[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12299″ img_size=”full” css=”.vc_custom_1709878534457{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Merchant exports make up approximately 35% of India’s export value, showcasing their crucial role in bolstering the nation’s overall export figures. This is especially noteworthy for MSMEs and small manufacturers, highlighting the importance of merchant exports in driving economic growth and providing opportunities for smaller businesses to participate in international trade.

In this blog, let’s understand merchant exports, meaning, and process under GST. Read carefully.

Who is a Merchant Exporter?

A merchant exporter is an entrepreneur engaged in the business of exporting goods obtained locally to international markets. This individual procures goods from local sources and sells them abroad, facilitating trade activities across borders.

What Are Merchant Exports?

Merchant exports refer to the process of selling goods manufactured in one country to buyers located in another country. In this type of export, the exporter purchases goods from local manufacturers or producers and then sells them to international buyers without any further processing or value addition.

Merchant exports play a significant role in global trade, contributing to a substantial portion of a country’s export revenue. They are particularly beneficial for small and medium-sized enterprises (SMEs) as they provide opportunities for them to access international markets without the need for extensive investment in production facilities or infrastructure.

What is Merchant Export under GST?

Under the Goods and Services Tax (GST) regime, merchant exports refer to transactions where goods are supplied by an Indian-based supplier to a destination outside of India. These transactions fall under the category of taxable supplies as defined by Section 2(108) of the CGST Act. Additionally, as per Section 7(5) of the IGST Act, such transactions are treated as inter-state supplies, even though the supplier is based in India but the place of supply is outside the country.

Consequently, merchant exporters are required to register under the GST regime and comply with GST regulations. This registration ensures that the exporter fulfills their tax obligations on these transactions. Therefore, while the goods are exported out of India, they are still subject to GST due to the involvement of an Indian-based supplier.

Role of Merchant Exporters under GST

Merchant exporters serve as intermediaries between manufacturers and international buyers, streamlining the export process without the need for manufacturing facilities. For more, read below.

- Merchant exporters do not manufacture goods but act as intermediaries between manufacturers and overseas buyers.

- They establish networks with various suppliers to source products for export.

- Merchant exporters utilize marketing techniques such as websites and social media campaigns to attract overseas clients.

- Upon receiving an order, the merchant exporter requests the supplier to supply the required products.

- Products are labeled with the merchant exporter’s name rather than the original supplier’s.

- Goods can be exported directly from the manufacturer’s premises, either sealed or unsealed.

- Alternatively, goods may be exported through the merchant exporter’s premises under a rebate claim or bond.

- Merchant exporters streamline the export process by handling documentation and logistics.

- They ensure compliance with export regulations and tax requirements, including GST.

- Merchant exporters play a crucial role in facilitating international trade and expanding market access for manufacturers.

Merchant Exports Process under GST

Under the Goods and Services Tax (GST) regime, the process of merchant exports involves several key steps to ensure compliance and facilitate smooth export transactions. Here’s an overview of the process:

Registration: Merchant exporters are required to register under the GST regime by obtaining a Goods and Services Tax Identification Number (GSTIN). This registration ensures that exporters fulfill their tax obligations on export transactions.

Order Placement: Exporters must place orders with local manufacturers or suppliers for the procurement of goods intended for export. A copy of the order should be provided to the manufacturer’s relevant tax officer.

Goods Procurement: Upon receiving an export order, the merchant exporter procures the required goods from local manufacturers or suppliers. These goods are sourced for export without any further processing or value addition.

Documentation: Exporters must maintain proper documentation of the procurement process, including tax invoices from suppliers and copies of export orders placed with manufacturers. This documentation serves as evidence for tax compliance and record-keeping purposes.

Export Procedure: Goods intended for export are transported directly from the manufacturer’s location to the port, airport, or designated customs office for export. Alternatively, goods may be exported through the merchant exporter’s premises under a rebate claim or bond.

Record-Keeping: Exporters must maintain records of product receipts, tax invoices, and export documentation. These records should be preserved for audit purposes and may need to be furnished to tax authorities upon request.

Export Timeline: Commercial exporters are required to export goods within 90 days from the date of invoice issuance. Adhering to export timelines ensures timely fulfillment of export orders and compliance with regulatory requirements.

Invoice Details: Exporters must include the supplier’s GSTIN and the manufacturer’s tax invoice number on the invoice or export document, if applicable. This ensures accurate documentation and tax compliance.

Submission of Documents: After export, exporters must submit copies of the invoice or export document containing the manufacturer’s GSTIN and tax invoice details. This serves as certification for the submission of the Export General Manifest (EGM) or export report.

By following these steps diligently, merchant exporters can navigate the GST framework effectively, ensure compliance with regulatory requirements, and facilitate seamless export transactions.

Steps to Become a Merchant Exporter

If you want to become a Merchant Exporter, follow the steps below:

Obtain PAN: Start by acquiring a PAN card for your export business. You and any partners must provide identity and address verification to register your business.

Choose Business Type & Name: Decide on the ownership type, like sole proprietorship or partnership, and select a name for your company.

Open a Current Account: After obtaining business registration and PAN, open a current bank account exclusively for your export business with any commercial bank.

Get Import Export Code (IEC): Apply for an Import Export Code (IEC) from DGFT, which is essential for exporting goods. You can apply online on the official DGFT website.

Obtain RCMC: Join an Export Promotion Council (EPC) to become a member, and then obtain a Registration-cum-Membership-Certificate (RCMC) from the EPC. Submit all required documents as per EPC guidelines.

Plan Logistics & Customs: Decide on international logistics for exporting your goods from India. Based on your shipping method and product category, you may need to obtain additional documents like Importer of Record (IOR), Bill of Lading, and shipping bill.

Merchant Exporter Benefits

Below are some of the benefits of Merchant Exporter that you should know:

Market Access for Small Producers: Merchant exporters provide an opportunity for small or medium-sized producers to access international markets without needing significant financial or personnel resources to establish their presence abroad.

Pre-shipment Financing: Unlike traditional exporters, merchant exporters offer pre-shipment financing to manufacturers without requiring any security, enabling producers to fulfill export orders efficiently.

Streamlined Export Operations: Merchant exporters handle the entire export process, including goods shipment, sales, and collection of export revenue from overseas customers, relieving manufacturers of these responsibilities.

Export Order Management: Merchant exporters are responsible for securing export orders from overseas customers, alleviating the burden on producers and allowing them to focus on production.

Access to Diverse Products: Merchant exporters can capitalize on various products for export, even if they lack manufacturing facilities, thereby expanding their business opportunities in international markets.

Recognition and Certification: Merchant exporters achieving exemplary export performance become eligible for an Export Status House certificate, recognizing their contribution to foreign trade and enhancing their credibility in the market.

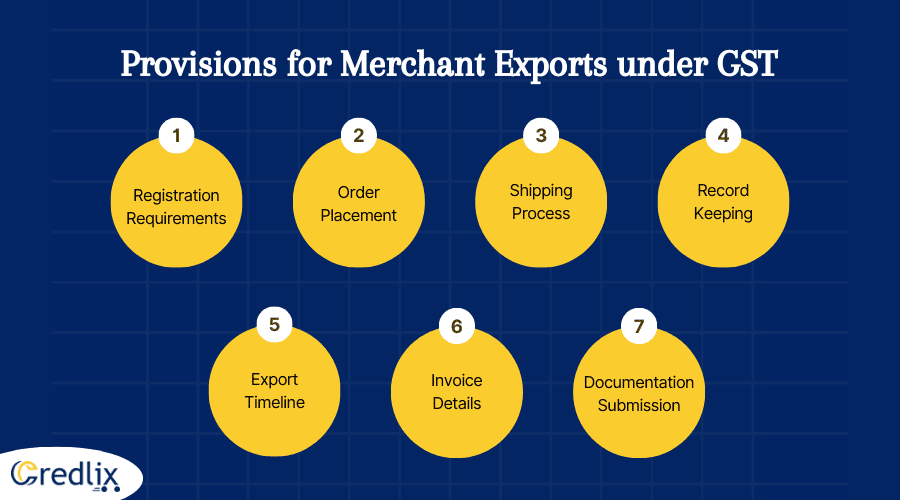

Provisions for Merchant Exports under GST

Explore and understand the provisions of Merchant Exports under GST below:

Registration Requirements: Merchant exporters are required to register under GSTIN (Goods and Services Tax Identification Number) and also become members of an Export Promotion Council or Commodity Commission approved by the Ministry of Commerce and Industry.

Order Placement: Exporters must place orders with manufacturers and provide a copy of the order to the manufacturer’s relevant tax officer.

Shipping Process: Goods for export must be shipped directly from the manufacturer’s location to the port, airport, or national customs office. Alternatively, goods can be shipped to a registered warehouse.

Record-Keeping: Exporters must maintain records of product receipts on tax invoices and provide copies to both the manufacturer and the relevant tax officer.

Export Timeline: Commercial exporters are required to export goods within 90 days from the date of invoice issuance.

Invoice Details: Exporters must include the supplier’s GSTIN and the manufacturer’s tax invoice number on the invoice or export document, if applicable.

Documentation Submission: After export, commercial exporters must submit a copy of the invoice or export document containing the manufacturer’s GSTIN and tax invoice details. This serves as certification for the submission of the General Export Record (EGM) or Export Report.

Eligibility Criteria for Concessional GST Rate on Merchant Exports

The government has introduced a concessional GST rate of 0.1% for purchases of goods from domestic suppliers, a measure aimed at promoting merchant exports. To qualify for this reduced rate, certain eligibility criteria must be met. Firstly, the invoice for the purchased item must explicitly specify a GST rate of 0.1%. Additionally, goods procured under this scheme must be exported within 90 days from the date of invoice issuance.

It is imperative that the invoice contains essential details such as the GSTIN (Goods and Services Tax Identification Number) and the supplier invoice number. Moreover, commercial exporters seeking to avail themselves of this concession must be registered with either an Export Promotion Council or Commodity Commission approved by the government. Lastly, to ensure compliance, a copy of the purchase order placed at the preferential tax rate must be furnished to the relevant tax officer of the registered supplier.

These conditions collectively aim to facilitate and incentivize merchant exports, thereby fostering growth and competitiveness in the export sector while ensuring adherence to regulatory standards and tax compliance.

Eligibility Conditions for 0.1% Concession on GST Rates

Eligibility conditions for 0.1% concession on GST rates are as follows:

Timely Export: Goods must be exported within 0 to 90 days from the date of tax invoice issuance. This ensures adherence to export timelines and facilitates efficient trade processes.

Registration Requirement: Merchant exporters must be registered with an Export Promotion Council/Commodity Board. This registration ensures compliance with regulatory standards and facilitates access to export-related benefits and support services.

Comprehensive Documentation: Shipping bills should include GST number and tax invoice number. This ensures accurate record-keeping and enables smooth processing of export transactions.

Clarity in Tax Invoice: Tax invoice must specify GST rate as 0.1%. Clear specification of the concessional GST rate ensures transparency and facilitates compliance with tax regulations.

Communication with Tax Authorities: Merchant exporters must provide a copy of the purchase order to the jurisdictional tax officer of the supplier. This fosters transparency and facilitates communication between relevant stakeholders.

Compliance with Export Procedures: Export must be conducted under LUT/bond without payment of IGST. Compliance with export procedures ensures smooth clearance of goods and minimizes procedural delays.

Direct Transport of Goods: Goods to be exported should be transported directly to port/ICDs/LCS from the sourcing location. Direct transport minimizes transit time and reduces the risk of damage or loss during transit.

Documentation Sharing: Suppliers and their jurisdictional tax officer should receive a copy of the shipping bill, Export General Manifest (EGM), and export report upon export of goods. This ensures transparency and enables verification of export transactions by relevant authorities.

Refunds Under Merchant Exports

To claim refunds under merchant exports, several scenarios exist:

- When a supplier sells goods to an exporter with a GST of 0.1%, and the exporter ships the goods without paying taxes, the exporter can request a refund of the unused Input Tax Credit (ITC) at the end of the taxable period. This is facilitated under Section 54(3) of the CGST Act for zero-rated or reverse-taxed goods.

- In a scenario involving two suppliers, the first supplier provides goods to the second supplier at the standard GST tax rate. However, the second supplier delivers these goods to a merchant exporter at a preferential rate of 0.1%. Under Section 54(3), the second supplier can claim a refund of ITC under a reverse tax structure, where the input tax rate exceeds the output tax rate.

- If an exporter pays IGST according to the standard tax system, they can claim a refund of both unutilized ITC and IGST paid against zero-rated supply. This process has been streamlined with online and paperless document filing and licensing procedures, aimed at facilitating exporters with hassle-free international shipping.

Can a Merchant Exporter Claim the Following?

Merchandise Exports from India Scheme (MEIS)

The MEIS scheme has been replaced by the RoDTEP scheme due to non-compliance with WTO norms. Under RoDTEP, merchant exporters can claim a benefit of 3% if the exported goods fall under specific tariff lines.

Input Tax Credit (ITC)

Merchant exporters can claim a refund on unused Input Tax Credit under Section 54(3) of the CGST Act if the exported goods are either zero-rated or taxed through an inverted tax structure. This refund needs to be claimed at the end of the tax period.

Duty Drawback

To claim duty drawback, exporters must provide evidence that they haven’t availed benefits under MODVAT. They need to include the manufacturer’s details in the shipping bill and provide a declaration by the manufacturer to relevant officials.

D/B Manufacturer Exporter and Merchant Exporter

A manufacturer exporter makes goods themselves and sends them to other countries to sell. They might make the whole product or just a part of it. On the other hand, a merchant exporter doesn’t make anything. Instead, they buy products from local suppliers and then sell them abroad under their own name. So, while a manufacturer exporter is involved in the production process, a merchant exporter is more like a middleman, connecting local goods with international markets. Both play important roles in international trade, but their involvement in the production and selling process differs significantly.

D/B Merchant Exports and Deemed Exports

Merchant exports and deemed exports are two distinct concepts in the realm of international trade, each with its own unique characteristics and implications.

Deemed exports refer to goods that are produced locally but are not physically shipped out of the country. Despite remaining within the borders, these products are still classified as exports by the government. This classification ensures that the manufacturers or sellers of these goods are eligible for the same incentives and benefits as those exporting goods overseas. Essentially, deemed exports recognize the contribution of domestic production to the export economy, allowing local manufacturers to access various incentives aimed at promoting exports.

On the other hand, merchant exports involve goods that are procured locally by an exporter but are subsequently exported to international buyers under the exporter’s name. Unlike deemed exports, which do not physically leave the country, merchant exports involve the actual movement of goods across international borders. While the exporter does not manufacture the goods themselves, they play a crucial role in facilitating the export process by sourcing products locally and connecting them with international markets. Like manufacturer exports, merchant exports also qualify for incentives and support measures designed to boost export activities.

Both deemed exports and merchant exports contribute to the overall export performance of a country. Deemed exports acknowledge the significance of domestic production in the export economy, ensuring that manufacturers receive appropriate recognition and support. On the other hand, merchant exports leverage the expertise of exporters in sourcing and distributing goods, enhancing the country’s export capabilities by expanding market reach and fostering trade relationships with international buyers.

Final Note

Understanding the nuances of merchant exports, including their significance under the GST regime, eligibility for incentives, and distinctions from other export categories like deemed exports and manufacturer exports, is essential for businesses seeking to thrive in international trade.

Merchant exporters play a pivotal role in connecting local goods with global markets, contributing significantly to India’s export landscape. By leveraging available schemes, complying with regulations, and embracing their intermediary role, merchant exporters can maximize their contributions to the economy while unlocking opportunities for growth and expansion in the dynamic world of international trade.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]