[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12750″ img_size=”full” css=”.vc_custom_1714382491112{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In today’s globalized world, efficient export procedures are crucial for businesses looking to expand their reach across borders. One key aspect of exporting goods is filing a Shipping Bill, a vital document required by customs authorities. With advancements in technology, the process of filing a Shipping Bill has become increasingly streamlined through online platforms.

In this comprehensive guide, we’ll walk you through the step-by-step process of filing a Shipping Bill online, covering everything from registration to submission and verification. By harnessing the power of digital tools, you can simplify and expedite your export documentation process, ensuring smoother international trade transactions.

What is a Shipping Bill?

A Shipping Bill is a crucial document required for exporting goods from one country to another. It serves as a customs declaration, providing details about the exported goods, their value, destination, and other pertinent information.

Essentially, it acts as a legal document and includes details such as exporter and importer information, itemized list of goods, their quantity, value, and any applicable duties or taxes. The Shipping Bill is submitted to the customs authorities of the exporting country to obtain clearance for the shipment to leave the country and enter the destination country.

Benefits of Filing a Shipping Bill

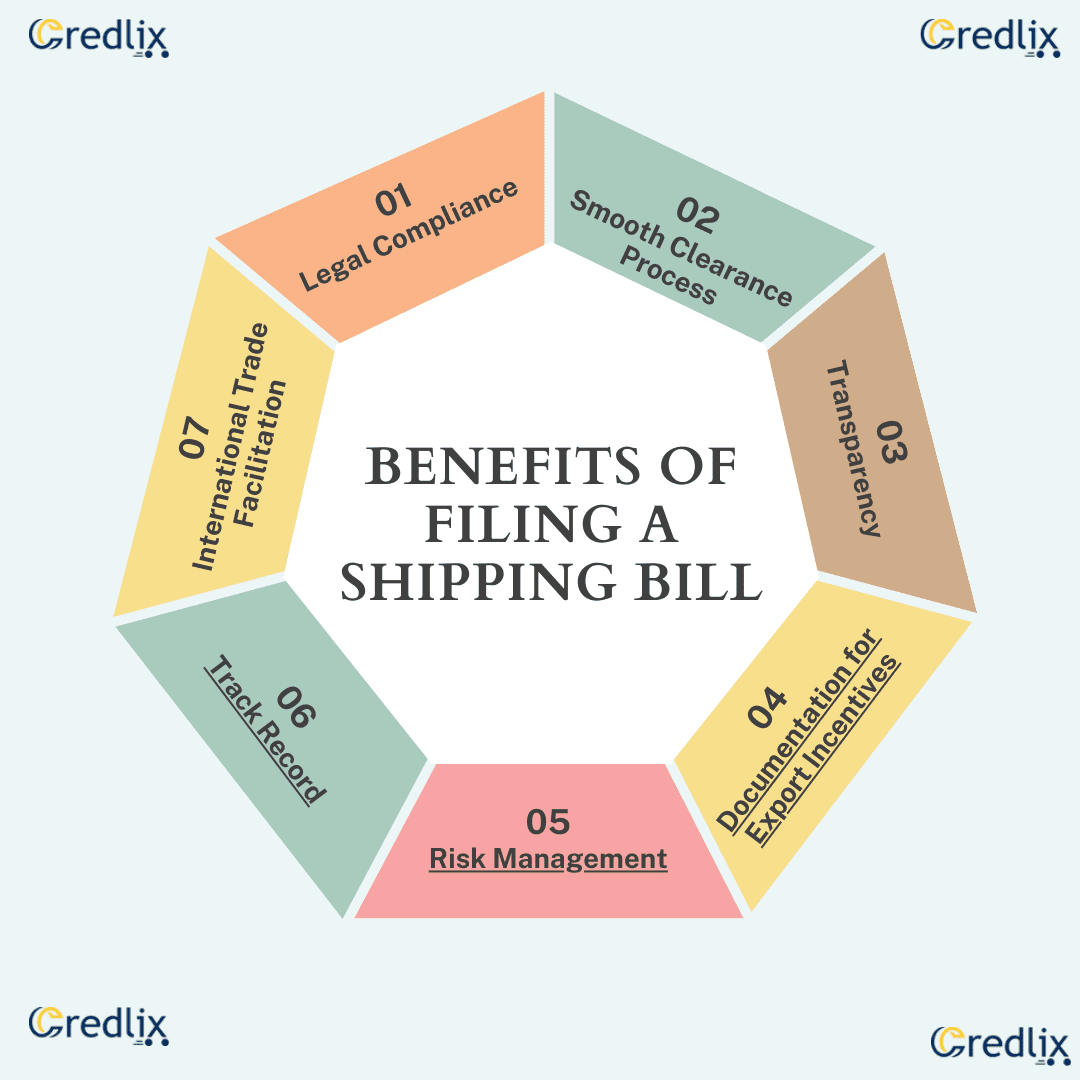

Filing a Shipping Bill offers several benefits for exporters:

Legal Compliance: Filing a Shipping Bill ensures compliance with customs regulations and export laws of the exporting country. It demonstrates adherence to legal requirements for international trade.

Smooth Clearance Process: A properly filed Shipping Bill helps facilitate the smooth clearance of goods through customs checkpoints, reducing delays and avoiding potential penalties or fines.

Transparency: By providing detailed information about the exported goods, the Shipping Bill promotes transparency in international trade transactions, which can help build trust between exporters and customs authorities.

Documentation for Export Incentives: The Shipping Bill serves as documentation for claiming export incentives or benefits offered by the government, such as duty drawback, export promotion schemes, or tax refunds.

Risk Management: Filing a Shipping Bill allows exporters to accurately declare the value, quantity, and nature of goods being exported, helping to mitigate the risk of errors, discrepancies, or misunderstandings during the export process.

Track Record: Keeping a record of filed Shipping Bills establishes a track record of export transactions, which can be useful for future reference, audits, or compliance verification.

International Trade Facilitation: Filing Shipping Bills contributes to the smooth functioning of international trade by ensuring the proper documentation and clearance of goods at ports and border checkpoints, thereby promoting trade facilitation and economic growth.

Basic Yet Detailed Guide on How to File a Shipping Bill Online

Filing a shipping bill online involves several steps, and the process can vary slightly depending on the country and the specific platform or system used for online filing. However, we can provide you with a general guide that covers the common steps involved in filing a shipping bill online:

Gather Necessary Information

- Before you begin the online filing process, gather all the required information and documents related to the shipment. This may include:

- Exporter details (name, address, contact information)

- Importer details (if applicable)

- Description of goods

- Quantity and unit of measurement

- Value of goods

- Export invoice

- Packing list

- Shipping documents (Bill of Lading, Airway Bill, etc.)

- Export license or any other required permits

Access the Online Portal

Visit the website of the customs or export authority of your country to access the online portal for filing shipping bills. These portals are typically part of the customs department or a related government agency.

User Registration/Login

If you haven’t already registered as a user on the portal, you’ll need to do so. Follow the instructions to create an account and log in using your credentials.

Select the Filing Option

Once logged in, navigate to the section for filing shipping bills. Depending on the system, you may have options for different types of shipments (e.g., sea, air, road).

Enter Shipment Details

Fill out the online form with the details of your shipment. This includes information about the exporter, importer, goods, value, and other relevant data. Make sure to double-check the accuracy of the information entered.

Attach Documents

Upload the required documents, such as the export invoice, packing list, and any permits or licenses. Ensure that the documents are in the specified format and comply with the requirements of the customs authority.

Submit the Shipping Bill

Once you have entered all the necessary information and attached the required documents, review the details to ensure everything is correct. Then, submit the shipping bill through the online portal.

Payment of Fees (if applicable)

In some cases, you may be required to pay certain fees or duties associated with the shipment. Follow the instructions on the portal for making the payment online.

Receive Confirmation

After successfully submitting the shipping bill and completing any necessary payments, you should receive a confirmation or reference number. This serves as proof that the shipping bill has been filed.

Monitor the Status

Keep track of the status of your shipment through the online portal. You may receive notifications or updates regarding the processing of the shipping bill and clearance of the goods.

Print or Save Documentation

Once the shipping bill is processed and approved, make sure to print or save copies of the documentation for your records.

Remember to consult the specific guidelines provided by your country’s customs or export authority, as well as any instructions or tutorials offered on the online portal for filing shipping bills.

Shipping Bill Formats and Required Information: An Overview

In March 2019, amendments were made to the regulations governing Shipping Bill and Bill of Export forms, updating the formats for different types of shipping bills. Here’s a simplified breakdown of the changes:

New Formats Introduced:

- Form SB – I: Shipping Bill for Export of Goods (Original and Quadruplicate)

- Form SB – III: Bill for Export of Goods (Original and Quadruplicate)

Required Information:

- Exporter, Buyer, and Customs Broker Details

- Carrier, Port, and Transportation Information

- Invoice and Purchase Order/Indent Details

- Itemized Cargo Information

- Export Duty and GST-related Information

- Export Scheme/Job Work/Re-export Details

These revised formats streamline the process of filing shipping bills by clearly defining the required information and providing separate copies for different purposes, such as original and export promotion copies. This ensures compliance with regulations while facilitating smoother export procedures.

Filing of Shipping Bill (Non-EDI)

Shipping Bills can be processed manually, bypassing EDI platforms. This involves manual submission along with original copies of documents like the invoice and packing list.

Filing of Shipping Bill (EDI)

Utilizing the ICEGATE platform, electronic filing of Shipping Bills through EDI is facilitated. Exporters or Customs House Agents (CHAs) register with the system using relevant codes. The process involves online submission of the Shipping Bill along with necessary documents. Verification is done by either the exporter or CHA, followed by submission of the checklist into the EDI system by service center operators. Queries and status updates can be addressed at these centers.

Steps Before Generating the Shipping Bill

Here are the steps involved in generating the shipping bill before the actual process:

Assessment by Officer

- The system automatically processes the Shipping Bill based on exporter declarations. However, if the FOB value exceeds Rs 10 lakh or certain criteria are met, an Assistant Commissioner (Exports) assesses it.

- The officer checks goods value, applicable duties/cess, classification, export policy compliance, and other rules.

Specific Scheme Processing

- For certain schemes like DEEC/DEPB, processing is done in respective groups.

- Goods description in the Bill and Invoice must match for DEEC Shipping Bills.

Additional Checks

- The officer may ask for samples or more info during assessment.

- Samples might undergo visual inspection or tests.

Assessment Completion

- After assessment, the Assessing Officer passes the shipping bill.

- Exporter or agent proceeds to Shed Appraiser (Export) for goods examination.

Goods Examination

- A Customs officer, supervised by Shed Appraiser, examines goods.

- If details match the declaration, Shed Appraiser issues a ‘Let Export’ order.

Loading and Export

- Goods are loaded onto the vessel under preventive superintendent supervision.

- This completes the shipping bill generation process.

Handling Discrepancies

- If discrepancies arise during examination, the Bill may be sent back for review.

- The export department assesses and decides whether to allow export, suggest amendments, or take action for false declaration.

To sum up, using online methods for filing Shipping Bills makes exporting goods smoother and more transparent. By following the steps mentioned and using platforms like ICEGATE, exporters can handle customs procedures more easily. This saves time and ensures that everything is correct according to the rules, making international trade simpler and helping businesses grow worldwide.

Also Read: How to Download Shipping Bills from ICEGATE?[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]