[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12597″ img_size=”full” css=”.vc_custom_1712728576313{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In GST compliance, the Harmonized System of Nomenclature (HSN) code plays a crucial role. Since the implementation of Notification No. 78/2020 – Central Tax, dated October 15, 2020, taxpayers are required to declare HSN codes on tax invoices, effective from April 1, 2021. However, despite the importance of accurate HSN code reporting, taxpayers often encounter errors and challenges in this process.

In this guide, we will delve into the common HSN code errors faced by taxpayers and provide comprehensive solutions to mitigate them effectively.

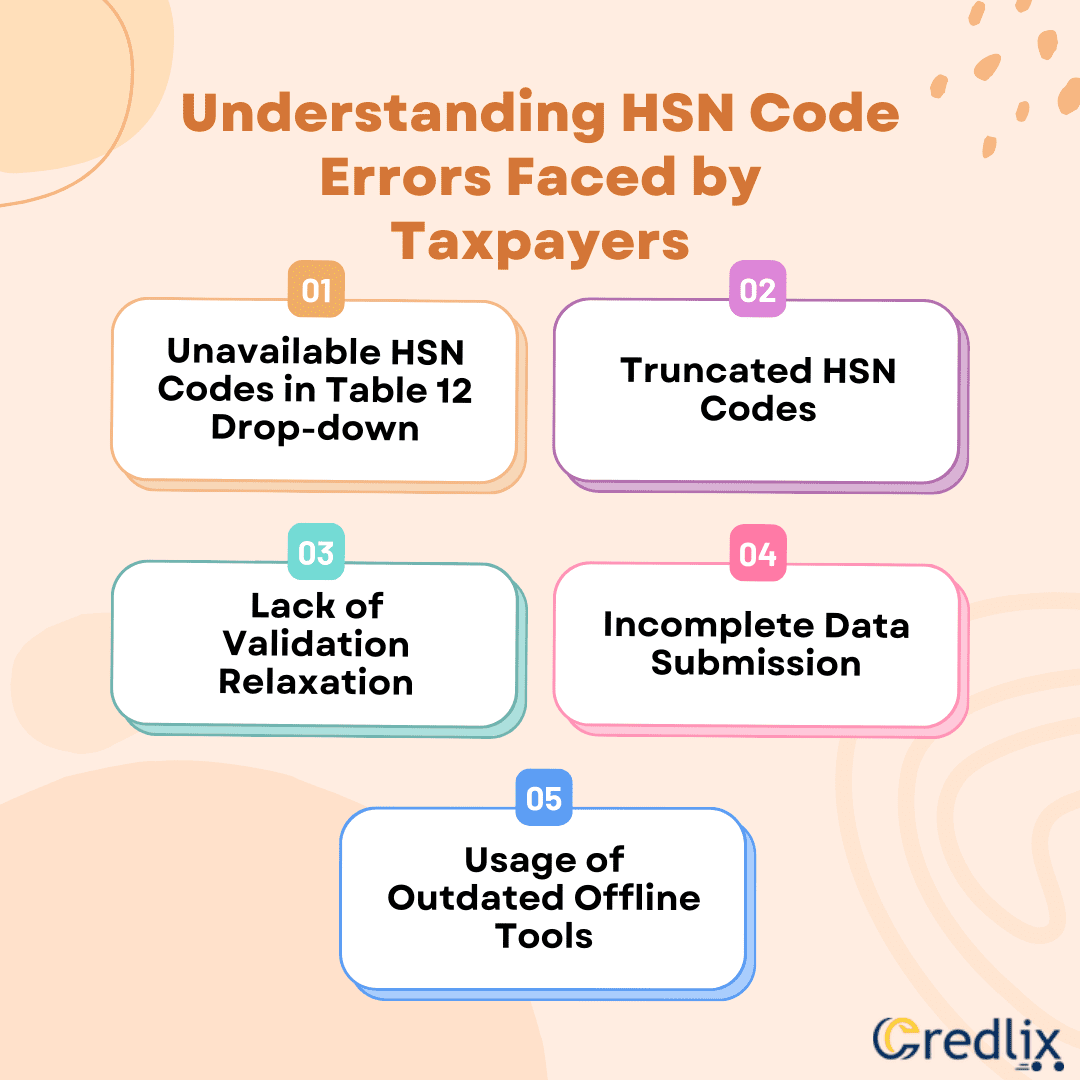

Understanding HSN Code Errors Faced by Taxpayers

Here are some of the errors faced by taxpayers:

1. Unavailable HSN Codes in Table 12 Drop-down

Some taxpayers reported that the HSN codes they use for GSTR-1 filing are not available in the Table 12 HSN drop-down menu. This limitation poses difficulties in entering essential HSN information for filing Form GSTR-1, particularly for the month of July 2021. Additionally, errors such as “Error in processing,” “In progress or received but not yet processed,” and “Duplicate invoice number in the payload” further exacerbate the issue.

2. Truncated HSN Codes

Several taxpayers attempt to report truncated first 6-digits from an otherwise legitimate 8-digit HSN. However, these shortened HSN codes, not available in the GST Tariff at the 6-digit level, are invalid. It’s imperative for taxpayers to refrain from truncating or removing the final two digits of a legal 8-digit HSN code to create a 6-digit HSN code.

3. Lack of Validation Relaxation

While the GSTN has relaxed some validations in GSTR-1 due to the pandemic scenario, these relaxations do not extend to other platforms such as the IRP portal for e-invoices or the e-way bill portal for issuing e-way bills. Therefore, it’s essential for taxpayers to ensure compliance across all platforms.

4. Incomplete Data Submission

Some taxpayers face rejections when attempting to submit data in Table 12 of GSTR-1 on the GST portal due to incomplete information entry. All necessary fields, including HSN code and description, must be filled out before submission to avoid such rejections.

5. Usage of Outdated Offline Tools

In certain instances, taxpayers use outdated versions of the Offline Tool when uploading their GSTR-1 returns, leading to errors in HSN code and tax rate entries. To mitigate this issue, taxpayers should always use the latest version of the Offline Tool (version 3.0.4) available on the GST portal.

Solutions to Address HSN Code Errors

Here are the solutions to address HSN code errors:

1. Utilize GSTN’s Search HSN Facility

To ensure accurate reporting, taxpayers should utilize the GSTN’s Search HSN facility available on the GST portal. This feature allows users to verify the correctness of their HSN codes by cross-referencing them with the database. Additionally, the HSN code directory, accessible in Excel format on the portal, serves as a valuable resource for selecting the appropriate HSN codes.

By leveraging these tools, taxpayers can minimize the risk of errors and discrepancies in their tax filings, thereby promoting compliance with regulatory requirements and avoiding potential penalties.

2. Avoid Truncating HSN Codes

Taxpayers must strictly avoid truncating or modifying legitimate 8-digit HSN codes in an attempt to create 6-digit codes. Such practices not only result in invalid HSN codes but also pose significant compliance risks. Truncated codes may not align with the GST Tariff at the 6-digit level, leading to discrepancies in goods classification and taxation.

Furthermore, utilizing incorrect HSN codes can potentially trigger audits and penalties from tax authorities. Therefore, it is imperative for taxpayers to adhere to the prescribed format and length of HSN codes to ensure accurate reporting and compliance with GST regulations.

3. Ensure Complete Data Entry

Before submitting data in Table 12 of GSTR-1, taxpayers must meticulously ensure that all required fields, including HSN code and description, are filled out completely and accurately.

Incomplete or missing information can result in rejections during the filing process, causing delays and compliance issues. By double-checking the entered data against the invoice details and relevant documentation, taxpayers can mitigate the risk of errors and ensure seamless filing of their GST returns. Additionally, thorough data entry facilitates transparency and accountability in tax reporting, fostering trust between taxpayers and regulatory authorities.

4. Update Offline Tools

Taxpayers relying on Offline Tools for GSTR-1 filing must prioritize updating to the latest version available on the GST portal. Outdated versions may lack necessary enhancements and bug fixes, potentially leading to errors in HSN code and tax rate entries.

By staying abreast of software updates, taxpayers can leverage improved functionalities and ensure compliance with regulatory requirements. Additionally, utilizing the latest version of Offline Tools enhances efficiency in tax filing processes, minimizing the risk of data inaccuracies and streamlining overall compliance efforts for businesses of all sizes.

5. Seek Assistance from GST Self-Service Portal

In cases where taxpayers encounter issues related to HSN codes that are valid but not accepted on GST, e-invoice, or e-way bill portals, seeking assistance from the GST Self-Service Portal is paramount. By raising a ticket and detailing the specific problem faced, taxpayers can prompt timely resolution from regulatory authorities.

This proactive approach not only facilitates smoother tax compliance but also fosters trust and transparency in the regulatory framework. Additionally, leveraging the support available through the Self-Service Portal enables taxpayers to address complex issues effectively and ensure uninterrupted business operations within the GST ecosystem.

In conclusion, accurate reporting of HSN codes is vital for GST compliance. By understanding common errors and implementing the suggested solutions, taxpayers can streamline their HSN code reporting processes and ensure adherence to regulatory requirements. Compliance not only fosters smoother operations but also mitigates the risk of penalties and non-compliance issues in the long run.[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]