[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12467″ img_size=”full” css=”.vc_custom_1711606129956{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Incorporating invoice discounting into your financial strategy can be a strategic move for businesses seeking to optimize cash flow and manage working capital efficiently. Invoice discounting, a form of debtor finance, involves selling unpaid invoices to a third-party financier at a discount in exchange for immediate cash. This enables businesses to access funds tied up in accounts receivable, providing liquidity to support ongoing operations, capitalize on growth opportunities, or navigate temporary cash flow challenges.

By leveraging invoice discounting strategically, businesses can unlock numerous benefits, including improved cash flow management, enhanced financial flexibility, and the ability to leverage unpaid invoices as a valuable asset. However, it’s crucial to approach invoice discounting thoughtfully, considering factors such as cost-effectiveness, customer relationships, and overall financial objectives.

In this guide, we’ll explore various aspects of incorporating invoice discounting into your financial strategy, including its benefits, considerations, best practices, and how to effectively integrate it into your overall financial management approach.

What is Invoice Discounting?

Invoice discounting is a financial practice that allows businesses to improve cash flow by receiving funds against their outstanding invoices before the customer pays. It involves a company selling its unpaid invoices to a third-party finance provider, known as a factor or discounting company, at a discounted rate.

Unlike factoring, where the factor takes over the responsibility of collecting payments from customers, in invoice discounting, the business retains control over its sales ledger and customer relationships. The finance provider advances a percentage of the invoice value upfront, typically ranging from 70% to 90%, and then collects the full invoice amount from the customer on the agreed-upon due date.

Invoice discounting helps businesses to access cash tied up in unpaid invoices, providing them with immediate working capital to cover expenses, invest in growth opportunities, or manage fluctuations in cash flow. It is particularly beneficial for businesses with long payment terms or seasonal sales cycles, allowing them to bridge the gap between invoicing and receiving payment while maintaining control over their accounts receivable.

Also Read: The Ultimate Guide on What is Invoice Discounting

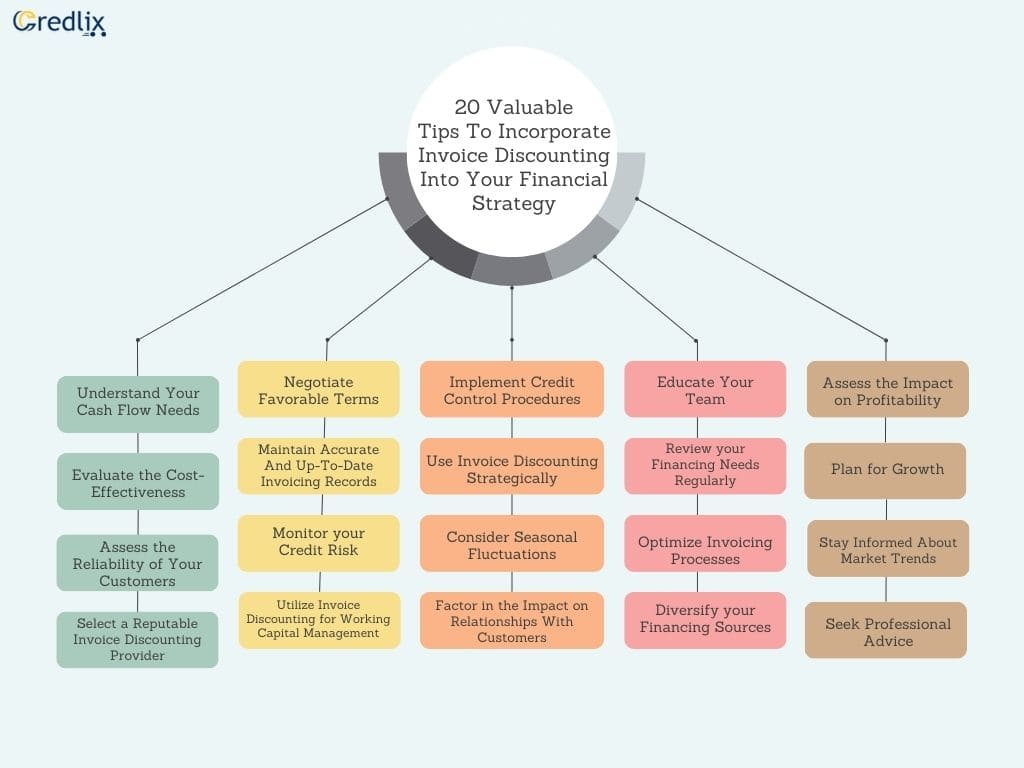

20 Valuable Tips To Incorporate Invoice Discounting Into Your Financial Strategy

Incorporate invoice discounting strategically into your financial plan to optimize cash flow, manage working capital efficiently, and support business growth.

Understand Your Cash Flow Needs

Delve into your company’s cash flow demands comprehensively. Assess whether invoice discounting harmonizes with your financial strategy, considering its ability to fulfill short-term cash flow requirements while preserving the integrity of long-term financial health. Evaluating the suitability of invoice discounting involves a meticulous examination of its impact on your company’s financial stability over time, balancing immediate liquidity needs with the imperative of sustaining robust financial standing.

By scrutinizing these factors meticulously, you can make informed decisions regarding the integration of invoice discounting into your financial framework, ensuring alignment with your overarching strategic objectives and financial sustainability.

Evaluate the Cost-Effectiveness

Assess the cost-effectiveness of invoice discounting by comparing its expenses with those of alternative financing options. Ensure that the benefits derived from invoice discounting exceed its costs, thereby optimizing its financial impact on your business.

By conducting a thorough evaluation, you can make informed decisions regarding the utilization of invoice discounting as a strategic financial tool, aligning it with your business objectives to enhance overall financial performance and sustainability.

Assess the Reliability of Your Customers

Evaluate your customers’ reliability by scrutinizing their payment history and creditworthiness. Choose to utilize invoice discounting with customers known for consistently meeting payment deadlines, thus minimizing the risk of invoice default. This selective approach ensures that invoice discounting is employed with customers who pose lower credit risks, enhancing the overall effectiveness of this financing strategy while safeguarding your business against potential losses.

By prioritizing reliable customers, you can optimize the benefits of invoice discounting while mitigating associated risks, fostering a more stable and sustainable financial environment for your business.

Select a Reputable Invoice Discounting Provider

When selecting an invoice discounting provider, prioritize a reputable and established firm like Credlix. Look for providers offering competitive rates, efficient services, and a proven track record of reliability. This ensures that your financial interests are safeguarded and that you receive quality service.

By partnering with a reputable provider like Credlix, you can mitigate risks associated with invoice discounting and confidently leverage this financing option to support your business’s cash flow needs and growth initiatives.

Negotiate Favorable Terms

When negotiating your invoice discounting agreement, aim to align the terms with your business objectives. Secure favorable discount rates, advance percentages, and repayment terms to optimize benefits. By negotiating advantageous terms, such as lower rates and flexible repayment schedules, you can maximize the value of invoice discounting for your company.

This strategic approach ensures that your financing arrangement supports your business goals while minimizing costs and enhancing cash flow management. Effective negotiation empowers you to tailor the agreement to suit your specific needs, ultimately improving the overall financial health and sustainability of your business.

Maintain Accurate And Up-To-Date Invoicing Records

Maintaining accurate and up-to-date invoicing records is crucial for efficient invoice discounting. Thoroughly document all invoices, ensuring accuracy and completeness. Well-organized records streamline the discounting process, reducing delays and errors.

By prioritizing meticulous record-keeping, you enhance the efficiency and effectiveness of invoice discounting, enabling smoother transactions and minimizing potential complications. This disciplined approach not only supports timely access to financing but also strengthens financial transparency and accountability within your business, fostering trust and reliability with your invoice discounting provider.

Monitor your Credit Risk

Regularly monitor the credit risk of your customers to preempt potential issues. Employ proactive measures to mitigate the risk of bad debt, ensuring the stability and profitability of your finances. By staying vigilant and implementing preventive strategies, you can safeguard your business from financial instability and optimize overall profitability.

Utilize Invoice Discounting for Working Capital Management

Maximize working capital efficiency by utilizing invoice discounting strategically. Incorporate it as a key tool for addressing short-term cash flow gaps and sustaining ongoing business operations. By leveraging invoice discounting, you can optimize liquidity management and ensure the smooth functioning of your operations.

This approach empowers you to proactively manage working capital needs, enabling agility in responding to financial challenges and supporting sustained business growth.

Implement Credit Control Procedures

Implementing credit control procedures is crucial for effective management of customer payments. Establish robust systems to minimize late payments and mitigate the necessity for invoice discounting. By enforcing disciplined credit management practices, you can enhance cash flow stability and reduce reliance on external financing.

These procedures ensure timely receipt of payments, improving overall financial health and reducing the risk of bad debt. With structured credit control measures in place, your business can maintain stronger financial stability and optimize operational efficiency.

Use Invoice Discounting Strategically

Strategically integrate invoice discounting into your financial framework to capitalize on opportunities, fund growth endeavors, or address temporary cash flow fluctuations. By deploying invoice discounting strategically, you can optimize cash flow management and leverage available funds to propel business growth.

Whether seizing new opportunities, investing in expansion initiatives, or overcoming short-term financial hurdles, incorporating invoice discounting into your strategy enables flexibility and agility in navigating dynamic business landscapes. This approach empowers you to harness the benefits of invoice discounting to support your business objectives effectively and drive sustainable growth.

Consider Seasonal Fluctuations

Be proactive in anticipating and preparing for seasonal fluctuations in cash flow. By leveraging invoice discounting, you can effectively mitigate the impact of these variations, ensuring consistent liquidity year-round. This strategic approach enables your business to maintain financial stability and operational continuity, regardless of seasonal changes in revenue and expenses.

By utilizing invoice discounting as a flexible financing solution, you can navigate through lean periods and capitalize on peak seasons more effectively. This proactive stance towards seasonal fluctuations strengthens your financial resilience and supports sustained business performance over time.

Factor in the Impact on Relationships With Customers

Account for the potential impact of invoice discounting on customer relationships. Prioritize transparent communication and uphold professional standards to preserve trust and goodwill. By proactively addressing any concerns or questions your customers may have regarding invoice discounting, you can maintain strong relationships built on transparency and reliability. Upholding professional conduct throughout the invoicing process ensures that your business maintains positive interactions with customers, fostering long-term loyalty and satisfaction.

This approach strengthens your reputation and reinforces your commitment to maintaining mutually beneficial relationships with your customer base.

Educate Your Team

Empower your finance team with a thorough understanding of the invoice discounting process. Offer comprehensive training and resources to equip them with the knowledge and skills needed to manage invoice discounting efficiently within your organization.

By investing in their education and development, you enable your team to navigate the intricacies of invoice discounting confidently. This ensures smooth integration into your financial operations and enhances your ability to leverage invoice discounting as a strategic financing tool. Educating your team fosters competence and proficiency, optimizing the benefits of invoice discounting for your organization.

Review your Financing Needs Regularly

Periodically revisit your financing requirements and goals. Modify your invoice discounting strategies as needed to synchronize with shifting business agendas and market dynamics. Regular reviews ensure that your financing solutions remain relevant and optimized for current conditions, empowering your business to adapt and thrive in a dynamic environment.

By staying attuned to evolving needs and opportunities, you can fine-tune your invoice discounting approach to maintain financial agility and capitalize on emerging trends. This proactive approach fosters resilience and responsiveness, enhancing your overall financial strategy and performance.

Optimize Invoicing Processes

Enhance cash flow efficiency by optimizing invoicing procedures. Streamline processes to reduce the time between invoicing and receipt of funds through discounting. This optimization accelerates liquidity management, bolstering financial agility and resilience. By minimizing delays and maximizing efficiency in invoicing, you can leverage discounting to access funds promptly and support operational needs.

This strategic approach ensures that your business maintains robust cash flow, enabling you to navigate challenges effectively and capitalize on opportunities for growth. Streamlining invoicing processes enhances overall financial performance and strengthens your competitive position in the market.

Diversify your Financing Sources

Mitigate risk by diversifying your financing sources beyond solely relying on invoice discounting. Broaden your funding options to enhance financial resilience across diverse economic landscapes. By diversifying, you reduce vulnerability to market fluctuations and potential disruptions. This strategic approach ensures your business remains adaptable and well-positioned to weather changing economic conditions.

Supplementing invoice discounting with alternative financing avenues strengthens your financial foundation, providing stability and flexibility to support long-term growth and sustainability objectives. Embracing a diversified approach to financing safeguards against undue reliance on any single funding mechanism, bolstering overall financial health and resilience.

Assess the Impact on Profitability

Assess the influence of invoice discounting on profitability by analyzing its costs and benefits. This evaluation informs strategic decisions aimed at optimizing overall financial performance. By considering the trade-offs involved, you can make informed choices regarding the utilization of invoice discounting as a financing tool.

This ensures that your financial strategy aligns with profitability objectives while mitigating potential risks. Evaluating the impact on profitability enables you to maintain a balanced approach to financing, maximizing returns while minimizing expenses.

Plan for Growth

Utilize invoice discounting strategically to facilitate business expansion and growth. Allocate discounted funds towards strategic investments that enhance long-term profitability and competitiveness. By leveraging discounted invoices, you can access immediate capital to support initiatives such as expanding operations, launching new products, or entering new markets.

This strategic approach accelerates growth while optimizing financial resources, positioning your business for sustained success and competitiveness in the marketplace.

Stay Informed About Market Trends

Stay updated on market trends in invoice discounting to adapt your strategy effectively. Monitor developments to seize emerging opportunities and mitigate risks promptly. By remaining proactive, you can align your approach with market dynamics, optimizing the benefits of invoice discounting for your business.

This informed stance empowers you to capitalize on favorable trends and navigate challenges with agility, ensuring your strategy remains responsive to evolving market conditions. Staying informed enhances your ability to make strategic decisions that drive sustainable growth and resilience.

Seek Professional Advice

Seek guidance from financial experts or advisors with expertise in invoice discounting. Receive tailored insights to optimize your strategy based on your business’s unique circumstances. Consulting professionals ensures that your approach to invoice discounting is aligned with industry best practices and tailored to maximize success. By leveraging their expertise, you can make informed decisions that enhance the effectiveness of your invoice discounting strategy, ultimately driving financial performance and business growth.

Also Read: Is Invoice Discounting the Right Supply Chain Finance Option for You?

Final Note

Incorporating invoice discounting into your financial strategy offers businesses a powerful tool to optimize cash flow, manage working capital efficiently, and support growth initiatives. By strategically leveraging invoice discounting, businesses can access immediate funds tied up in accounts receivable, providing valuable liquidity to navigate operational challenges and capitalize on emerging opportunities. However, success with invoice discounting hinges on careful consideration of various factors, including cost-effectiveness, customer relationships, and overall financial objectives.

Through proactive monitoring, strategic planning, and regular review, businesses can effectively integrate invoice discounting into their financial framework, enhancing resilience and driving sustainable growth. Seeking professional advice and staying informed about market trends further empowers businesses to make informed decisions and optimize the benefits of invoice discounting. With thoughtful implementation and ongoing management, invoice discounting can serve as a cornerstone of financial strategy, supporting businesses in achieving their goals and maximizing long-term profitability.

Also Read: Invoice Discounting vs Bank Loans: Pros and Cons for Businesses

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]