[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12208″ img_size=”full” css=”.vc_custom_1709018295988{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In the dynamic world of international trade, exporters face various challenges, and managing risks is paramount for success. Export financing plays a pivotal role in mitigating these risks, ensuring a smooth and secure journey into global markets.

This blog aims to provide exporters with a comprehensive understanding of risk management strategies through effective export financing.

Understanding Export Financing

Export financing is a crucial aspect of international trade that involves the provision of financial resources and services to support businesses engaged in exporting goods or services across borders. This multifaceted concept encompasses various financial instruments and mechanisms designed to facilitate and secure transactions between exporters and importers. Let’s delve deeper into the key components and significance of export financing.

Working Capital Support: Export financing provides working capital to exporters, addressing the financial requirements associated with different stages of the export process. This includes procuring raw materials, production costs, and other pre-export expenses.

Risk Mitigation: One of the primary purposes of export financing is to manage and mitigate risks inherent in international trade. Exporters often face uncertainties such as non-payment, political instability, and currency fluctuations. Financial instruments like export credit insurance and guarantees help safeguard against these risks.

Also Read: A Comprehensive Guide to Export Finance in India

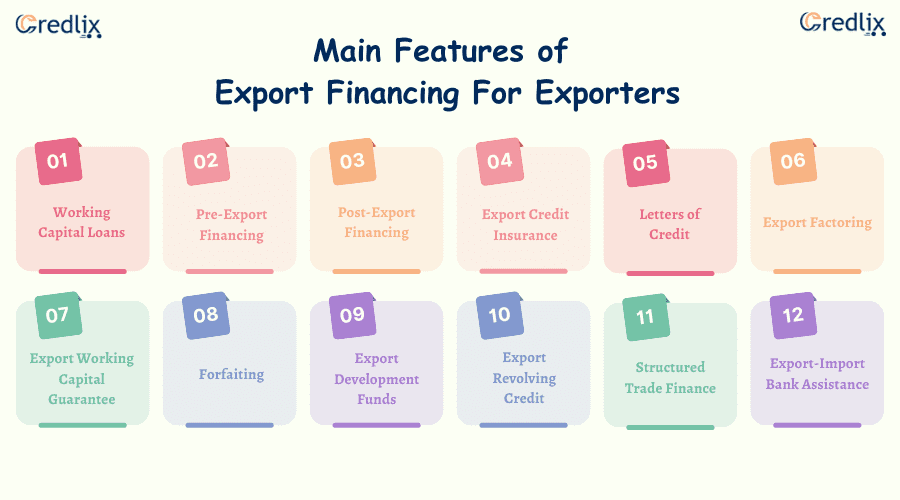

Main Features of Export Financing For Exporters

Export financing is a crucial aspect of international trade, providing exporters with the necessary funds to support their operations and mitigate financial risks associated with cross-border transactions. The main features of export financing for exporters include:

Working Capital Loans

Export financing often includes working capital loans to help exporters cover day-to-day operational expenses, including production costs, inventory management, and other short-term financial needs.

Pre-Export Financing

Exporters may receive financing before the actual shipment of goods. This pre-export financing helps cover expenses related to production, packaging, and transportation, ensuring a smooth process leading up to the shipment.

Post-Export Financing

Post-export financing provides funds to exporters after the goods have been shipped and the relevant documentation (such as bills of lading) has been submitted. This helps bridge the gap between shipment and payment from the buyer.

Export Credit Insurance

Exporters can obtain export credit insurance to protect themselves against the risk of non-payment by foreign buyers. This insurance provides coverage for commercial and political risks that may lead to non-payment or delayed payment.

Letters of Credit

Letters of credit (LCs) are widely used in international trade. Exporters can request their buyers to open a letter of credit, which serves as a guarantee of payment. The exporter receives payment upon presenting compliant documents to the bank.

Export Factoring

Export factoring involves selling accounts receivable to a financial institution (factor) at a discount. This provides immediate cash flow to the exporter, and the factor assumes the risk of non-payment.

Export Working Capital Guarantee

Governments or export credit agencies may provide export working capital guarantees, ensuring that financial institutions are more willing to lend to exporters by mitigating the risk of default.

Forfaiting

Forfaiting is a method of trade finance where exporters sell their medium to long-term receivables at a discount to a forfaiter, who assumes the credit and political risks. The exporter receives immediate cash.

Export Development Funds

Some countries have export development funds or institutions that provide financial support to exporters, including grants, low-interest loans, or other financial incentives to promote international trade.

Export Revolving Credit

Exporters may secure a revolving credit facility that provides ongoing access to funds. This flexibility is particularly beneficial for businesses with continuous or seasonal export activities.

Structured Trade Finance

Structured trade finance involves the use of complex financial instruments and mechanisms to facilitate trade transactions. This may include commodity financing, warehouse receipt financing, and other structured arrangements tailored to specific trade scenarios.

Export-Import Bank Assistance

Many countries have Export-Import Banks that offer financial assistance, guarantees, and insurance to support exporters. These institutions play a crucial role in promoting international trade.

Understanding these features of export financing enables exporters to choose the most suitable financing options based on their specific needs and the nature of their export transactions. It’s important for exporters to work closely with financial institutions, export credit agencies, and other relevant stakeholders to optimize their financial arrangements and minimize risks in the global marketplace.

Risk Management Strategies for Exporters With Export Financing

Exporters face various risks when engaging in international trade, including economic, political, and financial risks. Implementing effective risk management strategies is crucial to ensure the success and sustainability of export ventures. Export financing plays a significant role in managing financial risks associated with international trade. Here are some key risk management strategies for exporters with a focus on export financing:

Diversification of Markets

- Strategy: Expand your target markets to reduce dependence on a single market.

- Rationale: Economic downturns or political instability in one region may have a lesser impact if you have diversified your customer base.

Credit Risk Assessment

- Strategy: Conduct thorough credit checks on potential international buyers.

- Rationale: Reducing the risk of non-payment by ensuring that your customers have a good credit history and financial stability.

Credit Insurance

- Strategy: Purchase credit insurance to protect against non-payment by foreign buyers.

- Rationale: In the event of non-payment due to insolvency or political risks, credit insurance provides coverage, minimizing financial losses.

Export Financing Instruments

- Strategy: Utilize export financing tools such as letters of credit, documentary collections, and export credit agencies.

- Rationale: These instruments help secure payment and reduce the risk of non-payment or delayed payment.

Currency Risk Management

- Strategy: Hedge against currency fluctuations using financial instruments like forward contracts or currency options.

- Rationale: Fluctuations in exchange rates can impact the profitability of exports; hedging helps mitigate this risk.

Political Risk Mitigation

- Strategy: Stay informed about political developments in target markets and consider political risk insurance.

- Rationale: Political instability, government changes, or regulatory issues can affect payment and disrupt business operations.

Supply Chain Risk Management

- Strategy: Diversify suppliers and establish contingency plans for supply chain disruptions.

- Rationale: Disruptions in the supply chain can impact production and delivery schedules, affecting export commitments.

Customs and Regulatory Compliance

- Strategy: Stay informed about and comply with international trade regulations and customs requirements.

- Rationale: Non-compliance can lead to delays, fines, and even the confiscation of goods, negatively impacting financial outcomes.

Documentation and Contractual Clarity

- Strategy: Ensure clear and comprehensive documentation, including contracts, invoices, and shipping documents.

- Rationale: Well-documented transactions reduce the risk of disputes and facilitate smoother international trade.

Build Strong Relationships

- Strategy: Foster strong relationships with international buyers, financial institutions, and other partners.

- Rationale: Good relationships can help in resolving disputes, gaining market insights, and accessing valuable support in times of crisis.

Implementing these risk management strategies, along with effective export financing practices, can enhance an exporter’s ability to navigate the complexities of international trade and minimize financial uncertainties. Regularly reassessing and updating these strategies based on changing market conditions is essential for continued success in the global marketplace.

Final Note Sailing Towards Success

In the dynamic realm of international trade, exporters find themselves navigating through uncertainties. This blog has unveiled the pivotal role of export financing and outlined key strategies for risk management. From working capital support to diverse financing instruments, exporters now possess a toolkit for financial resilience.

As you set sail into global markets, remember: diversify, assess risks, and leverage export financing features. These strategies, akin to a well-charted map, will guide you through the challenges, ensuring a smooth and prosperous journey.

May your exports flourish, and your ventures be marked by success on the global stage![/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]