[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12584″ img_size=”full” css=”.vc_custom_1712641241432{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Did you know that PVC Pipes and Fittings have a special code called the HSN code? It’s like a unique ID for these products, helping to identify them in electronic systems. This code is made up of six digits, separated by a hyphen. The first two digits are like a secret handshake—they represent the manufacturer, giving a nod to the company that made the product. The remaining four digits are like a detailed map, pointing out each specific component within the product.

What’s cool is that the HSN code isn’t just for PVC Pipes and Fittings—it’s part of a bigger system called the Harmonized System of Nomenclature (HSN). Think of it as a worldwide language for classifying goods. This system helps make sure that products are categorized consistently, no matter where they’re being bought or sold. So, next time you see an HSN code on PVC Pipes and Fittings, remember that it’s like their own special ID card, helping them navigate the global marketplace.

What is an HSN Code?

The HSN code, short for Harmonized System of Nomenclature, is an 8-digit classification code used globally to categorize goods. In India, it’s crucial for businesses, especially those manufacturing or selling PVC pipes and fittings, as it’s used for Goods and Services Tax (GST) purposes. PVC pipes and fittings specifically fall under HSN code 3917, attracting a GST rate of 18%. Understanding and applying the correct HSN code ensures compliance with tax regulations and facilitates smoother transactions within the Indian market.

The HSN code for PVC Pipes and Fittings in India

In India, if you’re in the business of PVC pipes and fittings, there’s something you need to know: the HSN code 3917. But what’s that, you ask? Well, think of it as a special code that’s like a universal language for classifying products. This code system helps categorize goods worldwide, making it easier to understand what you’re buying or selling.

Now, let’s break down the HSN code for PVC pipes and fittings. It’s made up of six digits, with the first two (39) representing the chapter where the product belongs. Then, the next two digits (17) pinpoint the specific classification heading for PVC pipes and fittings. Finally, the last two digits identify the product itself, like a unique fingerprint.

But why is this important? Because the HSN code is not just some random number—it’s used for something called GST, or Goods and Services Tax. This tax is added to the price of goods and services, and the HSN code determines the rate. For PVC pipes and fittings, the GST rate is 18%. So, whenever you buy PVC pipes or fittings in India, be prepared to pay that extra 18% on top of the price.

Understanding the HSN code for PVC pipes and fittings isn’t just about following the rules—it’s about making sure you’re on the right side of the law and doing business the right way. So, next time you see that HSN code 3917 on a package of PVC pipes, you’ll know exactly what it means and why it matters.

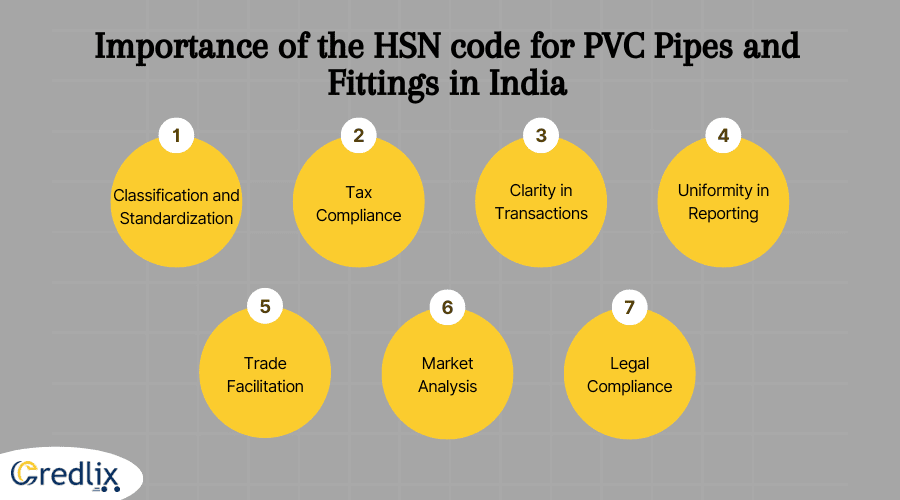

Importance of the HSN code for PVC Pipes and Fittings in India

See why it’s important to understand the HSN code for PVC pipes and fittings in India:

Classification and Standardization: The HSN code provides a standardized classification system for PVC pipes and fittings, ensuring consistency in how these products are categorized and identified across India.

Tax Compliance: HSN codes are essential for Goods and Services Tax (GST) compliance in India. By correctly identifying PVC pipes and fittings under the HSN code 3917, businesses can accurately calculate and apply the appropriate GST rate of 18%, ensuring compliance with tax regulations.

Clarity in Transactions: Having a designated HSN code for PVC pipes and fittings facilitates clarity in business transactions. It helps buyers and sellers easily identify and understand the nature of the products being traded, streamlining the process of buying and selling.

Uniformity in Reporting: Businesses use HSN codes to report their sales and purchases for GST purposes. Using the correct HSN code for PVC pipes and fittings ensures uniformity in reporting across different businesses and sectors, enabling accurate tax assessments and audits.

Trade Facilitation: The HSN code for PVC pipes and fittings simplifies trade documentation and customs procedures for importers and exporters. It allows customs authorities to quickly identify and classify imported or exported goods, expediting clearance processes and reducing delays at ports.

Market Analysis: HSN codes provide valuable data for market analysis and economic research. By tracking sales of PVC pipes and fittings under specific HSN codes, policymakers, analysts, and businesses can gain insights into market trends, demand patterns, and industry performance.

Legal Compliance: Complying with HSN code requirements is essential for legal compliance in India. Businesses must accurately classify their products under the relevant HSN codes to avoid penalties, fines, or legal repercussions related to tax evasion or misrepresentation.

How To Get HSN Code?

If you’re a business owner and need to classify your goods and services, getting an HSN code is a must. This code is like a secret decoder ring that helps customs officials apply the right taxes on imported and exported items. Plus, it helps companies keep tabs on their inventory in a snap.

Now, getting your hands on an HSN code isn’t too tricky. One common way is to reach out to the Customs department and apply for it. They’ll hook you up with a unique 6-digit number that identifies your product like a fingerprint.

But hey, if you’re more of a DIY type, there are other options too. You can hop online and fill out an application for an HSN code. Or, if you’re not sure where to start, you can use an HSN code lookup tool to find the right code for your product.

Whichever route you choose, having an HSN code for your business is key. It’s like having a passport for your products—it opens doors, keeps things organized, and makes sure you’re playing by the rules.

Understanding the HSN code for PVC pipes and fittings is crucial for businesses in India. It ensures proper tax compliance, facilitates smooth transactions, and simplifies trade processes. By accurately classifying products under the HSN code 3917, businesses can navigate the complexities of the Indian market with confidence. Whether you’re a manufacturer, importer, or exporter, having a clear understanding of the HSN code system is essential for legal compliance and efficient business operations.

So, next time you encounter the HSN code 3917, remember its significance—it’s not just a number, but a key to unlocking success in the world of PVC pipes and fittings.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]