- December 2, 2024

- Posted by: admin

- Categories: Invoice discounting, Blog

Maintaining a steady cash flow is critical for businesses, especially in the micro, small, and medium enterprise (MSME) sector. However, unsettled invoices and delayed payments often disrupt this flow, creating challenges for businesses to meet day-to-day operational costs. A study shows that 60% of MSMEs in India receive payments from clients after 60 days or longer, highlighting the urgency for effective financing solutions.

This is where bill discounting and bill purchase come into play, offering innovative ways to tackle cash flow issues. In this article, we’ll explore these financing tools in detail, including their processes, differences, and how to decide which option is best for your business.

Understanding Bill Discounting

What is Bill Discounting?

Bill discounting is a short-term financing solution that allows businesses to borrow money against unpaid invoices. It helps address cash flow shortages by offering an advance on the invoice amount, enabling companies to manage operational expenses without waiting for customer payments.

The bank or financial institution deducts a discounting fee before disbursing the loan. Once the buyer settles the payment, the business repays the loan to the lender.

How Does Bill Discounting Work?

Let’s break it down with an example:

Invoice Generation: Suppose Company A sells products worth ₹1,00,000 to Company B, which agrees to pay after two months.

Approaching the Lender: Company A, needing immediate funds, approaches a financial institution for a loan against the invoice.

Loan Approval: The lender verifies the creditworthiness of Company B and the invoice’s authenticity.

Loan Disbursement: After deducting a ₹5,000 discounting fee, the lender deposits ₹95,000 into Company A’s account.

Repayment: At the end of the two-month credit period, Company B pays ₹1,00,000 to Company A, which is used to repay the lender.

Advantages of Bill Discounting:

- Instant funds to manage operational costs.

- No need to inform the buyer, preserving customer relationships.

- Short-term financial relief without requiring additional collateral.

Exploring Bill Purchases

What is a Bill Purchase?

Bill purchase, also known as invoice factoring, involves selling trade receivables to a third-party financial institution (factor) in exchange for an immediate cash advance. Unlike bill discounting, the lender takes on the responsibility of collecting payments from customers.

This solution is especially beneficial for businesses with limited credit control systems or those looking to outsource payment collection.

How Does Bill Purchase Work?

Here’s an example to illustrate the process:

Selling Trade Receivables: Company X has unpaid invoices worth ₹2,00,000 and approaches a factor (ABC Finance) for funding.

Advance Payment: ABC Finance agrees to buy the invoices and provides an upfront payment of ₹1,60,000 (80% of the invoice value).

Payment Collection: The factor takes over the responsibility of collecting payments from Company X’s customers.

Final Settlement: Once the customers pay the invoices, ABC Finance deducts its fees and deposits the remaining 20% to Company X.

Advantages of Bill Purchase:

- Outsourcing payment collection saves time and resources.

- Provides instant funds without needing collateral.

- Ideal for businesses struggling with customer credit control.

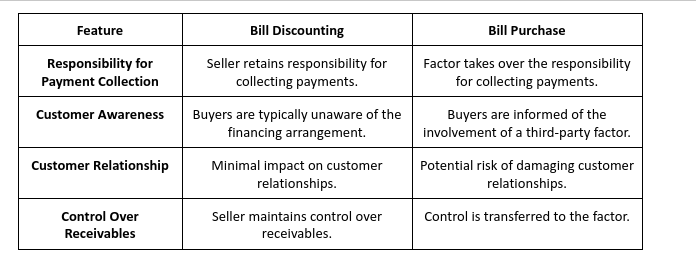

Key Differences Between Bill Discounting Vs. Bill Purchase

While both solutions address cash flow challenges, they differ in certain key aspects:

Which Option is Better for Your Business?

Choosing between bill discounting and bill purchase depends on various factors, including customer relationships, payment collection capabilities, and your business’s specific cash flow needs. Let’s dive deeper into these considerations:

1. Customer Relationships

If maintaining a positive relationship with your customers is a priority, bill discounting may be the better choice. Since the buyer remains unaware of the financing arrangement, there’s no risk of damaging trust or goodwill.

On the other hand, if you’re comfortable with informing your customers about third-party involvement, bill purchase can provide an efficient way to manage payments.

2. Payment Collection Expertise

Businesses with strong credit control systems may prefer bill discounting, as they already have processes in place to manage collections.

However, for businesses lacking expertise or resources to handle collections, bill purchase offers a convenient solution by outsourcing this task to the factor.

3. Cash Flow Needs

Both solutions offer immediate funding, but the choice depends on your business’s operational dynamics.

Opt for Bill Discounting if:

- You prefer retaining control over receivables.

- You want to maintain a seamless relationship with your customers.

Opt for Bill Purchase if:

- You need assistance with payment collection.

- You’re comfortable with third-party involvement.

Benefits of These Financing Tools for MSMEs

- Enhanced Cash Flow: Both solutions provide instant access to funds, ensuring uninterrupted business operations.

- No Additional Collateral: Unpaid invoices act as collateral, eliminating the need for other security.

- Growth Opportunities: With timely access to working capital, businesses can invest in expansion, procurement, and fulfilling larger orders.

- Flexibility: These tools cater to diverse needs, from short-term financing to efficient payment collection.

- Reduced Financial Strain: Businesses can focus on growth instead of worrying about delayed payments.

Challenges to Keep in Mind

While bill discounting and bill purchase offer several advantages, they come with certain challenges:

- Discounting Fees: Both solutions involve fees or interest charges, which can add up over time.

- Buyer Creditworthiness: Approval often depends on the creditworthiness of your customers, which could limit eligibility.

- Impact on Relationships: In the case of bill purchase, involving third parties in payment collection might strain buyer relationships.

- Dependence on Lenders: Relying on external financing for cash flow management may not be sustainable in the long term.

FAQs: Bill Discounting vs. Bill Purchase

1. How are fees calculated for bill discounting and bill purchase?

Both financing options involve fees, which vary by lender. For bill discounting, the fee is a percentage of the invoice value, known as the discounting rate. For bill purchase, the factor charges a combination of upfront fees and a service fee for collecting payments.

2. Can any business use bill discounting or bill purchase?

These solutions are ideal for businesses that sell on credit and have verifiable trade receivables. Approval depends on factors like the creditworthiness of the buyer and the authenticity of invoices.

3. Is collateral required for bill discounting or bill purchase?

No additional collateral is required, as unpaid invoices serve as the security for both financing options.

4. Can both solutions be used simultaneously?

Yes, businesses can use both tools based on their specific needs. For example, you can use bill discounting for high-value customers where relationships matter and bill purchase for customers with a history of delayed payments.

5. Are there risks involved in bill discounting or bill purchase?

The primary risks include:

Potential strain on customer relationships (in bill purchase).

Fees and interest charges that impact profit margins.

Dependence on buyer creditworthiness.

Final Thoughts

Bill discounting and bill purchase are powerful tools for addressing cash flow challenges, especially for MSMEs grappling with delayed payments. While both solutions provide immediate financial relief, their suitability depends on your business’s unique needs, customer dynamics, and credit control capabilities.

Bill Discounting is ideal for businesses that prefer retaining control over payment collection and value customer relationships. Meanwhile, Bill Purchase is a great option for companies seeking professional assistance with receivables management.

By understanding the processes and benefits of these tools, businesses can make informed decisions to optimize their cash flow, reduce financial strain, and focus on growth.

For MSMEs, adopting innovative financing solutions like these could be the key to thriving in a competitive market.

Also Read: Don’t Wait, Start Growing: How Bill Discounting Can Help Your Business