The HSN code for laptops is 84713020, and they attract an 18% GST rate. The GST Council, responsible for deciding tax margins, links rates directly to HSN codes, spanning from 0% to 28%.

This brief overview explores the correlation between HSN codes and GST rates, specifically focusing on laptops, PCs, and related electronic devices.

Understanding the HSN code for laptops aids in determining the applicable GST, with the tax rate varying across different goods and services, as governed by the GST Council. This knowledge ensures clarity on taxation for products falling under the laptop HSN code.

Understanding HSN Code

HSN, which stands for Harmonized Structure of Nomenclature, is like a special language the government uses to organize different things people buy and sell. At first, the government used a six-digit code to sort out products. But as technology got better, they added two more digits to make it even more precise.

Now, let’s talk about computers, laptops, and similar stuff. They got their own special code, which is 8471. The first two digits, 84, are like the chapter number. It’s a big category that includes mechanical things like computers, boilers, and even nuclear reactors. The next two digits, 71, are like a detailed description. In this case, they’re talking about machines that can handle data automatically—they can take in information, process it, and send it out in a coded way.

So, in simple terms, HSN codes help the government organize products, and for computers and related gadgets, the code 8471 tells us it’s about automatic data machines found in the big category of mechanical instruments. It’s like a special code language that makes things clear and organized when we’re dealing with different products in the business world.

Relation Between HSN Code and GST

Finding the right HSN Code is super important because it decides how much GST (Goods and Services Tax) you have to pay when selling a product. Once you know the HSN Code for your product, figuring out the GST rate becomes a breeze. So, it’s like a secret code that helps the government and businesses understand what kind of product it is and how much tax should be applied to it. Making sure you have the correct HSN Code is like unlocking the key to knowing the right GST rate for your item.

What determines the GST rates in India?

The GST (Goods and Services Tax) rates in India are decided by a group called the GST Council. They’re like the decision-makers for how much tax you pay on different things you buy or services you use. This council meets regularly and talks about what tax rates should be for various products and services. They can change these rates often based on discussions during their meetings.

Recently, the government collected more GST than they expected. Because of this, they’re thinking about reducing the tax rates for some things. It’s like they have extra money, and they want to give people a bit of a break by making certain items a little less expensive.

So, the government is actively trying to figure out ways to lower the GST rates for specific categories of goods. This way, people might end up paying a bit less tax when they buy certain things. It’s a way for the government to balance things out and make sure people benefit from the extra tax money collected.

Also Read: HSN Codes: What You Need to Know for Trade and Taxation

HSN Code for Laptop

Understand the HSN code for a laptop in detail below:

- HSN codes in Chapter 84 cover personal computers, laptops, and related devices manufactured in India.

- Chapter 84 specifically deals with “Automatic Data Handling Machines & Units.”

- The four-digit HSN code 8471 is assigned to represent computers.

- The GST margin for this code is fixed at 18%.

- “Automatic data handling machine” refers to any electrical device meeting specific criteria.

- These criteria include storing processing software and supporting data, providing a flexible user interface, executing arithmetic operations, and implementing logical reasoning.

- The machine must function as a singular component or system capable of hosting multiple subunits.

- Any subunit linked to the primary data handling device is categorized under HSN Code 8471.

- Subunits, including mouse, printer, keyboard, and USB storage, are actively used to achieve computational goals.

- They are linked to the CPU either directly or through intermediary units.

- These supporting gadgets receive and transmit information as signals.

- Fluctuations in the performance of these subunits can render the computer non-functional.

- The HSN Code – 8471 covers the entire system, including supporting devices.

- The GST rate for this code is 18%.

- The code is part of Chapter 84, emphasizing Automatic Data Handling Machines & Units.

- The phrase “automatic data handling machine” encompasses various electrical devices.

- Regular updates to HSN codes may occur, so staying informed is crucial.

Tax Levied on Laptops

Before GST (Goods and Services Tax) came into play, sellers used to pay a tax called VAT (Value Added Tax) on laptops in India. This tax was 14% of the net revenue they earned from selling laptops. In some states, this VAT could go as high as 15%. It was kind of like a cost for the sellers.

Now, under GST, there’s a fixed tax rate for laptops, just like for other stuff. When you buy a laptop, you pay 18% GST on the laptop’s maximum retail price. It’s a straightforward system, making it easier to know how much tax is included in the laptop’s price. So, before it used to be this variable VAT, and now it’s a set GST rate that everyone follows when buying or selling laptops in India.

HSN Codes for Computer Hardware and Software

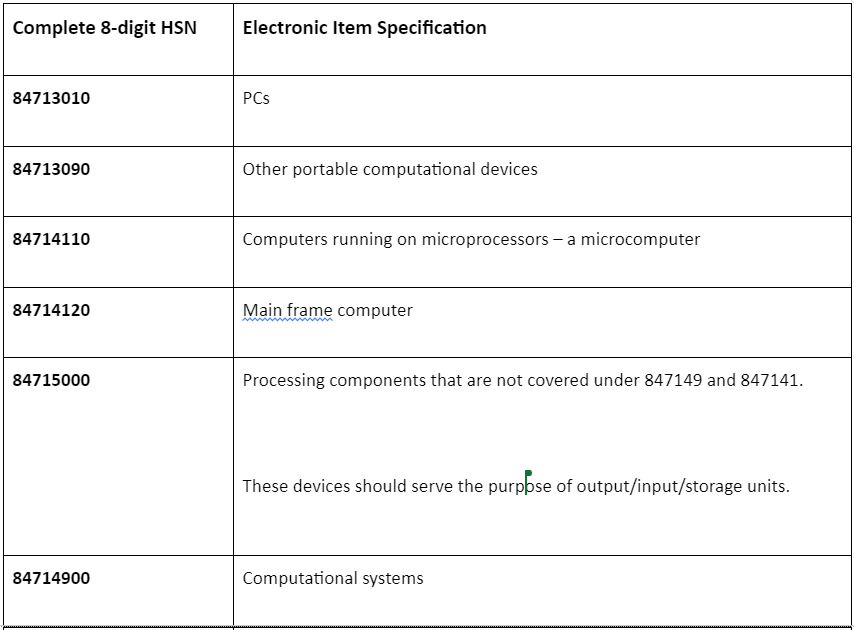

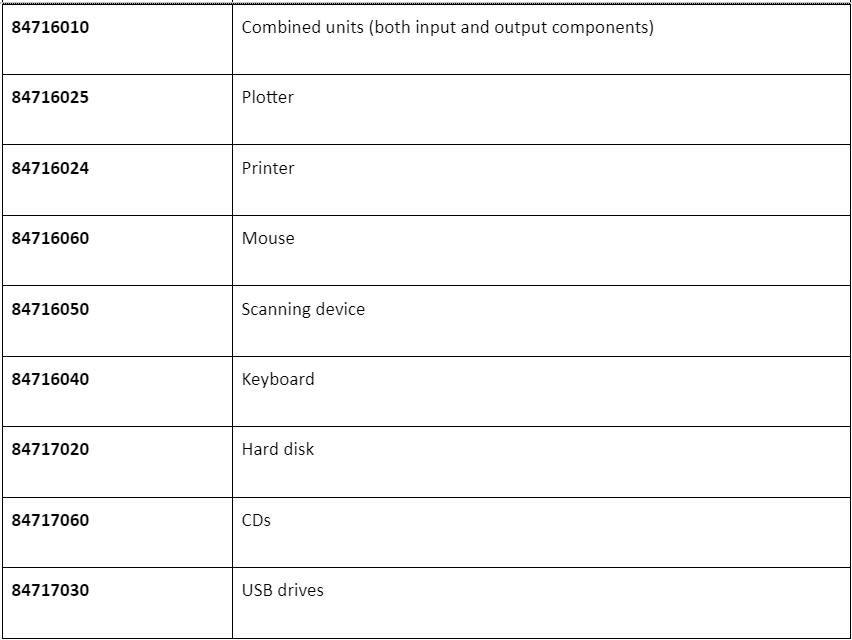

Let’s break down the HSN codes for computer hardware and software. The common code is 8471, which covers various computing tools. Now, let’s look at more specific codes:

847160: This code is for printing devices and input components like mouse, scanner, and keyboard.

847170: If we’re talking about storage instruments like hard disks and flash drives, the code becomes 847170.

847130: Now, this is a six-digit code (847130) specifically for personal computers weighing less than 22 pounds. It’s used in offices and homes.

Here’s a table with more details:

These codes help categorize and understand different computer-related items, making it easier for businesses and customers.

Final Words

Understanding HSN codes and GST rates simplifies the world of commerce. HSN codes, like a special language, organize products, with laptops having the code 84713020 and an 18% GST rate. The GST Council, acting as decision-makers, links tax rates directly to these codes, aiming for fairness. The correlation between HSN codes and GST ensures clarity on taxation, making it straightforward for products under specific codes, such as laptops.

Moreover, the system adapts, evidenced by the transition from variable VAT to a fixed 18% GST rate for laptops under the Goods and Services Tax. The HSN codes for computer hardware and software further break down categories, aiding businesses and customers in comprehending and navigating the complexities of the electronic world. It’s like a code language that speaks clarity in the dynamic realm of goods and services, fostering a more accessible and organized business environment.

Also Read: Demystifying HSN Codes: Impact on Your Business and Its Significance