[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”13073″ img_size=”full” css=”.vc_custom_1718085066400{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In the world of business, especially for small and medium-sized enterprises (SMEs), cash flow can be a significant challenge. One solution to this problem is purchase order financing. This financial tool helps businesses fulfill large orders that they might otherwise have to turn down due to insufficient capital. In this blog, we will take a deep dive into how purchase order financing works, step by step, so you can understand its mechanics and benefits.

What is Purchase Order Financing?

Purchase order financing (PO financing) is a funding solution that allows businesses to obtain the necessary capital to fulfill customer orders. It is particularly useful for businesses that receive large orders but lack the funds to pay their suppliers upfront. PO financing companies, or financiers, provide the required capital based on the purchase order, enabling the business to produce and deliver the goods.

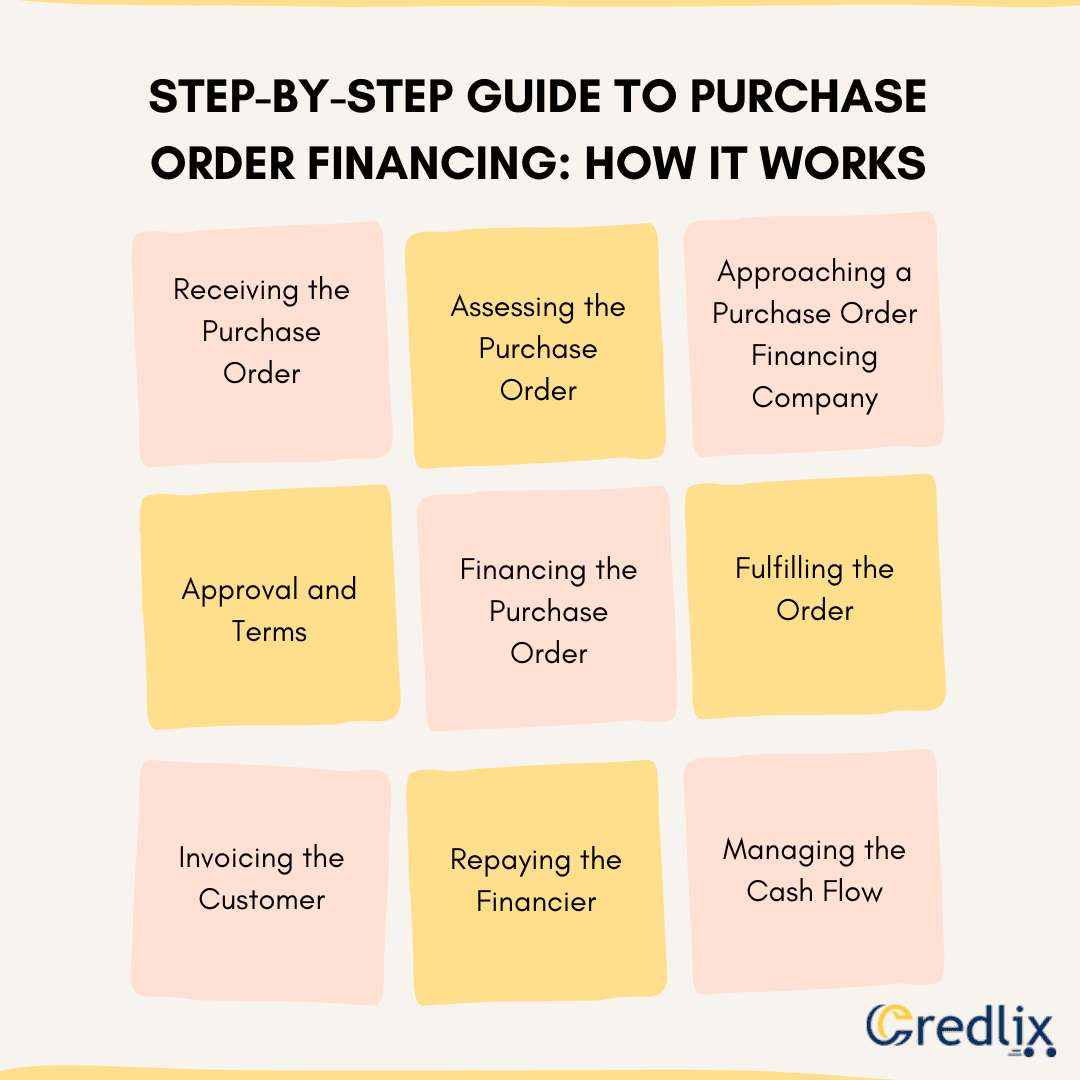

Step-by-Step Guide to Purchase Order Financing: How it Works

Here’s stepwise guide on how PO financing works:

1. Receiving the Purchase Order

The process begins when a business receives a purchase order from a customer. This purchase order is a formal request from the customer to buy goods or services from the business. It outlines the details of the order, including quantities, specifications, and delivery deadlines.

2. Assessing the Purchase Order

Once the purchase order is received, the business needs to assess whether they have the capacity to fulfill it. This assessment includes evaluating their current inventory, production capabilities, and financial situation. If the business determines that they cannot fulfill the order due to a lack of funds, they may consider purchase order financing.

3. Approaching a Purchase Order Financing Company

The next step is to approach a purchase order financing company. The business presents the purchase order to the financier and applies for funding. The financier will conduct due diligence, which includes verifying the legitimacy of the purchase order, assessing the creditworthiness of the customer (the buyer), and evaluating the financial health of the business.

4. Approval and Terms

If the purchase order financing company approves the application, they will offer terms for the financing. These terms outline the amount of funding, the fees or interest rates, and the repayment conditions. It is crucial for the business to review these terms carefully to ensure they align with their financial capabilities and profit margins.

5. Financing the Purchase Order

Upon acceptance of the terms, the financier provides the necessary capital directly to the business’s suppliers. This capital is used to produce or procure the goods needed to fulfill the customer’s order. By paying the suppliers upfront, the business can ensure timely production and delivery of the goods.

6. Fulfilling the Order

With the suppliers paid and the goods produced, the business can now fulfill the customer’s order. The goods are delivered to the customer as per the purchase order specifications and timeline.

7. Invoicing the Customer

After the goods are delivered, the business invoices the customer. The invoice includes the total amount due, payment terms, and any other relevant details. The customer is typically given a specific period to make the payment, such as 30, 60, or 90 days.

8. Repaying the Financier

Once the customer pays the invoice, the business uses the proceeds to repay the purchase order financing company. The repayment includes the initial amount financed plus any agreed-upon fees or interest. The remaining balance, if any, is retained by the business as profit.

9. Managing the Cash Flow

Throughout this process, the business needs to manage its cash flow effectively. It is essential to keep track of all transactions, monitor payment deadlines, and ensure that all financial obligations are met. Proper cash flow management ensures that the business can continue to operate smoothly and take on new orders.

Example of Purchase Order Financing

To better understand how purchase order financing works, let’s look at a practical and interesting example.

Example: Bella’s Boutique

Bella’s Boutique is a small but rapidly growing company that specializes in custom-designed fashion accessories. Bella, the owner, has recently received a large purchase order from a well-known retail chain, Trendy Stores, for 10,000 custom-designed handbags. Each handbag is to be sold to Trendy Stores at $50, making the total order worth $500,000. However, Bella’s Boutique does not have enough capital to pay the suppliers to produce such a large quantity of handbags.

Step-by-Step Process:

Receiving the Purchase Order:

Bella receives a purchase order from Trendy Stores for 10,000 handbags. The order needs to be fulfilled within three months.

Assessing the Purchase Order:

Bella assesses the purchase order and realizes she needs $300,000 to pay her suppliers upfront for materials and production costs.

Approaching a Purchase Order Financing Company:

Bella contacts a purchase order financing company, Fast Finance, and presents the purchase order from Trendy Stores. She applies for funding to cover the supplier costs.

Approval and Terms:

Fast Finance reviews the purchase order, verifies Trendy Stores’ creditworthiness, and evaluates Bella’s Boutique’s financial health. They approve the financing and offer terms: they will provide $300,000 upfront, with a financing fee of 3% of the purchase order value.

Financing the Purchase Order:

Bella agrees to the terms. Fast Finance provides $300,000 directly to Bella’s suppliers, ensuring that production can begin immediately.

Fulfilling the Order:

Bella’s suppliers produce the handbags, and Bella’s Boutique completes the order, delivering all 10,000 handbags to Trendy Stores within the agreed timeline.

Invoicing the Customer:

Bella invoices Trendy Stores for $500,000. The payment terms are 60 days, meaning Trendy Stores has 60 days to pay the invoice.

Repaying the Financier:

Trendy Stores pays the invoice within the 60-day period. Bella receives the $500,000 and uses $315,000 to repay Fast Finance ($300,000 principal + $15,000 financing fee). Bella retains the remaining $185,000 as profit.

Managing the Cash Flow:

With careful cash flow management, Bella ensures all financial obligations are met and continues to take on new orders, using the profits to grow her business further.

Benefits Of PO Financing

- Increased Sales: Bella was able to accept a large order she otherwise might have declined.

- Improved Cash Flow: Immediate capital allowed her to pay suppliers without dipping into her own reserves.

- Customer Satisfaction: Timely delivery ensured Trendy Stores was satisfied and likely to place future orders.

- Growth Opportunities: The successful fulfillment of this order opened doors for more significant opportunities and potential partnerships with other large retailers.

- No Debt: Since PO financing is not a loan, Bella’s Boutique did not add any long-term debt to its balance sheet.

Conclusion

Purchase order financing is a valuable tool for businesses looking to grow and manage their cash flow more effectively. By understanding how it works step by step, businesses can make informed decisions about whether this financing option is right for them. With the right financier and careful financial management, purchase order financing can help businesses fulfill large orders, maintain customer satisfaction, and achieve sustainable growth.

Also Read : The Pros and Cons of PO Financing[/vc_column_text][vc_column_text][/vc_column_text][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]