[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11951″ img_size=”full” css=”.vc_custom_1706687923693{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Setting sail into the vast oceans brings excitement and challenges. Ever wondered how ships and cargo stay protected? That’s where Marine Insurance comes in. Marine Insurance, also called Cargo Insurance, is essential for ship owners, shipping companies, and cargo owners to safeguard their interests.

In this guide, we’ll sail through easy explanations of what Marine Insurance is, the different types it has, the good things it does for you, and the stuff it covers.

Think of it as a friendly map to help you navigate the sea of insurance. So, if you’re curious about keeping things safe at sea, hop on board as we explore the world of Marine Insurance together!

What is Marine Insurance?

Marine insurance acts as a protective shield for ships, cargoes, terminals, transports, and transfers, ensuring coverage in the face of damage or loss. In simpler terms, if something goes wrong with your boat or watercraft, a marine insurance policy steps in to cover the financial setbacks.

However, the extent of coverage depends on specific criteria, like the location of your boat. Whether it’s onshore, out of the water, snug in your garage, or parked at a boat club, these details play a crucial role in determining the safety considerations affecting your insurance premiums.

Essentially, marine insurance offers a safety net for the unpredictable seas of potential risks, ensuring that your investment in maritime assets remains protected, regardless of the various circumstances that might come its way. So, whether you’re a shipowner, cargo handler, or simply passionate about maritime ventures, understanding the nuances of marine insurance becomes paramount for securing your nautical interests.

Advantages of Marine Insurance

Understand the benefits of Marine Insurance to make a good and informed choice:

Financial Protection: Marine insurance provides a financial safety net, offering coverage for potential losses and damages to ships, cargo, and related assets during maritime activities.

Risk Mitigation: Helps businesses mitigate risks associated with unpredictable events at sea, such as accidents, storms, or other maritime perils, reducing the impact of these uncertainties.

Business Continuity: Ensures business continuity by covering the costs of repairing or replacing vessels and cargo, allowing operations to resume swiftly after an insured incident.

Customer Confidence: Demonstrates commitment to customer satisfaction, instilling confidence in clients by assuring them of secured and insured transportation services.

Legal Compliance: Meets contractual obligations, as many export contracts necessitate the inclusion of marine insurance, ensuring compliance with trade agreements and international shipping standards.

Comprehensive Coverage: Offers a range of policies catering to diverse needs, including coverage for vessels, cargo, liability, and specific risks associated with marine activities.

Flexible Policies: Provides flexibility with various policy types, allowing businesses to choose coverage based on their specific maritime operations and requirements.

Efficient Claims Process: Streamlines the claims process, facilitating quicker reimbursements and minimizing disruptions to business operations in the aftermath of an insured incident.

Global Trade Support: Facilitates global trade by mitigating the financial risks associated with transporting goods across international waters, fostering a more secure and reliable shipping environment.

Protection Against Unforeseen Events: Acts as a safeguard against unforeseen events such as theft, accidents, or natural disasters, offering peace of mind to businesses engaged in marine activities.

Understanding Marine Insurance Coverage

Get into more details to understand Marine Insurance Coverage:

Vessel Damage: Covers physical or structural damage resulting from collisions with submerged or above-water vessels.

Property and Injury Coverage: Protects against damage to your property or others’ belongings on board, including coverage for bodily injuries.

Assistance Services: Includes towing, assistance, and gas delivery if your boat is stranded.

Cargo Protection: Extends coverage to your ship and cargo during the transportation of goods.

Liability Coverage: Covers liabilities arising from damage or loss of goods during transit.

Commercial Transportation: Crucial for businesses involved in transporting customers’ goods, ensuring comprehensive coverage.

Trust Building: Having adequate marine insurance builds trust with customers, assuring them of insured services.

Collision Events: Addresses damages caused by collisions, whether with underwater or above-water vessels.

Property on Board: Safeguards against losses related to property on the vessel, ensuring financial protection.

Bodily Injury Protection: Offers coverage for bodily injuries, providing financial support in case of accidents.

Emergency Assistance: Provides essential services like towing and gas delivery during unexpected incidents.

Goods in Transit: Protects goods being transported, mitigating financial risks associated with potential damage or loss.

Liability Protection: Extends coverage to liabilities arising from damage or loss, reducing financial burdens.

Customer Assurance: Demonstrates a commitment to customer satisfaction by ensuring a secure and insured service.

Responsibility Emphasis: Highlights the importance of taking personal responsibility to secure adequate marine insurance, especially in commercial transportation scenarios.

How Does Marine Insurance Work?

Understand how Marine Insurance works below:

Liability Transfer: When you secure marine insurance, the liability for potential losses and damages shifts from you and other stakeholders to the insurance provider. This ensures that you have financial protection in case of unforeseen events during transportation.

Limited Liability as an Intermediary: As an intermediary handling transported goods, you inherently have limited liability. However, purchasing insurance further safeguards your interests and minimizes potential financial risks associated with cargo loss or damage.

Exporter’s Responsibility: Export contracts often mandate the exporter to obtain marine insurance. As an exporter, it becomes your responsibility to secure insurance coverage to fulfill the contractual terms and conditions, such as Carriage and Insurance Paid (CIP) or Cost Insurance and Freight (CIF).

Customer Protection: Marine insurance is a crucial tool for protecting your customers’ interests and property. By adhering to contractual policies and providing insurance coverage, you assure customers that their goods are safeguarded throughout the transportation process.

Contractual Obligations: Fulfilling the terms of agreements, such as CIP or CIF, becomes seamless with marine insurance. This not only protects your business but also establishes a trustworthy relationship with customers, emphasizing your commitment to delivering goods safely and in compliance with contractual obligations.

Different Types of Marine Insurance

Various types of marine insurance coverage are available to meet diverse needs. Let’s explore these different options:

Freight Insurance: Freight insurance shields the owning corporation of a merchant ship from financial losses incurred in the transport of goods. In the event of cargo loss due to accidents, this insurance covers the monetary setbacks, providing a safety net for businesses heavily involved in freight operations.

Freight Demurrage and Defense Insurance (FD&D): Commonly known as FD&D, this insurance is a legal safeguard, covering costs, claims, and handling assistance for disputes not handled by other marine insurance types. It ensures a robust defense against a broad spectrum of legal challenges, supplementing the protection provided by P&I, Hull, or machinery insurance.

Hull Insurance: Hull insurance offers comprehensive coverage for a vessel’s structure, protecting ship owners from financial losses caused by damage or loss in accidents. It encompasses the hull, torso, and various ship components, serving as a crucial financial safeguard for ship owners.

Liability Insurance: Liability marine insurance compensates for financial liabilities arising from ship collisions, crashes, or induced attacks. It provides essential financial protection, ensuring ship owners can navigate unforeseen events without incurring significant financial losses.

Marine Cargo Insurance: Essential for cargo owners, marine cargo insurance protects against mishandling risks during handling or voyages. This coverage ensures compensation for losses incurred, including damage, loss, or misplacement of goods, offering peace of mind to cargo owners.

Machinery Insurance: Machinery insurance safeguards vital on-board machinery, providing compensation for operational damage to the ship. While subject to survey and approval from a surveyor, this coverage ensures that essential ship machinery remains protected from potential risks.

P&I Insurance (Protection and Indemnity): P&I insurance, provided by a P&I club, focuses on damages or losses to third-party goods that might not be covered by standard marine insurance policies. This specialized coverage ensures shipowners have comprehensive protection, emphasizing indemnity for damages to third-party interests.

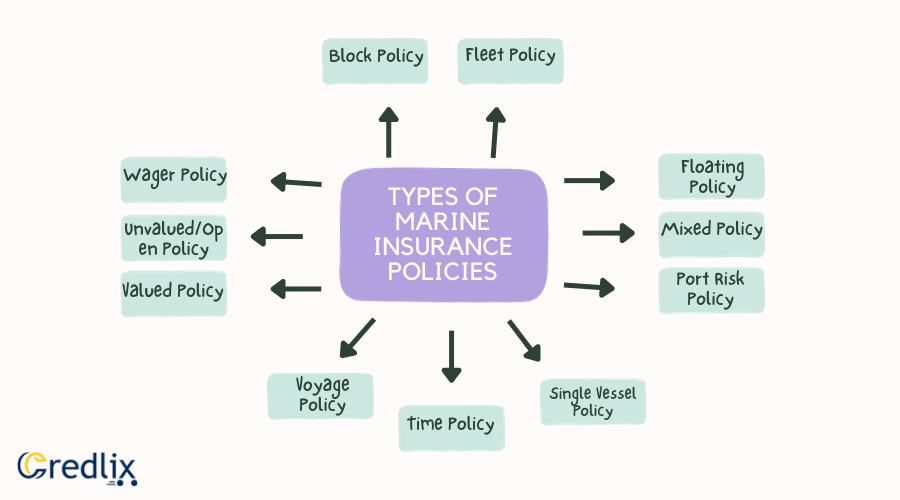

Types of Marine Insurance Policies

After the types of Marine Insurance, understanding Marine Insurance Policies is equally important.

Block Policy: Covers cargo owners against loss or damage throughout the journey, falling under maritime insurance.

Fleet Policy: Beneficial for owners of multiple ships, offering comprehensive coverage for the entire fleet.

Floating Policy: Ideal for frequent cargo transporters, this policy sets a maximum insurance limit, with details provided when the vessel begins its journey, saving time and money.

Mixed Policy: Combines both voyage and time policies, providing versatile coverage.

Port Risk Policy: Offers insurance to the ship while docked at a port, ensuring comprehensive protection during this crucial phase.

Single Vessel Policy: Tailored for small ship owners, providing coverage for a single ship’s insurance needs.

Time Policy: Valid for a specified time period, often a year, offering consistent coverage during this duration.

Voyage Policy: Specifically valid for designated voyages, providing targeted coverage.

Valued Policy: Clearly states the cargo’s value in the document, ensuring transparency in reimbursement.

Unvalued/Open Policy: Opposite of a valued policy, the cargo value is assessed after an incident, determining reimbursement based on the extent of damage or loss.

Wager Policy: Involves no fixed reimbursement terms, relying on the discretion of the insurance provider to determine genuine damage worth reimbursing. Note: This informal policy lacks legal standing in the court of law.

Conclusion

Whether you own a single ship, manage a shipping company, or handle cargo, marine insurance is crucial for safeguarding your goods and investments. Always consider securing marine insurance and consult with experts to ensure you get the right coverage tailored to your specific needs. It’s a smart way to protect your assets and gain peace of mind in the unpredictable world of maritime activities.

FAQs

Who can use Marine Insurance Coverage?

Marine insurance is accessible to various stakeholders, including:

- Manufacturers

- Importers and exporters

- Cargo owners

- Buying agents

- Buyers

What documents are needed to make a claim under maritime insurance?

To make a claim under maritime insurance, you would need to have the following documents:

- Claim form

- Insurance certificate and the policy number

- Bill of lading

- Missing certificate or survey report

- Invoices, packaging lists, and shipping details

- Xerox of correspondences exchanged

What does Marine Insurance not cover?

While marine insurance offers comprehensive coverage, certain exclusions should be noted:

- Deliberate damage or misconduct

- Damages from riots, strikes, or war

- Cargo damage due to inadequate packaging

- Transportation delays and related costs

- Wear, tear, or cargo leakage

- Shipping company insolvency or financial distress

- Wreck removal

Also Read: Understanding ECGC Insurance: Protection for International Trade[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]