bank requesting the issuance of an AD Code against your business’s account. The letter should be written in the prescribed format provided by the Directorate General of Foreign Trade (DGFT).

Submission of the Letter: Submit the letter to the branch manager of the bank either physically or through electronic means, as per the bank’s preferred mode of communication.

Processing by the Bank: The bank will process your application and verify the details provided in the letter. This may involve confirming your business’s account details and ensuring compliance with regulatory requirements.

Issuance of the AD Code:Upon approval, the bank will issue a 14-digit AD Code on its letterhead, adhering to the format specified by the DGFT. This code serves as a unique identifier for your business’s export transactions.

Registering the AD Code with the Customs House Agent (CHA): Once you receive the AD Code from the bank, you need to register it with the Customs House Agent (CHA) responsible for customs clearance at the port from which you intend to export your goods. This step ensures that your export transactions are aligned with customs regulations.

Port-wise Registration: It’s important to note that you’ll need separate AD Codes for each port from which you export goods. For example, if you export goods from both Mundra and Ankleshwar ports in Gujarat, you’ll require separate AD Codes for each port.

Registration with CHA House: Registering your AD Code with the CHA House ensures that all basic information about your business and shipping consignments is recorded and processed correctly. This registration facilitates seamless coordination between your business, customs authorities, and other relevant stakeholders.

Verification and Visibility on ICEGATE: Once the registration process is complete, all relevant information about your business and export transactions will be accessible on the ICEGATE website. This platform serves as a centralized portal for managing customs-related activities and ensures transparency and efficiency in the export process.

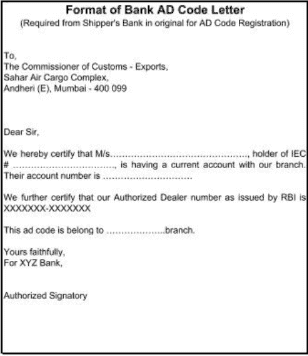

AD Code Format

The AD Code (Authorized Dealer Code) follows a specific format prescribed by the Directorate General of Foreign Trade (DGFT) in India. It is a 14-digit alphanumeric code that serves as a unique identifier for businesses engaged in foreign trade transactions. The format of the AD Code typically consists of the following components:

Bank Code (4 digits): The first four digits of the AD Code represent the code assigned to the bank by the Reserve Bank of India (RBI). This portion identifies the bank that issued the AD Code to the business.

Branch Code (3 digits): The next three digits indicate the code assigned to the specific branch of the bank where the business holds its current account. This portion distinguishes between different branches of the same bank.

Unique Serial Number (7 digits): The remaining seven digits constitute a unique serial number assigned by the bank to the business’s AD Code. This portion serves as a unique identifier for the business within the bank’s system.

Here’s an example of how the AD Code format might appear:

Register AD Code with Customs

Once your bank issues you an AD Code, the next step is to register it with customs authorities. To complete this process, you’ll need to engage with a Customs House Agent (CHA) and provide the following documents:

AD Code Registration Authority Letter: This letter is issued by your bank and confirms the allocation of your AD Code.

Self-Attested Copies of the Following Documents:

- GST registration certificate

- Last three years’ Income Tax returns of the company or self and partners

- Bank statements covering the last 12 months

- Company’s Import-Export (IE) Code

- Company’s PAN card

- Board resolution (if applicable)

- Partners’ PAN, Aadhaar card, and voter ID/passport

- Signatory’s PAN, Aadhaar card, and voter ID/passport (along with originals for verification)

- Export House Certificate (optional)

The CHA will collect these documents from you and submit them to customs on your behalf. Typically, this process takes around 3 to 4 working days.

Once your AD Code is registered, it remains valid for a lifetime at the specific port where you registered it. It’s important to note that you’ll need to repeat this registration process at every port from which you intend to clear customs and export goods.

Upon successful registration, if your shipping bill is generated through the Electronic Data Interchange (EDI) system during export filing, it indicates that your AD Code registration is complete, ensuring smooth transactions and compliance with customs regulations.

Understanding AD Code registration and format is essential for smooth global trade. This guide has shed light on how AD Codes streamline financial transactions and simplify exporting. By learning how to apply for an AD Code, its format, and how to register it with customs, you’re equipped to confidently navigate international markets. Remember, AD Code registration isn’t just a formality; it’s a strategic move to ensure compliance and open doors to new opportunities worldwide. So, take these insights and dive into the world of global trade with confidence, knowing you’re prepared to make your mark.

Also Read: What is Export Finance in International Marketing?[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]