[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11647″ img_size=”full” css=”.vc_custom_1702886291969{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In 2017, experts predicted that India’s retail and online shopping would boom. They said the money made in this business would jump from US$39 billion in 2017 to US$120 billion by 2020. That means the industry would grow by 51% each year, the highest compared to other countries.

In India, the electronics part of online shopping is the most popular. But now, people are starting to buy other things online too. This means there are more products available to meet what customers want.

Running the day-to-day tasks and dealing with unpaid bills can be hard. It’s important for businesses to have fast access to money they can use. Invoice discounting is a way to help the retail and online shopping businesses get funds by using the money stuck in the bills that haven’t been paid yet. Both regular stores and online shops need money to buy the things they sell from their suppliers.

When businesses get big orders, they often have to wait a long time, usually between 30 to 90 days, to get paid. This creates problems like needing to pay the seller upfront, getting money later than expected, dealing with slow payments, having to wait a long time for money to come in, spending a lot on overhead costs, and facing issues with how the work is done. All of these things make it even tougher for the industry.

Key Takeaways!

- Invoice discounting accelerates financial agility for retail and e-commerce, ensuring quick access to funds.

- Streamlines day-to-day tasks, reduces dependence on payment timelines, and mitigates high overhead costs.

- Facilitates timely payments, strengthening supplier relationships and opening doors to better terms.

- Acts as a financial cushion for handling peak demands, ensuring stability and growth.

- Fuels business expansion and innovation through quick access to funds.

What is Invoice Discounting?

Invoice discounting is a financial arrangement that helps businesses get quick access to cash. Invoice discounting operates as a form of short-term financing for businesses. When a company delivers goods or services and issues an invoice to its customers, it typically has to wait for a certain period before receiving payment.

This waiting period can strain a business’s cash flow, hindering its ability to cover immediate expenses such as operational costs, supplier payments, or other financial obligations.

Also Read : The Ultimate Guide on What is Invoice Discounting

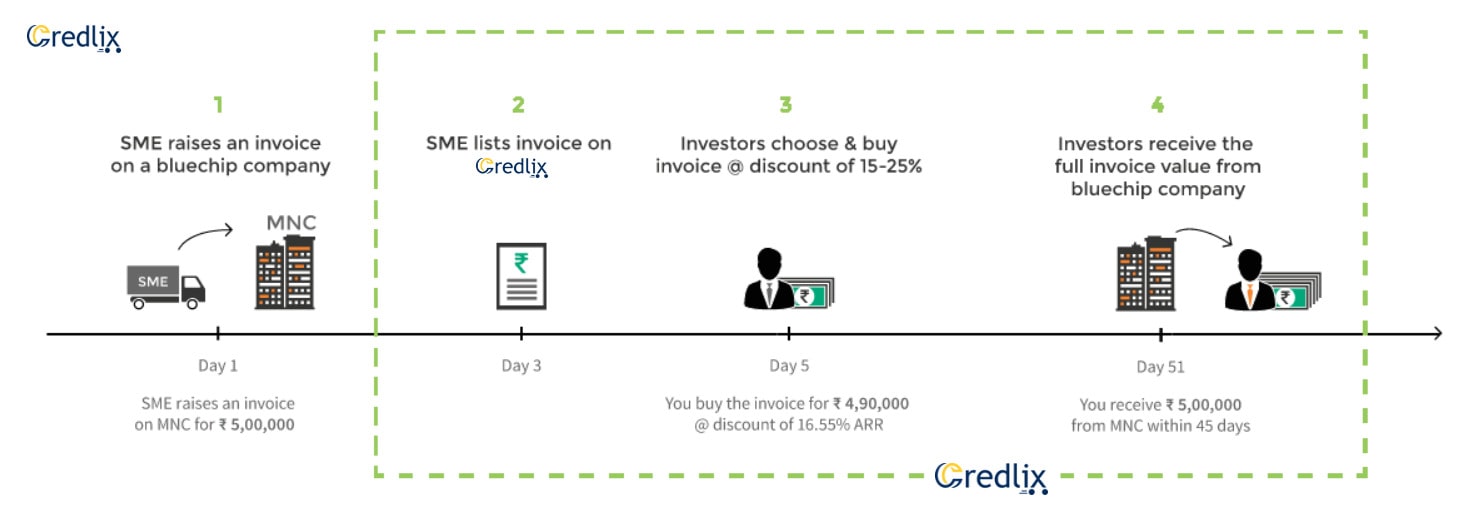

How Does it Work?

Get a glimpse about the functioning of Invoice Discounting below:

Invoice Issuance: Business delivers goods or services and sends an invoice to the customer.

Payment Waiting Period: Typically, the business has to wait for a specified period, often between 30 to 90 days, to receive payment.

Invoice Discounting Decision: To overcome cash flow challenges during this waiting period, the business opts for invoice discounting.

Third-Party Involvement: The business sells the unpaid invoice to a financial institution or third-party service provider.

Discounted Purchase: The financial entity purchases the invoice at a discounted rate, which serves as their fee for providing immediate funds.

Upfront Payment: In return, the business receives an upfront payment, usually a percentage of the total invoice value.

Cash Flow Management: This immediate infusion of funds helps the business manage cash flow and address immediate financial needs.

Responsibility Transfer: The financial institution takes over the responsibility of collecting the full invoice amount from the customer on the agreed-upon due date.

Flexibility for Businesses: Invoice discounting offers businesses flexibility to navigate working capital challenges and ensures smooth ongoing operations.

Customer Payment Handling: The financial institution collects the full invoice amount directly from the customer when it becomes due.

Financial Solution: Overall, invoice discounting serves as a financial solution that enables businesses to convert accounts receivable into immediate cash, maintaining financial stability.

The Role of Invoice Discounting for Retail and E-Commerce Enterprises

Here’s how Invoice Discounting works for Retail and e-Commerce enterprises:

Improved Cash Flow Management

Invoice discounting helps retail and e-commerce businesses handle their money better. It lets them use the cash stuck in unpaid bills, making sure they always have enough working money. This way, they can keep things running smoothly without waiting too long for payments. It’s like a tool that helps them manage their funds and have the cash they need for daily operations.

Timely Working Capital

When businesses get paid right away for their invoices, it helps them take care of urgent money matters. They can use this quick payment for things like buying more products for their store, covering everyday costs, or investing in making their business even better and bigger. It’s like getting a boost of cash when they need it the most, giving them the flexibility to handle various financial needs and keep things moving forward.

Flexible Financial Solution

Invoice discounting is like a flexible money solution for companies. It gives them the freedom to handle short-term money issues without depending only on regular loans or credit. Instead of going through the usual borrowing process, businesses can use the funds from selling their unpaid invoices. This flexibility helps them navigate financial challenges more easily, ensuring they have options beyond traditional banking methods to keep their operations running smoothly.

Reduced Dependence on Customer Payment Timelines

Businesses don’t have to wait a long time for customer payments thanks to reduced reliance on their payment schedules. This means they’re not as affected by delays in getting the money they’re owed. It’s like avoiding the stress of waiting, helping companies manage their daily tasks without being slowed down by late payments. This way, they can keep things moving smoothly and focus on what they do best without worrying too much about when they’ll get paid.

Enhanced Supplier Relationships

Getting money faster helps companies pay their suppliers on time, making their relationships stronger. It’s like having the speed to settle bills promptly, creating a positive connection with suppliers. Plus, when companies are good at paying on time, they might even talk about better deals for future business. This improved connection with suppliers not only helps with current transactions but also sets the stage for better terms and cooperation in the future.

Streamlined Operations

Getting quick funds through invoice discounting is like adding a boost to a company’s bank account. This helps things run more smoothly because there’s always money available when needed. It’s like having a safety net that prevents disruptions in daily tasks. With this financial help, businesses can keep everything running efficiently, focus on their work, and avoid any hiccups that might come up due to a shortage of funds. In short, it’s a way to make sure everything works like a well-oiled machine.

Mitigation of High Overhead Costs

Getting rid of working capital problems quickly is like a superhero move for businesses. It helps them avoid the extra costs that come with waiting too long for payments. Imagine it as a way to prevent big bills and expenses from piling up. When businesses can sort out their money matters fast, it’s like turning down the volume on those high overhead costs, making things more manageable and leaving room for the business to thrive without unnecessary financial burdens.

Support for Seasonal Demands

Imagine invoice discounting as a helpful tool for retail and e-commerce, especially when dealing with busy and slow times. Businesses in these industries often experience changes in demand, like more shoppers during holidays. Invoice discounting provides a financial cushion during these peak periods. It’s like having extra funds on hand to handle the rush and keep things going smoothly. This flexibility ensures that businesses can meet the ups and downs of seasonal demands without stressing about cash flow issues, fostering stability and growth.

Investment in Marketing and Innovation

Having quick access to funds is like having a key to unlock opportunities for retail and e-commerce businesses. With these funds, companies can invest in smart advertising and new ideas, staying ahead in the ever-changing online shopping world. It’s like having the fuel to power up marketing strategies and innovative projects. This financial support allows businesses to compete strongly, attracting more customers and staying fresh and exciting in the fast-paced retail and e-commerce scene.

Adaptability to Changing Market Conditions

Think of invoice discounting as a superhero cape for businesses. It gives them the power to adjust quickly when the market changes. Instead of getting stuck because of money problems, businesses can use this tool to grab new chances as they come. It’s like having a safety net that lets them jump into opportunities without worrying about running out of cash. Invoice discounting is the secret weapon that helps businesses stay flexible, adapt to changes, and make the most of new possibilities in the ever-shifting market.

Overall Business Growth

Think of improved financial agility as the rocket fuel for retail and e-commerce companies. With this boost, they can concentrate on growing in a smart and lasting way. It’s like having the energy to add more cool stuff to sell, explore new places to sell, and become a bigger and better part of the market. Improved finances act as the wind beneath their wings, allowing these companies to soar, expand their products, venture into new markets, and shine brighter in the overall business landscape.

Also Read : Exclusive Tips to Maximize Benefits of Invoice Discounting for Individuals

How Credlix Boosts Your E-commerce Success

A prominent e-commerce platform encountered hurdles in expanding and progressing further, primarily due to insufficient working capital for retail and limited avenues to raise essential funds. This resulted in challenges managing operational expenses efficiently, pressing for an urgent need to expand the credit line.

Faced with the strict processes of financial institutions, the company chose Credlix for invoice discounting in retail and e-commerce services, effectively addressing their working capital requirements.

Why Choose Credlix

Credlix empowers your e-commerce success with swift fund access and hassle-free Invoice Discounting.

- Rapid Fund Access: Credlix’s invoice discounting technology ensures quick working capital for retailers, manufacturers, and wholesalers. Verified vendors can receive funds within 24-72 hours*.

- No Collateral Needed: Enjoy the freedom from collateral and securities when securing working capital with Credlix.

- Competitive Discount Rates: List your unpaid invoices at attractive discounting rates ranging from approximately 1.2-2%**.

- Effortless Process: Experience a hassle-free journey with Credlix’s secure digital platform and user-friendly technology.

- Real-time Tracking: Stay informed with real-time updates on the status of your listed invoices through the Credlix platform.

Final Words

In conclusion, invoice discounting is like a superhero sidekick for retail and e-commerce businesses, offering quick funds to tackle various challenges. From managing cash flow and reducing dependence on payment timelines to fostering better supplier relationships and supporting growth initiatives, it plays a crucial role.

This financial tool not only streamlines operations but also provides the flexibility needed to adapt to market changes. With improved financial agility, businesses can confidently navigate the dynamic landscape, ensuring overall growth and success in the competitive world of retail and e-commerce.

Also Read : How Investing In Invoice Discounting Is More Profitable Than Stock Market

FAQs

Q: What are the eligibility criteria for FMCG business?

FMCG businesses eligible for Credlix invoice discounting services are those supplying goods/services to large blue-chip companies. To avail of this service, the company must be open to sharing its financial information and related documents for the verification process.

Q: Is there any maximum limit for FMCG business financing?

There is no fixed upper limit for financing FMCG businesses. The sanctioned amount depends on the specific needs and eligibility criteria set by the financing provider. The upper limit is determined by the business requirements and the terms established in the financing agreement.

Q: Will invoice discounting on Credlix impact the company’s balance sheet?

No, utilizing invoice discounting on Credlix does not affect the company’s balance sheet. Credlix offers a zero-liability invoice discounting service, allowing businesses to access working capital based on outstanding invoices without impacting their balance sheet.

Q: What is the maximum tenure for Invoice Discounting on Credlix?

Credlix offers a maximum tenure of 90 days for discounted invoices. This aligns with their provision for short-term investments, providing businesses with a time frame of up to 90 days to fulfill the discounted invoice. It serves as a flexible financing solution for managing cash flow needs within a relatively short period.

Q: Will the financial information of the company be shared with a third party on Credlix?

Credlix, as an ISO 27001:2013 certified private entity, prioritizes the security of client information. They adhere to stringent measures to safeguard financial data, ensuring that confidential information, including the financial details of the company, is handled securely and not shared with third parties.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]