- December 4, 2024

- Posted by: admin

- Categories: Export Financing, Blog

In today’s interconnected world, international trade has become a cornerstone of business growth. However, navigating the complexities of cross-border transactions can be challenging. This is where international factoring steps in as a powerful financial tool that ensures smooth transactions while mitigating risks. Let’s delve into the intricacies of international factoring, its types, benefits, and how it empowers businesses.

What is International Factoring?

International factoring enables businesses involved in cross-border trade to sell their accounts receivables (invoices) to a factoring company, known as a factor, in exchange for immediate cash. The factoring company assumes the responsibility of collecting payments from the importer, often in a currency of the exporter’s choice.

Unlike domestic factoring, international factoring requires an in-depth understanding of global markets, legal frameworks, compliance protocols, and diverse cultural nuances. Factoring companies must also handle intricate logistics, customs procedures, and varying credit terms.

Why Should Companies Choose International Factoring Services?

Risk Mitigation:

Cross-border transactions often involve dealing with unfamiliar buyers. Exporters may lack the resources to verify the importer’s credibility or handle payment defaults. International factoring services allows exporters to transfer these risks to the factoring company, especially with non-recourse factoring options.

Streamlined Payment Collection:

In international factoring services, the factoring company acts as an intermediary, collecting payments from the importer. Exporters are relieved from chasing payments, enabling them to focus on their core business.

Access to Global Expertise:

Factors possess knowledge about international markets, including laws, customs, and cultural nuances. This expertise helps exporters navigate complexities and expand into new geographies with confidence.

Improved Working Capital:

Immediate access to funds ensures consistent cash flow, allowing businesses to meet operational expenses, take on larger orders, and scale effectively.

Non-Recourse Options:

Non-recourse international factoring services protects exporters from bad debts, ensuring they receive payments even if the importer defaults.

How Does International Factoring Work?

Here’s a step-by-step breakdown of how international factoring operates:

- Initiating the Process: The exporter shares details of the importer and their purchase order with the factor.

- Credit Assessment: The factoring company evaluates the importer’s creditworthiness and approves the transaction.

- Shipment and Documentation: After shipping the goods, the exporter submits invoices and shipping documents to the factor.

- Advance Payment: The factor advances up to 80–90% of the invoice amount to the exporter, ensuring immediate liquidity.

- Payment Collection: At the end of the credit period (30/60/90 days), the factor collects payment directly from the importer.

Final Settlement: The factor deducts its fees and transfers the remaining amount to the exporter.

Parties Involved in International Factoring Services

There are typically two main parties in international factoring services arrangements:

Export Factor:

Located in the exporter’s country, the export factor funds invoices and collects shipping documents. They may also partner with local agencies to handle customs and regulations.

Import Factor:

Situated in the importer’s country, the import factor assesses the buyer’s financial health, payment history, and creditworthiness. They ensure timely payment collection and act as a guarantor.

While some arrangements involve both export and import factors (two-factor system), single-factor models are more common for simplicity and cost-efficiency.

Types of International Factoring

International factoring services come in different types, each tailored to suit specific trade needs and arrangements. Below is a detailed explanation of the various types of international factoring services:

1. Single-Factor System

In the single-factor system, only one factoring company (the export factor) is involved in the transaction. This factor handles all the responsibilities, including financing, credit risk assessment, and payment collection.

How it works:

- The exporter directly assigns their invoices to the export factor.

- The export factor provides an advance (typically 80–90% of the invoice value).

- The factor collects payment from the importer when the invoice becomes due.

Key Benefits:

- Simplifies the process with only one intermediary.

- Ideal for exporters with a strong understanding of their importers’ creditworthiness.

- Reduces costs since only one factor is involved.

Best Suited For:

- Exporters dealing with a limited number of foreign buyers or in familiar markets.

2. Two-Factor System

The two-factor system involves two factoring companies:

- Export Factor: Located in the exporter’s country.

- Import Factor: Based in the importer’s country.

These two factors work together to manage the transaction.

How it works:

- The exporter assigns their invoices to the export factor.

- The export factor partners with an import factor in the buyer’s country.

- The import factor assesses the importer’s creditworthiness and ensures payment collection.

- The export factor advances funds to the exporter after deducting their fees.

- Payment is collected from the importer by the import factor and sent to the export factor for final settlement.

Key Benefits:

- Enhanced risk mitigation as the import factor has local expertise and connections.

- Smooth handling of collections, especially in markets with complex legal or financial systems.

- Greater assurance for the exporter as the import factor guarantees payment.

Best Suited For:

- Exporters entering new or unfamiliar markets.

- Transactions involving higher risks or complex legal environments.

3. Non-Recourse Factoring

In non-recourse factoring, the factoring company (or companies) assumes the risk of non-payment by the importer. If the buyer defaults due to insolvency or inability to pay, the exporter is not liable.

How it works:

- The factoring company evaluates the creditworthiness of the importer.

- After approval, the exporter assigns invoices to the factor.

- If the importer fails to pay, the factor absorbs the loss.

Key Benefits:

- Complete protection against bad debts.

- Suitable for high-risk markets or when dealing with new buyers.

- Provides peace of mind, enabling exporters to focus on core operations.

Best Suited For:

- Exporters with limited resources for credit checks.

- Businesses operating in industries with volatile payment behaviors.

4. Recourse Factoring

In recourse factoring, the exporter remains liable if the importer fails to pay. While the factor provides advance funding and collection services, the exporter must repay the factor if the buyer defaults.

How it works:

- The factoring company assesses the transaction and provides funding against invoices.

- Payment collection is handled by the factor, but the exporter is responsible for unpaid invoices.

Key Benefits:

- Lower fees compared to non-recourse factoring.

- Accessible to businesses with a reliable client base.

Best Suited For:

- Exporters are confident in their buyers’ financial stability.

- Businesses seeking cost-effective financing solutions.

5. International Reverse Factoring (Supply Chain Finance)

In reverse factoring, the process is initiated by the importer rather than the exporter. The importer collaborates with a factoring company to provide early payments to their suppliers (exporters).

How it works:

- The importer contracts with a factor to finance their suppliers.

- The exporter receives early payments from the factor, reducing the payment risk.

- The importer settles the amount with the factoring company at a later date.

Key Benefits:

- Enhances the financial stability of suppliers by providing faster payments.

- Strengthens supplier-importer relationships.

- Typically involves lower costs due to the importer’s strong credit profile.

Best Suited For:

- Importers looking to support their suppliers while managing cash flow.

- Businesses with frequent or large transactions.

6. Maturity Factoring

Maturity factoring does not involve advance payment to the exporter. Instead, the factor collects payment from the importer when due and transfers the amount to the exporter after deducting fees.

How it works:

- The exporter assigns invoices to the factor but does not receive upfront funding.

- The factor ensures timely collection of payments from the importer.

- Payment is transferred to the exporter on the invoice’s due date.

Key Benefits:

- Focuses on payment collection and risk mitigation.

- Low-cost solution as no advance funding is provided.

- Useful for exporters with strong working capital.

Best Suited For:

- Exporters with sufficient cash reserves but needing assistance in collections.

7. Disclosed and Undisclosed Factoring

Disclosed Factoring:

The importer is informed about the factoring arrangement. This type is more transparent and often used in cases where the importer agrees to work with the factoring company.

Undisclosed Factoring:

The factoring arrangement is kept confidential from the importer. The exporter continues to interact with the importer as usual, while the factor works in the background.

Key Benefits:

- Disclosed factoring builds trust between all parties.

- Undisclosed factoring maintains the exporter’s relationship with the buyer.

Best Suited For:

- Disclosed: For open and collaborative partnerships.

- Undisclosed: For maintaining competitive market positions.

Benefits of International Factoring Services

Consistent Cash Flow:

International factoring ensures that businesses receive immediate funds, preventing disruptions in operations. This is particularly vital for small enterprises facing working capital shortages.

Extended Credit Terms:

Exporters can offer longer payment periods to attract more customers, boosting sales and building stronger client relationships.

Business Expansion:

By mitigating risks and securing payments, exporters can confidently enter new markets, diversify their clientele, and achieve growth.

Simplified Documentation:

Unlike traditional loans, international factoring requires minimal paperwork, making the funding process quicker and more accessible.

Protection Against Bad Debts:

Non-recourse factoring safeguards businesses from losses due to buyer insolvency or non-payment.

Expertise and Insights:

Factors provide valuable market intelligence, helping exporters identify lucrative opportunities and choose reliable trade partners.

Efficient Collections:

With expertise in local laws and cultural practices, factoring companies streamline payment collection across borders, eliminating communication barriers.

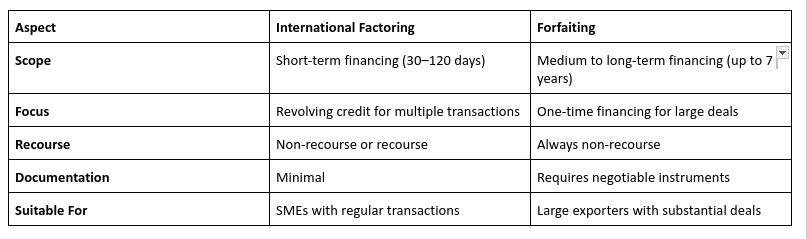

International Factoring Services vs. Forfaiting

While both international factoring services and forfaiting offer trade financing solutions, there are notable differences:

Credlix’s Global Factoring Solution

Credlix stands out as a leader in international factoring, empowering businesses to thrive in global markets. With experience funding over $3 billion in trade and working with 10,000+ suppliers worldwide, Credlix offers unmatched services:

- Collateral-Free Factoring: Enjoy non-recourse factoring solutions without pledging assets.

- Digital Processing: Technology-driven appraisals and automated processes ensure quick disbursements.

- Flexible Currency Options: Receive payments in major currencies like USD, EUR, or GBP.

- Personalized Support: Dedicated account managers handle interactions, ensuring seamless experiences.

Conclusion

International factoring is a lifeline for businesses navigating the challenges of cross-border trade. By providing immediate liquidity, mitigating risks, and simplifying payment collection, factoring services empower exporters to expand globally and achieve financial stability. With trusted partners like Credlix, businesses can confidently explore new markets and unlock their full potential. Whether you are a small enterprise or a large corporation, international factoring is a game-changing solution for your global trade needs.