[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11644″ img_size=”full” css=”.vc_custom_1702884103890{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Insufficient funds, outdated technology, and limited infrastructure often hinder businesses from maximizing profits. Rapid access to capital is a key solution to address these challenges and streamline operations effectively.

A common method to secure immediate financing is through short-term business loans, offering substantial funds with straightforward eligibility criteria.

Enter Credlix, where businesses can easily obtain short-term business loans using bill discounting to meet their working capital requirements.

What is a Short-Term Business Loan?

A short-term business loan is a type of financing designed to meet immediate financial needs. Unlike long-term loans, these loans have a shorter repayment period, typically ranging from a few months to a few years. They are often used to address pressing financial challenges, such as managing cash flow fluctuations, covering operational expenses, or seizing time-sensitive opportunities. Short-term business loans can provide quick access to capital, helping businesses navigate temporary financial hurdles and ensure smooth operations.

Different Types of Short-Term Business Loan

Here are all the types of short-term business loans:

1. Lines of Credit

Description: Lines of credit embody a dynamic financial tool, offering businesses a revolving credit line with continuous access to funds, up to a predetermined credit limit. This flexible financing arrangement provides a safety net, allowing businesses to draw funds as needed, providing adaptability to changing financial requirements. This revolving nature means that once a portion of the credit line is repaid, the funds become available again, creating an ongoing resource for businesses. Lines of credit are commonly provided by financial institutions, offering a strategic financial cushion for various needs.

Use Case: Businesses leverage lines of credit to navigate working capital fluctuations effectively. This versatile financial instrument proves invaluable for covering operational expenses, such as payroll, inventory management, or unexpected costs like equipment repairs. Moreover, it serves as a proactive strategy to ensure financial resilience during uncertain business conditions.

Repayment: Interest accrues on the amount borrowed, and businesses are required to make periodic interest payments. One notable advantage is the flexibility in repayment – businesses can choose to repay the borrowed amount at their own pace, as long as they stay within the credit limit. This ability to repay and borrow again, as needed, provides a level of financial agility, aligning with the dynamic nature of business operations.

2. Invoice Financing

Description: Invoice financing empowers businesses by turning outstanding invoices into immediate working capital. By selling these invoices to financial institutions or specialized providers, businesses swiftly access cash before customers fulfill payment. This strategy bridges the gap between invoicing and actual payment, enhancing financial agility for growth and operational resilience.

Use Case: Valuable for businesses with outstanding receivables, especially when facing challenges from delayed customer payments. It provides a tailored solution for funding operational expenses, expansion, and maintaining financial stability.

Repayment: Seamlessly woven into the business’s revenue cycle, repayment occurs as customers settle invoices. The business repays advanced funds along with a predetermined fee or interest, ensuring a sustainable and synchronized process.

3. Working Capital Loans

Description: Invoice financing swiftly transforms outstanding invoices into immediate working capital. By selling these invoices to financial institutions or specialized providers, businesses access cash before customers fulfill payments, enhancing financial agility for growth and operational resilience.

Use Case: Valuable for businesses with outstanding receivables, especially when facing challenges from delayed customer payments. It provides a tailored solution for funding operational expenses, expansion, and maintaining financial stability.

Repayment: Seamlessly woven into the business’s revenue cycle, repayment occurs as customers settle invoices. The business repays advanced funds along with a predetermined fee or interest, ensuring a sustainable and synchronized process.

Also Read: What is Working Capital

4. Trade Credit/Vendor Financing

Description: Trade credit represents a strategic arrangement between businesses and their suppliers, granting the flexibility to defer payment for received goods or services. This financial tool facilitates a symbiotic relationship, allowing businesses to access the necessary products or services without an immediate financial outlay. The terms of trade credit typically specify a grace period during which the purchasing business can delay settling the outstanding amount with the supplier.

This arrangement is fundamental to fostering strong partnerships within the supply chain, offering a valuable means for businesses to balance their financial commitments with the imperative to maintain a steady inventory of goods or services.

Use Case: Trade credit emerges as a pivotal asset for managing cash flow effectively. By providing a window of time between receiving goods or services and the obligation to make payment, businesses gain the flexibility to sell these goods, convert them into revenue, and then settle their financial obligations to suppliers. This strategic maneuver ensures that businesses can optimize their working capital, aligning their financial activities with the natural cadence of their operations.

Repayment: Unlike traditional loan structures, repayment for trade credit is intricately tied to the negotiated payment terms with suppliers. These terms vary and are subject to mutual agreement, allowing businesses and suppliers to establish a harmonious financial relationship. This tailored approach to repayment ensures that the financial commitments align with the unique operational needs of both parties, fostering a collaborative and sustainable framework within the supply chain.

5. Business Credit Cards

Description: Business credit cards offer a tailored solution for meeting the day-to-day spending needs of business entities. These cards not only fulfill immediate cash requirements but also come with added advantages.

Utilizing a business credit card provides business owners with benefits such as cashback, milestone bonuses, and reward points for most transactions, enhancing overall savings. It is essential to highlight that users must adhere to a specified payment due date; otherwise, they may incur additional charges in the form of interest and late fees.

Use Case: Business credit cards serve as a versatile financial tool, catering to the diverse spending demands of enterprises. The accrued perks, including cashback and rewards, contribute to multiplying savings for businesses. However, it is imperative for users to manage their dues efficiently and settle payments within the stipulated timeframe to avoid incurring extra charges.

Repayment: Unlike traditional loans, the repayment structure for business credit cards involves meeting the payment obligations within the predetermined timeframe. Business entities seeking to leverage these financial tools must fulfill eligibility criteria, submit necessary documentation, and agree to the terms of repayment set forth by financial institutions. This ensures a transparent and mutually beneficial financial arrangement between the business and the credit card provider.

Also Read: Understanding Trade Credit: Advantages, Disadvantages, and Management

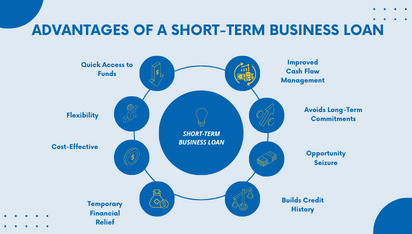

Advantages of a Short-Term Business Loan?

Here are some of the advantages of a short-term business loan:

Quick Access to Funds: Short-term business loans offer rapid access to much-needed capital, addressing immediate financial requirements without lengthy approval processes.

Flexibility: These loans provide flexibility in terms of usage, allowing businesses to deploy funds for various purposes, such as managing cash flow, covering operational expenses, or seizing timely opportunities.

Cost-Effective: Short-term loans often come with lower interest rates compared to long-term loans, making them a cost-effective solution for businesses needing quick financing.

Temporary Financial Relief: Ideal for addressing temporary financial challenges, short-term loans offer relief during cash flow gaps, helping businesses maintain stability.

Builds Credit History: Successfully repaying a short-term business loan can positively impact a business’s credit history, improving its creditworthiness for future financial transactions.

Opportunity Seizure: Businesses can capitalize on time-sensitive opportunities, such as inventory discounts or strategic investments, by quickly securing funds through short-term loans.

Avoids Long-Term Commitments: With a shorter repayment period, businesses can fulfill their financial needs without committing to long-term debt, providing more financial agility.

Tailored to Immediate Needs: Short-term loans are designed to address pressing financial needs, providing a targeted solution for businesses requiring quick and focused financing.

Improved Cash Flow Management: By infusing immediate capital, these loans assist businesses in optimizing cash flow, ensuring smoother day-to-day operations.

Adaptability: Suited for businesses with fluctuating cash needs, short-term loans offer adaptability to navigate dynamic financial landscapes and changing market conditions.

Short-Term Business Loan Calculator

Given the limited repayment duration of short-term business credit, businesses should carefully assess the timeline and interest rate that aligns with their needs. Employing financial tools, like a short-term business loan calculator, becomes crucial for making well-informed decisions.

Effectively utilizing the calculator involves considering essential factors:

Loan Amount:

Businesses input the desired loan amount they intend to borrow.

Interest Rates:

Determining the applicable interest rates helps in understanding the overall cost of the loan.

Repayment Tenure:

Selecting a suitable repayment tenure, considering the business’s financial capacity and goals.

Several user-friendly financial tools provide instant results and allow for multiple adjustments. This feature facilitates easy comparison of various loan options, empowering users to choose an affordable funding solution.

However, before availing a short-term business loan in India, businesses should thoroughly assess their financial position, creditworthiness, and repayment capabilities to ensure a prudent and sustainable borrowing decision.

Documents Required For Short-Term Business Loans

To show you qualify for short-term business loans, you just have to share some important papers. Here’s what you’ll need:

ID Papers (KYC Documents): Basic papers to confirm who you are.

Proof of Money: Show how much money your business makes with recent papers like financial statements, tax returns, and bank statements.

Proof of Address: Share something recent, like your utility bills, to confirm where your business is located.

Invoices and Discount Papers: If you have bills and papers for discounting, include those too.

Conclusion

Short-term business loans, including the innovative options offered by Credlix, are pivotal tools for businesses navigating the unpredictable terrain of finance. These loans, designed for quick access, flexibility, and cost-effectiveness, empower businesses to address immediate needs, seize opportunities, and build a positive credit history. With advantages ranging from temporary relief to improved cash flow management, businesses can leverage these loans strategically. Utilizing a short-term business loan calculator adds a layer of informed decision-making.

As businesses explore these financial avenues, it’s essential to align borrowing with specific needs and ensure a pathway to sustainable growth. In a nutshell, short-term business loans provide more than just funds; they offer a dynamic approach to financial challenges and opportunities.

FAQs

Q: Why do we need short-term business loans?

Short-term business loans are essential to address immediate working capital needs, ensuring the continuity of operations and sustaining cash flow for business owners.

Q: What are the benefits of availing a short-term business loan?

Short-term business loans offer a crucial financial bridge, closing the gap between operational plans and their execution through prompt and adequate financing.

Q: What are the sources of short-term loans for a business?

Short-term loan sources include vendor financing, bank loans, invoice discounting, and business credit cards. The eligibility and repayment terms vary, contingent on the borrower’s creditworthiness.

Q: What is the difference between long-term and short-term loans for a business?

Long-term business loans involve an extended repayment period and a thorough application process, while short-term loans provide swift capital access with instant approval.

Q: Does a short-term loan suit large-scale businesses?

Yes, as short-term loans cater to immediate operational funding needs, they are suitable for both small and large-scale businesses.

Q: What are the short-term business funding options available for less than 1 year?

Options like invoice discounting, business credit cards, or invoice factoring offer short-term loans for less than a year, with invoice discounting typically available for a maximum tenure of 90 days.

Q: What are the limitations of short-term business loans?

Short-term loans often come with high-interest rates, prepayment penalties, and substantial installment amounts. Poor repayment management can lead to borrowers getting caught in a risky borrowing cycle.

Q: What is the repayment tenure of a short-term business loan?

Repayment tenures for short-term business credit usually range from 3 months to 3 years. Businesses can select a suitable tenure based on their repayment capability.

Q: Can I get a short-term business loan if I have a bad credit score?

Yes, it’s possible to obtain a short-term business loan with a poor credit score, but borrowers may face higher interest rates as a trade-off for funding accessibility.

Q: What are the benefits of a short-term business loan calculator?

A short-term business loan calculator assists in selecting an optimal repayment tenure, estimating EMIs, and efficiently managing finances for effective financial planning.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]