[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12629″ img_size=”full” css=”.vc_custom_1713255409749{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Exporting goods can be a lucrative venture, but it often comes with its own set of challenges, particularly in terms of managing cash flow. One effective financial instrument that exporters can utilize to address cash flow issues is bill discounting.

In this comprehensive guide, we will delve into the concept of bill discounting, its benefits for exporters, how it works, and key considerations to keep in mind.

What is Bill Discounting

Bill discounting, also known as invoice discounting of receivables financing, is a financial arrangement wherein a seller (exporter) receives immediate funds by selling their trade receivables or invoices to a financial institution (usually a bank or a specialized financing company) at a discount. Essentially, it allows exporters to unlock the value of their outstanding invoices before their payment due date.

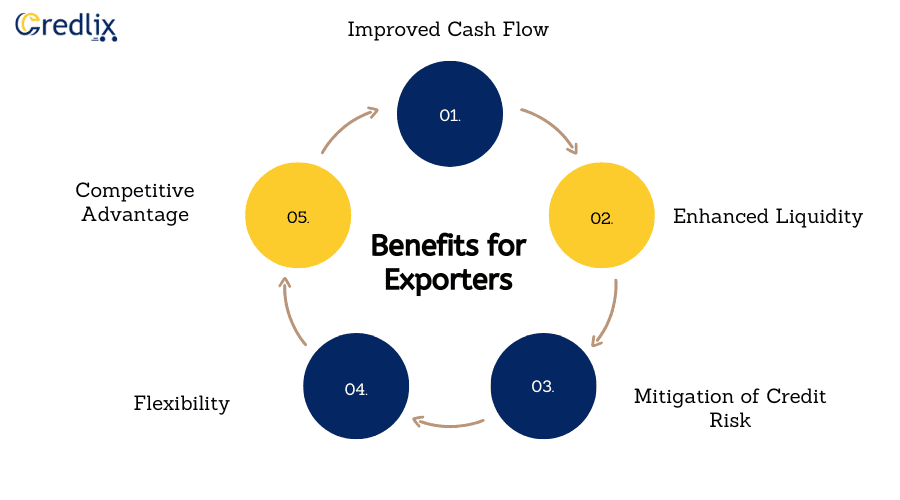

Benefits for Exporters

Here are the major benefits for exporters:

Improved Cash Flow

Bill discounting significantly improves cash flow for exporters by providing them with immediate access to funds. Instead of waiting for customers to settle invoices, exporters can receive a portion of the invoice value upfront from the financial institution.

This liquidity injection allows exporters to meet their working capital requirements promptly. They can use the funds to pay suppliers on time, cover operational expenses, and invest in business growth initiatives without experiencing cash flow constraints.

Enhanced Liquidity

Converting accounts receivable into cash through bill discounting enhances exporters’ liquidity position. Cash liquidity is vital for businesses to operate smoothly and seize growth opportunities. With improved liquidity, exporters have the financial flexibility to navigate unforeseen expenses, capitalize on market opportunities, and withstand economic fluctuations.

Enhanced liquidity also bolsters the financial stability of exporters, making them better equipped to weather challenges and sustain long-term growth.

Mitigation of Credit Risk

Bill discounting helps exporters mitigate credit risk associated with trade receivables. By selling invoices to a third-party financial institution, exporters transfer the credit risk of non-payment or late payment to the buyer. The financial institution assumes responsibility for collecting payments from customers, reducing the exporter’s exposure to default risks.

This risk mitigation strategy safeguards exporters’ financial health and protects them from potential losses arising from payment delays or defaults by customers.

Flexibility

One of the key advantages of bill discounting is its flexibility in terms of financing amount and timing. Exporters can tailor the bill discounting arrangement to suit their specific cash flow requirements and business cycles. They have the freedom to discount individual invoices or batches of invoices as needed, without being bound by rigid borrowing structures.

This flexibility empowers exporters to optimize their financing strategies, maintain adequate liquidity, and respond promptly to changing market dynamics or business needs.

Competitive Advantage

Access to timely financing through bill discounting confers a competitive advantage on exporters. By accelerating cash flow and improving liquidity, exporters can offer more attractive payment terms to customers, such as discounts for early payment or extended credit periods. This flexibility in payment terms can enhance customer satisfaction, strengthen business relationships, and differentiate exporters from competitors.

Moreover, with sufficient liquidity at their disposal, exporters can capitalize on emerging opportunities, expand their market presence, and gain a foothold in new territories, thereby bolstering their competitive position in the global marketplace.

How Bill Discounting Works

Understand how bill discounting works:

Agreement

The process of bill discounting begins with the exporter and the financial institution entering into a formal agreement. This agreement outlines the terms and conditions governing the bill discounting arrangement.

These terms typically include crucial details such as the discount rates applied to the invoices, any recourse provisions in case of default by the exporter or their customers, and the repayment terms for the discounted amount.

Submission of Invoices

Once the agreement is in place, the exporter submits their invoices or bills of exchange to the financial institution. Along with the invoices, the exporter provides relevant documentation supporting the validity and authenticity of the invoices.

This documentation may include purchase orders, shipping documents, and any other relevant paperwork that verifies the transaction and the debt owed by the customers to the exporter.

Discounting

Upon receipt of the invoices, the financial institution conducts a thorough verification process to ensure the authenticity of the invoices and assesses the creditworthiness of the exporter’s customers. Based on this assessment, the financial institution decides the amount it is willing to advance to the exporter.

Typically, this advance ranges from 70% to 90% of the total invoice value. The financial institution deducts a discount or fee from this advance amount, which serves as its compensation for providing the financing.

Collection

Following the discounting process, the financial institution assumes the responsibility of collecting payments from the exporter’s customers on the due date of the invoices. This relieves the exporter of the burden of chasing payments and managing accounts receivable.

The financial institution uses its resources and expertise to ensure timely collection from customers, thereby reducing the risk of payment delays or defaults.

Settlement

Once the customers settle the invoices on their due dates, the financial institution receives the payment on behalf of the exporter. From this payment, the financial institution deducts the discounted amount advanced to the exporter, along with any applicable fees or charges.

The remaining balance, representing the invoice value minus the discount and fees, is remitted to the exporter. This settlement process completes the bill discounting transaction, allowing the exporter to access immediate funds while retaining ownership of their accounts receivable.

Key Considerations

When considering bill discounting, here are the key things to always keep in the back of your mind:

Cost: Exporters should carefully evaluate the cost of bill discounting, including discount rates, processing fees, and any other charges, to assess the overall affordability and feasibility of the arrangement.

Creditworthiness: Financial institutions typically assess the creditworthiness of both the exporter and their customers before approving bill discounting facilities, so exporters should maintain good credit standing and deal with reputable buyers.

Recourse vs. Non-Recourse: Exporters should understand whether the bill discounting arrangement is recourse or non-recourse. In recourse financing, the exporter remains liable for unpaid invoices, while in non-recourse financing, the financial institution assumes the credit risk.

Confidentiality: Some financial institutions offer confidential bill discounting facilities, wherein the exporter’s customers are not notified of the arrangement, preserving business relationships and reputation.

Regulatory Compliance: Exporters must ensure compliance with relevant laws, regulations, and accounting standards governing bill discounting transactions in their jurisdiction.

Conclusion

Bill discounting offers exporters a powerful financial tool to optimize cash flow, enhance liquidity, and mitigate credit risk. By understanding the fundamentals of bill discounting, evaluating its benefits and considerations, and working with reputable financial institutions, exporters can effectively leverage this financing option to support their export activities and drive business growth.

However, it’s essential to conduct thorough due diligence and seek professional advice to make informed decisions tailored to their unique circumstances and objectives.

Also Read: Export Factoring vs. Bill Discounting: Which Financing Option is Right for You?[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]