[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12111″ img_size=”full” css=”.vc_custom_1707973863008{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Invoice financing plays a crucial role in today’s credit-centric global trade environment, offering valuable solutions such as factoring and discounting for sellers looking to optimize their working capital.

In particular, factoring stands out as a streamlined financial option, providing businesses with a swift infusion of funds and allowing them to concentrate on their core activities.

In essence, factoring involves financial entities, commonly known as factoring companies, advancing funds to sellers against their trade receivables based on issued invoices. Typically, these funds constitute a percentage, often ranging from 80% to 90%, of the specified receivables amount.

Upon the buyers’ payment to the factoring companies, the remaining portion of the invoice sum is released to the sellers, with the factoring company retaining a percentage as their commission. Two prevalent types of factoring solutions are recourse and non-recourse factoring, differing primarily in the factoring company’s willingness to assume the credit risks associated with the seller.

In various instances, factoring companies may offer businesses a choice between recourse and non-recourse factoring solutions, presenting a crucial distinction in their approach to handling credit risks.

Recourse Factoring Meaning

Recourse factoring is a type of invoice financing where the factoring company, or financier, provides funds to the seller against their trade receivables. The distinct feature of recourse factoring lies in the fact that, in the event of non-payment by the buyer, the seller retains the ultimate responsibility for the credit risk.

Example of Recourse Factoring

Let’s envision a small manufacturing company, ABC Widgets, that engages in recourse factoring to improve its cash flow. ABC Widgets supplies widgets to various retailers and uses recourse factoring to expedite the conversion of its accounts receivable into immediate working capital.

In this scenario, ABC Widgets invoices Retailer X for $100,000 worth of widgets. The recourse factoring company, upon verifying the invoice, advances 85% of the total amount, which amounts to $85,000, to ABC Widgets. ABC Widgets receives the funds promptly, allowing them to address immediate operational needs such as purchasing raw materials or meeting payroll obligations.

Now, suppose Retailer X encounters financial difficulties and fails to fulfill its payment obligation. As per the recourse agreement, the responsibility for the outstanding $15,000 falls back on ABC Widgets. In such a situation, ABC Widgets must repurchase the debt from the factoring company using its own funds.

While this poses a risk for ABC Widgets, the initial advantage lies in the quick injection of funds they received when the invoice was factored. This allowed ABC Widgets to maintain a steady cash flow and continue operations seamlessly. The company must, however, manage the credit risk diligently to minimize the impact of potential non-payment scenarios.

Advantages of Recourse Factoring

Here are some of the advantages of recourse factoring:

Lower Costs: Recourse factoring typically incurs lower fees for the seller, as the credit risk remains with them.

Flexibility: Sellers often have more flexibility in choosing which invoices to factor, giving them control over their financing arrangements.

Easier Approval: Since the credit risk is borne by the seller, recourse factoring may be more accessible and available to a broader range of businesses.

Also Read: Advantages of Export Factoring

Disadvantages of Recourse Factoring

Here are some of the disadvantages of recourse factoring:

Credit Risk: The primary drawback is that the seller is exposed to the risk of non-payment by the buyer. If buyers default, the seller must absorb the financial loss.

Impact on Reputation: Repurchasing debts in case of non-payment might strain the relationship between the seller and their customers.

Financial Burden: In the case of non-payment, the seller must have the financial capacity to repurchase the debt, potentially leading to cash flow challenges.

In essence, recourse factoring offers cost advantages and flexibility but requires careful consideration of the potential credit risks and financial implications for the seller. It is a financing strategy that suits businesses with a robust credit management system and the ability to absorb occasional losses.

Non-Recourse Factoring Meaning

Non-recourse factoring is a specialized form of invoice financing wherein the factoring company assumes the credit risk associated with the buyer’s non-payment. Unlike recourse factoring, in non-recourse factoring, the responsibility for bad debt is transferred from the seller to the factoring company.

Example of Non-Recourse Factoring

Let’s consider a scenario where a tech startup, XYZ Tech Solutions, opts for non-recourse factoring to ensure financial stability and risk mitigation. XYZ Tech Solutions provides software solutions to various clients, including a recent project for Company A valued at $150,000.

In the non-recourse factoring arrangement, the factoring company reviews the invoice from XYZ Tech Solutions and advances 90% of the total amount, which equals $135,000. XYZ Tech Solutions receives this substantial sum promptly, providing them with the necessary capital to invest in research and development, cover operational expenses, and explore new business opportunities.

Now, suppose Company A, due to unforeseen circumstances, faces financial challenges and is unable to fulfill its payment obligation. In a non-recourse factoring agreement, the financial responsibility for the non-payment rests entirely with the factoring company. XYZ Tech Solutions is not required to repurchase the debt or absorb any losses related to Company A’s default.

This scenario showcases the practical advantage of non-recourse factoring for XYZ Tech Solutions. The company benefits from improved financial security, as the factoring company assumes the credit risk associated with non-payment. This allows XYZ Tech Solutions to focus on its core business activities without the burden of potential bad debt, contributing to a more stable and predictable cash flow.

Advantages of Non-Recourse Factoring

Here are some of the advantages of non-recourse factoring:

Risk Mitigation: The primary advantage is that the seller is protected from the credit risk associated with buyer non-payment. The factoring company assumes the financial responsibility in such cases.

Financial Security: Sellers benefit from enhanced financial security, knowing that they won’t be liable for repurchasing debts resulting from non-payment by the buyer.

Improved Customer Relationships: Non-recourse factoring can contribute to better customer relationships, as the seller is not involved in debt collection activities.

Disadvantages Of Non-Recourse Factoring

Here are some of the disadvantages of non-recourse factoring:

Higher Costs: Non-recourse factoring typically comes with higher fees for the seller, as the factoring company assumes the credit risk and charges accordingly.

Selective Approval: Factoring companies may be more selective in approving non-recourse arrangements, as they bear the entire risk of non-payment.

Reduced Flexibility: Sellers may have less flexibility in choosing which invoices to factor, as the factoring company assesses the creditworthiness of buyers more rigorously.

In summary, non-recourse factoring offers significant risk mitigation for sellers, providing financial security and potentially fostering better customer relationships. However, it comes with higher costs and reduced flexibility, making it suitable for businesses willing to trade some control for enhanced risk protection.

What Should a Company Consider While Opting for Recourse or Non-Recourse Factoring?

When deciding between recourse and non-recourse factoring, a company should carefully consider various factors to align the financing option with its specific needs and risk tolerance. Here are key considerations:

Risk Tolerance

Recourse Factoring: Companies with a higher risk tolerance and confidence in their credit management systems may opt for recourse factoring. They must be prepared to absorb the financial impact if buyers fail to pay.

Non-Recourse Factoring: Businesses seeking to transfer the credit risk entirely to the factoring company and minimize exposure may choose non-recourse factoring.

Cost Structure

Recourse Factoring: Generally comes with lower fees since the seller bears the credit risk. This can be advantageous for companies looking to minimize financing costs.

Non-Recourse Factoring: Typically involves higher fees, reflecting the factoring company’s assumption of credit risk. Businesses should assess whether the cost is justified by the risk mitigation benefits.

Customer Relationships

Recourse Factoring: May impact customer relationships, as the seller may need to handle collections if buyers default. It’s essential to evaluate the potential impact on customer goodwill.

Non-Recourse Factoring: Offers the advantage of the factoring company handling collections, potentially preserving positive customer relationships for the seller.

Creditworthiness of Buyers

Recourse Factoring: Allows flexibility in choosing which invoices to factor, as the seller’s creditworthiness is a key consideration.

Non-Recourse Factoring: Factoring companies may be more selective, assessing the creditworthiness of buyers more rigorously. This could impact the seller’s ability to factor certain invoices.

Financial Capacity

Recourse Factoring: Requires the seller to have the financial capacity to repurchase the debt in case of non-payment by buyers. It’s crucial to assess whether the company can absorb potential losses.

Non-Recourse Factoring: Provides financial security for the seller, as they are not responsible for repurchasing debts. This can be advantageous for companies with limited financial reserves.

Flexibility in Funding

Recourse Factoring: Offers more flexibility in choosing which invoices to factor, allowing businesses to tailor their financing arrangements based on specific needs.

Non-Recourse Factoring: May have stricter approval criteria, reducing flexibility in selecting invoices to factor. Companies should consider their need for customization.

The decision between recourse and non-recourse factoring involves a careful evaluation of risk tolerance, cost considerations, customer relationships, buyer creditworthiness, financial capacity, and flexibility requirements. Companies should thoroughly analyze these factors to choose the option that best aligns with their business objectives and financial strategy.

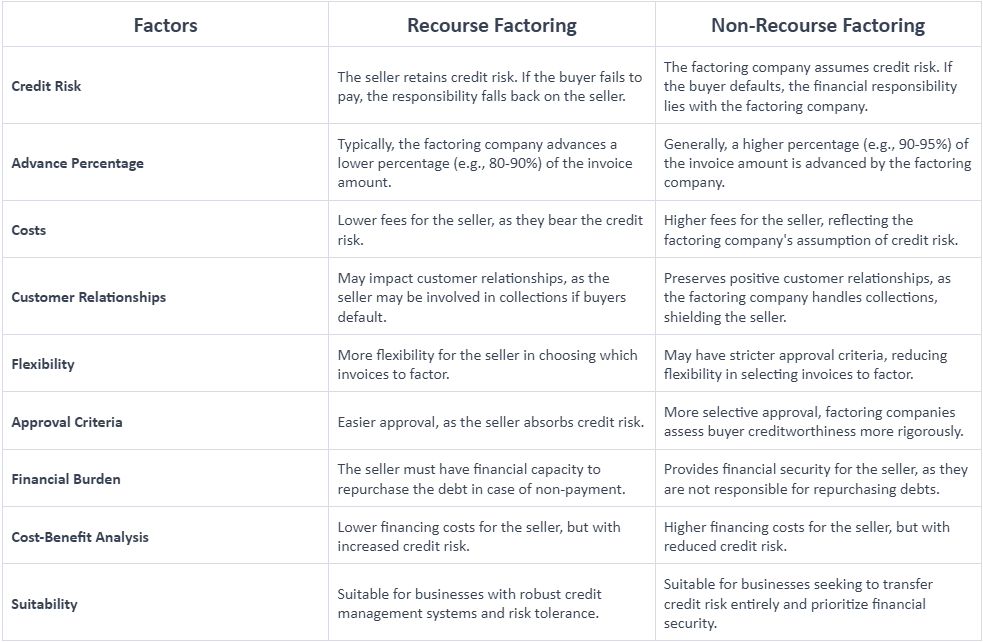

D/B Recourse & Non-Recourse Factoring

Here’s an elaborate table representation of recourse and non-recourse factoring:

Accounting Treatment for Recourse and Non-Recourse Factoring Transactions

In the context of a non-recourse factoring transaction, consider a scenario where trade receivables amounting to $100,000 are transferred to the factor. This signifies the full value of the accounts receivable being handed over to the factoring company.

In a typical non-recourse factoring arrangement, factoring companies provide a partial disbursement of the total receivables, often around $95,000, while retaining a fee. In this example, let’s assume a factoring fee of $5,000, which represents an expense borne by the business.

In accounting terms

Initial Transfer of Receivables:

Non-Recourse Factoring: Debit Accounts Receivable $100,000, Credit Revenue $100,000. This records the transfer of the receivables to the factoring company.

Disbursement and Factoring Fee:

Non-Recourse Factoring: Debit Cash $95,000 (amount disbursed by the factoring company), Debit Factoring Fee Expense $5,000, Credit Accounts Receivable $100,000. This accounts for the cash received, the factoring fee as an expense, and adjusts the remaining accounts receivable.

The accounting entries reflect the financial implications of the non-recourse factoring transaction, capturing both the initial transfer of receivables and the subsequent disbursement and fee arrangement. It is essential for businesses to accurately document these transactions to maintain transparent and compliant financial records.

Final Words

The choice between recourse and non-recourse factoring is a pivotal decision for businesses seeking efficient cash flow management. Recourse factoring offers cost advantages and flexibility but comes with the responsibility of absorbing credit risks. On the other hand, non-recourse factoring provides enhanced financial security, mitigating credit risks at a potentially higher cost.

The decision hinges on factors such as risk tolerance, cost considerations, and customer relationships. Regardless of the choice, accurate accounting practices are crucial for transparency. Ultimately, businesses must align their factoring strategy with their unique financial goals and circumstances to optimize working capital and ensure sustained growth.

Also Read: E-commerce Expansion: Export Factoring Solutions for Online Global Businesses[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]